Surprising fact: nearly one in five retirement savers say they would move a slice of their 401(k) into metals if it meant better protection from inflation.

This guide explains how a partial transfer works so you can add physical metals to a retirement account without touching your core investments.

A gold ira is a self-directed ira that holds IRS-approved precious metals like gold, silver, platinum, and palladium. Rules require an IRS-approved custodian and storage at an approved depository — you cannot keep metals at home.

Choosing a partial rollover lets you shift only some funds from a 401(k) to add metals exposure while leaving the rest invested. Direct transfers move money custodian-to-custodian and avoid withholding; indirect transfers can trigger 20% withholding and a 60-day deadline.

Follow this step-by-step guide to learn eligibility, selecting a custodian, approved coins and fineness rules, fees, taxes, and how to avoid common pitfalls.

Key Takeaways

- Partial transfers let you diversify without abandoning your main retirement strategy.

- Metals in an IRA require an approved custodian and depository — home storage is not allowed.

- Direct transfers avoid withholding; indirect transfers risk 20% withholding and tight deadlines.

- IRS rules limit which coins and fineness qualify for an ira; check approved lists.

- Understand fees, taxes, and account limits before you move any funds.

Why consider a partial rollover to a Gold IRA right now

A targeted partial move can add a defensive layer to your portfolio without changing your core approach. Many retirees worry about inflation and the market swings that come with economic uncertainty.

Diversification helps because precious metals often behave differently than stocks bonds. When equities fall, physical metals sometimes rise, which can smooth volatility for long-term retirement savings.

For many investors, a small allocation lets you test gold investments without upending your plan. A partial allocation can reduce emotional reactions during drawdowns and make it easier to stick to a long-term strategy.

Remember, metals can be volatile and are not risk-free. Liquidity and storage differ from paper assets, so expect trade-offs in access and fees.

Practical tip: treat a partial gold ira rollover as a strategic hedge — set allocation targets, plan rebalancing rules, and view metals as one piece of a diversified retirement plan.

What a partial 401(k) to Gold IRA rollover actually means

Moving only part of your employer plan into a metals-backed account means you keep core holdings while adding a defensive position.

Definition: a partial rollover moves a chosen dollar amount or percentage of your 401(k) into a gold ira, not the entire balance. This preserves stock and bond exposure in the original retirement account.

Mechanics are similar to a full transfer. You can request a direct rollover to the new custodian to avoid withholding. An indirect transfer requires completion within 60 days and replacing any 20% withheld to prevent taxes.

Align the amount you move with target ranges in your retirement plan. Many investors start with 5%–10% in metals. Keep enough funds in the 401(k) for liquidity, loans, or low-cost index options.

- Partial distributions are usually allowed after you leave an employer; in-service rules vary.

- Document every step so the payment is coded as a rollover and not a taxable distribution.

- Consider scheduling multiple partial transfers to dollar-cost average into precious metals.

Goal: use partial transfers to build a resilient retirement plan, not to concentrate risk. Coordinate amounts with your risk tolerance, time horizon, and rebalancing schedule for the best results.

Eligibility and plan rules: Can you move “some” of your 401(k)?

Eligibility depends on your specific 401(k) document and employment status. Many plans allow rollovers after you leave an employer, but current employer plans often restrict partial moves.

In-service distributions and the 59½ benchmark

In-service access and the age test

Some plans permit in-service distributions once you are at least 59½ years old. Hitting that age can open options to move a portion of funds without leaving your job.

Former employer plans vs. current employer plans

Former employer plans are usually easier to transfer to an ira, including a gold ira, after separation. While still employed, your plan may limit partial moves or allow only certain subaccounts (after-tax or employer match).

Plan-specific restrictions to confirm with your administrator

Contact your plan administrator and make sure you get a written summary of allowed distributions, blackout dates, and paperwork. Confirm whether a partial rollover or transfer is coded as non-taxable.

- Indirect rollovers must be completed within 60 days or they become taxable and may trigger a 10% penalty if under 59½.

- Plan documents determine whether pre-tax or Roth sources are eligible for a partial move.

- Document every step and allow processing time to align with IRS rules for a successful ira rollover.

Gold IRA basics: Self-directed IRAs, approved metals, and storage

Holding physical metals inside a retirement account requires special rules and an approved custodian. A self-directed ira lets you hold IRS-approved precious metals instead of only mutual funds or ETFs.

What a self-directed account is—and isn’t

Self-directed accounts give control over allowable investments, but they follow strict IRS rules. These accounts accept investment-grade precious metals, not collectibles or most numismatics.

IRS fineness standards

Most gold coins and bars must meet 99.5% purity. Silver must be 99.9% pure. An important exception: American Gold Eagles are permitted even though they are 91.67% pure.

Why home storage is prohibited

Metals in a tax-advantaged retirement account must be held by an IRS-approved custodian at an approved depository. Home storage can disqualify the account and trigger taxes and penalties.

Custodians usually provide approved lists, coordinate shipping, and arrange insurance. Verify metal eligibility and packaging before purchase to keep your account compliant. For an overview of these rules, see gold iras.

Step-by-step: How to execute a partial direct rollover

Prepare a clear plan before you move any money. Start by choosing a reputable custodian and completing the onboarding for a new gold ira so the transfer is smooth and tax-free.

Open the account and confirm depository options, fee schedules, and required forms. Make sure the custodian supports trustee-to-trustee direct rollover transfers to avoid withholding.

Initiate the partial transfer

Specify the exact dollar amount or percentage to send from your 401(k). Provide precise receiving account details so the payment is coded correctly.

Handle funds and purchases promptly

Track the funds until the custodian confirms receipt. Once the money posts, purchase IRS-approved metals that meet fineness rules to reduce idle cash drag.

Document everything

- Keep copies of distribution codes, deposit confirmations, trade tickets, and storage receipts.

- Ask the custodian about settlement timelines, shipping, and insurance for coins and bars.

- Schedule a follow-up review to verify statements and storage location.

Build a short checklist for future partial transfers so each ira rollover follows the same compliant, low-friction process.

Choosing your Gold IRA custodian and depository

Picking the right custodian and storage partner is the single best step to protect physical metals inside a retirement account. Start with reputation, transparent fees, and a clear custodial process.

Reputation and fee disclosures: Evaluate track records and ratings (BBB, BCA). Compare setup, admin, storage, and management fees across providers. Examples of fee structures include Birch Gold Group (A+ BBB; $50 setup; $100 storage; $125 management) and Goldco (A+ BBB; $50 setup; $80 admin; $100–$150 storage).

Customer support and learning: Look for firms that educate first-time investors and offer responsive service. American Bullion and Monetary Gold provide concierge-style assistance and 24/7 support options for hands-on help.

- Compare flat vs. tiered fees and how they affect small accounts (Augusta Precious Metals has a $50,000 minimum).

- Verify approved depositories like Delaware Depository and confirm insurance, audits, and 24/7 monitoring.

- Make sure the custodian lists IRS-approved products, buyback policies, and how statements display holdings and storage details.

Final check: match minimums and fee models to your planned partial transfer. For a vetted list of top providers, see this best gold ira companies.

Selecting IRS-approved precious metals for a new Gold IRA

Choose products that custodians accept and buyers recognize. Start with items that meet IRS fineness rules and are easy to value when you sell.

Coins vs. bars: coins often offer better liquidity and recognition. Small, popular gold coins can be easier to sell in tight markets.

Bars usually carry lower premiums per ounce. Bigger bars reduce per-ounce storage costs but can limit small-sale flexibility.

Common IRS‑approved options

- American Gold Eagles — approved despite 91.67% purity and widely accepted.

- Canadian Maple Leafs — 99.99% pure and highly liquid globally.

- Bullion bars — must meet 99.5% purity (or higher) for gold; packaging and assay marks matter.

“Only IRS-approved items qualify for tax-advantaged treatment; avoid collectibles and uncertified pieces.”

| Product | Purity | Liquidity | Storage impact |

|---|---|---|---|

| American Gold Eagles | 91.67% | High | Easy inventory; smaller units |

| Canadian Maple Leafs | 99.99% | Very high | Recognized, low markup |

| Bullion bars (assayed) | 99.5%+ | High (size-dependent) | Lower per-ounce storage cost |

| Silver, platinum, palladium | Silver 99.9%; Pt/Pd meet IRS fineness | Good | Good complement to gold; volume varies |

Practical notes: verify mint condition and original packaging. Custodians often reject improperly packaged or altered pieces.

Watch gold prices and bid-ask spreads. These affect total cost of ownership and your exit strategy.

Work with your custodian to confirm product lists and documentation before you buy. Align picks with your allocation size and liquidity needs so the new gold ira account supports your long-term plan.

Funding strategy: How much to roll and how to allocate it

Deciding how much to move starts with a clear target for the metals slice in your retirement plan. Aim for a modest initial allocation so you can learn how physical gold behaves in your broader mix.

Position sizing should reflect time horizon, liquidity needs, and tolerance for price swings. Many investors begin with 5%–10% of total retirement assets and scale up gradually.

Starting small and scaling over time

Use periodic partial rollovers rather than a single large transfer. Staging transfers helps with dollar-cost averaging and reduces timing risk.

Balancing stocks, bonds, and physical gold

Map the metals slice to your target asset allocation alongside stocks bonds and fixed income. Set maximum and minimum bands so the metals portion can’t drift into over-concentration.

- Choose bands (for example, target 7% with a 4%–10% band) and rebalance annually or when thresholds hit.

- Factor in expense ratios, bid-ask spreads, and storage fees when setting allocation size.

- Mix coins and bars to balance liquidity and cost efficiency.

“Start modestly, document each partial transfer, and revisit allocation after major life events.”

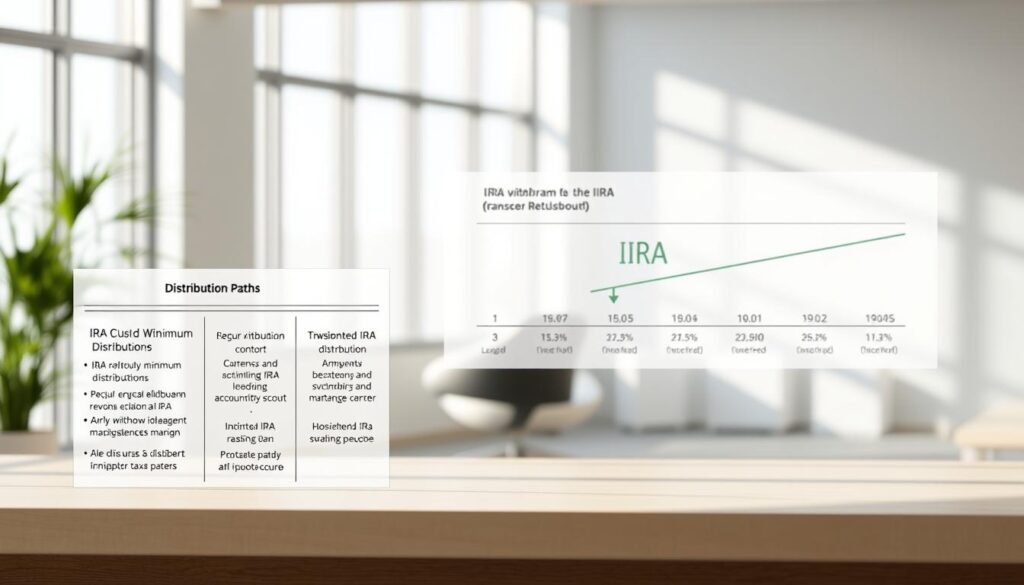

Gold IRA rollover

When you move part of a workplace retirement plan into a metals-backed account, the method you choose affects taxes and timing.

Direct rollover vs. indirect rollover for partial amounts

Direct rollovers send funds straight from the 401(k) plan to the receiving custodian. This approach avoids withholding and keeps the transfer a tax-free event.

Indirect rollovers pay you first and commonly have 20% withheld. If you take this route, you must redeposit the full distribution amount within 60 days to avoid taxes and penalties.

Avoiding the 60-day trap and 20% withholding

With an indirect transfer, the withheld portion still counts toward the total you must replace. Missing the 60-day window makes the withheld sum taxable and may trigger early withdrawal penalties if you are under 59½.

Multiple indirect transfers in a 12‑month span can be limited by IRS rules. Always check with your custodian before attempting repeat moves.

- Initiate a custodian-to-custodian transfer to reduce manual handling of funds.

- Confirm receiving account details and distribution codes with the plan administrator.

- Track the wire or check and save all confirmations for tax records.

- Remember partial amounts follow the same rules as full transfers—accuracy matters.

| Issue | Direct transfer | Indirect transfer |

|---|---|---|

| Withholding | No withholding | Typically 20% withheld |

| Tax risk | Low if coded correctly | High if 60‑day rule missed |

| Recordkeeping | Cleaner custodian records | Requires proof of redeposit |

| Practical tip | Use trustee-to-trustee wiring | Replace withheld funds and track deadline |

Checklist for plan admin: account numbers, receiving custodian name, EIN, distribution code, transfer amount, and contact for confirmations. Share copies with both parties and keep digital receipts for tax season.

For details about tax treatment on distributions, see this guide on do you pay tax on a gold. Good coordination and clear paperwork help you preserve the tax-advantaged retirement benefits of the transfer.

Taxes, penalties, and compliance for partial rollovers

A small paperwork error can turn a tax-free transfer into a taxable event—so attention to detail matters. Proper steps protect the tax-advantaged retirement account status of the funds you move and preserve long-term benefits.

Why direct rollovers are typically tax-free

When your plan sends funds directly to the receiving custodian, the transfer is coded as trustee-to-trustee. That avoids the 20% withholding and keeps the event non-taxable if handled correctly.

Risks with indirect transfers and the 60-day rule

If you receive distribution funds first, the plan may withhold 20%. You must redeposit the full amount within 60 days or the distribution becomes taxable. If you are under 59½, a 10% early withdrawal penalty may also apply.

Compliance and reporting

Keep 1099-R and 5498 forms, account statements, and wire confirmations. Make sure communications with your plan and custodian specify “trustee-to-trustee” to reduce miscoding risk.

- Home storage of physical metals violates IRS rules and can disqualify the account, causing taxes and penalties.

- Retain evidence of timelines—mail dates, wire receipts, and trade confirmations—for audit readiness.

- State tax rules vary; consult a tax professional for complex situations.

Practical wrap-up: compliance preserves the benefits of a tax-advantaged retirement account. Choose custodians that offer strong compliance support to reduce costly errors and protect your funds.

Contribution limits, RMD alignment, and ongoing rules

Contribution caps and withdrawal rules shape how metals fit into a long-term retirement plan. Knowing limits and distribution rules helps you avoid surprises when you need income.

2025 IRA contribution and catch-up limits

For 2025, annual contributions to a traditional or Roth ira are capped at $7,000. If you are 50 years old or older, you may add a catch-up contribution, raising the limit to $8,000.

Important: amounts moved from a workplace plan into your account are treated as rollovers and do not count against these annual contribution limits.

Coordinating RMDs with metals liquidity in retirement

Required minimum distributions apply to traditional accounts and must be taken each year after the IRS age threshold. Physical gold holdings can complicate RMDs because coins and bars are less liquid than cash or securities.

- You can sell a portion of metals to meet an RMD and keep the rest stored.

- Alternatively, in-kind distributions of physical gold are possible but may create tax-reporting and valuation tasks.

- Roth iras generally avoid RMDs, so placing precious metal holdings there can change distribution timing.

Recordkeeping matters: track acquisition dates, cost basis, and custodian valuations when taking in-kind distributions to document taxable amounts correctly.

“Plan RMD timing and depository access in advance to avoid forced sales at low prices.”

Ongoing rules for storage, approved products, and custodian reporting remain in force for the life of the account. Review your plan annually, confirm depository access, and consult a tax professional to optimize RMD strategy and reduce unnecessary taxes.

For a detailed primer on how these rules interact with physical holdings when you retire, see understanding how a gold IRA works when you.

Costs to expect: Custodian, storage, and transaction fees

Costs aren’t the same across custodians — small accounts can feel the difference fast. Start by breaking fees into clear categories so you can compare quotes fairly.

Typical cost categories:

- Account setup and one-time onboarding fees.

- Annual administration or management charges.

- Storage and insurance at an approved depository.

- Transaction spreads and premiums on precious metals purchases.

- Potential buyback or exit fees affecting liquidity.

Flat vs. scaled fee models — impact on smaller partial transfers

Flat fees hit small accounts harder. A $125 annual custodian charge reduces returns more when your balance is low.

Scaled models rise with account size and can be cheaper per dollar as balances grow. For staged partial transfers, ask which model yields lower long-term costs.

Examples from well-known providers

Use these figures to benchmark quotes and negotiate an itemized fee schedule in writing.

| Provider | Setup / Admin | Storage / Annual | Notes |

|---|---|---|---|

| Birch Gold Group | $50 setup | $100 storage; $125 management | Flat fees; A+ BBB |

| Goldco | $50 setup; $80 admin | $100–$150 storage | No minimum purchase; A+ BBB |

| American Bullion | $25 setup | $160 annual; free first-year storage on $50k+ | Tiered incentives for larger funds |

| Augusta Precious Metals | $50 application | $100 storage; $125 annual custodian | $50,000 minimum; A+ BBB |

Practical tips: confirm whether storage is segregated or commingled, ask for published spreads on coins and bars, and weigh lower fees against service, education, and compliance support. Small savings compound over decades, but service failures can cost more than fees alone.

Timing, market conditions, and rebalancing your retirement account

Tactical timing matters when you add metals to a retirement account, but it should not replace a long-term approach. Short-term price swings can be sharp, so many investors time partial transfers in stages to reduce entry risk.

Gold prices, volatility, and long-term perspectives

Daily volatility is normal for precious metals. Staging partial transfers or using calendar-based purchases helps smooth entry costs.

Focus on the hedge role. Treat precious metals as a diversifier, not a trading vehicle for retirement funds.

Periodic reviews to keep your allocation on track

Use calendar or threshold rebalancing to maintain target weights in your plan. Triggers for review include major price moves, life events, or shifts in retirement timing.

- Coordinate rebalancing with tax rules and distribution needs to avoid unnecessary transactions.

- Consider liquidity when choosing coins versus bars—smaller units are easier to trim.

- Integrate metals views with equity and fixed-income outlooks for a holistic allocation.

“Stick to a disciplined schedule and document each action—especially when a partial rollover funds or alters holdings.”

| Action | When to do it | Why it matters |

|---|---|---|

| Staged purchases | Regular intervals | Reduces timing risk from volatile gold prices |

| Threshold rebalancing | When allocation drifts | Keeps metals slice aligned with targets |

| Liquidity check | Before selling | Ensures coins/bars can meet distribution needs |

| Documentation | After each trade or rollover | Supports tax compliance and audit trails |

Conclusion

A partial transfer can add a safety layer to your retirement savings without disrupting core positions.

Key takeaway: a partial gold ira rollover can diversify retirement assets while keeping most holdings intact. Use a direct, custodian-to-custodian transfer to keep the rollover process tax-efficient and simple.

Make sure approved metals are stored at an IRS-approved depository and document every step. Start small, set clear allocation targets, and review periodically. Compare custodians on experience, fees, and service quality.

Costs like setup, annual admin, storage, and spreads affect long-term results—see understanding the costs for details. Plan for RMDs and liquidity so precious metals hedge volatility without creating distribution problems. Proceed step by step, ask questions, and keep records to maintain a tax-advantaged retirement account.

FAQ

What does a partial rollover from a 401(k) to a precious metals IRA mean?

A partial rollover moves only a portion of funds from your workplace retirement plan into a tax-advantaged precious metals account rather than transferring the entire balance. This lets you add physical coins or bars to diversify while keeping most savings in your existing plan.

Why consider a partial transfer now?

Many investors add metals during economic uncertainty or rising inflation to hedge purchasing power. A partial move preserves core retirement savings in stocks and bonds while introducing tangible assets that often behave differently from paper investments.

Can I move “some” of my current employer 401(k) while still employed?

It depends on your plan’s rules. Some plans allow in-service distributions after age 59½ or under specific conditions. Check your plan documents or ask the plan administrator before attempting a transfer.

Are former employer plans easier to transfer from?

Yes. When you leave an employer, most plans permit full or partial direct rollovers to an IRA. Verify any plan-specific restrictions and whether the administrator requires paperwork for partial amounts.

What is a self-directed precious metals account and how is it different?

A self-directed account lets you hold approved physical metals and other alternative assets. It functions like other IRAs for tax rules, but the account holder selects eligible metals and works with a custodian to hold them in an approved depository.

What purity standards must approved metals meet?

The IRS requires minimum fineness for acceptable metals. For example, approved gold typically must meet specific purity levels, and silver, platinum, and palladium also have defined standards. Use a custodian or depository checklist to confirm eligibility.

Can I keep purchased metals at home after the transfer?

No. IRS rules prohibit holding IRA metals at home. Approved depositories store the physical assets, and custodians arrange secure storage and insurance to remain compliant and avoid taxes or penalties.

How do I execute a partial direct transfer step-by-step?

Open a new account with a reputable custodian, request a direct transfer specifying the dollar amount or percentage, have your plan administrator send funds directly to the custodian, and direct the custodian to purchase approved metals promptly. Keep documentation of each step.

How should I choose a custodian and depository?

Look for firms with strong reputations, transparent fee schedules, experienced staff, and quality customer support. Confirm the depository’s insurance coverage and whether it stores segregated or commingled holdings.

Which coins or bars are commonly approved for a new account?

Popular approved options include widely recognized government-issue coins and standard bullion bars with established liquidity. Examples often cited are American Eagles and Canadian Maple Leafs, which meet fineness and authenticity standards.

How much should I move — what’s a good funding strategy?

Many start small and scale over time, using position sizing to limit exposure while testing the new allocation. Balance holdings among stocks, bonds, and metals based on risk tolerance, time horizon, and retirement goals.

What’s the difference between a direct transfer and an indirect transfer for partial amounts?

A direct transfer moves funds straight from your plan to the custodian and is usually tax-free. An indirect transfer sends funds to you first, triggering potential withholding and a 60-day deadline to avoid taxes and penalties, so it’s riskier for partial moves.

Will a direct transfer trigger taxes?

Direct transfers are typically tax-free when handled correctly. Keep records and work with the custodian and plan administrator to ensure funds move directly and documents reflect a trustee-to-trustee transaction.

What happens if I mishandle the transfer and miss deadlines?

If you fail to complete an indirect transfer within 60 days or don’t follow rules, the amount can be treated as a distribution, subject to income tax and potential early withdrawal penalties if you’re under age 59½.

How do required minimum distributions (RMDs) affect holding physical metals?

RMDs still apply to tax-deferred accounts. Because physical holdings can be less liquid, plan ahead to meet RMDs by selling a portion of holdings or keeping some funds in more liquid assets to cover withdrawals.

What fees should I expect when moving a partial amount?

Expect custodian setup and maintenance fees, storage and insurance costs from the depository, and transaction premiums when buying coins or bars. Fee models vary—flat annual fees can hit small balances harder than scaled percentage models.

How often should I rebalance after adding physical metals?

Schedule periodic reviews—annually or semiannually—to assess allocation versus targets. Rebalancing frequency depends on market moves, price volatility, and your retirement timeline.

Can I use a Roth strategy when moving part of my account?

Yes. You can transfer eligible pre-tax funds into a Roth account, but that conversion triggers income tax on the converted amount. Discuss implications with a tax advisor before converting.

Are there common pitfalls to avoid during a partial transfer?

Avoid indirect transfers unless necessary, don’t store metals at home, confirm plan rules and custodian fees in writing, and keep detailed invoices and paperwork to prevent tax or compliance issues.

Where can I find reliable education and customer support as a first-time investor?

Choose custodians and companies that provide clear guides, transparent costs, and responsive support. Look for firms with educational resources about approved metals, storage options, and the transfer process.