Rebalancing your Gold IRA is one of the most crucial yet overlooked aspects of retirement planning. As market conditions shift and precious metals prices fluctuate, your carefully designed portfolio allocation can drift significantly from your original plan. Without proper rebalancing, you might find yourself overexposed to certain assets or missing opportunities to optimize your retirement savings. This comprehensive guide will walk you through the why, when, and how of Gold IRA rebalancing to help secure your financial future.

Understanding Gold IRA Rebalancing: The Fundamentals

Gold IRA rebalancing is the process of readjusting the weight of precious metals and other assets in your retirement portfolio to maintain your desired level of risk and return potential. Unlike traditional stock and bond portfolios, Gold IRAs contain physical precious metals, which creates unique considerations when rebalancing.

When gold prices rise significantly compared to other assets, your portfolio may become overweighted in precious metals. Conversely, when stocks or bonds outperform, your gold allocation might shrink below your target percentage. Either scenario leaves your retirement savings potentially vulnerable to market shifts.

The primary goals of rebalancing your Gold IRA include:

- Maintaining your desired risk level as you approach retirement

- Capitalizing on the “buy low, sell high” principle

- Ensuring proper diversification across different asset classes

- Protecting your portfolio from overexposure to any single market

- Adapting your allocation to changing life circumstances and goals

Optimal Timing for Gold IRA Rebalancing

Determining when to rebalance your Gold IRA is a critical decision that can significantly impact your retirement savings. There are several approaches to timing your rebalancing efforts, each with its own advantages and considerations.

Calendar-Based Rebalancing

Many financial advisors recommend rebalancing your Gold IRA on a regular schedule, regardless of market conditions. This approach removes emotion from the equation and establishes a disciplined investment practice.

| Frequency | Best For | Considerations |

| Quarterly | Active investors in volatile markets | Higher transaction costs; may trigger more taxable events |

| Semi-annually | Balanced approach for most investors | Good compromise between responsiveness and cost |

| Annually | Conservative investors; stable markets | Lower costs; may miss short-term opportunities |

Threshold-Based Rebalancing

Rather than rebalancing on a fixed schedule, some investors prefer to rebalance when their asset allocation drifts beyond a predetermined threshold. This approach can be particularly effective for Gold IRAs, as precious metals often move independently from traditional securities.

For example, if your target gold allocation is 20% of your portfolio, you would rebalance when it reaches either 25% (absolute deviation of 5%) or 15% (relative deviation of 25% from target).

Market-Triggered Rebalancing

Some investors choose to rebalance after significant market events, such as:

- Gold price surges or drops of 10% or more

- Major stock market corrections (10%+ declines)

- Federal Reserve interest rate decisions

- Significant geopolitical events affecting precious metals

While this approach can capitalize on market movements, it requires close monitoring and can lead to emotional decision-making if not implemented carefully.

Free Gold IRA Rebalancing Calendar

Get our 2024 Gold IRA Rebalancing Calendar with recommended dates, market indicators to watch, and a tracking worksheet to optimize your precious metals portfolio.

Step-by-Step Guide to Rebalancing Your Gold IRA

Rebalancing a Gold IRA requires careful planning and execution. Follow these steps to ensure you maintain your desired asset allocation while minimizing costs and potential tax implications.

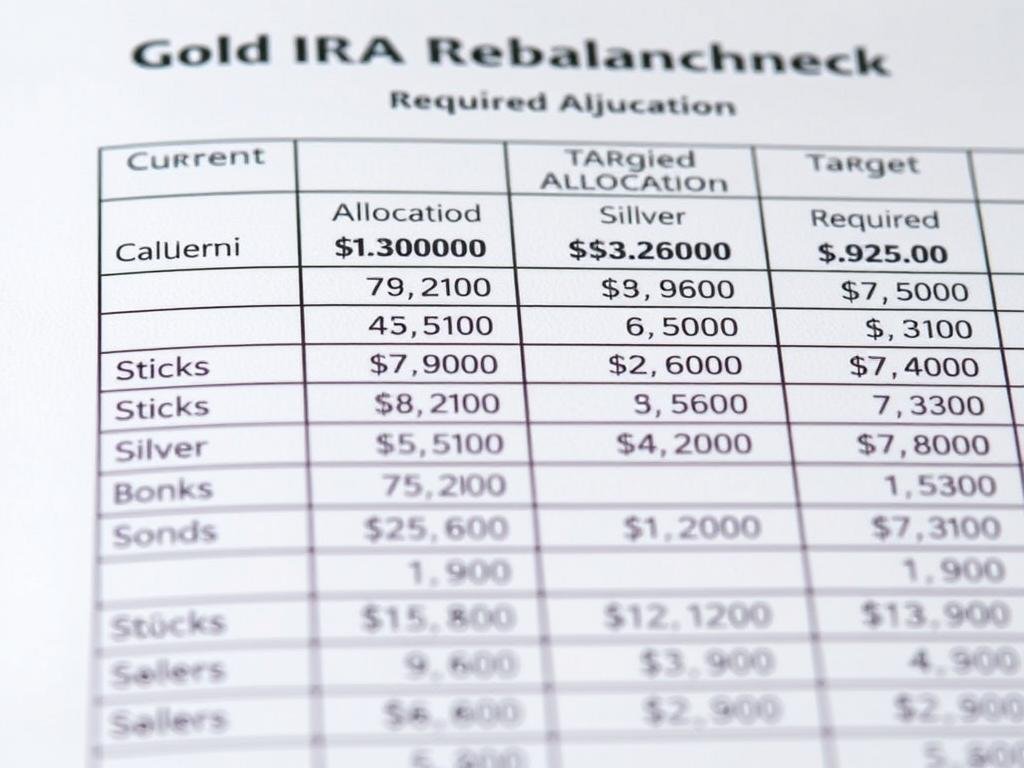

- Review Your Current Allocation – Determine the exact percentage of your portfolio currently allocated to each asset class, including different types of precious metals (gold, silver, platinum, palladium).

- Compare to Target Allocation – Identify how far your current allocation has drifted from your target percentages.

- Calculate Necessary Adjustments – Determine the dollar amount of each asset that needs to be bought or sold to return to your target allocation.

- Consider Tax Implications – Assess potential tax consequences before executing trades (more on this in the next section).

- Contact Your Gold IRA Custodian – Initiate the rebalancing process through your custodian, who will handle the actual buying and selling of precious metals.

- Verify Storage Arrangements – Ensure any new precious metals purchases are properly stored in IRS-approved facilities.

- Document the Rebalancing – Keep detailed records of all transactions for tax purposes and future reference.

- Schedule Your Next Review – Mark your calendar for your next rebalancing check based on your preferred timing strategy.

Tax Implications When Rebalancing a Gold IRA

One of the primary advantages of a Gold IRA is its tax-deferred or tax-free status, depending on whether you have a Traditional or Roth Gold IRA. However, rebalancing still carries important tax considerations that every investor should understand.

Traditional vs. Roth Gold IRA Tax Considerations

Traditional Gold IRA

- Contributions are typically tax-deductible

- Growth is tax-deferred until withdrawal

- Rebalancing within the account triggers no immediate tax

- Required Minimum Distributions (RMDs) begin at age 73

- Withdrawals are taxed as ordinary income

Roth Gold IRA

- Contributions are made with after-tax dollars

- Growth is tax-free

- Rebalancing within the account triggers no tax

- No Required Minimum Distributions

- Qualified withdrawals are completely tax-free

Important Tax Considerations When Rebalancing

- Custodian Fees – Fees for buying, selling, or storing precious metals within your Gold IRA are typically paid from the IRA itself, making them tax-advantaged.

- Prohibited Transactions – Ensure all precious metals meet IRS purity requirements (99.5% for gold) to avoid disqualification of your IRA.

- Early Withdrawal Penalties – Taking physical possession of metals before age 59½ can trigger taxes plus a 10% penalty.

- In-Kind Distributions – When taking distributions, you can choose between liquidating metals or taking them as in-kind distributions (both are taxable events in a Traditional IRA).

Never attempt to rebalance a Gold IRA by purchasing precious metals personally and contributing them to your IRA. The IRS considers this a prohibited transaction that could disqualify your entire IRA.

How Gold IRA Rebalancing Differs from Traditional Portfolios

Rebalancing a Gold IRA presents unique challenges and opportunities compared to conventional stock and bond portfolios. Understanding these differences is essential for effective precious metals portfolio management.

| Factor | Traditional Portfolio | Gold IRA |

| Liquidity | Highly liquid; trades execute almost instantly | Less liquid; physical metals must be bought/sold through custodian |

| Transaction Costs | Minimal with discount brokers | Higher due to premiums, shipping, assaying, and storage |

| Valuation | Real-time pricing readily available | Spot prices plus premiums; dealer spreads vary |

| Fractional Ownership | Easy to buy exact percentages | Limited by physical metal sizes (e.g., 1 oz coins) |

| Correlation Benefits | Assets often move together in crises | Gold often moves counter to stocks during market stress |

Special Considerations for Gold IRA Rebalancing

- Physical vs. Paper Gold – Some Gold IRAs include both physical metals and “paper gold” (ETFs, mining stocks). These have different liquidity profiles and should be considered separately in your rebalancing strategy.

- Premium Fluctuations – The premium over spot price for physical gold products can vary significantly, affecting your true allocation and rebalancing decisions.

- Storage Considerations – Unlike digital assets, physical gold requires secure storage, which adds complexity and cost to the rebalancing process.

- Dealer Selection – Working with reputable dealers is crucial when buying or selling precious metals for your IRA to ensure fair pricing and authentic products.

Tools and Resources for Gold IRA Rebalancing

Effective Gold IRA rebalancing requires specialized tools and resources. Here are some essential aids to help you maintain your optimal precious metals allocation.

Portfolio Tracking Software

Several software platforms can help track your Gold IRA allocation and alert you when rebalancing is needed:

- Specialized Gold IRA Platforms – Services like GoldStar Trust and New Direction IRA offer dedicated precious metals tracking.

- General Portfolio Trackers – Personal Capital and Morningstar Portfolio Manager can track precious metals alongside traditional assets.

- Spreadsheet Templates – Custom Excel or Google Sheets templates can be created to monitor your specific Gold IRA allocation.

Market Monitoring Resources

Stay informed about precious metals markets with these resources:

Price Tracking

- Kitco.com

- APMEX Precious Metals Spot Prices

- GoldPrice.org

- Bloomberg Precious Metals

Market Analysis

- World Gold Council

- CPM Group

- Seeking Alpha (Precious Metals section)

- Gold Newsletter

Economic Indicators

- Federal Reserve Economic Data (FRED)

- Bureau of Labor Statistics (inflation data)

- U.S. Debt Clock

- Treasury Direct (bond yields)

Custodian Services

A good Gold IRA custodian is essential for efficient rebalancing. Look for these features:

- Transparent fee structure for buying, selling, and storing metals

- Efficient processing of rebalancing requests

- Regular statements showing current holdings and values

- Access to competitive precious metals pricing

- Secure, IRS-approved storage facilities

- Knowledgeable customer service for rebalancing questions

Case Studies: Successful Gold IRA Rebalancing Strategies

Examining real-world examples can provide valuable insights into effective Gold IRA rebalancing approaches. Here are three case studies demonstrating different strategies and their outcomes.

Case Study 1: Conservative Quarterly Rebalancing

Investor Profile: Robert, 58, retirement planned at 65

Initial Allocation: 25% physical gold, 10% silver, 40% stocks, 25% bonds

Rebalancing Strategy: Strict quarterly rebalancing regardless of market conditions

Outcome: During the 2020 market volatility, Robert’s disciplined approach allowed him to sell gold at its peak in August (when it had grown to 32% of his portfolio) and buy stocks at reduced prices. This systematic approach yielded a 2.3% higher return over 24 months compared to a non-rebalanced portfolio.

Case Study 2: Threshold-Based Approach

Investor Profile: Maria, 62, semi-retired

Initial Allocation: 30% gold, 5% silver, 5% platinum, 35% stocks, 25% bonds

Rebalancing Strategy: 5/20 threshold rule (rebalance when any asset class deviates by 5% absolute or 20% relative)

Outcome: This approach triggered only two rebalancing events over 18 months, reducing transaction costs while still maintaining risk control. When gold surged in 2020, reaching 38% of her portfolio, the threshold triggered a rebalancing that protected her from the subsequent correction while maintaining appropriate precious metals exposure for inflation protection.

Case Study 3: Strategic Rebalancing with RMDs

Investor Profile: James, 74, fully retired

Initial Allocation: 20% gold, 10% silver, 30% stocks, 40% bonds/cash

Rebalancing Strategy: Annual rebalancing coordinated with Required Minimum Distributions

Outcome: By strategically taking his RMDs from overweighted asset classes, James effectively rebalanced while satisfying IRS requirements. During 2021-2022, he directed his RMDs primarily from his stock allocation (which had grown to 37%) while preserving his precious metals positions as an inflation hedge. This approach saved on transaction costs and maintained his desired allocation through a period of high inflation.

Frequently Asked Questions About Gold IRA Rebalancing

How often should I rebalance my Gold IRA?

Most financial advisors recommend rebalancing your Gold IRA at least annually. However, the optimal frequency depends on your investment timeline, market conditions, and personal preferences. Conservative investors often choose annual rebalancing, while more active investors might opt for quarterly reviews. Alternatively, using a threshold approach (rebalancing when allocations drift by 5% or more) can be effective for Gold IRAs due to precious metals’ price volatility.

What percentage of my retirement portfolio should be in gold?

Financial experts typically recommend allocating between 5-15% of your retirement portfolio to precious metals, with gold being the primary component. However, during periods of high inflation or economic uncertainty, some investors increase this allocation to 20-25%. Your specific allocation should depend on your age, risk tolerance, and overall financial situation. As you approach retirement, you might consider increasing your gold allocation slightly for added stability.

Can I rebalance between different types of precious metals in my Gold IRA?

Yes, you can rebalance between different precious metals (gold, silver, platinum, and palladium) within your IRA as long as they all meet IRS purity requirements. Some investors maintain specific ratios between metals, such as 70% gold, 20% silver, and 10% platinum. This internal precious metals rebalancing can be done independently of your broader portfolio rebalancing and may help optimize returns as different metals perform differently in various economic conditions.

Are there minimum transaction amounts when rebalancing a Gold IRA?

Yes, most Gold IRA custodians have minimum transaction amounts for buying and selling precious metals, typically ranging from

Frequently Asked Questions About Gold IRA Rebalancing

How often should I rebalance my Gold IRA?

Most financial advisors recommend rebalancing your Gold IRA at least annually. However, the optimal frequency depends on your investment timeline, market conditions, and personal preferences. Conservative investors often choose annual rebalancing, while more active investors might opt for quarterly reviews. Alternatively, using a threshold approach (rebalancing when allocations drift by 5% or more) can be effective for Gold IRAs due to precious metals’ price volatility.

What percentage of my retirement portfolio should be in gold?

Financial experts typically recommend allocating between 5-15% of your retirement portfolio to precious metals, with gold being the primary component. However, during periods of high inflation or economic uncertainty, some investors increase this allocation to 20-25%. Your specific allocation should depend on your age, risk tolerance, and overall financial situation. As you approach retirement, you might consider increasing your gold allocation slightly for added stability.

Can I rebalance between different types of precious metals in my Gold IRA?

Yes, you can rebalance between different precious metals (gold, silver, platinum, and palladium) within your IRA as long as they all meet IRS purity requirements. Some investors maintain specific ratios between metals, such as 70% gold, 20% silver, and 10% platinum. This internal precious metals rebalancing can be done independently of your broader portfolio rebalancing and may help optimize returns as different metals perform differently in various economic conditions.

Are there minimum transaction amounts when rebalancing a Gold IRA?

Yes, most Gold IRA custodians have minimum transaction amounts for buying and selling precious metals, typically ranging from $1,000 to $5,000 depending on the custodian. Additionally, physical gold products come in standard sizes (1 oz, 1/2 oz, etc.), which can make precise rebalancing challenging for smaller accounts. For this reason, some investors with smaller balances rebalance less frequently to ensure transaction sizes meet minimums and to reduce relative fee impact.

Should I rebalance differently during periods of high inflation?

During periods of high inflation, many investors adjust their rebalancing strategy to maintain or even increase their precious metals allocation, as gold has historically served as an inflation hedge. Rather than automatically selling gold that has appreciated beyond your target allocation, you might consider temporarily adjusting your target allocation upward during inflationary periods. Just remember to reassess this strategy regularly as economic conditions change.

,000 to ,000 depending on the custodian. Additionally, physical gold products come in standard sizes (1 oz, 1/2 oz, etc.), which can make precise rebalancing challenging for smaller accounts. For this reason, some investors with smaller balances rebalance less frequently to ensure transaction sizes meet minimums and to reduce relative fee impact.

Should I rebalance differently during periods of high inflation?

During periods of high inflation, many investors adjust their rebalancing strategy to maintain or even increase their precious metals allocation, as gold has historically served as an inflation hedge. Rather than automatically selling gold that has appreciated beyond your target allocation, you might consider temporarily adjusting your target allocation upward during inflationary periods. Just remember to reassess this strategy regularly as economic conditions change.

Conclusion: Balancing Your Golden Years

Rebalancing your Gold IRA is not merely a technical exercise—it’s a crucial strategy for preserving and growing your retirement wealth through changing economic conditions. By maintaining your desired allocation between precious metals and other assets, you create a resilient portfolio that can weather market volatility while capitalizing on gold’s unique properties as a store of value.

Remember that successful rebalancing requires both discipline and flexibility. Establish a regular rebalancing schedule or threshold that works for your situation, but be willing to adapt your approach as market conditions and your retirement timeline evolve. Whether you choose a conservative annual approach or a more active strategy, the key is consistency and alignment with your long-term goals.

As you implement your Gold IRA rebalancing strategy, leverage the tools and resources available to you, stay informed about precious metals markets, and don’t hesitate to consult with financial professionals who specialize in retirement planning with precious metals. Your diligence in maintaining a properly balanced Gold IRA today will help ensure financial security and peace of mind throughout your retirement years.

Get Expert Help With Your Gold IRA Strategy

Still have questions about rebalancing your Gold IRA? Our precious metals specialists can help you develop a customized rebalancing strategy tailored to your retirement goals and market conditions.

Or download our comprehensive guide: