Are you concerned about how inflation might impact your retirement savings? It’s a valid worry, especially as inflation can eat away at your purchasing power, leaving you with less than you expected during your golden years. Fortunately, you have strategies at your disposal to help safeguard your retirement funds against the effects of inflation. By adopting these strategies, you ensure that your hard-earned savings retain their value and continue to meet your needs as time goes on. Let’s explore how you can inflation-proof your retirement.

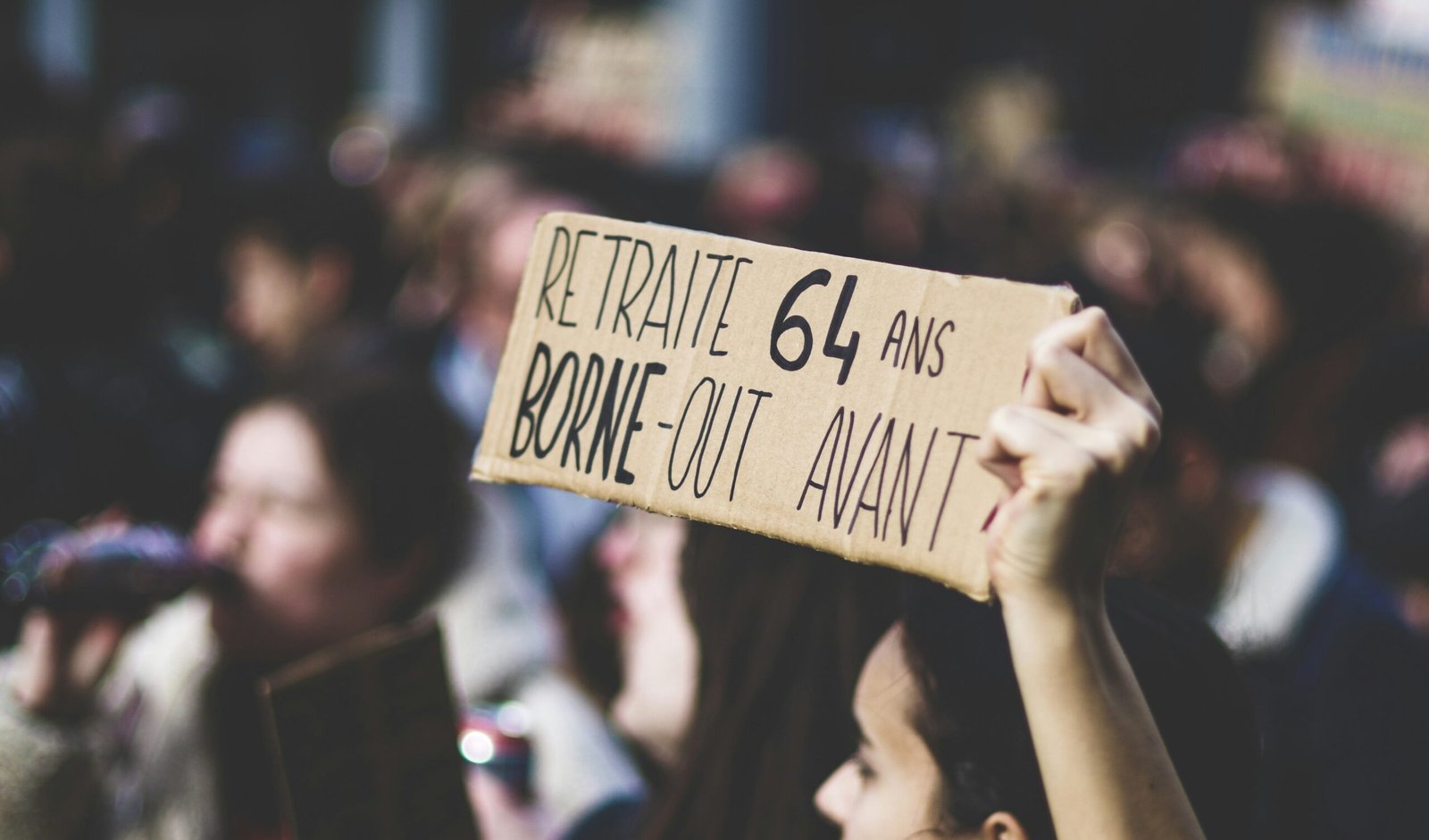

This image is property of images.unsplash.com.

Understanding Inflation and Its Impact

Before delving into the strategies, it’s important that you understand what inflation actually is and how it affects your savings. Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. For example, if inflation is at 3% annually, something costing $100 today will cost $103 next year.

How Inflation Affects Your Savings

Inflation decreases the value of money over time, meaning the same amount of money buys fewer goods and services in the future. This has significant implications for your retirement savings. If your investments don’t keep up with inflation, you risk not being able to afford your desired lifestyle during retirement.

Historical Inflation Rates

To grasp how inflation could impact your retirement, it helps to consider past trends. Historically, inflation has averaged around 3%. However, this rate fluctuates, sometimes rising sharply or dropping. Planning for various inflation scenarios ensures you’re prepared for whatever the future holds.

Diversifying Your Investment Portfolio

One of the fundamental ways to protect your retirement savings from inflation is diversification. Having a well-rounded portfolio lets you spread risk and capitalize on different investment opportunities.

Stocks as a Hedge Against Inflation

Investing in stocks can potentially offer returns that outpace inflation. Equities tend to give higher returns over the long term compared to bonds and savings accounts, thus preserving purchasing power. Companies have the ability to raise prices and grow profits as expenses rise, which can be beneficial for shareholders.

Real Estate and REITs

Real estate is another asset class that tends to keep up with or outpace inflation over time. When property values and rents increase, so does the income generated from these investments. Real Estate Investment Trusts (REITs) provide a way to invest in real estate without the need to directly manage properties, adding another layer of diversification.

Commodities and Precious Metals

Investing in commodities like gold and silver can serve as a hedge against inflation. The value of physical commodities often increases when inflation rises, protecting your purchasing power. Consider allocating a small percentage of your portfolio to these assets to balance other investments.

Considering Inflation-Protected Securities

There are specific financial instruments designed to help you guard against inflation’s impact on your savings.

Treasury Inflation-Protected Securities (TIPS)

TIPS are a type of U.S. Treasury bond that’s indexed to inflation. The principal of a TIPS bond increases with the Consumer Price Index (CPI), ensuring that the bond’s payout keeps pace with inflation. While they may offer lower yields than regular treasury bonds, their inflation-adjustment feature provides valuable protection.

Understanding I Bonds

I Bonds are another inflation-protected investment offered by the U.S. Treasury. These savings bonds adjust for inflation twice a year. They’re relatively safe and can be cashed after 12 months, providing both flexibility and inflation protection.

Saving More Than You Think You’ll Need

Planning for more than your anticipated expenses gives you a buffer against inflation.

Aligning Savings with Inflation

When setting your retirement savings goals, err on the side of caution. Consider adding an additional 3-4% to your expected expenses to account for inflation. This ensures more flexibility and security in your retirement years.

Emergency Fund Considerations

Maintain an emergency fund that’s separate from your retirement savings. This fund should be readily accessible and can help prevent you from dipping into your retirement savings for unplanned expenses, thus keeping those funds intact and growing.

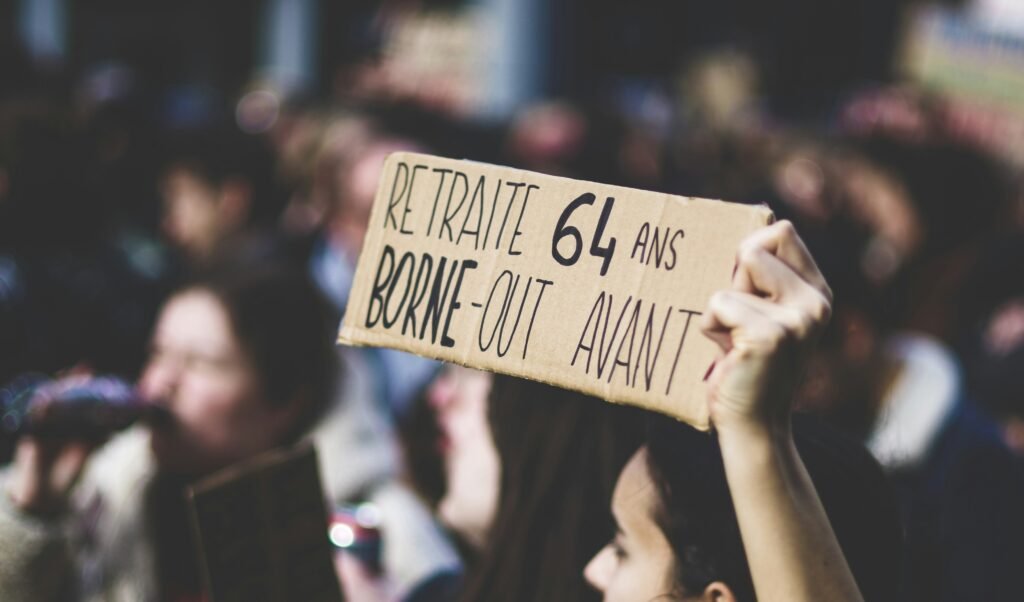

This image is property of images.unsplash.com.

Utilizing Annuities Strategically

Annuities can be a useful tool in your strategy to lock in a steady income, but they come with their complexities.

Fixed and Variable Annuities

Fixed annuities offer a guaranteed payout, which can provide stability. In contrast, variable annuities yield returns based on market performance, with the potential for higher gains. Consider combining both types to balance security with growth.

Inflation-Protected Annuities

Some annuities are specifically designed to adjust payouts according to inflation rates. While these might come with lower initial payouts, they ensure that your income keeps pace with inflation, securing your purchasing power over time.

Social Security and its Role

Social Security benefits include a cost-of-living adjustment (COLA) which can help mitigate the effects of inflation.

Maximizing Social Security Benefits

Delaying your Social Security benefits can increase your monthly payout. Since these benefits are adjusted for inflation, a higher starting amount gives you a better base to grow upon.

Understanding COLA

The COLA increases your Social Security payments to align with inflation, providing a built-in hedge. Understanding how COLA works and how it affects your benefits can aid in planning your retirement strategy effectively.

This image is property of images.unsplash.com.

Planning for Healthcare Costs

Healthcare can be one of the most significant expenses you face during retirement, and these costs generally rise faster than the overall inflation rate.

Estimating Future Healthcare Expenses

While it’s tough to predict exact figures, start by looking at average healthcare costs for retirees in your region. Factor in long-term care insurance to protect yourself from unpredictable medical expenses.

Health Savings Accounts (HSAs)

HSAs offer a tax-advantaged way to save for healthcare expenses. The money contributed is tax-deductible, can grow tax-free, and withdrawals are tax-free for qualified medical expenses. HSAs are a smart addition to your inflation-proof retirement strategy.

Lifestyle Changes and Budgeting

Flexibility in your plans can also shield you against inflation.

Adjusting Lifestyle Expectations

Consider tweaking your lifestyle both before and during retirement. Opt for less expensive versions of the things you enjoy, or find free ways to engage in hobbies. This ensures a more adaptable spending model.

Creating a Flexible Budget

You should set a budget that allows for fluctuations in costs and unanticipated expenses. Monitor your spending closely and adjust as needed to keep up with inflationary trends.

The Power of Continuous Learning

Staying informed enables you to adapt better to changes in inflation and the economy.

Keeping Abreast of Economic Trends

Engage in continuous education about market trends, economic shifts, and factors affecting inflation. This knowledge equips you to adjust your strategies proactively, maintaining your financial health.

Seeking Professional Guidance

Consider consulting financial advisors specializing in retirement planning and inflation-proof strategies. They can offer tailored advice based on your specific situation and goals.

Utilizing Technology and Tools

Use financial management tools and apps to project inflation’s impact on your retirement savings. These tools can help track your investments and expenses accurately, offering insights that facilitate goal-oriented planning.

Conclusion

Inflation-proofing your retirement is not a one-size-fits-all approach but a multifaceted strategy requiring thoughtful planning and regular revision. By diversifying your investments, considering inflation-protected securities, and maintaining flexibility in your spending, you’re taking proactive steps to ensure your retirement savings maintain their value. Pay attention to healthcare costs and consider annuities cautiously. Stay informed and continue to learn, adjusting your strategy as needed. By preparing carefully, you’re securing a more stable and enjoyable retirement, free from the destabilizing effects of inflation.