Surprising fact: in 2024, retirement rules let investors contribute up to $7,000 to a self-directed individual retirement account that holds physical metals — but those holdings must stay in an IRS-approved depository or face taxes and penalties.

This introduction helps readers compare American Gold Eagles and bars inside a gold ira. It explains why a self-directed ira needs a specialty custodian and secure storage to keep tax benefits intact.

Why it matters: coins often carry higher recognition and resale ease, while bars usually have lower premiums. Both choices affect cost, liquidity, and how well metals fit a balanced retirement plan.

The article will cover custody rules, total cost of ownership, and how to weigh diversification versus long-term returns so investors can pick the best option for their accounts.

Key Takeaways

- Self-directed accounts holding physical metals require an approved custodian and depository for tax protection.

- American Eagles may trade easier; bars often cost less per ounce—both affect liquidity and value.

- Evaluate dealer spreads, custodian fees, insurance, and storage before buying.

- Gold can hedge inflation, but stocks have historically offered higher long-term returns.

- Compliance matters: personal possession can trigger taxable distributions and penalties.

Why Consider Gold in Retirement? Setting the Stage for a Balanced, Self-Directed Strategy

A small allocation to tangible assets can smooth returns when stocks stumble. Investors often add metals to a retirement account to hedge inflation economic uncertainty and to introduce a non-correlated holding alongside stocks and bonds.

Inflation hedge and diversification during economic uncertainty

Metals tend to hold or gain value during crises and high volatility. That behavior can reduce portfolio drawdowns when risk assets fall.

Note: these benefits are most visible during sharp market stress, not every year. Treat this as insurance rather than a growth engine.

How gold’s role compares to stocks over the long term

Historically, broad equities delivered stronger long-run returns than bullion. Stocks have offered compounding growth, while metals often trade sideways between spikes.

So, position metals as a complement, not the primary growth driver. Size allocations by time horizon, risk tolerance, and retirement goals.

- Practical trade-offs: holding tangible metals changes liquidity, costs, and storage versus funds.

- Plan first: buy gold for retirement as part of a written strategy, not a headline-driven reaction.

- Self-directed work: these accounts require more involvement; vet custodians and depositories carefully.

Learn more about structuring a self-directed individual retirement and how to buy gold for an account before you commit.

Gold IRA Basics: How a Self-Directed Individual Retirement Account Holds Physical Metals

Not all IRAs can store minted bars and coins — a self-directed option changes that. A self-directed individual retirement lets a retirement account hold approved bullion such as gold, silver, platinum, and palladium that meet IRS standards.

How this account differs from standard retirement accounts

A type self-directed individual structure functions like traditional and Roth IRAs for tax rules. You choose pretax or after-tax treatment, and distributions follow the usual timelines.

Approved metals, purity, and contribution rules

- Eligible forms: only IRS-approved bullion bars and specific coins from accredited mints; collectible or numismatic pieces do not qualify.

- Purity standards: most gold must meet 99.5% purity, though some coins are exceptions under IRS guidance.

- 2024 limits and age rules: contribution caps are $7,000 ($8,000 if 50+). Withdrawals before age 59½ typically incur a 10% penalty. Traditional accounts require RMDs at the statutory ages; Roths do not.

Custodian and storage requirements

The qualified custodian administers your account, coordinates purchases, and ensures assets meet rules. Your metals must be shipped directly to an IRS-approved depository.

Important: taking possession of approved bullion triggers a taxable distribution and possible penalties. For an overview of how these accounts work, see this guide on gold ira basics.

Physical Gold IRA: Step-by-Step to Open, Fund, Buy, and Store

Before you buy, follow a stepwise path to open, fund, and secure metals inside a retirement account.

Step 1: Choose a qualified custodian that handles self-directed accounts for precious metals and confirm they support the exact items you plan to buy.

Step 2: Fund the account by contribution within annual limits or via a direct transfer or rollover from a 401(k) or another ira to avoid taxes. Confirm paperwork and timelines.

Step 3: Use the custodian’s purchase flow to buy IRS-approved products so the dealer ships directly to an approved depository. Never have holdings sent to your home.

- Confirm storage type (segregated vs non-segregated), insurance, and reconciliation procedures.

- Keep invoices, spot-price records, and depository confirmations for your retirement plan file.

Tax and timing: Distributions before age 59½ are generally taxed and may incur a 10% penalty. Plan for required minimum distributions on traditional accounts.

Compare costs: Ask companies for written fee schedules, buy/sell spreads, and shipping insurance so you can compare total ownership expenses. For more on downsides, see this short guide on potential negatives of a gold ira.

American Gold Eagles vs Gold Bars: What’s IRS-Eligible and What Fits Your Plan

Deciding between minted coins and stamped bars affects fees, liquidity, and long-term value. Start by checking eligibility and how a choice supports your retirement goals.

Purity and eligibility

Most bullion held in a gold ira must meet a 99.5% purity threshold and come from an approved mint or refiner. The American Eagle coin is a notable exception the IRS allows despite slightly lower purity.

Tip: confirm any item against the official IRA-approved gold list before purchase to avoid disallowed collectibles.

Premiums and spreads

Coins like Eagles often carry higher premiums because of brand recognition and U.S. Mint backing. Dealers sell above spot and buy below spot; that spread determines how quickly an investment breaks even.

Bars usually cost less per ounce and lower initial markup, making them attractive for larger allocations where minimizing premiums is the priority.

Liquidity, recognition, and resale

Coins tend to be easier to resell thanks to wide recognition, while some large bars require assays or find fewer buyers. Consider whether you want to sell in small increments or move larger blocks of metal.

- Ask dealers for written buy/sell quotes to compare spreads.

- Match your choice to your plan: coins for resale ease, bars for cost efficiency.

- Learn more on how these choices affect retirement holdings by understanding how a gold ira works.

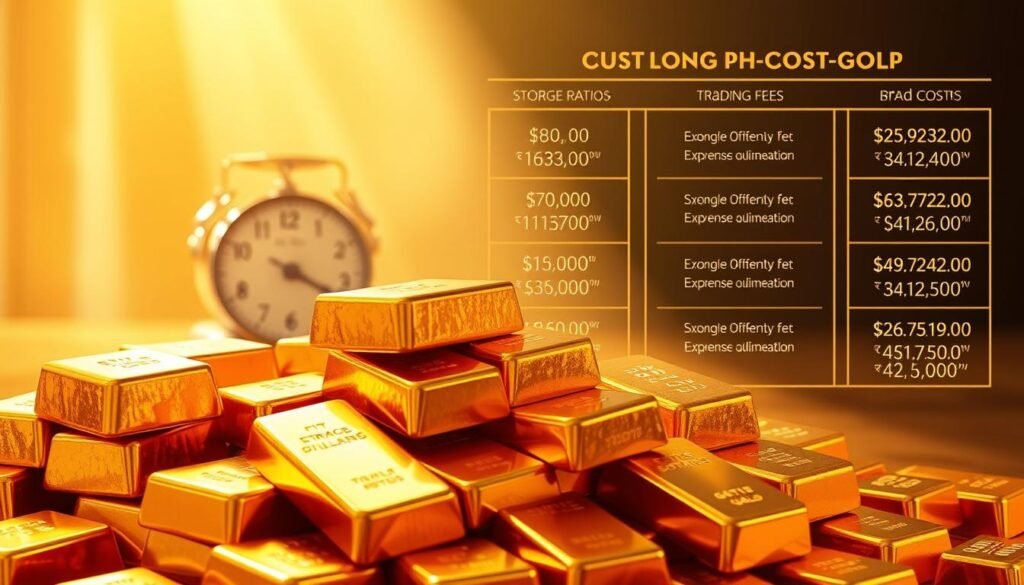

Total Cost of Ownership: Fees, Spreads, and Storage That Impact Long-Term Value

Total ownership costs determine how fast your stake reaches breakeven and how much value remains for retirement. Start by knowing the spot price — the cash cost per troy ounce for immediate delivery. Dealers quote retail prices above spot and buy-back prices below spot; that difference is the spread and it matters for your breakeven timeline.

How to compare quotes and compute the true spread

Multiply total ounces by today’s spot to get melt value. Then compare that to the quoted retail price. Ask the dealer for a written buy-back price the same day to reveal the spread.

Ongoing fees and red flags

- Ongoing costs: custodian administration, approved depository storage, and insurance — request a full written schedule.

- Beware extreme markups: CFTC cases exposed spreads over 300%. If a company won’t disclose fees in writing, treat it as a red flag.

- Verify holdings: review SDIRA statements for melt value (weight × spot) to confirm you received the metals you paid for.

Practical tip: get multiple quotes from different companies for identical products, quantities, and storage. Lower premiums and modest ongoing fees let more of your money work for long-term investments.

For a deeper look at hidden charges and long-term cost impact, read this guide on true cost of holding metals in.

Compliance and Rules to Avoid Penalties with Physical Gold in IRAs

Clear compliance steps protect your retirement savings from surprise taxes and penalties.

Keeping metals in your personal home or safe will usually trigger a taxable distribution. That means the ira account can lose tax-advantaged status and you may owe taxes plus penalties.

Why home storage is not an option

Do not take possession of items that an account is supposed to hold. A custodian must arrange delivery to an IRS-approved depository. Allowing personal possession risks immediate taxation and possible excise penalties.

Which products qualify and how to verify

Only bullion coins and bars from approved mints or accredited refiners meet eligibility. Collectible or numismatic coins are not allowed.

| Compliance Item | What to Check | Action Required |

|---|---|---|

| Storage | IRS-approved depository under custodian | Confirm depository receipt for each shipment |

| Product Eligibility | Approved mints/refiners; bullion only | Verify UPC/assay and custodian approval before buy |

| Documentation | Invoices, shipping, depository statements | Keep copies in retirement file for audits |

Practical tip: review your custodian’s approved product list and require dealers to confirm eligibility in writing. Document every step to protect your account from unexpected taxes and to preserve long-term retirement benefits.

Risk Management: Volatility, Fraud Red Flags, and Finding Reputable Companies

Before adding bullion to a retirement plan, set position sizes that match your time horizon and risk tolerance. Market swings can be sharp; limit allocations so short-term volatility won’t derail retirement goals.

Market risk and sizing

Treat metals as a hedge, not a growth engine. Small, measured allocations help preserve purchasing power without exposing the whole account to price gyrations.

Fraud warnings from regulators

The CFTC and FINRA warn about scams that target older people. Red flags include unsolicited cold calls, pressure tactics, vague pricing, “free gifts,” and refusal to provide written spreads or buy-back quotes.

How to vet dealers and firms

Verify business addresses, operating history, and registrations. Search owner and salesperson names for disciplinary records and complaints.

- Ask for all fees, commissions, storage, insurance, and buy-back prices in writing.

- Compare multiple companies side-by-side to find transparent fee schedules.

- Review your account statements for melt value and quantities; report discrepancies immediately to your custodian.

Report suspected fraud to CFTC.gov/complaint or to FINRA. Seniors can call the FINRA Securities Helpline for Seniors at 844-574-3577 for guidance.

Conclusion

A clear retirement strategy makes the choice between minted coins and stamped bars much easier. American Gold Eagles offer strong recognition and easy resale, while bars usually lower premiums. Match the pick to your exit plan and liquidity needs.

Open the correct type self-directed individual account, pick a trusted custodian, fund the account properly, and only buy items that meet rules. Insist on depository storage and never move holdings to your home to avoid taxes and penalties.

Confirm spreads, fees, and buy-back terms in writing to protect retirement savings. Size this allocation as part of a diversified plan, then compare at least two best gold ira providers or gold ira companies for transparency and service.

Document every step, ask questions, and partner with reputable firms so your precious metals strategy supports your broader individual retirement account goals.

FAQ

What is a self-directed retirement account that holds precious metals?

A self-directed individual retirement account lets you hold alternative assets like IRS-approved bullion and certain coins instead of just stocks and bonds. It works like a traditional or Roth plan for tax treatment but requires a specialty custodian to manage account paperwork and an approved depository to store the metal. You still follow contribution limits and distribution rules set by the IRS.

Why add bullion to retirement savings as an inflation hedge?

Metals often move differently than equities and can help reduce portfolio volatility during inflationary or uncertain economic periods. Allocating a portion of retirement savings to bullion can provide diversification and may preserve purchasing power when paper assets face volatility.

How does holding coins compare with bars inside a self-directed account?

Coins like American Eagles are highly recognized and liquid but tend to carry higher premiums. Bars usually deliver lower spreads relative to spot price, making them cost-effective for larger allocations. Eligibility and purity rules can affect which options are allowed inside the account.

What purity or eligibility rules should I know?

The IRS allows certain high-purity metals; most bullion must meet minimum fineness standards (for example, 99.5% for many bars). The American Eagle coin is an exception because the U.S. Mint issues it, even though its purity differs from some bars. Always confirm IRS guidance and custodian policies before buying.

How do I open and fund a self-directed account to buy approved bullion?

First, choose a qualified custodian that supports precious metals. Open the account, then fund it by annual contribution, a trustee-to-trustee transfer, or a rollover from a 401(k) or existing IRA. After funding, instruct the dealer to purchase IRS-approved metal and ship it directly to the custodian’s approved depository.

Can I store the metal at home or in a personal safe?

No. Holding metal personally typically triggers a taxable distribution and penalties because IRS rules require storage at an approved third-party depository. Home storage myths can be costly, so use custodian-approved storage and get written confirmation of the arrangement.

What fees should I expect over the life of the account?

Expect dealer markups (spreads), custodian administrative fees, depository storage fees, and insurance costs. These expenses affect long-term returns, so request full, written fee schedules and compare quotes against spot price before committing.

How do rollovers from a 401(k) work when buying metals?

A trustee-to-trustee rollover moves assets directly from the plan administrator to your new self-directed account without creating a taxable event. Once funds land in the account, you can instruct purchases of IRS-approved bullion, following custodian and depository procedures.

What tax and distribution rules apply when I take assets out?

Tax treatment depends on account type: distributions from a traditional account are taxed as ordinary income, while Roth distributions may be tax-free if qualified. Required minimum distributions (RMDs) apply to traditional accounts after age 73 (subject to current law), and taking physical metal as a distribution has special handling and tax consequences.

How do I avoid scams or fraudulent dealers?

Watch for cold calls, pressure to buy immediately, inflated buy-back guarantees, and hidden fees. Verify dealers with the Commodity Futures Trading Commission, FINRA, and state regulators. Check complaint histories, read independent reviews, and ask for clear, written pricing and custody terms before purchasing.

How liquid are holdings when I need to sell inside the account?

Liquidity depends on the product and dealer network. American-minted coins and major bars are easier to sell at competitive prices. Expect dealer spreads and processing time; always confirm the custodian’s sell process and any payout timelines before selling.

Are collectible or numismatic coins allowed in a retirement account?

Generally no. The IRS treats collectibles differently and often disallows rare, numismatic coins in retirement accounts. Stick to approved bullion and government-minted coins that meet IRS fineness and manufacturer criteria to avoid disqualification and taxes.

How should I size a metals position within my retirement portfolio?

Position sizing depends on risk tolerance, time horizon, and overall goals. Many investors allocate a modest percentage—often 5–15%—to metals for diversification. Avoid concentrating too heavily in any single asset class and rebalance periodically as part of a holistic retirement plan.

Can I combine tax advantages from different account types when buying bullion?

Yes. You can hold bullion within traditional, Roth, or SEP-style self-directed accounts. Each offers different tax benefits: traditional contributions may be tax-deductible with taxable distributions later, while Roth contributions grow tax-free if rules are met. Consult a tax advisor to align metal holdings with your tax strategy.

What documentation should I get when buying and storing bullion through my custodian?

Obtain purchase invoices, chain-of-custody shipping records, depository storage agreements, insurance confirmations, and custodian account statements showing the asset details. Keep these records for tax reporting and future resale or distribution events.