Have you ever found yourself wondering how you can ensure a comfortable retirement while keeping inflation’s impact at bay? It’s a common concern for many as they plan for their future. Retirement should be a time to relax and enjoy the fruits of your labor, but without proper planning, inflation can erode your savings and purchasing power. Let’s explore how you can safeguard your retirement against inflation’s long-reaching grasp.

Understanding Inflation and Its Impact on Retirement

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. In simple terms, as inflation increases, each dollar you save or earn buys less. Inflation is an inevitable economic phenomenon that can have a significant impact on your retirement savings.

How Does Inflation Affect Retirement?

Inflation can erode the value of your retirement savings, meaning that the money you have saved may not stretch as far in the future as it would today. This decrease in purchasing power can affect your ability to maintain your current lifestyle during retirement. Understanding inflation’s implications is crucial to developing strategies that preserve and enhance your financial security during retirement.

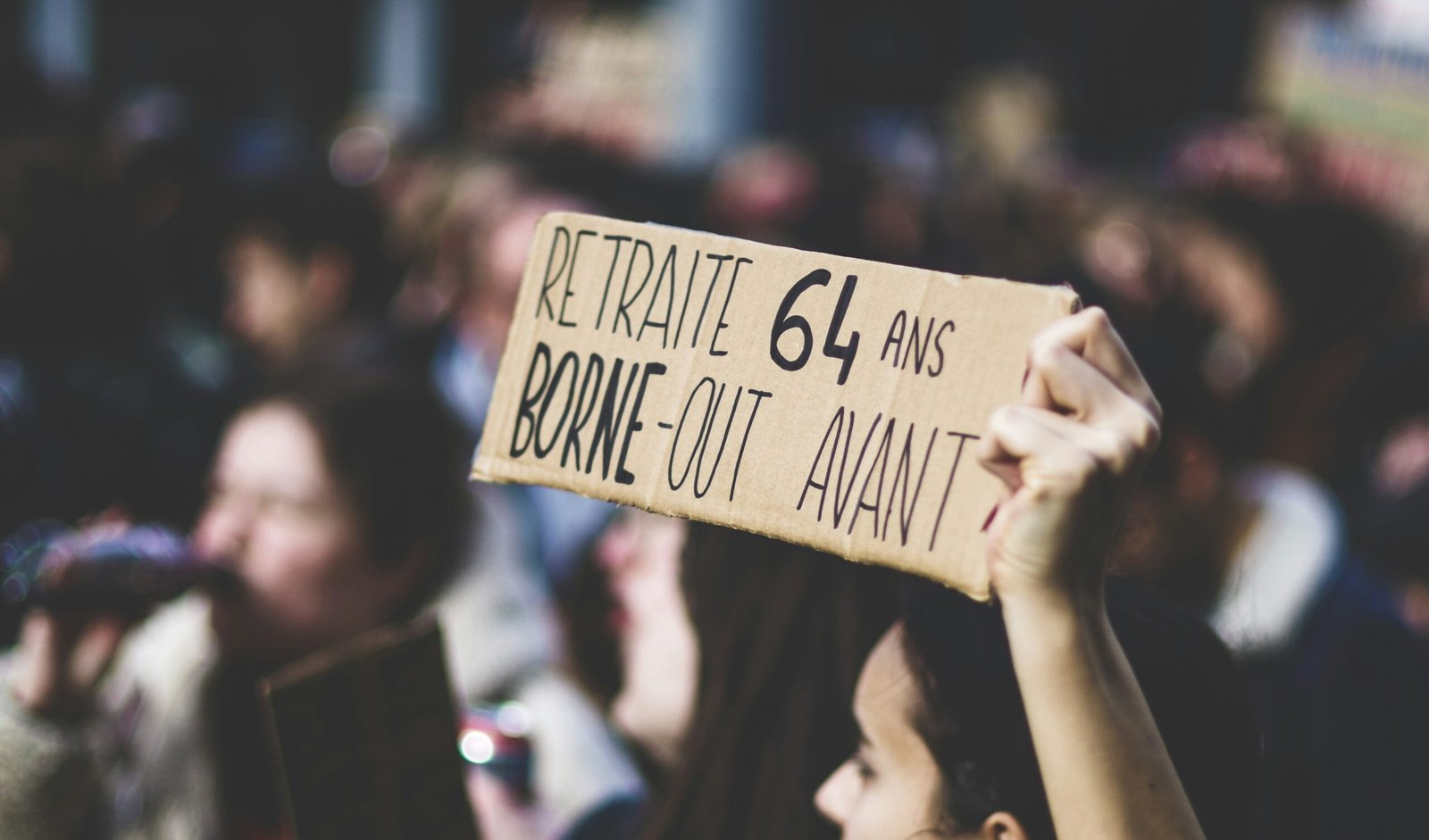

This image is property of images.unsplash.com.

Planning for an Inflation-Proof Retirement

Assessing Your Retirement Needs

Before addressing inflation, it’s essential to know what your retirement will require. Consider your anticipated living expenses, lifestyle choices, and potential medical costs. Having a clear idea helps in understanding how inflation could affect these areas and what kind of income you will need to cover them.

Diversifying Your Portfolio

A diversified investment portfolio is one of the most effective ways to protect against inflation. Allocating your assets into a mix of stocks, bonds, real estate, and commodities can help mitigate risks. Historically, certain asset classes like equities and real estate have provided returns that outpace inflation.

Exploring Inflation-Protected Investments

One of the fundamental strategies to counter inflation is to consider investments specifically designed to hedge against inflation.

| Investment Type | Description |

|---|---|

| TIPS (Treasury Inflation-Protected Securities) | TIPS are government bonds specifically indexed to inflation, ensuring that your principal increases with inflation and providing interest payments twice a year. |

| Real Estate | Property values and rental income often increase with inflation, providing a hedge. Real estate investment trusts (REITs) can be a good option for those not wanting to manage property directly. |

| Commodities | Investing in physical assets like gold and silver can serve as a hedge against inflation as their value typically rises with inflation. |

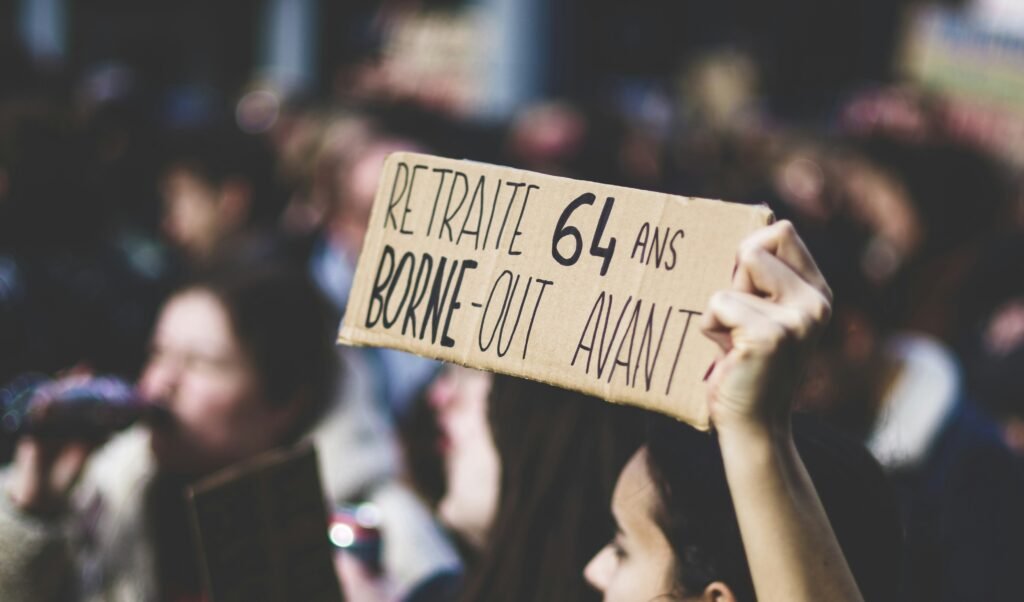

This image is property of images.unsplash.com.

Generating Income Streams to Combat Inflation

Social Security and Pensions

Social Security benefits are adjusted for inflation through Cost of Living Adjustments (COLAs), which help maintain your purchasing power. If you have a pension plan, understand how, if at all, it is adjusted for inflation.

Annuities and Their Inflation Protection

Annuities can provide a steady income stream, and some come with inflation protection features that periodically increase payouts. Consider inflation-indexed annuities, although they may offer lower initial payments, the protection they provide against inflation can be worth the trade-off.

Maximizing Your Earnings and Savings

Continuing to earn through part-time work or creative endeavors can supplement your income. In addition, maximizing employer retirement contributions, reducing unnecessary expenses, and regularly reviewing your financial plans can further insulate your savings from inflation’s impact.

This image is property of images.unsplash.com.

Considering Healthcare Costs

Planning for Rising Healthcare Expenses

Healthcare can be one of the most significant expenses during retirement. Medical costs usually rise faster than inflation, making it crucial to include them in your long-term planning. Consider long-term care insurance to help manage unexpected health-related expenses.

Health Savings Accounts (HSAs)

If you’re eligible, Health Savings Accounts offer tax-advantaged savings for medical expenses. Contributions, earnings, and withdrawals for qualified health expenses are tax-free, and these accounts can form a crucial part of your retirement health strategy.

This image is property of images.unsplash.com.

Staying Informed and Flexible

Regular Financial Reviews

Regularly reviewing your financial situation and retirement strategy allows you to make necessary adjustments and stay on track with your goals. Market conditions and personal circumstances evolve, and your financial plans should be flexible to accommodate these changes.

Consulting Financial Advisors

Engaging a financial advisor can provide you with professional insights and personalized strategies. Advisors can help ensure your retirement plan accounts for inflation and other economic variables while fitting your personal financial situation and goals.

The Role of Continuous Education

Staying informed about economic trends, inflation rates, and financial strategies is empowering. Continuous education helps you make informed decisions and adapt your strategies as needed to protect your future.

This image is property of images.unsplash.com.

Conclusion

Retirement planning requires careful consideration and proactive strategies to combat inflation. By diversifying your portfolio, exploring inflation-protected investment options, generating various income streams, planning for healthcare costs, and staying informed, you can help ensure your retirement savings maintain their purchasing power. Taking these steps today can provide peace of mind tomorrow, allowing you to focus on enjoying your retirement years to their fullest.