Have you ever wondered how you can protect yourself from crafty schemes targeting your finances, particularly your IRA (Individual Retirement Account)? If so, you’re not alone. Many people are concerned about the ever-present threat of scams in today’s fast-paced digital world. Unfortunately, IRAs, one of the cornerstones of retirement planning, are not free from such fraudulent activities. But worry not, with some basic awareness and precautionary measures, you can safeguard your hard-earned savings.

Understanding IRA Scams

Individual Retirement Accounts (IRAs) are popular among many for saving for retirement due to their tax advantages and flexibility in investments. This popularity also makes them a tempting target for scammers. By understanding the types of IRA scams out there, you can better protect yourself.

What is an IRA Scam?

An IRA scam typically involves deceptive practices or fraudulent schemes engineered to illegitimately access funds within your IRA. With improved technology, scammers have become more sophisticated in their approaches, using both direct and indirect methods to lure potential victims into providing confidential information or transferring funds.

Why Scammers Target IRAs

IRAs attract scammers because these accounts often contain substantial amounts of money, providing an appealing target for financial theft. Many people accumulate funds over several decades, making these accounts ripe for fraudulent activity. Additionally, the rules governing IRAs can be complex, which might cause some investors to be less vigilant about unusual transactions or claims.

This image is property of images.unsplash.com.

Common Types of IRA Scams

Understanding the different types of IRA scams is your first step toward protecting your investments. Here’s a breakdown of some of the most common scams:

Phishing Scams

Phishing is a fraudulent attempt to obtain sensitive information by masquerading as a trustworthy entity. In the context of IRA scams, scammers may send emails or texts claiming to be from a legitimate financial institution, prompting you to click on a link and verify your account information. Once you do, your personal data is at risk of being misused.

Ponzi Schemes

Ponzi schemes involve using funds from new investors to pay returns to earlier investors, rather than from profit earned by the organization. Scammers promise high returns with low risk in an attempt to attract investors into fake investment opportunities, including IRAs.

Identity Theft

Identity theft occurs when someone steals your personal information to commit fraud. Scammers may pose as financial advisors or representatives from credible institutions, convincing you to reveal your IRA details. Once they have access, they can siphon funds directly from your account.

Misleading Investment Opportunities

Some scammers present themselves as legitimate financial advisors, promoting specific investment products as ideal for your IRA. They might falsely represent the potential returns or risks associated with these investments. Always verify the credentials of any advisor and critically assess their investment claims.

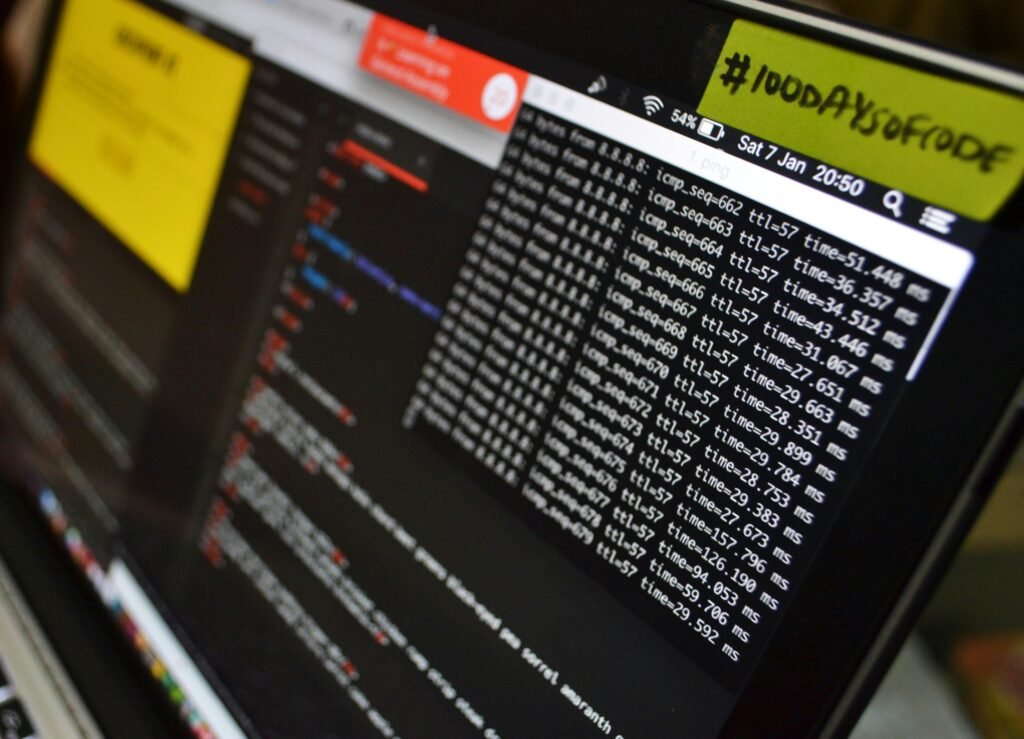

Cybersecurity Breaches

Cybersecurity breaches involve unauthorized access to your IRA through online platforms. Scammers might exploit weak passwords or outdated security protocols to gain access to your accounts. This can lead to unauthorized transactions and identity theft.

This image is property of images.unsplash.com.

Recognizing Warning Signs

Knowledge is power. Being aware of the red flags associated with IRA scams can empower you to detect and thwart potential threats.

Unsolicited Communication

Receiving unexpected contact from individuals or organizations claiming to require detailed account information is a red flag. Legitimate institutions will never ask for sensitive information via email or phone without a secure communication channel.

Pressure to Act Immediately

Scammers often create a sense of urgency to bypass your reasoning, encouraging you to make hasty decisions. Be wary of any investment opportunity that demands immediate action or suggests you’ll miss out on a once-in-a-lifetime return.

Too Good to Be True Returns

Promises of exceptionally high returns with little or no risk should raise suspicion. All investments carry a certain level of risk, and understanding this can help you identify scams promising otherwise.

Lack of Documentation

Reputable financial professionals and institutions provide thorough documentation and transparency in all transactions. If you’re faced with vague or missing details regarding your investments, it’s important to proceed with caution.

Changes in Account Statements

Monitor your account statements regularly. Sudden discrepancies or unauthorized transactions are strong indicators of fraudulent activity within your IRA.

This image is property of images.unsplash.com.

How to Protect Your IRA

Securing your IRA begins with proactive steps and a vigilant approach to managing your finances.

Use Secure Passwords and Authentication

Create strong, unique passwords for your financial accounts and update them regularly. Enable two-factor authentication for an added layer of security, ensuring that even if your password is compromised, an additional verification step is required.

Regular Monitoring of Account Activity

Keeping a close eye on your IRA enables you to detect suspicious activity promptly. Set up alerts and notifications for any transactions made, ensuring you’re immediately aware of any changes.

Educate Yourself on Investment Fraud

Knowledge of common fraud tactics is a powerful tool. Attend seminars, read reputable sources, and stay updated on new schemes targeting IRA accounts. Being informed allows you to recognize suspicious behavior early on.

Verify and Research Investment Opportunities

Before committing to any IRA investments, conduct thorough research. Verify the credentials of brokers or advisors through regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC). This ensures that you’re dealing with certified professionals.

Protect Personal Information

Safeguard your personal data both online and offline. Avoid sharing sensitive information through email or over the phone unless you’re sure of the recipient’s identity. Shred documents containing confidential information before disposal.

Report Suspicious Activity

If you suspect any fraudulent activity, it’s crucial to report it immediately. Contact your financial institution, the SEC, or FINRA. Timely reporting can help prevent further unauthorized actions on your accounts and assist authorities in combating fraudulent schemes.

This image is property of images.unsplash.com.

Resources and Support

Having access to the right resources can provide valuable support in safeguarding your IRA. Here are some places where you can seek help:

Regulatory Bodies

Organizations like the SEC and FINRA play a vital role in regulating the securities industry and protecting investors from fraud. These bodies offer resources and assistance if you suspect fraudulent activity targeting your IRA.

Online Security Organizations

Stay informed about the latest cybersecurity threats and tips by following online security organizations. They provide guidance on protecting your digital identity and secure browsing practices.

Educational Programs

Participate in investor education programs offered by financial institutions or regulatory bodies. These programs can equip you with the knowledge needed to make informed investment decisions and spot fraudulent activity.

Fraud Reporting Platforms

Use platforms such as the Federal Trade Commission’s (FTC) website to report suspected scams. These platforms track fraudulent activities, helping both individuals and regulatory bodies monitor scam trends and enhance prevention strategies.

Professional Financial Advisors

Consider seeking advice from credible, certified financial advisors. They can provide guidance tailored to your personal financial situation, aiding in creating a robust defense against potential threats.

This image is property of images.unsplash.com.

Conclusion

Protecting your IRA from scams requires vigilance and knowledge. By understanding the myriad scams out there and recognizing their warning signs, you can significantly reduce your risk of falling victim to such threats. Remember, safeguarding your financial future is an ongoing process that benefits from continual education, awareness, and precautionary practices. Stay alert, stay educated, and keep your investments secure.