Selecting the right Gold IRA custodian is a critical decision that directly impacts your retirement security and investment returns. While many investors focus solely on gold prices and investment potential, the custodian you choose can significantly affect your costs, service quality, and peace of mind. This comprehensive guide will help you navigate the process of finding a Gold IRA custodian that aligns with your financial constraints while still providing the essential services you need for a secure precious metals retirement investment.

Why Your Gold IRA Custodian Choice Matters for Your Budget

A Gold IRA custodian is a financial institution that oversees the assets in your precious metals IRA account. Unlike traditional IRAs that hold paper assets, Gold IRAs require specialized custodians approved by the IRS to handle physical precious metals. Your custodian will be responsible for IRS reporting, administering transactions and withdrawals, and managing depository paperwork.

The custodian you select will directly impact your investment in several ways:

- The fees you’ll pay annually and over the lifetime of your investment

- The minimum investment required to open your account

- The quality and security of the storage facilities used

- The level of customer service and educational resources available

- The transparency of pricing and fee structures

Budget-conscious investors need to carefully balance cost considerations with service quality. The lowest-cost option isn’t always the best value if it comes with security risks or poor customer service. Conversely, the most expensive custodian doesn’t necessarily provide superior protection for your precious metals.

Understanding Gold IRA Custodian Fee Structures

Before comparing custodians, you need to understand the typical fee categories that will impact your budget:

Common Gold IRA Fees to Consider

| Fee Type | Typical Range | Payment Frequency | Budget Impact |

| Account Setup Fee | $50-$300 | One-time | Low (one-time cost) |

| Annual Maintenance Fee | $75-$300 | Annual | High (recurring) |

| Storage Fee | $100-$300 | Annual | High (recurring) |

| Transaction Fees | $25-$50 per transaction | Per transaction | Medium (depends on activity) |

| Wire Transfer Fee | $20-$50 | Per transfer | Low (occasional) |

| Early Withdrawal Penalty | 10% of withdrawal amount | Per early withdrawal | High (if applicable) |

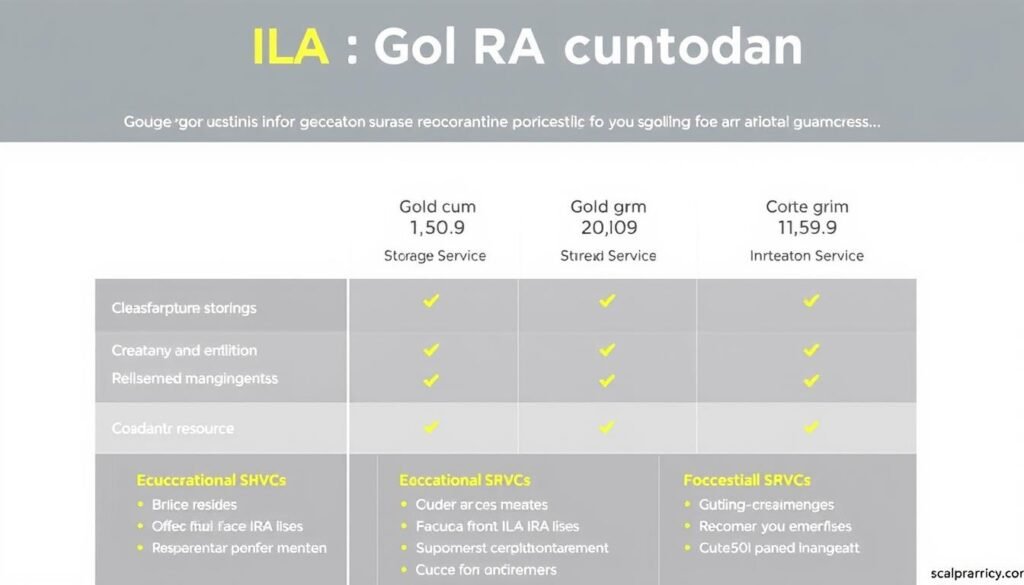

Fee Structure Types

Flat Fee Structure

Some custodians charge the same annual fees regardless of account size. This structure typically benefits investors with larger accounts, as the fee represents a smaller percentage of their total investment.

Example: A $150 annual fee on a $50,000 investment equals 0.3% of assets annually, but the same fee on a $10,000 investment equals 1.5% of assets.

Scaled Fee Structure

Other custodians use a percentage-based fee that scales with your account value. This approach often benefits smaller investors initially but can become more expensive as your account grows.

Example: A 0.5% annual fee on a $10,000 investment equals $50, but the same percentage on a $100,000 investment would be $500.

Budget Tip: When comparing custodians, calculate the total fees you’ll pay over 5, 10, and 20 years based on your expected investment amount. This long-term perspective often reveals significant cost differences that aren’t apparent when looking at individual fees.

Minimum Investment Requirements and Budget Constraints

Gold IRA custodians vary significantly in their minimum investment requirements, which is a critical consideration for budget-conscious investors:

Typical Minimum Investment Tiers

Entry-Level

$5,000-$10,000

Most accessible for new investors with budget constraints. May have higher percentage-based fees or fewer services.

Mid-Range

$10,000-$25,000

Balance of accessibility and service quality. Often the sweet spot for value-conscious investors.

Premium

$25,000-$50,000+

Higher minimums but may waive certain fees or offer enhanced services and dedicated representatives.

Budget Considerations for Minimum Requirements

When evaluating minimum investment requirements, consider these budget-related factors:

- Fee waiver thresholds: Some custodians waive first-year fees for accounts above certain thresholds (typically $25,000-$50,000).

- Rollover vs. new contribution: If you’re rolling over an existing retirement account, you may already meet higher minimums that provide better fee structures.

- Growth plans: If you plan to make regular contributions, starting with a custodian that accommodates smaller initial investments but offers competitive fees for larger accounts may be advantageous.

“The right minimum investment level for your Gold IRA should align with both your current budget constraints and your long-term retirement goals. Don’t overextend yourself financially just to meet a higher minimum, but also consider the long-term cost implications of your choice.”

Balancing Cost with Essential Services

Finding the right Gold IRA custodian for your budget isn’t just about identifying the lowest fees—it’s about maximizing value. Here’s how to evaluate what services are essential versus optional based on your specific needs:

Essential Services Worth Paying For

Worth the Investment

- Secure storage: Never compromise on the security of your physical gold storage. IRS-approved depositories with full insurance are essential.

- Transparent fee structure: Clear, upfront pricing without hidden fees protects your budget long-term.

- IRS compliance expertise: Proper tax reporting and compliance prevent costly penalties.

- Basic customer support: Access to knowledgeable representatives when you have questions or need to make transactions.

- Buyback program: The ability to sell your metals back to the company at competitive rates when needed.

Potential Cost-Saving Areas

- Premium customer service: While responsive service is important, dedicated account managers may be an unnecessary expense for some investors.

- Advanced online dashboards: Basic account access may suffice if you’re not an active trader.

- Segregated storage: While offering additional peace of mind, non-segregated storage in the same secure facility is often significantly less expensive.

- Extensive educational resources: These can be valuable but are often available for free from other sources.

- Brand premium: Some well-known custodians charge higher fees primarily for their name recognition.

Service Evaluation Framework

Use this framework to evaluate whether a custodian’s services justify their fees for your specific situation:

| Service Feature | Questions to Ask | Budget Impact |

| Storage Options | Is segregated storage offered? What security measures are in place? Is full insurance included? | High – Never compromise on security, but consider whether segregated storage is necessary for your needs. |

| Customer Support | What are the support hours? Is there a dedicated representative? What’s the typical response time? | Medium – Basic responsive support is essential, but premium service may be optional. |

| Educational Resources | Are market updates provided? Are there guides for tax implications? Is there retirement planning assistance? | Low – Valuable but often available from free sources. |

| Transaction Process | How easy is it to buy/sell metals? What are the transaction fees? How long do transactions take? | Medium – Efficiency matters, but frequency of transactions affects overall importance. |

| Buyback Program | Is there a guaranteed buyback? What are the terms? How do prices compare to market rates? | High – Essential for liquidity and potentially significant financial impact when selling. |

Identifying Red Flags and Hidden Costs

Budget-conscious investors need to be particularly vigilant about identifying potential red flags and hidden costs when selecting a Gold IRA custodian. Here are key warning signs to watch for:

Common Red Flags in Fee Structures

- Vague fee descriptions: Terms like “administrative fees” or “service charges” without specific amounts or clear explanations.

- Escalating fee schedules: Fees that increase significantly after an introductory period.

- Unusually low advertised fees: If it seems too good to be true, it often is—look for hidden charges elsewhere.

- High-pressure sales tactics: Reputable custodians don’t rush your decision or use aggressive sales techniques.

- Lack of fee transparency on websites: Having to call to get basic fee information is often a warning sign.

Hidden Costs to Investigate

Beyond the obvious fees, investigate these potential hidden costs before committing:

Transaction Spread Markups

Some custodians make significant profit on the spread between buying and selling prices of precious metals. Request information about their pricing compared to spot prices.

Insurance Limitations

Verify exactly what is covered by included insurance and whether there are additional costs for full coverage of your specific holdings.

Account Closure Fees

Some custodians charge substantial fees ($150-$500) to close your account or transfer assets to another custodian.

Inactivity Fees

Fees charged if you don’t make transactions within a certain period, which can silently erode your investment.

Warning: Always request a complete fee schedule in writing before opening an account. Ask specifically about any fees not listed in marketing materials, including potential future fee increases.

Strategies for Comparing Gold IRA Custodians

Use these practical strategies to effectively compare Gold IRA custodians while keeping your budget in mind:

Create a Standardized Comparison Framework

Develop a consistent method to compare custodians across the same criteria:

| Comparison Category | What to Document |

| Total First-Year Costs | Setup fee + Annual maintenance fee + Storage fee + Estimated transaction fees |

| Ongoing Annual Costs | Annual maintenance fee + Storage fee + Typical transaction fees |

| Minimum Requirements | Initial investment minimum + Any ongoing balance requirements |

| Storage Options | Segregated vs. non-segregated costs + Location options + Security features |

| Exit Costs | Account closure fees + Metal liquidation terms + Transfer fees |

Effective Research Techniques

- Request written quotes: Get detailed fee schedules in writing from each custodian you’re considering.

- Calculate long-term costs: Project total costs over 5, 10, and 20 years based on your expected investment amount.

- Check regulatory standing: Verify the custodian is IRS-approved and in good standing with regulatory bodies.

- Review independent ratings: Check Better Business Bureau ratings and reviews from independent financial sites.

- Ask about fee waiver thresholds: Many custodians waive certain fees for larger accounts or offer promotions for new accounts.

Pro Tip: Create a simple spreadsheet to track all fees and services across different custodians. Include columns for one-time fees, annual fees, and special circumstances like account closure costs.

Assessing Your Budget and Investment Goals

Before selecting a Gold IRA custodian, take time to clearly define your budget constraints and investment goals:

Budget Assessment Questions

Aligning Budget with Investment Goals

For Smaller Initial Investments ($5,000-$15,000)

- Prioritize custodians with lower minimum requirements

- Look for percentage-based fees rather than flat fees

- Consider custodians that offer fee waivers for automatic contributions

- Focus on essential services and forgo premium features

For Larger Initial Investments ($25,000+)

- Prioritize custodians with flat fee structures

- Look for fee waivers available at higher account values

- Consider custodians that offer premium services like segregated storage

- Negotiate fee reductions for larger accounts (many custodians will accommodate)

Step-by-Step Action Plan for Choosing Your Gold IRA Custodian

Follow this systematic approach to find the right Gold IRA custodian for your budget:

-

Define your investment parameters

Determine your initial investment amount, timeline, and the percentage of your portfolio you’ll allocate to precious metals.

-

Research potential custodians

Create a list of 5-7 custodians that appear to match your budget requirements based on initial research.

-

Request detailed fee information

Contact each custodian to request a complete fee schedule in writing, including all potential charges.

-

Create a comparison spreadsheet

Document all fees, services, and requirements in a standardized format for easy comparison.

-

Calculate long-term costs

Project the total cost of each custodian over 5, 10, and 20 years based on your expected investment amount.

-

Verify credentials and reputation

Check Better Business Bureau ratings, regulatory standing, and independent reviews for each finalist.

-

Ask specific questions

Contact your top 2-3 choices with specific questions about their services, storage options, and any potential fee waivers.

-

Make your selection

Choose the custodian that offers the best balance of cost, service, and security for your specific needs.

Budget-Friendly Tip: Many Gold IRA custodians offer promotional deals for new accounts, including waived first-year fees or reduced minimum investments. Ask specifically about current promotions when contacting potential custodians.

Making Your Final Decision: Balancing Cost and Value

Choosing the right Gold IRA custodian for your budget requires balancing immediate cost concerns with long-term value. Remember that the lowest-cost option isn’t always the best choice if it compromises security or service quality. Similarly, the most expensive option may include premium services you’ll never use.

The ideal custodian for your budget will offer transparent fees, appropriate minimum investment requirements, essential security measures, and responsive customer service—all at a cost that allows your precious metals investment to grow effectively over time.

By following the strategies outlined in this guide and conducting thorough research, you can find a Gold IRA custodian that aligns with both your financial constraints and your retirement goals. This careful selection process is an investment in itself—one that can save you thousands of dollars over the life of your Gold IRA while ensuring your precious metals are secure and properly managed.

Ready to Find Your Perfect Gold IRA Custodian?

Our team of precious metals specialists can help you identify Gold IRA custodians that match your budget requirements and investment goals. Request our free Gold IRA Information Kit to learn more about custodian options, fee comparisons, and strategies for maximizing your precious metals investment.

Or speak with a Gold IRA specialist today: