Have you ever wondered how your 401(k) grows, and what role the principal plays in your retirement savings strategy? Understanding the core components of your 401(k) can help you make informed decisions that could benefit your financial future. Let’s break down the concept of the 401(k) principal and unravel its significance in a way that’s simple and approachable.

This image is property of images.unsplash.com.

Understanding the Basics of a 401(k)

Before diving into the principal, it’s vital you grasp how a 401(k) works. A 401(k) is a tax-advantaged retirement account offered by many employers, allowing you to invest a portion of your salary into a long-term savings plan. Contributions are typically made pre-tax, meaning the money goes into the account before taxes are deducted from your paycheck. This process reduces your taxable income and defers taxes until you withdraw funds, usually during retirement.

Importance of Tax Advantage

One of the significant benefits of contributing to a 401(k) is the potential tax savings. Since contributions are made with pre-tax dollars, you might reduce your taxable income for the year, potentially moving into a lower tax bracket. This tax-deferral can be advantageous, as many individuals expect to be in a lower tax bracket during retirement, which could result in paying less tax on withdrawals.

Employer Contributions

In many cases, employers will match a portion of your contributions, effectively giving you free money towards retirement. These additional funds can significantly enhance your retirement savings. However, it’s essential to know your employer’s policy, as matching contributions can vary and often come with specific conditions regarding vesting.

What is the 401(k) Principal?

Now, let’s focus on the heart of your 401(k) – the principal. In the context of a 401(k) plan, the principal refers to the total amount you and your employer have contributed to your account. It’s the foundation upon which your retirement savings are built. These funds, through wise investments and contributions, are expected to grow over time to provide a reliable income during retirement.

Contribution Components

Your principal consists of two primary components: your own salary deferrals and any employer-matching contributions. Each paycheck, you decide how much money to allocate to your 401(k), and this sum directly contributes to your principal. Over time, as contributions continue and are possibly matched by your employer, the principal can grow rapidly.

Investment Growth

Although the principal is the initial amount in your 401(k), it’s important to remember that this money is typically invested in various financial vehicles such as stocks, bonds, or mutual funds. As these investments appreciate in value, the money in your 401(k) grows. This growth isn’t strictly due to additional contributions but rather the compounding effect where returns themselves generate further returns.

This image is property of images.unsplash.com.

The Power of Compound Interest

One of the most compelling reasons to build your 401(k) early is the beneficial impact of compound interest. It’s the concept that underlies the growth of your savings over time, as you earn interest not only on your initial principal but also on accumulated interest from previous periods.

Compounding Over Time

To illustrate, imagine you have a principal of $10,000 in your 401(k). If this money earns an average annual return of 7%, after one year, you’d have $10,700. In the second year, your return would apply to the new balance of $10,700, meaning you’re earning interest on both your initial principal and the first year’s interest. Over decades, this compounding effect can significantly increase your retirement savings—showcasing the potential power of starting early.

Managing Your 401(k) Principal

It’s crucial to manage your 401(k) thoughtfully to ensure it grows in the way you envision for your retirement. This involves a variety of strategies and financial management skills.

Regular Contributions

Consistent, regular contributions to your 401(k) ensure that your principal continues to grow. Ideally, you’ll want to max out your contributions each year up to the legal limits, as this will maximize both your savings and the potential for employer-matched funds.

Diversifying Investments

By diversifying the assets in which your 401(k) principal is invested, you can potentially reduce risks and improve overall returns. A diversified portfolio might include a mix of equities, bonds, and mutual funds, tailored to your risk tolerance and retirement timeline.

This image is property of images.unsplash.com.

Monitoring Fees and Expenses

Part of effectively managing your 401(k) involves being mindful of any fees or expenses that can erode your savings. While some costs are unavoidable, such as management fees, you should be aware of their impact.

Types of 401(k) Fees

It’s wise to review your plan for administrative, investment, and advisory fees. Administrative fees cover the cost of maintaining the plan, investment fees are charged by fund managers, and advisory fees might be incurred if you consult with a financial advisor.

| Fee Type | Description |

|---|---|

| Administrative | Costs associated with managing the 401(k) plan. |

| Investment | Fees charged by mutual funds or other investment managers. |

| Advisory | Fees for financial planning services or advice. |

Reducing Fees

To minimize these expenses, compare different funds within your 401(k) and opt for low-cost index funds or ETFs if available. They typically offer the same level of diversification and growth potential but at a fraction of the cost of actively managed funds.

Withdrawal Strategies and Principal Protection

As you near retirement, your strategy for your 401(k) transitions from growth to preservation. Protecting your principal becomes a priority, as does planning your withdrawals.

Understanding Required Minimum Distributions (RMDs)

At age 72, the IRS mandates you to start taking Required Minimum Distributions (RMDs) from your 401(k) plan. These are calculated based on your life expectancy and balance. Ignoring RMDs can result in severe penalties, including a tax of up to 50% on the amount that should have been withdrawn.

Withdrawal Strategies

Crafting a smart withdrawal strategy is essential. You’ll want to meet your RMD while also considering longevity risk—the risk of outliving your savings. Some choose a fixed percentage withdrawal, while others may follow the 4% rule, withdrawing 4% of their balance annually.

Protecting Your Principal

Ensuring you don’t outlive your funds involves protecting your principal. As you approach retirement, shifting part of your investments into more conservative options such as bonds may help preserve your principal while still offering some growth.

This image is property of pixabay.com.

Planning for the Unexpected

Life is unpredictable, and having a contingency plan for the unexpected is crucial for safeguarding your retirement plan.

Early Withdrawals and Penalties

While it might be tempting to tap into your 401(k) early for emergencies, it’s fraught with pitfalls. Withdrawing funds before age 59½ usually incurs a hefty 10% penalty, plus income taxes on the amount withdrawn. Consider other options like loans or other savings before targeting your 401(k).

Loan Options

Many 401(k) plans allow for loans, permitting you to borrow against your balance. These loans must be repaid with interest, typically through payroll deductions. However, defaulting on such a loan can trigger taxes and penalties, effectively treating the loan as a withdrawal.

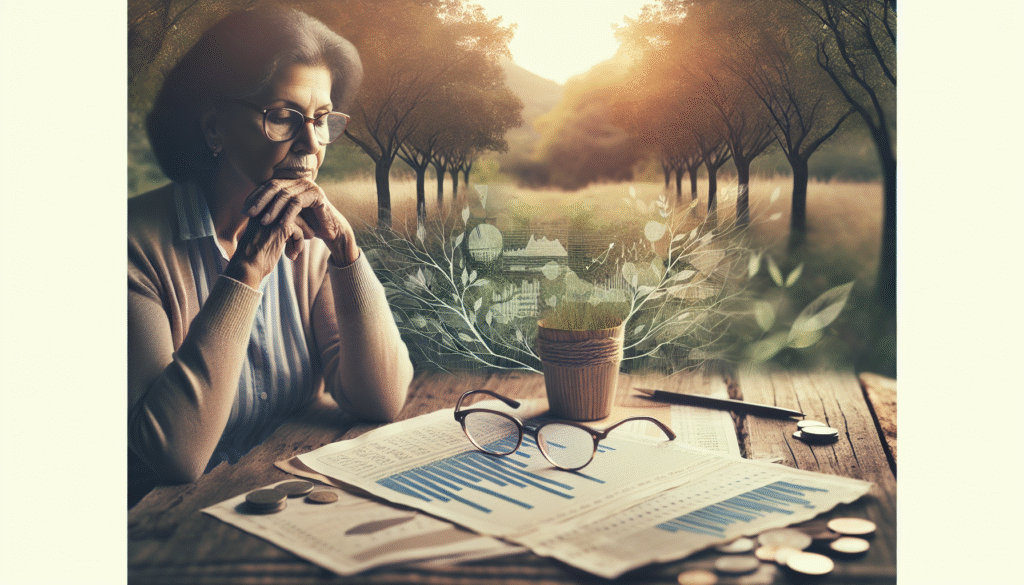

The Role of Professional Advice

With many variables and potential pitfalls, professional advice can be beneficial for managing your 401(k). Financial planners offer insights that cater to your specific needs and objectives.

Benefits of Financial Advisors

A financial advisor can provide personalized investment strategies, tax optimization advice, and retirement planning tailored to your circumstances. They can help balance the growth and security of your principal while maximizing tax efficiencies.

Selecting an Advisor

If you consider hiring an advisor, review their credentials and ensure they are fiduciaries, meaning they are legally obligated to act in your best interest. This distinction is vital for transparency and trust, ensuring that your financial health is their priority.

This image is property of pixabay.com.

Conclusion

The journey of growing and managing your 401(k) principal involves understanding tax advantages, the impact of compounding, and the importance of strategic planning. By regularly contributing, diversifying your investments, monitoring fees, planning for distributions, and possibly consulting with an advisor, you can effectively enhance your retirement savings. Embrace the opportunity to strengthen your financial future, creating a robust 401(k) plan that supports your retirement dreams.