When investing in a Gold IRA, the security of your precious metals becomes a paramount concern. Unlike traditional paper assets, physical gold requires specialized storage solutions that protect your investment from theft, damage, and potential government intervention. The decision between domestic and offshore storage isn’t merely a logistical choice—it’s a strategic one that can significantly impact the safety and accessibility of your retirement assets.

With increasing economic uncertainty and growing concerns about financial privacy, more investors are questioning whether their gold is truly secure within U.S. borders. This comprehensive analysis examines both domestic and offshore storage options for Gold IRAs, providing you with the critical information needed to determine which approach offers superior protection for your precious metals investment.

Domestic Gold IRA Storage: U.S. Depository Options

Storing your Gold IRA assets within the United States offers several advantages, particularly regarding accessibility and regulatory clarity. Let’s examine the key aspects of domestic storage options to understand their security profile.

Security Features and Protocols

U.S.-based depositories implement multi-layered security systems designed to protect precious metals against virtually any threat. These facilities typically feature:

- UL-rated Class 3 vaults with reinforced concrete walls and ceilings

- 24/7 armed security personnel and continuous surveillance

- Advanced biometric access controls and motion detection systems

- Dual-control protocols requiring multiple authorized personnel for vault access

- Regular third-party audits and inventory verification

Major domestic depositories like Delaware Depository, Brink’s, and International Depository Services (IDS) maintain security standards that exceed most banking institutions, with facilities specifically designed for precious metals storage.

Insurance Coverage and Protections

One significant advantage of domestic storage is comprehensive insurance coverage:

- All-risk insurance policies through Lloyd’s of London or similar providers

- Coverage against theft, damage, natural disasters, and mysterious disappearance

- Typical coverage limits of $1 billion or more per facility

- Individual account segregation ensuring your specific assets are insured

Unlike bank deposits, FDIC and SIPC protections don’t apply to physical precious metals. However, the private insurance carried by reputable depositories often provides more comprehensive coverage specifically designed for precious metals.

Regulatory Compliance and IRS Requirements

Domestic storage facilities are fully aligned with IRS regulations governing Gold IRAs:

- All IRS-approved depositories meet the strict requirements of IRC Section 408(m)

- Proper segregation of IRA assets from non-IRA holdings

- Detailed record-keeping and reporting systems for IRS compliance

- Simplified annual reporting and valuation for tax purposes

This regulatory alignment ensures your Gold IRA remains tax-compliant, avoiding potential penalties or disqualification of your retirement account.

Accessibility and Convenience Factors

Domestic storage offers practical advantages for U.S.-based investors:

- Physical inspection visits can be arranged with advance notice

- Faster processing for deposits and withdrawals (typically 1-3 business days)

- Simplified logistics for eventual distribution when taking required minimum distributions

- No international shipping complications or customs concerns

These convenience factors can be significant, especially for investors who may need to access their metals during retirement or in emergency situations.

Free Domestic Gold Storage Comparison Guide

Discover which U.S. depositories offer the best security features, lowest fees, and most comprehensive insurance for your Gold IRA. Our detailed comparison includes exclusive insights from security experts.

Offshore Gold IRA Storage: International Options

Storing your Gold IRA assets internationally presents a different security profile with unique advantages for investors concerned about jurisdiction-specific risks. Let’s examine the key aspects of offshore storage options.

Security Measures in Different Jurisdictions

Top international depositories implement world-class security systems, often exceeding U.S. standards:

- Swiss facilities feature mountain bunkers with military-grade protection

- Singapore’s vaults implement cutting-edge biometric security and robotic retrieval systems

- Dubai’s gold storage facilities maintain 24/7 armed security and advanced surveillance

- Most facilities operate in free-trade zones with additional security perimeters

- Many offshore vaults are located away from major population centers, reducing civil unrest risks

Jurisdictions like Switzerland, Singapore, and the Cayman Islands have long histories of protecting valuable assets and maintaining political neutrality during global conflicts.

International Insurance Considerations

Insurance for offshore storage presents both advantages and potential complications:

- Most premium facilities maintain all-risk insurance through Lloyd’s of London syndicates

- Coverage typically includes theft, damage, and mysterious disappearance

- Some jurisdictions offer additional government-backed guarantees

- Insurance documentation may be in local languages, requiring translation

- Claims processes may involve international legal considerations

Reputable offshore facilities like Strategic Wealth Preservation (SWP) in the Cayman Islands maintain insurance coverage comparable to top U.S. depositories, though policy details and claim procedures may differ.

Jurisdictional Risks and Political Stability

The political environment of your chosen offshore jurisdiction significantly impacts storage safety:

- Switzerland: Long history of neutrality and strong property rights protection

- Singapore: Exceptional political stability and strong rule of law

- Cayman Islands: British Overseas Territory with stable governance

- New Zealand: Consistently ranked among the world’s most stable democracies

- Hong Kong: Previously stable but facing increasing uncertainty regarding Chinese influence

Political stability metrics, sovereign debt levels, and historical respect for private property rights should all factor into your jurisdiction selection.

Privacy and Confidentiality Aspects

Offshore storage can offer enhanced privacy protections, though with important limitations for IRA assets:

- Many jurisdictions maintain stronger financial privacy laws than the U.S.

- Some facilities offer anonymous numbered accounts (though not applicable for IRA holdings)

- Reduced exposure to domestic litigation risks

- Protection from potential future domestic reporting requirements

It’s crucial to note that while offshore storage offers privacy advantages, IRA assets still require reporting to the IRS regardless of storage location. The privacy benefits primarily apply to non-IRA precious metals holdings.

Offshore Gold Storage Jurisdiction Guide

Understand the unique advantages and potential risks of different offshore jurisdictions. Our comprehensive guide includes political stability ratings, privacy laws, and insurance considerations for each major gold storage location.

Direct Safety Comparison: Offshore vs. Domestic

When directly comparing the safety profiles of offshore and domestic gold IRA storage options, several key factors emerge that can help guide your decision.

Physical Security Measures Comparison

| Security Feature | Domestic Storage | Offshore Storage |

| Vault Construction | UL-rated Class 3 vaults with reinforced concrete | Varies by jurisdiction; Swiss facilities often exceed U.S. standards |

| Armed Security | 24/7 armed guards at all major facilities | 24/7 armed security, often with military or police backgrounds |

| Surveillance | Comprehensive CCTV coverage with 90+ day retention | Similar or superior systems; some with longer retention periods |

| Access Controls | Biometric systems with multi-factor authentication | Comparable systems; some with additional diplomatic-level protocols |

| Geographic Isolation | Typically in industrial areas near transportation hubs | Often in remote locations or purpose-built secure zones |

From a purely physical security standpoint, both options can provide exceptional protection, with specific facilities in each category potentially offering advantages based on their unique security implementations.

Insurance Protection Levels

Insurance coverage represents a critical safety component for stored precious metals:

- Both domestic and premium offshore facilities typically secure coverage through Lloyd’s of London

- Coverage limits generally range from $150 million to over $1 billion per facility

- Domestic facilities may offer more standardized claim processes under U.S. law

- Some offshore jurisdictions provide additional government guarantees or protections

- Segregated storage options in both locations provide clearer insurance documentation

The insurance differential between top-tier domestic and offshore facilities is minimal, with both offering comprehensive coverage. The primary difference lies in the legal jurisdiction governing claims processes.

Regulatory Oversight Differences

Regulatory frameworks vary significantly between domestic and offshore options:

- Domestic facilities operate under comprehensive U.S. regulatory oversight

- IRS-approved domestic depositories must maintain specific compliance standards

- Offshore facilities follow local regulatory requirements, which vary by jurisdiction

- Some offshore jurisdictions may have less stringent regulatory frameworks

- IRA assets require IRS reporting regardless of storage location

While domestic facilities offer the advantage of operating within a familiar regulatory environment, certain offshore jurisdictions like Singapore and Switzerland maintain equally rigorous oversight systems specifically designed for precious metals storage.

Geopolitical Risk Assessment

Geopolitical considerations represent perhaps the most significant differentiator between storage options:

Domestic Storage Risks:

- Potential for future government intervention or policy changes

- Historical precedent of gold confiscation (Executive Order 6102 in 1933)

- Exposure to U.S. economic instability and sovereign debt concerns

- Vulnerability to domestic litigation and asset seizure

Offshore Storage Risks:

- Varying political stability across jurisdictions

- Potential for changing international relations affecting access

- Currency exchange considerations when accessing assets

- Jurisdictional risks specific to each country or territory

Diversification across multiple storage locations—both domestic and offshore—represents the most robust approach to mitigating geopolitical risks.

Recovery and Accessibility in Emergency Scenarios

How quickly and easily you can access your gold during various emergency scenarios differs significantly:

- Domestic storage offers faster physical access for U.S. residents

- Offshore facilities may require international travel or shipping arrangements

- Domestic assets may be more vulnerable to government freezes during national emergencies

- Offshore assets could be protected from domestic financial crises

- Both options typically offer liquidation services, though domestic facilities may provide faster settlement

Your personal emergency scenarios and contingency plans should heavily influence this aspect of your decision-making process.

Expert Opinions on Gold IRA Storage Safety

Industry experts offer valuable perspectives on the safety considerations of different storage options:

“The ideal approach for most investors is geographic diversification. Keeping all assets in one jurisdiction—whether domestic or offshore—creates unnecessary concentration risk. Consider splitting holdings between a reputable U.S. depository and a stable offshore jurisdiction like Singapore or Switzerland.”

“While physical security is comparable between top-tier facilities worldwide, the real differentiator is jurisdictional risk. The U.S. has a historical precedent of gold confiscation, while countries like Singapore have consistently maintained strong property rights protections without such interventions.”

“For IRA investors specifically, the regulatory clarity of domestic storage offers significant advantages. The IRS requirements are unambiguous, and the reporting process is streamlined. Offshore storage introduces additional compliance considerations that must be carefully navigated.”

These expert insights highlight that safety is multidimensional, encompassing physical security, jurisdictional considerations, and regulatory compliance. The “safer” option depends on which risks you prioritize mitigating.

Practical Considerations for Investors

Beyond the safety comparison, several practical factors should influence your storage decision:

Cost Comparison

Storage costs can significantly impact long-term investment returns:

- Domestic storage typically costs 0.5-1% of asset value annually

- Offshore storage generally ranges from 0.7-1.5% annually

- Both options may offer flat-fee structures for larger holdings

- Additional costs may include setup fees, withdrawal charges, and shipping expenses

- Segregated storage commands premium pricing in both locations

While offshore storage tends to be marginally more expensive, the cost differential has narrowed in recent years as competition has increased.

IRS Compliance Requirements

Maintaining IRS compliance is essential regardless of storage location:

- All Gold IRA assets must be stored in IRS-approved depositories

- Annual reporting requirements apply regardless of storage location

- Offshore storage requires additional FBAR (FinCEN Form 114) filing if account value exceeds $10,000

- FATCA reporting may apply to certain offshore arrangements

- Working with experienced custodians familiar with international storage is crucial

The additional reporting requirements for offshore storage create extra administrative steps but don’t necessarily increase tax liability when properly managed.

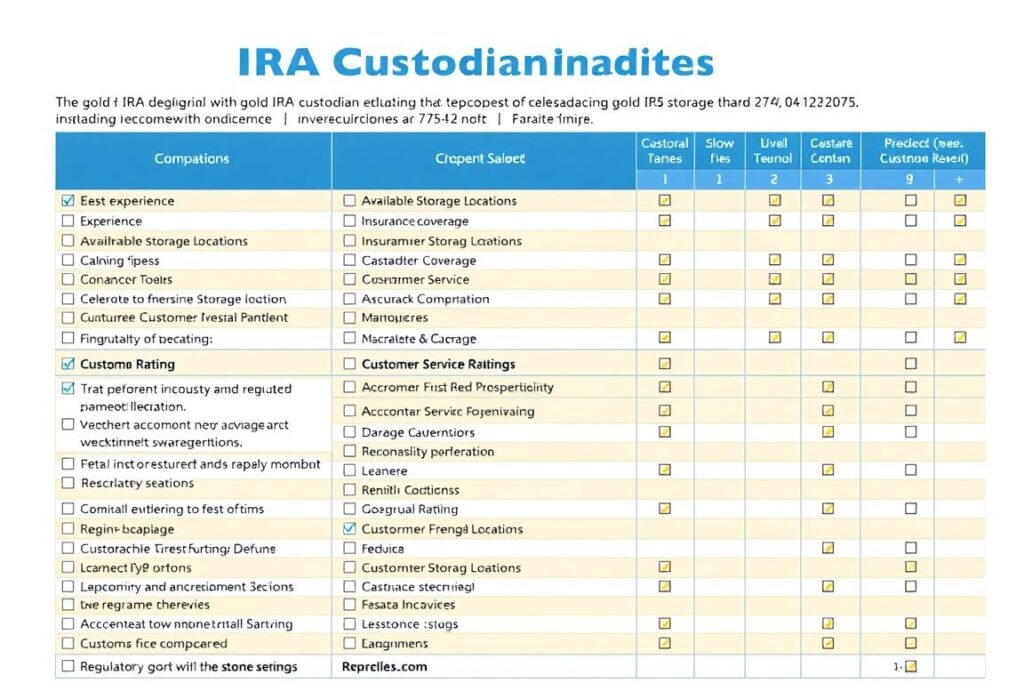

Custodian Considerations

Not all Gold IRA custodians support offshore storage options:

- Major custodians like Equity Trust and GoldStar Trust work with select offshore facilities

- Specialized international custodians may offer more offshore options

- Custodian fees often differ between domestic and offshore arrangements

- Response times for transactions may vary based on storage location

- Customer service quality becomes especially important with offshore storage

Thoroughly vetting potential custodians’ experience with your preferred storage location is essential before establishing your Gold IRA.

Distribution Planning

Consider how storage location affects eventual distributions:

- Required Minimum Distributions (RMDs) may be more complex with offshore storage

- Physical possession distributions require shipping arrangements

- Liquidation options and metal-to-cash conversion costs may differ

- Tax withholding considerations apply regardless of storage location

Your anticipated distribution timeline and preferences should factor into your storage decision, especially if you plan to take physical possession of metals during retirement.

Free Gold IRA Storage Consultation

Speak with a storage security specialist to determine which option best aligns with your specific risk concerns and investment goals. Our experts can help you navigate the complex considerations of domestic vs. offshore storage.

Conclusion: Which Option Is Truly Safer?

The question of whether domestic or offshore gold IRA storage is safer doesn’t have a one-size-fits-all answer. The “safer” option depends on which risks you prioritize mitigating:

Domestic Storage Advantages

- Simplified IRS compliance and reporting

- Faster physical access for U.S. residents

- Potentially lower costs and administrative burden

- Clearer legal protections under U.S. law

- Easier integration with existing retirement planning

Offshore Storage Advantages

- Diversification beyond U.S. jurisdiction

- Protection from potential domestic financial crises

- Enhanced privacy in certain jurisdictions

- Reduced exposure to U.S.-specific political risks

- Access to specialized storage facilities

For many investors, the optimal approach is diversification—storing precious metals across multiple locations to mitigate concentration risk. This strategy acknowledges that different storage options excel at protecting against different risk categories.

When evaluating safety, consider your personal risk profile, investment timeline, and specific concerns. An investor primarily worried about domestic economic instability might find offshore storage more secure, while someone concerned about administrative simplicity and physical access might prefer domestic options.

Regardless of which option you choose, working with reputable custodians and storage providers with proven track records is essential. The security of your gold ultimately depends more on the specific facility and provider than on whether it’s located domestically or offshore.

Download Your Comprehensive Gold IRA Storage Safety Guide

Get our complete analysis of domestic and offshore storage options, including facility comparisons, jurisdiction risk assessments, and a customizable decision matrix to determine which option best aligns with your specific concerns.

Frequently Asked Questions About Gold IRA Storage

Can I store my Gold IRA at home?

No, IRS regulations explicitly prohibit home storage of Gold IRA assets. Despite marketing claims from some companies about “home storage Gold IRAs” using LLC structures, these arrangements violate IRS requirements and can result in disqualification of your entire IRA and significant tax penalties. All Gold IRA precious metals must be stored in an IRS-approved depository.

Which countries are considered the safest for offshore gold storage?

Switzerland, Singapore, and the Cayman Islands consistently rank among the safest jurisdictions for offshore gold storage. These locations combine political stability, strong property rights protections, robust financial privacy laws, and world-class security infrastructure. New Zealand and Canada are also considered highly secure options with stable governance and strong rule of law.

How do I verify that my gold is actually stored where my custodian claims?

Reputable storage facilities provide several verification methods: regular third-party audit reports, detailed inventory statements with unique bar numbers and weights, photographic verification services, and scheduled in-person visits (with advance notice). Always choose facilities that maintain transparent verification processes and regular independent audits.

What happens to my offshore-stored gold if international relations deteriorate?

This risk varies by jurisdiction. Countries with long histories of neutrality like Switzerland have maintained asset protection even during world wars. Most reputable offshore facilities maintain contingency plans for geopolitical disruptions, including alternative shipping arrangements and liquidation options. Working with storage providers that maintain facilities in multiple jurisdictions provides additional protection against country-specific disruptions.

Still Have Questions About Gold IRA Storage?

Our gold storage specialists can help address your specific concerns and provide personalized guidance on the safest options for your precious metals investment.

Or request our comprehensive guide to gold storage security: