After decades of hard work and disciplined saving, you’ve finally reached retirement. But now comes a new challenge: making sure your nest egg lasts as long as you do. With increasing lifespans and rising healthcare costs, ensuring your retirement money lasts requires careful planning and smart strategies. This guide will walk you through proven approaches to stretch your retirement savings, helping you enjoy financial security throughout your golden years.

Planning carefully helps ensure your retirement money lasts through your golden years

The Retirement Longevity Challenge

The fundamental question every retiree faces is straightforward yet daunting: “Will my money last as long as I do?” According to recent studies, nearly 45% of Americans fear outliving their savings. This concern is valid, as retirement can span 20-30 years or more.

Think of your retirement savings like a reservoir that must supply water through an extended drought. Without proper management, even a substantial reservoir can run dry. The key is establishing a sustainable withdrawal system that balances your current needs with future security.

“Retirement planning isn’t about accumulating a specific number. It’s about creating a sustainable income stream that lasts as long as you do.”

Strategy #1: Implement a Sustainable Withdrawal Rate

The most widely cited approach to making your retirement money last is the 4% rule. This guideline suggests withdrawing 4% of your retirement savings in your first year of retirement, then adjusting that amount annually for inflation.

For example, with a $1 million portfolio, your first-year withdrawal would be $40,000. If inflation runs at 2% the following year, you’d withdraw $40,800, and so on. Research suggests this approach gives you a high probability of your money lasting for a 30-year retirement.

However, the 4% rule isn’t perfect. It assumes a rigid withdrawal schedule and doesn’t account for market fluctuations or changing personal circumstances. Many financial advisors now recommend a more flexible approach, with withdrawal rates ranging from 3-5% depending on your situation.

| Portfolio Size | 3% Withdrawal | 4% Withdrawal | 5% Withdrawal |

| $500,000 | $15,000 | $20,000 | $25,000 |

| $750,000 | $22,500 | $30,000 | $37,500 |

| $1,000,000 | $30,000 | $40,000 | $50,000 |

| $1,500,000 | $45,000 | $60,000 | $75,000 |

Consider your withdrawal strategy like a drip irrigation system rather than a garden hose. The steady, controlled release ensures your financial garden stays nourished throughout your retirement years.

Strategy #2: Create Multiple Income Buckets

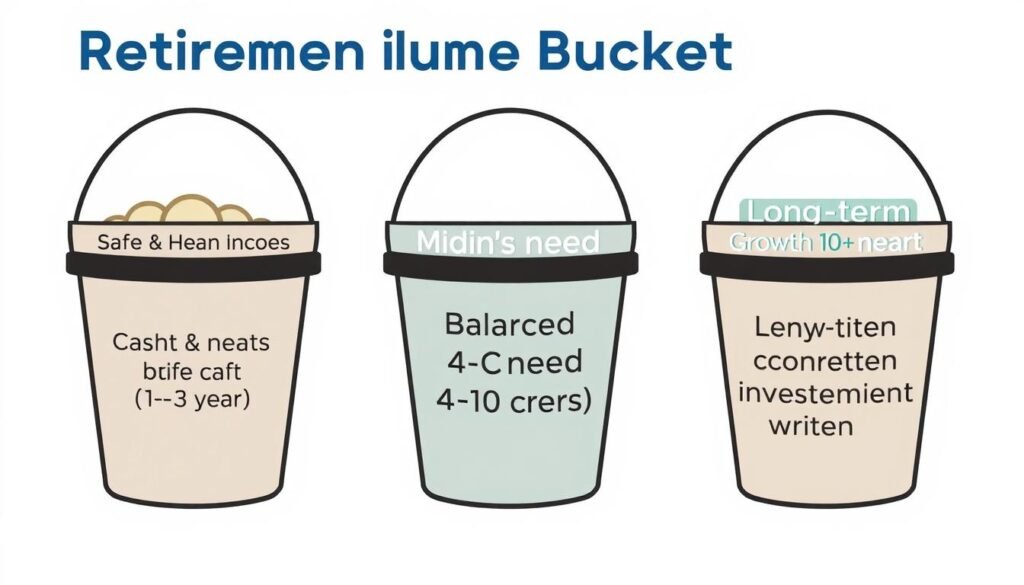

Diversifying your income sources is crucial to ensuring your retirement money lasts. Think of this approach as creating different “buckets” of money for different time horizons and purposes.

Immediate Needs Bucket

Cash and cash equivalents to cover 1-3 years of expenses. This provides security and prevents having to sell investments during market downturns.

- High-yield savings accounts

- Money market funds

- Short-term CDs

- Treasury bills

Mid-Term Bucket

Investments with moderate growth and income potential to cover years 4-10 of retirement. This bucket balances growth with stability.

- Dividend-paying stocks

- Bond funds

- Balanced mutual funds

- Some annuities

Long-Term Bucket

Growth-oriented investments for expenses beyond 10 years. This bucket can afford to be more aggressive since you won’t need the money immediately.

- Stock funds

- Real estate investments

- Growth-oriented ETFs

- Alternative investments

This bucket strategy helps ensure your retirement money lasts by giving your longer-term investments time to grow while your immediate needs are covered by safer assets. It’s like having separate accounts for your daily expenses, upcoming vacations, and your children’s future education.

Strategy #4: Implement Tax-Efficient Withdrawal Strategies

The order in which you withdraw from different retirement accounts can significantly impact how long your retirement money lasts. A tax-efficient withdrawal strategy can save you thousands in unnecessary taxes.

Generally, financial experts recommend this withdrawal sequence:

- Required Minimum Distributions (RMDs) from retirement accounts (mandatory after age 72)

- Taxable accounts (individual or joint brokerage accounts)

- Tax-deferred accounts (traditional IRAs, 401(k)s)

- Tax-free accounts (Roth IRAs, Roth 401(k)s)

This sequence isn’t rigid. In years when your income is lower, you might consider Roth conversions to move money from tax-deferred to tax-free accounts, paying taxes at a lower rate now to avoid higher taxes later.

“It’s not just what you earn that matters, but what you keep after taxes. Tax-efficient withdrawal strategies can add years to how long your retirement money lasts.”

Think of tax planning like navigating a river with varying currents. Sometimes you need to paddle harder (pay more taxes) in certain spots to ensure a smoother journey overall. The goal is to minimize your lifetime tax burden, not just your taxes in any given year.

Strategy #5: Plan for Healthcare Costs

Healthcare expenses represent one of the biggest threats to making your retirement money last. According to Fidelity, the average 65-year-old couple retiring today will need approximately $300,000 for healthcare expenses throughout retirement, not including long-term care.

Medicare Planning

While Medicare provides valuable coverage, it doesn’t cover everything. Understanding the different parts of Medicare is essential:

- Medicare Part A (hospital insurance) – Usually premium-free

- Medicare Part B (medical insurance) – Monthly premium required

- Medicare Part D (prescription drug coverage) – Monthly premium required

- Medicare Supplement (Medigap) or Medicare Advantage – Additional coverage options

Long-Term Care Strategy

About 70% of people over 65 will need some form of long-term care. Options to cover these costs include:

- Long-term care insurance

- Hybrid life insurance/long-term care policies

- Health Savings Accounts (HSAs)

- Self-funding through dedicated savings

Pro Tip: Health Savings Accounts (HSAs) offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. If you’re eligible, maximize these contributions before retirement.

Think of healthcare planning as an umbrella policy for your retirement finances. Just as you wouldn’t go without homeowner’s insurance, you shouldn’t enter retirement without a comprehensive healthcare funding strategy to ensure your retirement money lasts through medical challenges.

Strategy #6: Inflation-Proof Your Retirement Income

Inflation acts like a silent thief, gradually eroding your purchasing power over time. Even modest inflation of 3% annually will cut your purchasing power in half over 24 years – well within a typical retirement timespan.

To ensure your retirement money lasts despite rising costs, incorporate these inflation-fighting elements into your portfolio:

Treasury Inflation-Protected Securities (TIPS)

These government bonds automatically adjust with inflation, providing direct protection against rising prices. The principal increases with inflation and decreases with deflation.

Dividend-Growing Stocks

Companies with a history of increasing their dividends can provide income that grows faster than inflation. Focus on companies with strong balance sheets and consistent dividend growth records.

Real Estate Investments

Property values and rental income tend to increase with inflation. Real estate investment trusts (REITs) offer an accessible way to add real estate to your portfolio without directly owning property.

“Inflation is like termites in your financial house – silent but destructive over time. Building with inflation-resistant materials is essential for making your retirement money last.”

Social Security provides another inflation hedge, as benefits receive cost-of-living adjustments (COLAs). This is another reason why maximizing your Social Security benefit can help your retirement money last throughout your lifetime.

Strategy #7: Create a Flexible Spending Plan

Rather than following a rigid spending rule, creating a flexible spending plan can help your retirement money last while adapting to changing circumstances. This approach recognizes that retirement spending typically follows a “smile” pattern – higher in early active retirement years, lower in middle retirement, and potentially higher again in later years due to healthcare costs.

Essential vs. Discretionary Spending

Categorize your expenses as either essential (housing, food, healthcare, utilities) or discretionary (travel, hobbies, gifts). In challenging market years, you can temporarily reduce discretionary spending to preserve capital.

| Expense Category | Classification | Flexibility |

| Housing | Essential | Low |

| Healthcare | Essential | Low |

| Food | Essential | Medium |

| Travel | Discretionary | High |

| Entertainment | Discretionary | High |

Dynamic Spending Rules

Consider these flexible spending approaches:

- Floor-and-ceiling approach: Increase spending by inflation when markets perform well, but reduce spending during market downturns (never below a “floor” or above a “ceiling”)

- Guardrail strategy: Adjust spending up or down when your withdrawal rate moves outside predetermined boundaries

- RMD method: Base withdrawals on IRS Required Minimum Distribution tables, which naturally adjust based on your age and account balance

Think of your retirement spending like sailing a boat. Sometimes you’ll have favorable winds (bull markets) allowing you to make more progress (spend more). Other times, you’ll face headwinds (bear markets) requiring you to reduce sail (cut spending). This flexibility helps ensure your retirement money lasts through various conditions.

Strategy #8: Consider Additional Income Sources

Generating even modest additional income during retirement can significantly extend how long your retirement money lasts. Working part-time or developing passive income streams reduces the pressure on your investment portfolio.

Part-Time Work

Many retirees find that part-time work in a field they enjoy provides both financial and psychological benefits. Consider:

- Consulting in your former profession

- Teaching or tutoring

- Retail or hospitality roles

- Remote customer service positions

Passive Income

Developing income streams that require minimal ongoing effort can provide sustainable cash flow:

- Rental property income

- Royalties from books or creative works

- Affiliate marketing websites

- Peer-to-peer lending

Monetize Hobbies

Turn activities you enjoy into income sources:

- Selling crafts or artwork

- Teaching classes in your area of expertise

- Writing articles or blogs

- Photography services

Important: If you’re collecting Social Security before your full retirement age, be aware of earnings limits. In 2023, if you’re under full retirement age, $1 in benefits will be deducted for each $2 you earn above $19,560. This restriction ends once you reach full retirement age.

Think of additional income as tributaries flowing into your retirement river. These extra streams help maintain your financial flow even during drought periods, ensuring your retirement money lasts throughout your journey.

5 Steps to Audit Your Retirement Plan Today

To ensure your retirement money lasts, conduct this five-step audit annually or whenever significant life events occur:

-

Calculate your current withdrawal rate

Divide your annual withdrawals by your total portfolio value. If this exceeds 4-5%, consider adjusting your spending or exploring additional income sources.

-

Review your asset allocation

Ensure your investment mix aligns with your time horizon and risk tolerance. As you age, gradually shift toward more conservative allocations while maintaining some growth investments.

-

Assess your healthcare coverage

Review Medicare coverage, supplemental policies, and long-term care planning. Identify any gaps and explore options to address them.

-

Optimize tax efficiency

Review your withdrawal strategy and identify opportunities for tax-saving strategies like Roth conversions, tax-loss harvesting, or charitable giving.

-

Update your estate plan

Ensure your will, powers of attorney, and beneficiary designations reflect your current wishes. Consider how your plan affects both your financial security and legacy goals.

Get Your Personalized Retirement Sustainability Plan

Join thousands of retirees who’ve secured their financial future with a customized plan to make their retirement money last. Our retirement specialists will analyze your unique situation and provide actionable strategies.

Ensuring Your Retirement Money Lasts: The Bottom Line

Making your retirement money last isn’t about following a single rule or strategy. It requires a comprehensive approach that combines smart withdrawal strategies, tax planning, healthcare preparation, and flexibility to adapt to changing circumstances.

Remember that retirement planning isn’t a one-time event but an ongoing process. Regularly review your plan, adjust as needed, and don’t hesitate to seek professional guidance when facing complex decisions. With thoughtful planning and disciplined execution, you can enjoy financial security throughout your golden years.

The peace of mind that comes from knowing your retirement money will last is invaluable. It allows you to focus on what truly matters – enjoying the retirement lifestyle you’ve worked so hard to achieve.

“The goal isn’t to be the richest person in the cemetery. It’s to go to bed each night knowing your money will last as long as you do.”

Strategy #3: Optimize Social Security Benefits

Social Security benefits represent a critical income stream that can help your retirement money last. The timing of when you claim these benefits can significantly impact your lifetime income.

While you can start collecting Social Security at age 62, your benefits increase approximately 8% for each year you delay claiming until age 70. This guaranteed return is hard to beat in today’s investment environment.

Real-life scenario: Consider a retiree eligible for a $1,500 monthly benefit at full retirement age (66). If they claim at 62, they’ll receive only $1,125 per month. But if they wait until 70, their monthly benefit grows to $1,980 – a 76% increase over the age 62 amount. Over a 25-year retirement, this difference adds up to more than $250,000 in additional benefits!

For married couples, coordinating Social Security claiming strategies becomes even more important. The higher-earning spouse might delay benefits until 70, while the lower-earning spouse claims earlier. This approach maximizes the survivor benefit, which is based on the higher earner’s benefit amount.

Think of Social Security as the foundation of your retirement income house. The stronger this foundation, the more secure your overall financial structure will be, helping your retirement money last throughout your lifetime.