Investing in a Gold IRA can provide valuable portfolio diversification and inflation protection, but hidden fees can significantly erode your returns over time. Many investors lose thousands of dollars to excessive charges simply because they don’t know what to look for. This comprehensive guide will equip you with the knowledge to identify and avoid spot high fee hidden costs gold ira products, ensuring your precious metals investment works effectively for your retirement goals.

Why Fee Transparency Is Crucial for Gold IRA Investors

The long-term impact of fees on a $100,000 Gold IRA investment over 20 years

Fee transparency isn’t just about knowing what you’re paying—it’s about protecting your retirement future. With traditional IRAs, annual fees typically range from 0.25% to 1%. However, Gold IRAs often carry additional costs that can push total fees to 2-5% annually or higher when hidden charges are included.

Consider this: A seemingly small 3% annual fee difference on a $100,000 Gold IRA can reduce your retirement savings by over $120,000 over 20 years. This dramatic impact occurs because fees not only extract money directly from your account but also prevent that capital from growing over time.

Unfortunately, the Gold IRA industry has developed a reputation for obscuring fee structures. A 2023 consumer protection study found that 68% of Gold IRA providers failed to disclose at least one significant fee category in their marketing materials. This lack of transparency makes it challenging for investors to make informed decisions.

Did You Know? The Commodity Futures Trading Commission (CFTC) has reported cases where gold dealers charged markups of 20% to 400% above the spot price—making it nearly impossible for investors to ever profit from their precious metals investments.

Understanding Common Gold IRA Fee Structures

Before you can identify excessive charges, you need to understand the legitimate fee categories that all Gold IRA investors should expect to pay. Here’s a breakdown of standard fee structures:

One-Time Setup Fees

These are charges to establish your Gold IRA account. Reasonable setup fees typically range from $50 to $100, though some companies waive this fee for larger investments. Be wary of setup fees exceeding $200, as these are often inflated.

Annual Administration Fees

These cover account management, statements, and IRS reporting. Expect to pay between $75 and $300 annually, depending on your account size. Some companies charge a flat fee, while others use a sliding scale based on account value. Transparent companies clearly state whether these fees are fixed or percentage-based.

Storage and Insurance Fees

Since IRS regulations require Gold IRA assets to be held in an approved depository, you’ll pay annual storage fees. These typically range from $100 to $300, depending on whether you choose segregated storage (your metals stored separately) or non-segregated storage (commingled with others’ metals).

Transaction Fees

These include charges for buying and selling precious metals within your IRA. Expect transaction fees of $25-$50 per trade, plus the dealer’s spread (the difference between buying and selling prices). A reasonable spread for bullion products is 3-5% above the spot price when buying and 1-2% below spot when selling.

| Fee Type | Reasonable Range | Excessive Range | Red Flags |

| Account Setup | $0-$100 | $200+ | Fees not disclosed until paperwork stage |

| Annual Administration | $75-$300 | $500+ or >1% of assets | Percentage-based fees without caps |

| Storage (Non-segregated) | $100-$150 | $250+ | Markups on third-party storage costs |

| Storage (Segregated) | $150-$300 | $400+ | Forced segregated storage for small accounts |

| Transaction Fee | $25-$50 per trade | $100+ per trade | Percentage-based transaction fees |

| Buying Premium (over spot) | 3-5% | 10%+ | Inability to verify current spot price |

| Selling Discount (under spot) | 1-2% | 5%+ | No published buyback policy |

Red Flags That Signal Excessive Fees and Potential Scams

Beyond specific hidden fees, certain business practices and marketing tactics should immediately raise your suspicion. Watch for these warning signs:

High-Pressure Sales Tactics

Legitimate Gold IRA investments don’t require immediate decisions. Be wary of phrases like “limited time offer,” “prices increasing tomorrow,” or “exclusive opportunity.” These are designed to rush you into decisions before you can properly evaluate fees and alternatives.

Reluctance to Provide Written Fee Schedules

Reputable companies willingly provide complete fee schedules in writing before you commit. If a representative avoids direct questions about fees or refuses to provide documentation, consider it a major red flag.

Excessive Focus on “Rare” or “Collectible” Coins

While some numismatic coins may have legitimate investment value, they typically carry much higher premiums and are often pushed by dealers because of their higher profit margins. For most retirement investors, standard bullion products offer better value.

Unrealistic Return Projections

Be skeptical of any company that guarantees specific returns or makes predictions about gold prices doubling or tripling. Precious metals are long-term wealth preservation assets, not get-rich-quick investments.

Vague or Non-existent Buyback Policies

A transparent company will clearly explain their process and terms for buying back metals when you want to sell. Vague policies often indicate unfavorable selling terms that will cost you significantly when liquidating.

Misleading “Free” Promotions

Offers like “free silver coins” with your gold purchase typically mean you’re paying inflated prices elsewhere. There’s no such thing as free precious metals—the cost is built into the overall transaction.

“The biggest scam in the precious metals industry isn’t outright fraud—it’s the perfectly legal practice of charging excessive fees and premiums that make it mathematically impossible for investors to profit unless gold prices skyrocket.”

Essential Questions to Ask Before Opening a Gold IRA

Asking the right questions before committing to a Gold IRA provider can save you thousands in hidden fees. Here’s what to ask:

About Setup and Annual Fees

- What is the complete fee schedule for setting up and maintaining my account?

- Are annual fees fixed or percentage-based? If percentage-based, is there a cap?

- How often do you increase annual fees, and by what percentage?

- Are there any promotional fee waivers that will expire after a certain period?

- What is the fee for closing my account or transferring to another custodian?

About Storage and Insurance

- What is the actual fee charged by the depository, and do you add any markup?

- What insurance coverage is provided, and is there a separate charge for it?

- Can I choose between segregated and non-segregated storage, and what are the cost differences?

- Can I visit my metals at the depository, and what is the process?

About Buying and Selling Metals

- What is your current premium over spot price for standard bullion products?

- Do you have a published buyback policy, and what is the typical discount to spot when selling?

- Are there additional transaction fees when buying or selling metals?

- Can you provide a written quote that guarantees the price for a specific period?

- What is your process for handling required minimum distributions (RMDs) when I reach that age?

Important: Always request answers to these questions in writing. Verbal assurances about fees and policies are difficult to verify later if disputes arise. A reputable company will have no problem providing written documentation of all fees and policies.

Comparing Typical vs. Excessive Fee Structures

To help you identify excessive fees, here’s a comparison of what you might pay with transparent versus high-fee Gold IRA providers on a $100,000 investment:

| Fee Category | Transparent Provider | High-Fee Provider | Potential Savings |

| Setup Fee | $50 (often waived) | $250 | $200 |

| Annual Administration | $100 | $300 | $200/year |

| Storage (Non-segregated) | $100 | $250 | $150/year |

| Transaction Fee (initial purchase) | $40 | $150 | $110 |

| Premium on Gold (on $100,000) | 4% ($4,000) | 15% ($15,000) | $11,000 |

| First Year Total Cost | $4,240 (4.24%) | $15,950 (15.95%) | $11,710 |

| Annual Ongoing Costs | $200/year | $550/year | $350/year |

| 10-Year Total Cost Impact | $6,040 | $21,450 | $15,410 |

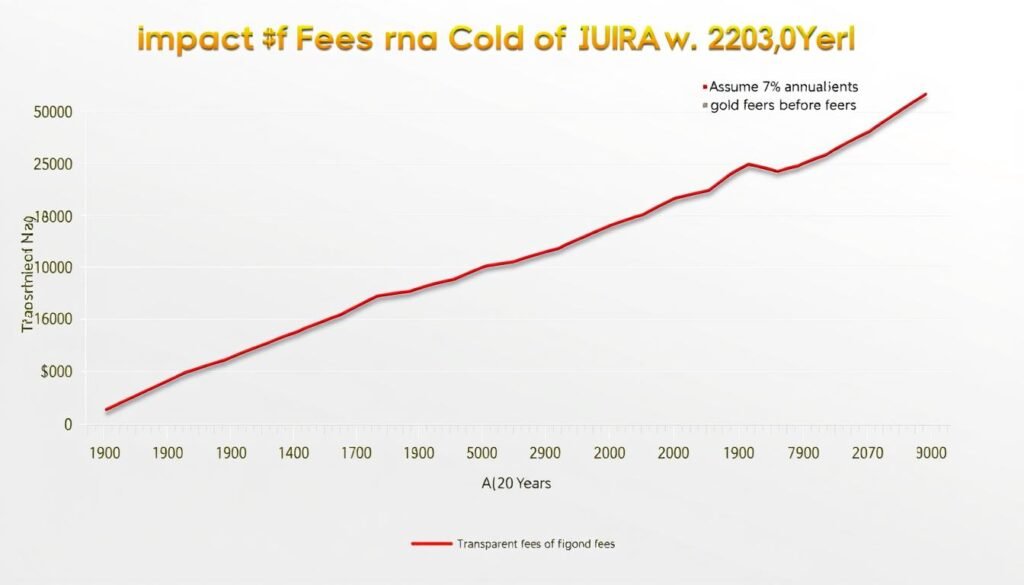

Impact of fee differences on a $100,000 Gold IRA over 20 years (assuming 7% annual gold appreciation)

As this comparison demonstrates, the difference between transparent and high-fee providers can be substantial—over $15,000 in just 10 years on a $100,000 investment. The largest discrepancy typically comes from the premium charged on the precious metals themselves, which is why it’s crucial to verify the spot price independently and compare premiums across providers.

How to Negotiate Better Fee Terms with Gold IRA Companies

Many investors don’t realize that Gold IRA fees are often negotiable, especially for larger accounts. Here are effective strategies to secure better terms:

1. Compare Multiple Providers

Obtain written quotes from at least three different Gold IRA companies. Having competitive offers gives you leverage when negotiating with your preferred provider. Be specific about the fee categories you’re comparing to ensure accurate comparisons.

2. Focus on the Biggest Cost Factors

Concentrate your negotiation efforts on the areas with the biggest financial impact: the premium over spot price and annual storage/administration fees. A 1% reduction in the premium on a $100,000 purchase saves you $1,000 immediately.

3. Request Fee Waivers for Larger Investments

Many companies will waive setup fees or first-year administration fees for accounts over certain thresholds (typically $25,000-$50,000). If these aren’t offered automatically, ask specifically about available waivers for your investment size.

4. Negotiate Buyback Terms Upfront

While you may not plan to sell soon, negotiating favorable buyback terms before investing can save you significantly in the future. Request a guaranteed maximum spread for buybacks in writing as part of your agreement.

5. Ask About Price Matching

Some Gold IRA companies will match or beat competitors’ fee structures to earn your business. Have specific competitor quotes ready and ask directly if they can match or improve upon those terms.

“The most successful negotiators are those who come prepared with specific competitor quotes and focus on the total cost of ownership rather than individual fee categories.”

Pro Tip: Timing your negotiation can make a difference. Many precious metals dealers have monthly or quarterly sales quotas. Negotiating near the end of these periods (end of month or quarter) may give you additional leverage as representatives are more motivated to close deals.

Real-World Examples: How Hidden Fees Impact Long-Term Returns

To illustrate the real impact of hidden fees, consider these actual scenarios based on investor experiences:

Case Study 1: The Premium Markup Impact

Robert invested $250,000 in a Gold IRA in 2018, paying a 12% premium over spot price based on the dealer’s recommendation of “premium” coins. A competitor would have charged only a 4% premium for standard bullion. The 8% difference cost Robert $20,000 in immediate purchasing power—meaning he owned $20,000 less gold from day one. Five years later, when gold had appreciated 40%, that initial $20,000 difference had grown to a $28,000 opportunity cost.

Case Study 2: The Annual Fee Compounding Effect

Margaret paid $800 annually in combined administration and storage fees for her $150,000 Gold IRA. A more competitive provider would have charged $300 annually for the same services. Over 15 years, the $500 annual difference grew to $12,500 in direct fee payments. But the true opportunity cost was much higher—approximately $22,000—when accounting for the lost growth potential of those fees.

Case Study 3: The Liquidation Surprise

James needed to take a distribution from his Gold IRA during retirement. His provider’s buyback program offered only 85% of the spot price (a 15% discount), while market standard was 98% of spot (a 2% discount). On his $75,000 liquidation, this hidden cost amounted to $9,750 in lost value that he discovered only at the point of sale.

Transparent Fee Structure Benefits

- Clear understanding of all costs upfront

- Ability to accurately project long-term returns

- Lower total cost of ownership

- Easier comparison between providers

- No surprises during liquidation

Hidden Fee Structure Consequences

- Significantly reduced investment returns

- Unexpected costs during account maintenance

- Difficulty accurately valuing your holdings

- Potential for substantial losses during liquidation

- Inability to make informed investment decisions

Resources for Verifying Fee Information and Comparing Providers

To effectively verify fee information and compare Gold IRA providers, utilize these valuable resources:

Independent Price Verification Tools

Always verify current precious metals spot prices independently before making purchase decisions. Reliable sources include:

Kitco.com

Industry standard for real-time precious metals pricing with historical charts and market analysis.

APMEX.com Price Charts

Comprehensive pricing data for various precious metals products with premium comparisons.

Reuters Metals

Financial news service providing objective market data and spot prices for all precious metals.

Regulatory and Consumer Protection Resources

These organizations provide valuable information about company reputations and potential red flags:

- Better Business Bureau (BBB) – Check company ratings, complaint history, and resolution patterns

- Consumer Financial Protection Bureau (CFPB) – Review complaints about financial products and services

- Commodity Futures Trading Commission (CFTC) – Access alerts about precious metals fraud and scams

- American Numismatic Association – Verify dealer memberships and access educational resources

- TrustPilot and Trustlink – Review verified customer experiences with Gold IRA providers

Industry Comparison Tools

Several independent resources provide side-by-side comparisons of Gold IRA providers:

- Retirement Living Information Center – Maintains updated fee comparisons for major Gold IRA companies

- Investopedia’s Gold IRA Provider Reviews – Detailed analysis of fee structures and company practices

- Consumer Affairs Gold Buyer Guides – Consumer-focused reviews with fee transparency ratings

Need Expert Guidance on Gold IRA Fees?

Our fee transparency specialists can review your current or prospective Gold IRA and identify potential hidden costs. Schedule a free 30-minute consultation today.

The Ultimate Gold IRA Fee Transparency Checklist

Use this comprehensive checklist when evaluating Gold IRA providers to ensure you capture all potential fees and avoid costly surprises:

Account Setup and Maintenance

- Account setup fee: $________

- Annual administration fee: $________

- IRA statement fee: $________

- Online account access fee: $________

- Account minimum balance requirement: $________

- Fee for falling below minimum: $________

Storage and Insurance

- Annual storage fee (non-segregated): $________

- Annual storage fee (segregated): $________

- Insurance costs (if separate from storage): $________

- Fee for depository visits: $________

Transaction Costs

- Wire transfer fee: $________

- Transaction fee per purchase: $________

- Premium over spot price: ________%

- Transaction fee per sale: $________

- Discount to spot price when selling: ________%

Exit and Special Situation Fees

- Account closure fee: $________

- Partial distribution fee: $________

- Full liquidation fee: $________

- Account transfer fee: $________

- Early withdrawal penalty (if applicable): $________

- Required Minimum Distribution (RMD) processing fee: $________

Tip: Request this information in writing from each provider you’re considering, then create a side-by-side comparison spreadsheet. Pay special attention to the total first-year costs and ongoing annual expenses to accurately assess the long-term impact on your investment.

Frequently Asked Questions About Gold IRA Fees

What is a reasonable total annual fee for a Gold IRA?

For a properly structured Gold IRA, total annual fees (administration and storage combined) should typically range from 0-0. Anything substantially higher deserves scrutiny. However, the largest cost factor is usually the initial premium paid over spot price when purchasing metals, which should ideally be in the 3-5% range for standard bullion products.

Are percentage-based fees better than flat fees for Gold IRAs?

For most investors, flat fees are preferable to percentage-based fees, especially as your account grows. A flat annual fee of 0 on a 0,000 account represents just 0.25%, while a seemingly low 1% fee would cost

Frequently Asked Questions About Gold IRA Fees

What is a reasonable total annual fee for a Gold IRA?

For a properly structured Gold IRA, total annual fees (administration and storage combined) should typically range from $200-$300. Anything substantially higher deserves scrutiny. However, the largest cost factor is usually the initial premium paid over spot price when purchasing metals, which should ideally be in the 3-5% range for standard bullion products.

Are percentage-based fees better than flat fees for Gold IRAs?

For most investors, flat fees are preferable to percentage-based fees, especially as your account grows. A flat annual fee of $250 on a $100,000 account represents just 0.25%, while a seemingly low 1% fee would cost $1,000 annually. The advantage of percentage-based fees only applies to very small accounts, typically under $25,000.

How can I verify if I’m being charged a fair premium over spot price?

Always check the current spot price on independent websites like Kitco.com or APMEX.com before making a purchase. Then calculate the percentage difference between the quoted price and the spot price. For standard bullion products like American Gold Eagles or Canadian Maple Leafs, premiums should typically be in the 3-5% range. Premiums of 10% or higher should be questioned unless you’re purchasing rare or collectible coins.

Is segregated storage worth the extra cost?

Segregated storage (where your metals are stored separately from others) typically costs $50-150 more annually than non-segregated storage. For most investors with accounts under $250,000, non-segregated storage at a reputable depository provides adequate security and insurance at a lower cost. Segregated storage becomes more valuable for larger accounts or for investors holding rare or collectible items that require special handling.

How do I avoid getting pressured into buying high-premium numismatic coins?

Before contacting any dealer, decide which specific bullion products you want to purchase (such as American Gold Eagles or Canadian Maple Leafs). Be firm about your choices and directly question any attempts to redirect you toward “premium,” “rare,” or “collectible” alternatives. Request written quotes for exactly the products you specified, and be willing to walk away if the dealer is persistent about pushing alternatives with higher premiums.

,000 annually. The advantage of percentage-based fees only applies to very small accounts, typically under ,000.

How can I verify if I’m being charged a fair premium over spot price?

Always check the current spot price on independent websites like Kitco.com or APMEX.com before making a purchase. Then calculate the percentage difference between the quoted price and the spot price. For standard bullion products like American Gold Eagles or Canadian Maple Leafs, premiums should typically be in the 3-5% range. Premiums of 10% or higher should be questioned unless you’re purchasing rare or collectible coins.

Is segregated storage worth the extra cost?

Segregated storage (where your metals are stored separately from others) typically costs -150 more annually than non-segregated storage. For most investors with accounts under 0,000, non-segregated storage at a reputable depository provides adequate security and insurance at a lower cost. Segregated storage becomes more valuable for larger accounts or for investors holding rare or collectible items that require special handling.

How do I avoid getting pressured into buying high-premium numismatic coins?

Before contacting any dealer, decide which specific bullion products you want to purchase (such as American Gold Eagles or Canadian Maple Leafs). Be firm about your choices and directly question any attempts to redirect you toward “premium,” “rare,” or “collectible” alternatives. Request written quotes for exactly the products you specified, and be willing to walk away if the dealer is persistent about pushing alternatives with higher premiums.

Protecting Your Retirement: The Importance of Fee Vigilance

The difference between a transparent, fair-fee Gold IRA and one laden with hidden costs can amount to tens or even hundreds of thousands of dollars over your investment lifetime. This isn’t merely about saving money—it’s about preserving the very purpose of your retirement strategy.

Remember that fee transparency isn’t just beneficial for investors; it’s a hallmark of reputable companies that value long-term relationships over short-term profits. The most trustworthy Gold IRA providers welcome fee discussions and provide clear, comprehensive information without hesitation.

As you navigate the Gold IRA landscape, maintain a healthy skepticism toward “too good to be true” offers, free promotions, and high-pressure sales tactics. Take your time, conduct thorough research, and leverage the resources and strategies outlined in this guide to ensure your precious metals investment truly serves its purpose: protecting and growing your retirement savings.

By remaining vigilant about fees and hidden costs, you can enjoy the portfolio diversification and potential inflation protection that physical precious metals offer—without surrendering your returns to excessive charges that undermine your financial security.

Take Control of Your Gold IRA Investment Today

Download our comprehensive Gold IRA Fee Comparison Checklist and schedule a free consultation with our fee transparency specialists to ensure you’re not overpaying.