Many entrepreneurs and real estate investors face a common dilemma: they have substantial funds locked in retirement accounts while seeking capital for business ventures or property acquisitions. With traditional financing options sometimes limited, some consider tapping into their Gold IRAs as a potential funding source. But is this legally permissible? This comprehensive guide examines whether you can use a Gold IRA to fund small business real estate investments, the regulatory framework, potential alternatives, and important considerations to protect your retirement savings and avoid costly penalties.

Understanding Gold IRAs: Beyond Traditional Retirement Accounts

Gold IRAs allow investors to hold physical precious metals in their retirement accounts

A Gold IRA, more accurately called a Self-Directed IRA (SDIRA) that holds precious metals, is a specialized type of Individual Retirement Account that allows investors to hold physical gold, silver, platinum, and palladium instead of traditional paper assets like stocks and bonds. These accounts maintain the same tax advantages as conventional IRAs but provide greater investment flexibility.

How Gold IRAs Differ from Traditional IRAs

Unlike conventional IRAs managed by banks or brokerage firms that typically limit investments to stocks, bonds, and mutual funds, Gold IRAs fall under the broader category of self-directed IRAs. The key differences include:

The self-directed nature of Gold IRAs gives investors more control over their retirement assets, but this freedom comes with additional responsibilities and regulatory considerations that are crucial to understand before attempting to use these funds for business or real estate investments.

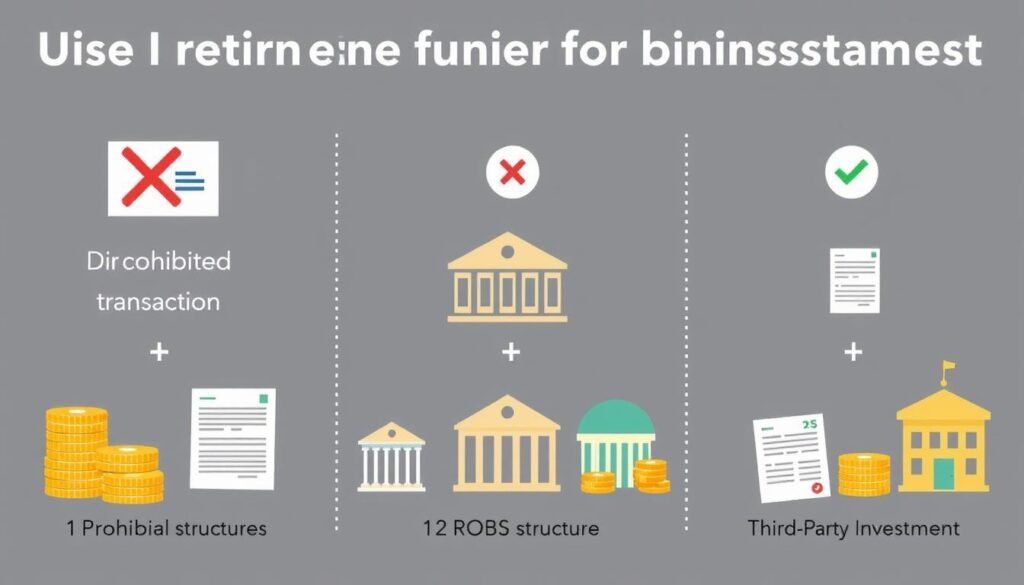

IRS Regulations: Prohibited Transactions and Self-Dealing

The IRS maintains strict regulations governing how retirement accounts, including Gold IRAs, can be used. These rules are designed to ensure that retirement accounts are used for their intended purpose—building retirement savings—rather than providing immediate benefits to account holders or related parties.

Prohibited Transactions Under IRC Section 4975

The Internal Revenue Code Section 4975 defines prohibited transactions as certain interactions between a retirement plan and a “disqualified person.” Understanding these restrictions is essential when considering using IRA funds for business or real estate purposes.

Who Are “Disqualified Persons”?

The IRS considers the following to be disqualified persons who cannot engage in certain transactions with your IRA:

Types of Prohibited Transactions

The following transactions between an IRA and a disqualified person are explicitly prohibited:

These regulations directly impact the question of using a Gold IRA to fund a small business or real estate investment, as we’ll explore in the following sections.

Can You Legally Use Gold IRA Funds for Small Business Investments?

The question of whether you can use Gold IRA funds to invest in a small business depends on several critical factors, primarily centered around ownership and control of the business entity.

Direct Investment in a Business Entity

A self-directed IRA, including a Gold IRA, can legally invest in certain business entities under specific conditions:

Important Restriction

Your Gold IRA cannot invest in a business where you or other disqualified persons own a controlling interest (50% or more). This effectively prevents using your IRA to fund your own business or a family member’s business.

Prohibited: Investing in Your Own Business

The IRS explicitly prohibits using IRA funds to invest in a business where you or other disqualified persons have substantial ownership or control. This means you cannot:

These restrictions effectively prevent entrepreneurs from using their Gold IRAs to fund their own business ventures, as doing so would constitute a prohibited transaction and trigger significant tax consequences.

Using Gold IRA Funds for Real Estate Investments

Real estate investments through self-directed IRAs, including Gold IRAs, follow similar rules to business investments but have some unique considerations.

Permitted Real Estate Investments

A self-directed IRA can legally invest in various types of real estate, including:

Key Restrictions for Real Estate Investments

However, several important restrictions apply:

Practical Example

Your Gold IRA could purchase a commercial building to lease to an unrelated business, but you could not lease it to your own business or manage the property yourself. All rental income would return to your IRA, not to you personally.

These restrictions make it challenging to use a Gold IRA to fund real estate that would directly benefit your small business operations, as this would likely constitute a prohibited transaction.

Liquidation Strategy: Converting Gold IRA Assets

Some investors consider liquidating their Gold IRA assets to access funds for business or real estate investments. This approach avoids prohibited transaction issues but comes with significant financial implications.

The Distribution Process

Taking a distribution from your Gold IRA involves:

Tax Consequences and Penalties

The financial impact of this approach can be substantial:

| Age | Tax Consequence | Early Withdrawal Penalty |

| Under 59½ | Ordinary income tax on full distribution amount | Additional 10% penalty |

| 59½ or older | Ordinary income tax on full distribution amount | None |

| Roth IRA (5+ years old, over 59½) | Tax-free if qualified distribution | None if qualified distribution |

Financial Impact Example

If you withdraw $100,000 from a Traditional Gold IRA at age 45, you could face ordinary income tax (potentially 22-32% depending on your tax bracket) plus a 10% early withdrawal penalty. This could reduce your available investment capital by $32,000-$42,000 or more.

Given these substantial costs, direct liquidation is rarely the most efficient way to access retirement funds for business or real estate investments.

Legal Alternatives for Accessing Retirement Funds

Several alternative strategies exist that may allow you to leverage retirement funds for business or real estate investments while minimizing tax consequences and avoiding prohibited transactions.

Rollover for Business Startups (ROBS)

A ROBS arrangement allows you to roll over retirement funds into a new business without triggering taxes or penalties:

While complex, this approach is recognized by the IRS when properly structured and can provide a tax-advantaged way to access retirement funds for business purposes.

Solo 401(k) with Checkbook Control

For self-employed individuals, a Solo 401(k) with checkbook control offers significant flexibility:

IRA LLC Structure

Another option is the IRA LLC or “checkbook IRA” structure:

Free Guide: Retirement Fund Business Financing

Download our comprehensive guide to legally accessing retirement funds for business and real estate investments while minimizing tax consequences.

Penalties and Tax Consequences of Improper IRA Usage

Violating IRS rules regarding IRAs can result in severe financial consequences. Understanding these penalties is crucial before attempting to use retirement funds for business or real estate investments.

Consequences of Prohibited Transactions

If the IRS determines you’ve engaged in a prohibited transaction with your Gold IRA, the consequences are severe:

Case Example

In Peek v. Commissioner (2013), the Tax Court ruled that personal guarantees on a loan for an IRA-owned business constituted prohibited transactions. The taxpayers were required to pay taxes on their entire $431,500 IRA, plus a 20% accuracy-related penalty.

Unrelated Business Taxable Income (UBTI)

Even with permitted investments, your IRA may face additional taxes:

Given these substantial penalties and tax consequences, it’s essential to consult with qualified tax and legal professionals before attempting to use Gold IRA funds for business or real estate investments.

Recommendations and Best Practices

If you’re considering using retirement funds for business or real estate investments, these recommendations can help you navigate the complex regulatory landscape while protecting your financial future.

Consult with Specialists Before Acting

Consider Alternative Funding Sources

Before risking retirement funds, explore other funding options:

If Using Retirement Funds, Follow These Guidelines

Potential Benefits

- Access to capital without traditional lending requirements

- Potential for higher returns than traditional IRA investments

- Diversification of retirement portfolio

- Tax-advantaged growth if properly structured

Significant Risks

- Severe tax consequences if rules are violated

- Potential loss of retirement security

- Complex regulatory compliance requirements

- High administrative costs and professional fees

- Concentration of retirement assets in a single investment

Practical Examples and Scenarios

Scenario 1: Prohibited Transaction Example

Situation: John wants to use his $200,000 Gold IRA to purchase a commercial building that will house his consulting business.

Analysis: This would constitute a prohibited transaction because John would receive a personal benefit (office space for his business) from the IRA investment.

Consequence: John’s entire IRA would be considered distributed, resulting in approximately $70,000 in taxes and penalties.

Scenario 2: Permissible Investment Example

Situation: Sarah uses her $200,000 Gold IRA to purchase a commercial building that is leased to an unrelated third-party business.

Analysis: This is permissible because Sarah is not receiving any personal benefit, and no disqualified persons are involved.

Outcome: Rental income flows back to Sarah’s IRA tax-deferred, and the property can appreciate within the tax-advantaged account.

Scenario 3: ROBS Structure Example

Situation: Michael wants to use his $150,000 Gold IRA to start a new retail business.

Analysis: Direct investment would be prohibited, but Michael establishes a ROBS structure by creating a new C Corporation and 401(k) plan.

Outcome: Michael successfully transfers his IRA funds to the new business without taxes or penalties, though he must adhere to strict operational requirements.

Scenario 4: IRA LLC Structure Example

Situation: Lisa wants more control over her $250,000 Gold IRA investments in real estate.

Analysis: Lisa establishes an IRA LLC structure, with her IRA owning 100% of a specially-created LLC that she manages (without compensation).

Outcome: Lisa can make real estate investments through the LLC checkbook without custodian approval for each transaction, but must still avoid prohibited transactions.

Conclusion: Balancing Opportunity with Compliance

Using a Gold IRA to fund small business or real estate investments presents a complex landscape of opportunities and regulatory challenges. While direct investment in your own business or personally-beneficial real estate is generally prohibited, several legal alternatives exist that may allow you to leverage retirement funds for entrepreneurial ventures.

The key takeaways from this analysis include:

While the desire to access retirement funds for current business opportunities is understandable, remember that these accounts exist primarily to secure your financial future. Any strategy that puts these funds at risk should be approached with caution and thorough due diligence.

Get Expert Guidance on Retirement Fund Investing

Schedule a consultation with our financial advisors specializing in self-directed IRAs and alternative investment strategies for retirement accounts.

Frequently Asked Questions

Can I use my Gold IRA to invest in my own startup business?

No, investing your Gold IRA directly in your own business constitutes a prohibited transaction under IRS rules. This would provide an immediate benefit to a disqualified person (you), which is not allowed. However, alternative structures like a Rollover for Business Startups (ROBS) might allow you to access retirement funds for business purposes without penalties.

What penalties apply if I use my Gold IRA for a prohibited transaction?

If you engage in a prohibited transaction, the IRS considers your entire IRA distributed as of January 1 of the year the transaction occurred. This means you’ll owe ordinary income tax on the full value of the account, plus a 10% early withdrawal penalty if you’re under age 59½. Additional penalties of up to 15% may apply for uncorrected prohibited transactions.

Can my Gold IRA purchase real estate that I later buy personally?

No, this would constitute a prohibited transaction. Your IRA cannot sell property to you or any other disqualified person (including family members). Such a transaction would disqualify the entire IRA, triggering taxes and potential penalties.

How does a ROBS arrangement work with a Gold IRA?

With a ROBS, you would first need to liquidate the gold holdings within your IRA (which may have tax implications depending on market values), then roll over the funds into a newly established 401(k) plan sponsored by your C Corporation. The 401(k) then purchases stock in your corporation, providing the business with capital. This complex arrangement requires professional assistance to implement properly.

Can I take a loan from my Gold IRA for business purposes?

No, IRAs (including Gold IRAs) do not permit loans to account holders. Taking money from an IRA is considered a distribution and is subject to taxes and potential penalties. However, if you roll over your IRA funds to a Solo 401(k), you may be eligible to borrow up to ,000 or 50% of the account value (whichever is less) through the loan provisions of the 401(k).