In times of economic uncertainty, many investors turn to precious metals to protect their retirement savings. Gold and silver IRAs have emerged as popular options for those seeking to diversify beyond traditional stocks and bonds. But which metal makes more sense for your financial future? This comprehensive comparison will help you determine whether a gold IRA vs silver IRA better aligns with your retirement goals, risk tolerance, and investment strategy.

Understanding Gold and Silver IRAs: The Basics

Precious metals IRAs are self-directed retirement accounts that allow you to hold physical gold, silver, platinum, or palladium instead of traditional paper assets. These specialized IRAs maintain the same tax advantages as conventional retirement accounts while providing exposure to tangible assets that often move independently from the stock market.

What Is a Gold IRA?

A Gold IRA holds physical gold in the form of IRS-approved coins or bullion. The gold must meet minimum purity requirements (99.5% pure) and be stored in an approved depository. Gold has historically served as a store of value during economic downturns and periods of currency devaluation.

What Is a Silver IRA?

A Silver IRA functions similarly but holds physical silver that meets IRS purity standards (99.9% pure). Silver offers a lower price point than gold and has significant industrial applications, which can influence its market dynamics differently than gold.

Free Precious Metals IRA Guide

Not sure which precious metal is right for your retirement? Get our comprehensive guide to understand all your options.

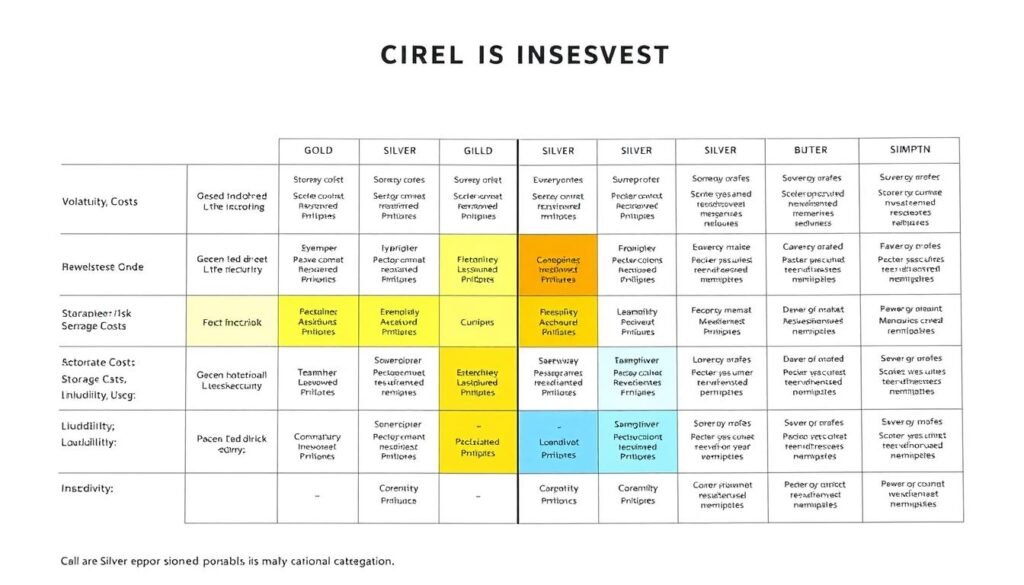

Gold IRA vs Silver IRA: Key Differences

When deciding between gold and silver for your retirement portfolio, several factors come into play. Each metal has distinct characteristics that affect its performance as an investment vehicle.

| Feature | Gold IRA | Silver IRA |

| Price Volatility | Lower volatility, more stable | Higher volatility, 2-3x more than gold |

| Entry Cost | Higher (gold is ~80x more expensive per ounce) | Lower price point, more accessible |

| Industrial Demand | Limited industrial applications | Strong industrial demand (electronics, solar, medical) |

| Storage Requirements | Less space needed per dollar value | More storage space required per dollar value |

| Historical Performance | 1,012% return over past 20 years | 941% return over past 20 years |

| Portfolio Diversification | Stronger negative correlation to stocks | Moderate correlation to economic activity |

Historical Performance and Price Volatility

Understanding how gold and silver have performed historically can provide insights into their potential future behavior in your retirement portfolio.

Gold’s Track Record

Gold has demonstrated remarkable stability during economic downturns. During the 2008 financial crisis, gold prices increased while the stock market plummeted. This counter-cyclical movement makes gold an effective portfolio diversifier. Gold typically experiences less day-to-day price volatility than silver, making it a more predictable store of value.

Silver’s Performance Patterns

Silver prices can be two to three times more volatile than gold on any given day. This volatility creates both opportunity and risk. During economic expansions, silver often outperforms gold due to increasing industrial demand. However, during sharp economic contractions, silver can initially fall alongside industrial commodities before recovering as investment demand increases.

Storage Requirements and Associated Costs

Both gold and silver IRAs require secure storage at IRS-approved depositories, but there are important differences in how this affects your investment.

Gold Storage Considerations

Gold’s high value-to-volume ratio means it requires less physical space for storage. A $50,000 investment in gold can be held in a relatively small space, which typically results in lower storage fees as a percentage of your investment. Most custodians charge between 0.5% and 1% annually for gold storage and insurance.

Silver Storage Challenges

Silver’s lower price per ounce means it takes significantly more physical space to store the same dollar value. This can result in higher relative storage costs. For example, $50,000 in silver requires roughly 80 times more space than the same value in gold. Some custodians charge higher percentage fees for silver storage due to these space requirements.

“When evaluating storage costs, consider the total expense ratio rather than just the nominal fee. Silver’s higher storage costs as a percentage of investment value can impact long-term returns.”

Liquidity and Market Dynamics

The ability to buy and sell your precious metals efficiently can significantly impact your retirement strategy, especially when you begin taking distributions.

Gold’s Market Liquidity

Gold enjoys exceptional liquidity in global markets. It can be bought and sold quickly with minimal price impact, even in large quantities. The bid-ask spread (the difference between buying and selling prices) is typically tighter for gold, meaning you lose less value in transactions. This liquidity becomes particularly important when taking required minimum distributions (RMDs) from your IRA.

Silver’s Market Characteristics

While silver is also highly liquid, its market is smaller than gold’s. This can occasionally result in wider bid-ask spreads, especially during market stress. However, silver’s lower price point makes it easier to sell precise dollar amounts when needed for distributions. The silver market is also more influenced by industrial demand, which can create both opportunities and challenges for timing sales.

Minimum Investment Thresholds

The initial investment required for gold and silver IRAs can vary significantly, affecting accessibility for different investors.

Gold IRA Minimums

Gold IRAs typically have higher minimum investment requirements due to gold’s higher price per ounce. Many custodians require initial investments between $15,000 and $25,000 for gold IRAs. This higher threshold can be a barrier for some investors, particularly those just beginning to diversify into precious metals.

Silver IRA Minimums

Silver IRAs often feature lower minimum investment requirements, sometimes starting at $5,000 to $10,000. This lower entry point makes silver IRAs more accessible to investors with smaller budgets or those who wish to start with a modest allocation to precious metals while maintaining diversification in other assets.

Compare Top Precious Metals IRA Companies

Find the best custodian for your gold or silver IRA with our detailed comparison of fees, minimums, and customer service.

Diversification Benefits and Inflation Hedging

Both gold and silver can help diversify a retirement portfolio, but they offer different advantages in terms of correlation to other assets and protection against inflation.

Gold as a Portfolio Diversifier

Gold has historically maintained a low or negative correlation with stocks and bonds. This makes it an effective diversification tool that can help reduce overall portfolio volatility. During market downturns, gold often moves independently or even counter to stock market performance, providing a stabilizing effect on retirement savings.

Silver’s Diversification Profile

Silver offers moderate diversification benefits but tends to have a higher correlation with economic activity than gold. This dual nature – part industrial metal, part precious metal – means silver can sometimes follow broader market trends during economic expansions while still providing some protection during downturns.

Inflation Protection Comparison

Both metals have served as hedges against inflation, but with different characteristics:

Gold’s Inflation Protection

- Consistent historical performance during inflationary periods

- Tends to maintain purchasing power over very long time horizons

- Less volatile response to inflation data

- Strong performance during currency devaluation

Silver’s Inflation Response

- Potentially higher percentage gains during inflationary periods

- More volatile price movements in response to inflation data

- Industrial demand can amplify inflation-driven price increases

- May lag gold initially but can outperform during sustained inflation

When a Gold IRA Makes More Sense

Gold IRAs tend to be the preferred choice in specific scenarios and for investors with certain priorities.

Ideal Scenarios for Gold IRA Investment

- Wealth Preservation Focus: If your primary goal is protecting existing wealth rather than aggressive growth, gold’s stability makes it a better choice.

- Lower Risk Tolerance: Investors uncomfortable with significant price volatility will appreciate gold’s more measured price movements.

- Nearing Retirement: Those closer to retirement age typically benefit from gold’s stability as they have less time to recover from market volatility.

- Significant Economic Concerns: During periods of serious economic uncertainty, banking concerns, or geopolitical tension, gold often outperforms.

- Larger Investment Amounts: The higher value-to-volume ratio makes gold more efficient for larger investment sums ($50,000+).

“Gold has consistently served as a financial anchor during times of uncertainty. For retirement investors focused on preservation rather than speculation, gold IRAs provide the stability and security that paper assets often lack during economic turbulence.”

When a Silver IRA Makes More Sense

Silver IRAs can be the better option in certain circumstances and for investors with specific goals.

Ideal Scenarios for Silver IRA Investment

- Growth Potential Priority: Investors seeking higher potential percentage returns might prefer silver’s more dynamic price movements.

- Smaller Investment Budget: With a lower price point, silver allows meaningful precious metals exposure with less initial capital.

- Longer Time Horizon: Younger investors with decades until retirement can better weather silver’s volatility while positioning for potential outperformance.

- Industrial Demand Play: Those bullish on technologies that use silver (solar, electronics, medical) may benefit from increasing industrial consumption.

- Higher Risk Tolerance: Investors comfortable with more significant price swings can potentially capture greater gains with silver.

Risk Factors and Considerations

Before investing in either a gold or silver IRA, it’s important to understand the potential drawbacks and limitations of precious metals as retirement assets.

Common Risks for Both Gold and Silver IRAs

- No Income Generation: Unlike stocks or bonds, physical precious metals don’t produce dividends or interest.

- Storage and Insurance Costs: Annual fees can erode returns over time.

- Price Volatility: Both metals experience price fluctuations, though to different degrees.

- Potential Tax Implications: Precious metals in IRAs may be taxed as collectibles (28% maximum rate) rather than capital gains when distributed.

- Dealer Markups: Purchasing physical metals involves premiums above spot price.

Gold-Specific Considerations

- Higher entry cost limits accessibility

- May underperform during strong economic growth

- Central bank policies can impact prices

- Higher opportunity cost during bull markets

Silver-Specific Considerations

- Greater price volatility can be stressful

- Industrial demand fluctuations affect price

- Higher relative storage costs

- More vulnerable to economic downturns initially

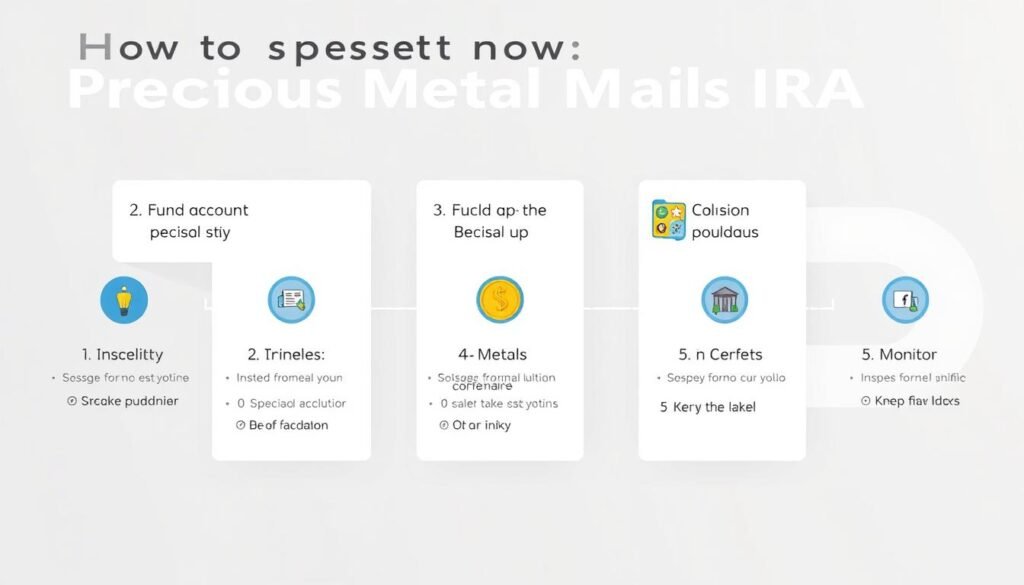

How to Get Started with a Precious Metals IRA

If you’ve decided to invest in either a gold or silver IRA, the process follows similar steps regardless of which metal you choose.

-

Choose a Self-Directed IRA Custodian

Select a reputable custodian that specializes in precious metals IRAs. Look for transparent fee structures, strong customer reviews, and experience in the industry.

-

Fund Your Account

Transfer funds from an existing retirement account (401(k), traditional IRA, etc.) or make a new contribution within annual IRA limits.

-

Select Your Metals

Choose IRS-approved gold or silver products. For gold, this means 99.5% purity; for silver, 99.9% purity is required. American Eagle coins, Canadian Maple Leafs, and certain bars from accredited refiners qualify.

-

Arrange Secure Storage

Your metals must be stored in an IRS-approved depository. Your custodian will coordinate this, but you can often select from multiple storage facilities.

-

Monitor and Manage

Review your precious metals holdings regularly as part of your overall retirement strategy. Rebalance as needed based on market conditions and your changing financial goals.

Conclusion: Making the Right Choice for Your Retirement

When deciding between a gold IRA vs silver IRA, there is no one-size-fits-all answer. The right choice depends on your specific financial situation, retirement timeline, and investment goals.

Gold IRAs tend to be better suited for investors prioritizing stability, wealth preservation, and protection against severe economic downturns. With lower volatility and a stronger track record during crises, gold provides a reliable anchor for retirement portfolios, especially for those nearing retirement age.

Silver IRAs may be more appropriate for investors with a longer time horizon, smaller initial investment budget, and higher risk tolerance. Silver’s industrial applications and potential for higher percentage gains make it attractive for those seeking growth alongside inflation protection.

Many experienced investors choose to include both metals in their retirement strategy, leveraging gold’s stability alongside silver’s growth potential. This balanced approach can provide comprehensive precious metals exposure while mitigating the individual drawbacks of each metal.

Regardless of which precious metal you choose, remember that diversification remains key. Most financial advisors recommend limiting precious metals to 5-15% of your overall retirement portfolio, using them as a complement to traditional assets rather than a replacement.

Ready to Protect Your Retirement with Precious Metals?

Speak with a precious metals specialist today to determine whether a gold IRA, silver IRA, or combination approach best suits your financial goals.