Transferring your existing gold IRA to a new provider can be a strategic financial move that potentially saves you money, improves customer service, and provides better storage options for your precious metals. Whether you’re dissatisfied with your current custodian’s fees, looking for more diverse investment options, or simply seeking better customer support, this comprehensive guide will walk you through the entire transfer process step by step.

Why Transfer Your Gold IRA to a New Provider?

Before diving into the transfer process, it’s important to understand the common reasons investors choose to switch their gold IRA custodians:

Cost Considerations

- Lower annual maintenance fees

- Reduced storage costs

- Better transaction fee structure

- Elimination of hidden charges

Service Improvements

- More responsive customer support

- Better online account management

- Transparent communication

- Dedicated account representatives

Investment Options

- Wider selection of IRS-approved metals

- More diverse precious metals products

- Better pricing on purchases

- Improved buyback programs

Security & Storage

- Enhanced security protocols

- More storage location options

- Better insurance coverage

- Segregated storage availability

Ready to explore better gold IRA options?

Get your free Gold IRA Transfer Guide to compare top providers and find the best fit for your needs.

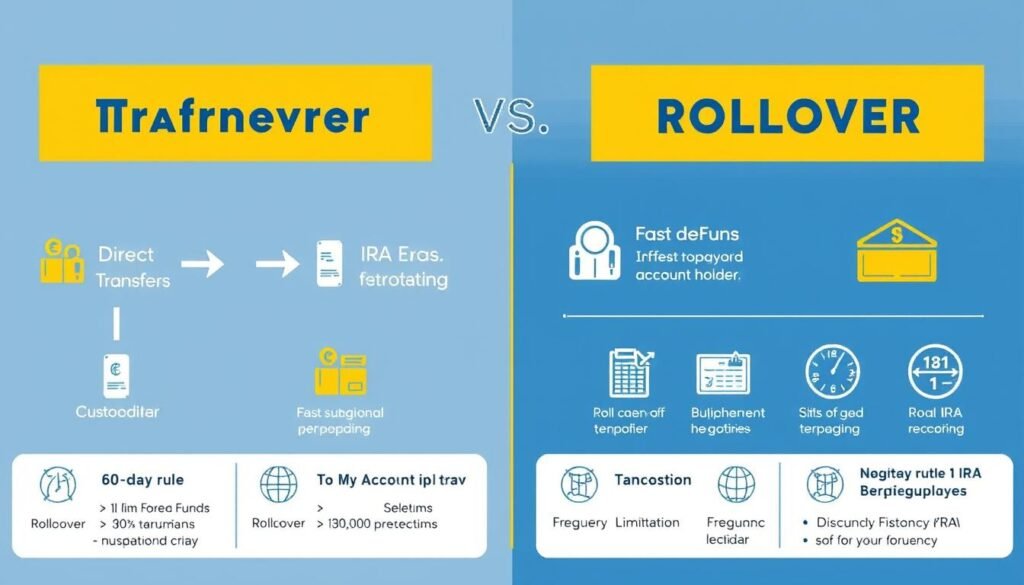

Understanding the Difference: Transfer vs. Rollover

Before initiating the process, it’s crucial to understand the difference between a transfer and a rollover, as they have different IRS rules and potential tax implications:

| Feature | Gold IRA Transfer | Gold IRA Rollover |

| Fund Movement | Direct custodian-to-custodian | Funds distributed to you first |

| Time Constraints | No 60-day rule | Must deposit within 60 days |

| Tax Withholding | No withholding taxes | Possible withholding |

| Frequency Limits | No annual limits | Limited to one per 365 days |

| Early Withdrawal Penalties | None | Possible 10% penalty if rules violated |

| Complexity | Simpler process | More complex with more rules |

Recommendation: For most investors, a direct transfer is the preferred method when moving an existing gold IRA to a new provider. It’s simpler, has fewer restrictions, and eliminates the risk of missing deadlines or incurring penalties.

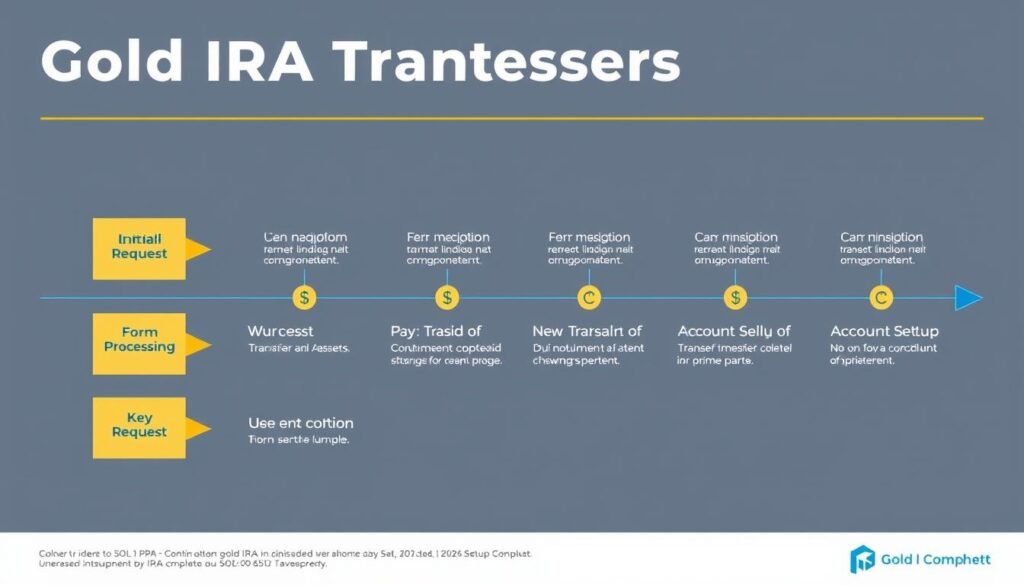

Step-by-Step Guide to Transferring Your Gold IRA

Follow these detailed steps to ensure a smooth transition of your precious metals IRA to a new provider:

Step 1: Research and Select a New Gold IRA Provider

The first and most crucial step is selecting the right new custodian for your gold IRA. Consider these key factors:

- Reputation and Experience: Look for established companies with strong track records in the precious metals industry.

- Fee Structure: Compare annual maintenance fees, storage costs, and transaction fees.

- Customer Service: Read reviews about responsiveness and quality of support.

- Storage Options: Verify they offer secure, IRS-approved storage facilities.

- Available Products: Ensure they offer the types of precious metals you want to hold.

- Buyback Program: Check if they have a fair buyback policy for when you want to sell.

Compare Top Gold IRA Companies

Receive detailed information about the most reputable gold IRA providers to make an informed decision.

Step 2: Contact Your New Provider to Open an Account

Once you’ve selected a new provider, you’ll need to establish your account:

- Contact the new provider via phone or their website.

- Complete their new account application forms.

- Provide identification documentation (typically a driver’s license or passport).

- Sign the custodial agreement outlining terms and conditions.

- Designate beneficiaries for your account.

Speak with a Gold IRA Specialist Today

Step 3: Initiate the Transfer Request

Your new gold IRA provider will help you initiate the transfer process:

- Your new custodian will provide a transfer request form.

- You’ll need to provide details about your current gold IRA (account number, custodian name, approximate value).

- Specify whether you want a complete or partial transfer.

- Indicate whether you want an “in-kind” transfer (keeping the same metals) or liquidation and repurchase.

- Sign and submit the transfer request form to your new custodian.

Pro Tip: Most reputable gold IRA companies will handle most of the paperwork for you, making the process much simpler. They’ll often provide a dedicated transfer specialist to guide you through each step.

Step 4: Wait for the Transfer to Process

Once you’ve submitted your transfer request, the process will unfold as follows:

- Your new custodian forwards the transfer request to your current custodian.

- Your current custodian reviews and processes the request (typically 1-3 business days).

- For in-kind transfers, your metals are physically moved to the new custodian’s storage facility.

- For liquidation transfers, your metals are sold, and cash is transferred to the new custodian for repurchase.

- The entire process typically takes 2-4 weeks to complete.

Important: During the transfer process, you won’t have access to your gold IRA assets. Plan accordingly and avoid initiating transfers during periods of high market volatility if possible.

Step 5: Verify Completion and Review Your New Account

After the transfer is complete, take these important steps:

- Confirm receipt of all assets with your new custodian.

- Verify that the metals transferred match your records (type, quantity, purity).

- Review the storage arrangements and confirm insurance coverage.

- Set up online account access if available.

- Update your records with the new account information.

- Consider requesting a physical audit or inventory report of your holdings.

Tax Implications and IRS Compliance

One of the most critical aspects of transferring your gold IRA is ensuring you remain compliant with IRS regulations to avoid unexpected taxes and penalties:

Key IRS Rules to Follow

- Qualified Custodian Requirement: The IRS requires that all IRA assets be held by a qualified custodian. Self-storage of gold IRA assets is prohibited.

- Same Asset Class Rule: For tax-free treatment, you must transfer “like for like” – IRA to IRA.

- No Physical Possession: You cannot take physical possession of the metals during the transfer process.

- 60-Day Rule for Rollovers: If you choose a rollover instead of a transfer, you must complete it within 60 days to avoid taxes and penalties.

- One-Year Waiting Period: You can only perform one IRA-to-IRA rollover in any 12-month period (this doesn’t apply to transfers).

Ensure IRS Compliance

Download our free IRS Compliance Checklist for Gold IRA Transfers to avoid costly mistakes.

Potential Tax Pitfalls to Avoid

Tax-Free Transfers (Do These)

- Direct custodian-to-custodian transfers

- Properly documented rollovers completed within 60 days

- Maintaining the same account type (Traditional to Traditional, Roth to Roth)

- Working with experienced gold IRA specialists

Taxable Events (Avoid These)

- Taking physical possession of your gold during transfer

- Missing the 60-day rollover window

- Attempting multiple rollovers within 12 months

- Mixing Traditional and Roth accounts improperly

Understanding Fees and Costs

When transferring your gold IRA, it’s important to understand all potential costs involved:

Common Fees Associated with Gold IRA Transfers

| Fee Type | Typical Range | Paid To | Notes |

| Exit/Termination Fee | $50-$250 | Current Custodian | One-time fee to close your existing account |

| Transfer Fee | $0-$75 | Current Custodian | Some custodians waive this for larger accounts |

| Setup Fee | $50-$150 | New Custodian | One-time fee to establish new account |

| Annual Maintenance | $75-$300 | New Custodian | Ongoing fee for account administration |

| Storage Fee | $100-$300 | Storage Facility | Annual fee based on account value or flat rate |

| Insurance | Typically included | Storage Facility | Should be included in storage fee |

| Wire Transfer Fee | $25-$50 | Banks | If liquidating and transferring funds |

Cost-Saving Tips

- Negotiate Fee Waivers: Many new custodians will offer to cover your exit fees or transfer costs.

- Look for Promotions: Some companies offer first-year fee waivers or reduced rates for transfers.

- Consider Flat-Fee vs. Scaled: For larger accounts, flat-fee structures often save money compared to percentage-based fees.

- Bundle Services: Some providers offer discounts when you use them for both custodial and storage services.

- Ask About Price Matching: Some companies will match or beat competitors’ fee structures.

Important: Always get a complete fee schedule in writing before initiating a transfer. Ask specifically about any “hidden” or conditional fees that might apply to your situation.

Storage Options and Security Considerations

When transferring your gold IRA, you’ll need to make decisions about how your precious metals will be stored:

Types of Storage Options

Segregated Storage

Your metals are stored separately from other investors’ holdings, with specific serial numbers assigned to you.

- Complete ownership verification

- Easier auditing and confirmation

- Higher fees (typically 10-30% more)

- Recommended for larger accounts

Allocated Storage

Your metals are specifically allocated to you but may be stored alongside other investors’ holdings.

- Balance of security and cost

- Still maintains individual ownership

- Moderate fees

- Most common option

Unallocated Storage

You own a share of a larger pool of metals rather than specific pieces.

- Lowest storage fees

- No specific serial numbers assigned

- Potential counterparty risk

- Not recommended for most investors

International Storage

Some providers offer storage options outside the United States.

- Geographic diversification

- Additional jurisdictional protection

- Potentially higher fees

- More complex reporting requirements

Security Features to Look For

- IRS Approval: All storage facilities must be IRS-approved for precious metals IRAs.

- Insurance Coverage: Verify the facility has adequate insurance for your holdings.

- Physical Security: Look for features like 24/7 monitoring, armed guards, and advanced access controls.

- Audit Procedures: Regular third-party audits ensure accountability.

- Disaster Protection: Facilities should be protected against fire, flood, and other natural disasters.

- Reputation: Research the depository’s history and standing in the industry.

Learn About Premium Storage Options

Discover the most secure storage facilities for your precious metals IRA.

Best Practices for a Smooth Transfer

Follow these best practices to ensure your gold IRA transfer goes as smoothly as possible:

Before Initiating the Transfer

- Document Your Current Holdings: Create a detailed inventory of your current precious metals (types, quantities, serial numbers if available).

- Research Thoroughly: Compare at least 3-5 potential new custodians before making a decision.

- Read the Fine Print: Review all fee schedules and agreements carefully.

- Check Credentials: Verify your new custodian is IRS-approved and has proper licensing.

- Consider Timing: Market volatility or year-end processing may slow transfers.

During the Transfer Process

- Stay Organized: Keep copies of all paperwork and communication.

- Follow Up Regularly: Check on the status of your transfer weekly.

- Get Everything in Writing: Request email confirmation of important details and agreements.

- Be Patient: The physical transfer of metals can take time.

- Keep Contact Information Updated: Ensure both custodians can reach you easily.

After the Transfer is Complete

- Verify All Assets: Confirm that all your metals arrived at the new custodian.

- Update Your Records: Maintain detailed documentation of the transfer.

- Close Old Accounts: Formally close your old account to avoid ongoing fees.

- Review Storage Arrangements: Confirm your storage preferences were implemented.

- Schedule Regular Reviews: Plan to review your account at least annually.

Frequently Asked Questions About Gold IRA Transfers

How long does a gold IRA transfer typically take?

Most gold IRA transfers take between 2-4 weeks to complete. The timeline depends on several factors, including the responsiveness of your current custodian, the physical movement of assets, and the efficiency of your new provider. Direct transfers are usually faster than rollovers.

Can I transfer only part of my gold IRA to a new provider?

Yes, partial transfers are possible. You can specify which assets you want to transfer and which you want to keep with your current custodian. This might be useful if you want to diversify across multiple custodians or test a new provider before moving all your assets.

Will I have to pay taxes on my gold IRA transfer?

If done correctly as a direct transfer, you should not incur any taxes or penalties. The key is ensuring the assets move directly from one qualified custodian to another without you taking possession. If you choose a rollover instead, you must complete it within 60 days to avoid tax consequences.

Can I change the types of precious metals during a transfer?

Yes, you have two options. You can either transfer your existing metals “in-kind” (keeping the same physical assets) or liquidate your current holdings and use the funds to purchase different metals through your new custodian. The latter may involve additional transaction fees but gives you flexibility to adjust your portfolio.

Top Gold IRA Providers for Transfers

Based on customer reviews, fee structures, and transfer process efficiency, these companies consistently rank among the best for gold IRA transfers:

Augusta Precious Metals

- Outstanding customer education

- Transparent fee structure

- Lifetime customer support

- Streamlined transfer process

Goldco

- Excellent buyback program

- Low fee structure

- Specialized transfer team

- Strong customer reviews

American Hartford Gold

- Lower minimum investment

- Free transfers and rollovers

- Family-owned business

- Price match guarantee

Ready to start your gold IRA transfer?

Speak with a gold IRA specialist who can guide you through the entire process.

Conclusion: Making Your Gold IRA Transfer a Success

Transferring your existing gold IRA to a new provider can be a strategic move to improve your retirement portfolio’s performance, reduce fees, and enhance your customer experience. By following the step-by-step process outlined in this guide, you can navigate the transfer with confidence and avoid potential pitfalls.

Remember these key takeaways:

- Choose a direct transfer whenever possible to avoid tax complications.

- Research potential providers thoroughly before making a decision.

- Understand all fees involved with both your current and new custodian.

- Keep detailed records throughout the entire process.

- Verify receipt of all assets once the transfer is complete.

- Work with reputable, experienced gold IRA companies that specialize in transfers.

With proper planning and the right partner, transferring your gold IRA can be a smooth process that positions your retirement savings for better long-term performance and security.

Take the Next Step in Securing Your Retirement

Get your comprehensive Gold IRA Transfer Guide and start the process today.