Have you ever considered a self-directed Individual Retirement Account (IRA) as a way to diversify your retirement investments? It’s a great option for those looking to have a broader range of investment opportunities. However, it’s essential to tread carefully as not everything that glitters is gold. The term “self-directed” opens the door to a wide array of investments, but it also comes with its own set of challenges, including the risk of scams. Let’s explore how self-directed IRAs can be ripe for manipulation and what you can do to protect yourself.

This image is property of images.unsplash.com.

Understanding Self-Directed IRAs

A self-directed IRA is a type of retirement account that gives you more control over how you invest your savings. Unlike traditional IRAs, which typically limit you to stocks, bonds, and mutual funds, self-directed IRAs allow you to explore a wider array of investment options. While this freedom is fantastic, it also comes with a lot of responsibility.

The Appeal of Self-Directed IRAs

The main draw of a self-directed IRA is flexibility. Imagine being able to invest in real estate, private companies, or even precious metals as part of your retirement plan. You can tailor your investments according to your familiarity with different asset classes and personal interests. This autonomy is unparalleled compared to traditional IRAs.

The Regulations Surrounding Self-Directed IRAs

While self-directed IRAs are legitimate investment vehicles, they are subject to specific regulations. The Internal Revenue Service (IRS) outlines particular rules governing them, mainly concerning prohibited transactions and disqualified persons. Understanding these regulations is crucial, as failing to comply can lead to severe penalties, including disqualification of your IRA.

The Emergence of Scams

With the flexibility offered by self-directed IRAs, it’s no wonder why they attract both legitimate investors and scammers alike. Scams can arise due to a lack of understanding or awareness among investors, making it easier for fraudulent schemes to take root.

Common Types of Scams

Let’s break down some of the most common scams associated with self-directed IRAs:

- Ponzi Schemes: These scams promise high returns with little risk, but they rely on funds from new investors to pay returns to earlier investors.

- Real Estate Frauds: Scammers may sell overvalued or non-existent properties claiming huge potential for appreciation.

- Fake Investments in Precious Metals: Here, fraudsters might sell phony gold or silver that doesn’t exist.

These scams are particularly harmful because they prey on your desire for better investment returns, making it essential to be vigilant.

Warning Signs of IRA Scams

Being aware of red flags can save you from falling victim to scams. Here are a few signs to look out for:

- Unsolicited Offers: Be cautious of offers that promise unrealistically high returns with minimal risk.

- Pressure Tactics: Pushing you to make quick decisions should raise suspicions.

- Unregistered Salespeople: Always verify that those offering investment opportunities are registered with the proper authorities.

This image is property of images.unsplash.com.

How to Safeguard Your Investments

Understanding the landscape of potential scams is just the first step; knowing how to protect yourself is equally important. Here are some strategies you can employ:

Conduct Thorough Research

Due diligence is your first line of defense against scams. Research every investment opportunity rigorously. Seek out market trends, financial reports, and third-party evaluations. The more information you have, the better your decision-making will be.

Consult Financial Advisors

Having a reliable financial advisor can be invaluable. They provide an extra layer of scrutiny and help you avoid unwise investments. Choose advisors who are knowledgeable about self-directed IRAs and have a good track record.

Verify Legitimacy

Always confirm the credentials of the people and entities involved in your investment. Check their registration with the SEC or FINRA. Valid credentials are generally a sign of legitimacy, although they’re not foolproof.

Special Considerations for Specific Investments

Different asset classes pose unique challenges and risks. Understanding these can help you better manage your investments.

Real Estate Investments

Real estate can be lucrative, but it requires in-depth knowledge and market research. Ensure you’re aware of property values and local ordinances. Always work with accredited real estate professionals.

Private Companies

Investing in private companies can offer substantial returns, but it’s inherently risky. Ensure the business has a clear history and secure any financial statements you can review.

Precious Metals

Investments in gold, silver, or other metals are appealing for diversification. Be cautious about storage arrangements and ensure the physical assets you purchase are real.

This image is property of images.unsplash.com.

Success Stories Versus Horror Stories

The freedom of self-directed IRAs has led to both tremendous success for informed investors and devastating losses for those who have been scammed. Hearing both success and horror stories can offer valuable lessons for your investment journey.

Learning from Success Stories

Consider the tales of investors who did their homework and consulted experts. Many have significantly grown their portfolios by investing in real estate or startups, owing to diligent research and cautious optimism.

Learning from Horror Stories

On the flip side, there are far too many cautionary stories where individuals lost everything to deceitful schemes. Learning from these unfortunate tales can provide essential insights into what to avoid.

The Role of Regulations

Regulations play an essential role in protecting investors. Awareness of these can be your best weapon against potential scams.

Governmental Oversight

Organizations like the IRS and SEC have guidelines to control the types of assets eligible for IRA inclusion and to regulate the markets. Familiarize yourself with these rules, as they can help you make informed decisions and recognize fraudulent schemes.

Reporting Fraud

If you suspect fraud, you have resources at your disposal, including federal agencies and consumer protection organizations. Reporting suspected scams helps others and can sometimes protect your own assets.

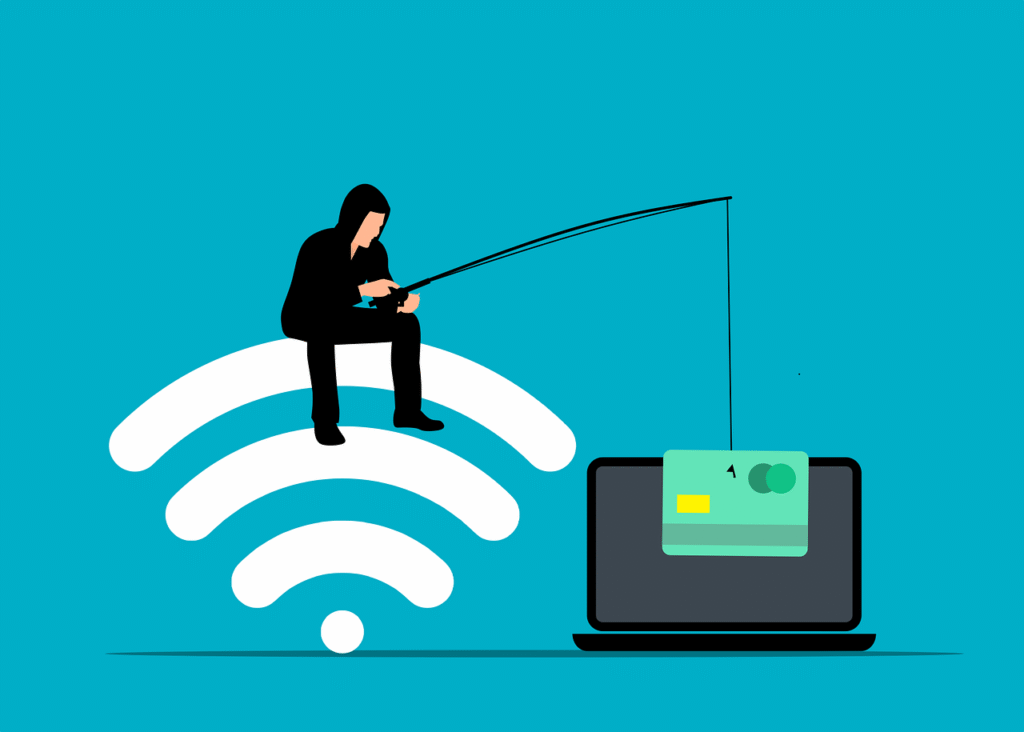

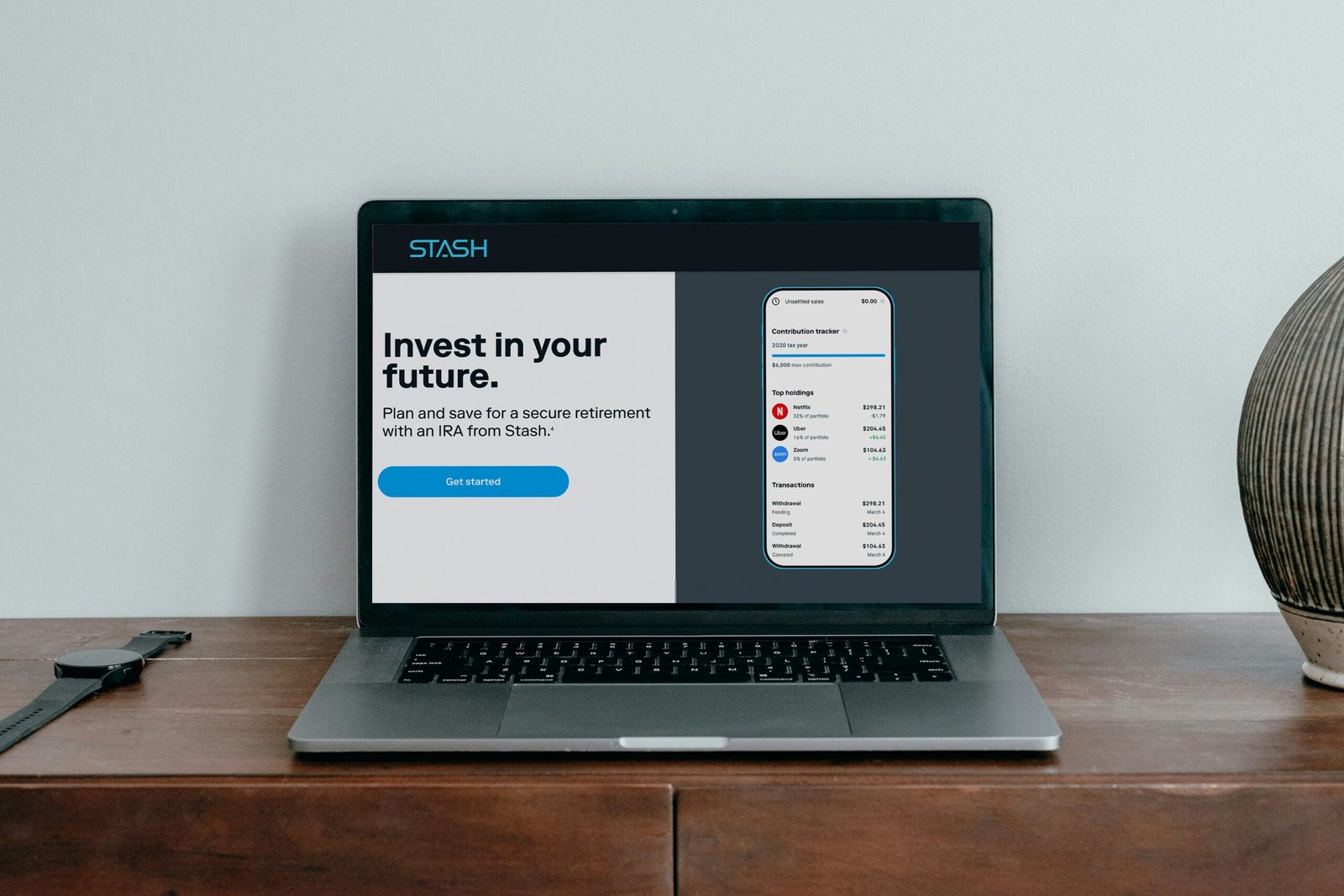

This image is property of images.unsplash.com.

Conclusion: Staying Vigilant

The journey of investing in a self-directed IRA can be rewarding yet fraught with risks. With the knowledge of potential scams and how to guard against them, you can confidently build a diversified retirement portfolio. Always stay informed and never be afraid to ask questions. With due diligence, a cautious approach, and expert advice, the world of self-directed IRAs can be navigated successfully. Remember, while the freedom to direct your retirement savings is empowering, it requires a vigilant eye to ensure its safety.