Have you ever received an unexpected phone call, email, or message that promises unbelievable returns on your Individual Retirement Account (IRA)? If so, you’re not alone. Scammers are continually finding new ways to target individuals and deceive them out of their hard-earned retirement savings. Navigating the world of financial security can be challenging, especially when malicious actors attempt to exploit your trust and understanding of investment strategies.

Understanding the intricacies of IRA scams is crucial to protecting yourself from fraud and ensuring that your financial future remains intact. In this piece, you’ll learn about the different types of IRA scams, how to identify red flags, and steps to safeguard your investments. Furthermore, you’ll gain insight into what to do if you ever fall victim to these cunning schemes. Let’s make sure you’re equipped to recognize and combat IRA scams effectively.

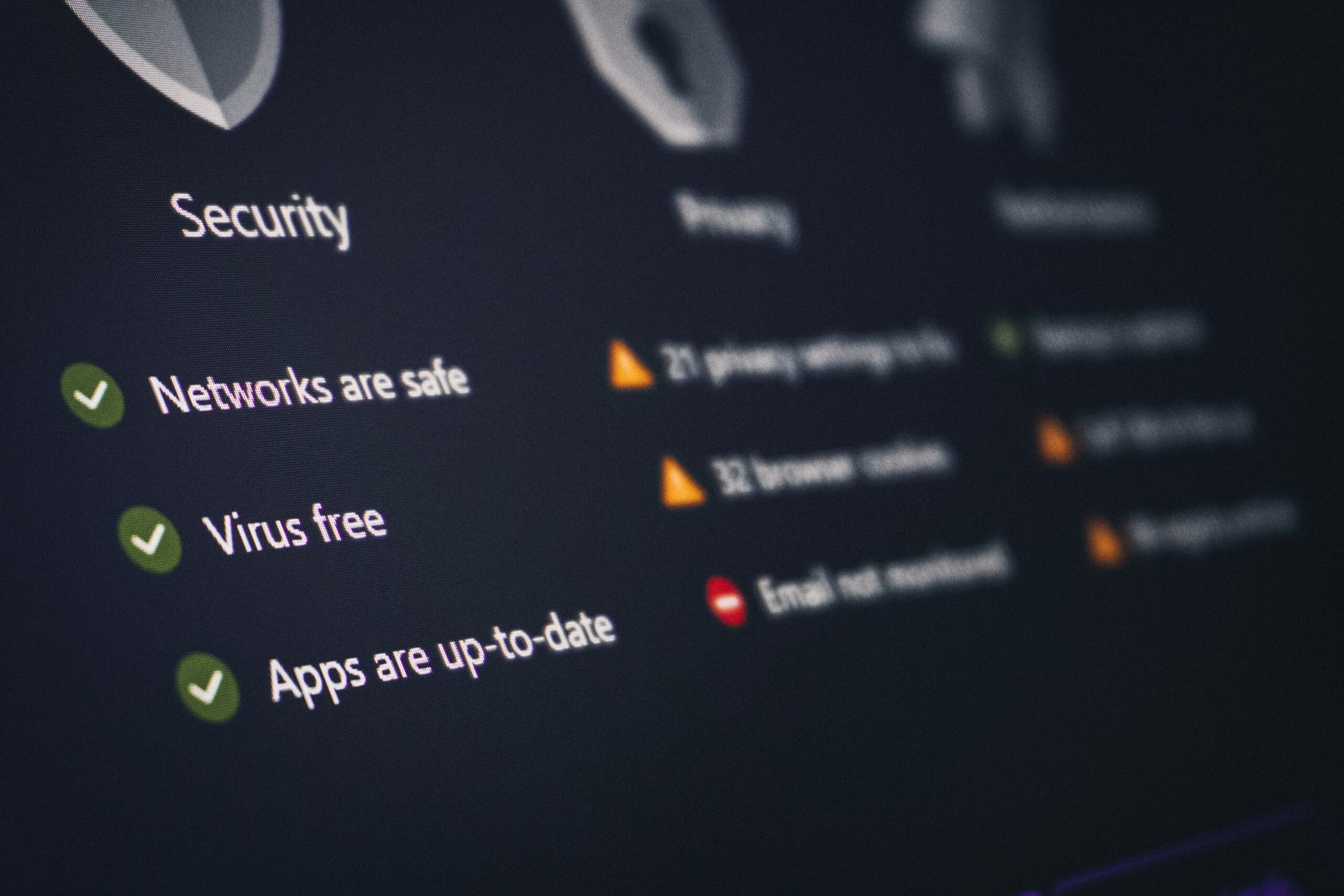

This image is property of images.unsplash.com.

What Are IRA Scams?

Individual Retirement Accounts (IRAs) are widely used by individuals seeking to secure their finances for retirement. Unfortunately, these accounts can become targets for scammers. An IRA scam typically involves fraudsters posing as legitimate financial advisors or companies to trick you into transferring funds or sharing sensitive personal information. They might promise high returns with low risks, present fake investment opportunities, or use sophisticated tactics to gain your confidence.

The Appeal of IRA Scams

Scammers know that IRAs are attractive targets due to the large sums of money they often contain and the fact that many account holders may not fully understand the complexities of investment management. By preying on this lack of knowledge or tempting you with the promise of quick gains, they find opportunities to deceive even the most cautious investors.

Common Types of IRA Scams

Understanding the variety of scams can help you recognize suspicious activity. Let’s delve into some of the most prevalent IRA scams out there today.

Ponzi Schemes

Ponzi schemes are infamous for promising lucrative returns that no legitimate investment could possibly deliver. They involve soliciting funds from new investors to pay returns to earlier participants, without any actual profit-generating activity in place. These schemes eventually collapse when there are not enough new investors to bank on, leaving the majority with significant losses.

Phishing Scams

Phishing scams often come in the form of emails, text messages, or phone calls pretending to be from credible institutions. These communications urge you to provide personal information, such as your social security number or account details, under the guise of updating your records or resolving an imaginary issue.

Self-Directed IRA Scams

A self-directed IRA allows for a broader range of investment options but typically lacks the oversight provided by traditional IRAs. Scammers may initiate fraudulent investments in self-directed IRAs, promoting real estate, precious metals, or business ventures that either don’t exist or are significantly overvalued.

Fake Investment Opportunities

Fraudsters might present entirely fake investment schemes as part of IRA scams. These can vary from non-existent energy projects to fabricated offshore ventures. They may employ glossy brochures and articulate sales pitches to sound convincing and credible, clouding the judgment of even experienced investors.

This image is property of images.unsplash.com.

Recognizing Red Flags

Spotting the warning signs of IRA scams can prevent potential losses. Knowing what to look out for is your first line of defense.

Unsolicited Communications

Be wary of any unsolicited phone calls, emails, or messages about your IRA. Legitimate financial institutions or advisors typically won’t approach you without prior engagement, specifically asking for sensitive information or urging immediate action.

Pressure to Act Quickly

Scammers often leverage urgency to manipulate decision-making. If you’re being pressured to commit funds swiftly or discouraged from consulting trusted financial advisors, it’s an immediate red flag.

Promises of High Returns With Low Risk

While investment comes with the possibility of returns, anyone promising extremely high rates with minimal risk is likely attempting to scam you. Remember that all investments carry some level of risk.

Lack of Transparency

Legitimate investment opportunities are open to scrutiny and questions. If you encounter someone who is evasive with information or reluctant to disclose crucial details, proceed cautiously.

This image is property of images.unsplash.com.

Protecting Yourself From IRA Scams

Prevention is key when it comes to safeguarding your retirement savings. Here are steps you can take to protect yourself from IRA scams.

Verify Credentials

Always verify the credentials of any individual or company offering financial advice. Use resources like the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC) to confirm registration and scrutinize any disciplinary actions.

Conduct Thorough Research

Before making decisions about your IRA investments, conduct thorough research. Look into the company’s history, read reviews, and verify the legitimacy of any claims.

Secure Your Personal Information

Be diligent in protecting your personal information. Use strong, unique passwords for your IRA accounts, and avoid sharing sensitive details via email or over the phone unless you are certain of the recipient’s identity.

Consult a Reputable Financial Advisor

If you’re unsure about an investment opportunity or the authenticity of interactions involving your IRA, consult a reputable financial advisor. Trusted advisors can offer guidance and validate your investment strategies.

This image is property of images.unsplash.com.

What To Do If You Fall Victim

Falling victim to an IRA scam can be distressing, but immediate action may help you recover or minimize loss. Here’s what you should consider if you find yourself in this situation.

Contact Your Financial Institution

Notify your financial institution or IRA custodian immediately if you suspect fraud. They may be able to freeze transactions or offer solutions for recovery.

Report to Authorities

Report the scam to authorities such as the SEC, FINRA, and your state’s attorney general’s office. While recovery of funds isn’t guaranteed, your report can assist in investigations and protect others from falling victim.

Monitor Your Accounts

Keep a close eye on your accounts for any unauthorized transactions or suspicious activity. Report any anomalies at once to your financial institution.

Seek Legal Assistance

Consider obtaining legal assistance to explore potential recovery options and to receive advice on your rights in this scenario.

This image is property of images.unsplash.com.

Conclusion

IRA scams pose a significant threat to individuals seeking to secure their financial future. By staying informed about the types of scams, recognizing red flags, and implementing preventive measures, you can protect yourself against these fraudulent schemes. Preparation and vigilance are your best defenses. Now, you’re better equipped to ensure your retirement savings remain secure from the clutches of unscrupulous scammers. Stay informed, stay alert, and don’t hesitate to seek professional guidance if something seems amiss with your IRA investments.