Diversifying your retirement portfolio with precious metals can provide a hedge against inflation and market volatility. If you’re self-employed or a small business owner with a SEP IRA or SIMPLE IRA, you might be wondering if you can use these retirement accounts to invest in gold. The short answer is yes – but there are specific rules and processes you need to follow. This comprehensive guide will walk you through everything you need to know about using SEP and SIMPLE IRAs to invest in gold and other precious metals.

Understanding SEP IRAs, SIMPLE IRAs, and Gold IRAs

Different retirement account types and their key features

What is a SEP IRA?

A SEP (Simplified Employee Pension) IRA is designed for self-employed individuals and small business owners. It allows for higher contribution limits compared to traditional IRAs – up to 25% of your annual income or $70,000 for 2024, whichever is less. SEP IRAs are relatively easy to set up and maintain, making them popular among freelancers and entrepreneurs who want to maximize their retirement savings.

What is a SIMPLE IRA?

A SIMPLE (Savings Incentive Match Plan for Employees) IRA is another retirement option for small businesses with 100 or fewer employees. For 2024, employees can contribute up to $16,000 annually, with an additional $3,500 catch-up contribution for those 50 and older. Employers are required to make either matching contributions of up to 3% of employee compensation or a 2% fixed contribution for all eligible employees.

What is a Gold IRA?

A Gold IRA is a self-directed individual retirement account that allows you to hold physical precious metals like gold, silver, platinum, and palladium instead of traditional paper assets like stocks and bonds. These accounts follow the same tax rules as conventional IRAs but require a specialized custodian who can handle physical precious metals investments. Gold IRAs are not a separate type of retirement account but rather a way of diversifying the holdings within a self-directed IRA.

Free Gold IRA Investment Guide

Discover how to properly diversify your retirement portfolio with precious metals. Our comprehensive guide explains IRS rules, eligible metals, and step-by-step instructions for using your SEP or SIMPLE IRA to invest in gold.

IRS Rules for Investing in Gold with Retirement Funds

IRS-approved gold coins and bars that qualify for Gold IRA investments

The IRS has specific regulations governing precious metals investments within retirement accounts. Understanding these rules is crucial to avoid penalties and ensure your investment remains tax-advantaged.

Approved Precious Metals

Not all gold and precious metals qualify for IRA investment. The IRS requires that precious metals meet specific purity standards:

- Gold must be at least 99.5% pure (24 karat)

- Silver must be at least 99.9% pure

- Platinum must be at least 99.95% pure

- Palladium must be at least 99.95% pure

Eligible Gold Products

The following gold products typically qualify for Gold IRA investments:

Gold Coins

- American Gold Eagle (bullion and proof)

- Canadian Gold Maple Leaf

- Austrian Philharmonic

- Australian Kangaroo/Nugget

- American Buffalo (uncirculated)

Gold Bullion

- Gold bars produced by NYMEX or COMEX approved refiners

- Gold bars from national government mints

- Gold bars from IRS-approved refiners

- Gold bars meeting minimum fineness requirements

Storage Requirements

The IRS prohibits IRA owners from personally possessing the physical gold in their retirement accounts. All precious metals must be stored in an IRS-approved depository under the name of the IRA. This ensures proper security, insurance, and regulatory compliance. Taking physical possession of the metals would be considered a distribution and could trigger taxes and penalties.

IRS-approved depository storing precious metals for retirement accounts

Prohibited Transactions

The IRS has strict rules about prohibited transactions with IRA assets. You cannot:

- Purchase collectible coins or jewelry for your IRA

- Store IRA gold at home or in a personal safe

- Use IRA funds to purchase precious metals for personal use

- Sell personally owned precious metals to your IRA

Violating IRS rules regarding Gold IRAs can result in your entire IRA being considered distributed, potentially triggering significant tax liabilities and penalties. Always consult with a financial advisor or tax professional before making investment decisions.

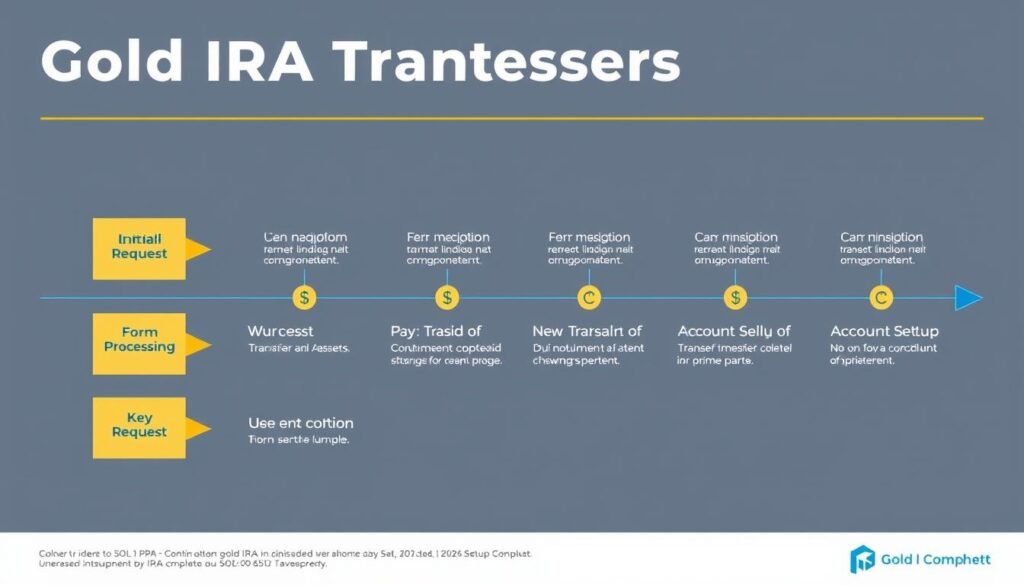

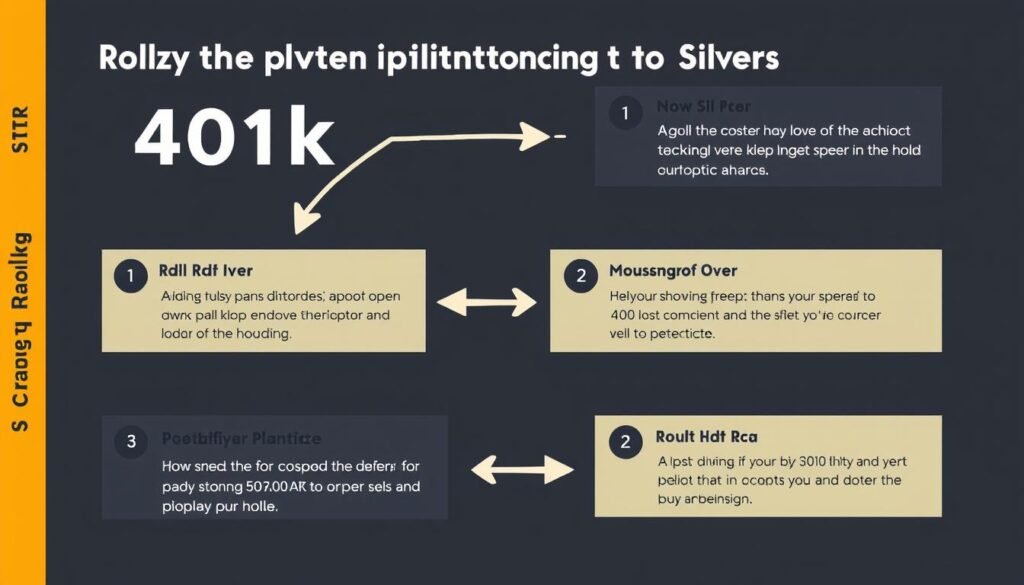

Step-by-Step Process: Rolling Over SEP or SIMPLE IRA Funds into a Gold IRA

The rollover process from a SEP/SIMPLE IRA to a Gold IRA

Converting your SEP or SIMPLE IRA into a Gold IRA involves several key steps. Here’s a detailed breakdown of the process:

- Open a Self-Directed IRA

First, you’ll need to establish a self-directed IRA with a custodian that allows precious metals investments. Not all custodians offer this option, so research is essential. - Choose a Reputable Custodian

Select a custodian with experience handling precious metals IRAs. Look for companies with strong reputations, transparent fee structures, and excellent customer service. - Fund Your Self-Directed IRA

You can fund your new self-directed IRA through a direct transfer or rollover from your existing SEP or SIMPLE IRA. There are two main methods:- Direct Transfer: Funds move directly from one custodian to another without you taking possession. This method avoids potential tax issues.

- 60-Day Rollover: You receive the funds and then deposit them into the new account within 60 days. This method carries more risk of penalties if not done correctly.

- Select Your Precious Metals

Work with your custodian or a precious metals dealer to select IRS-approved gold, silver, platinum, or palladium products for your IRA. - Complete the Purchase

Your custodian will handle the purchase transaction and ensure all paperwork is properly completed. - Arrange for Secure Storage

Your precious metals will be transferred to an IRS-approved depository for secure storage. Your custodian will handle this arrangement.

“The most important step in the rollover process is selecting a reputable custodian who specializes in precious metals IRAs. This ensures compliance with IRS regulations and a smooth transition of your retirement assets.”

SIMPLE IRA Special Considerations

If you have a SIMPLE IRA, be aware of the two-year rule: You cannot roll over funds from a SIMPLE IRA to another type of retirement account within the first two years of participation. Doing so would trigger a 25% early withdrawal penalty instead of the standard 10%. After the two-year period, you can roll over SIMPLE IRA funds to other retirement accounts following the normal rules.

Speak with our Gold IRA specialists for personalized guidance

Tax Implications and Potential Penalties

Understanding the tax implications of Gold IRA investments

Converting your SEP or SIMPLE IRA to a Gold IRA has specific tax implications you should understand before proceeding.

Tax-Advantaged Status

When done correctly, rolling over funds from a SEP or SIMPLE IRA to a Gold IRA maintains the tax-advantaged status of your retirement savings. This means:

- No immediate tax consequences for the rollover itself

- Continued tax-deferred growth on your investments

- Same distribution rules as your original retirement account

Potential Penalties to Avoid

Several missteps can trigger penalties when converting to a Gold IRA:

| Potential Issue | Penalty | How to Avoid |

| Exceeding 60-day rollover window | Taxes + 10% early withdrawal penalty if under 59½ | Use direct custodian-to-custodian transfers |

| SIMPLE IRA rollover within first 2 years | 25% early withdrawal penalty | Wait until after 2-year period to roll over |

| Purchasing non-IRS approved metals | Transaction treated as distribution | Only purchase IRS-approved precious metals |

| Taking personal possession of metals | Entire IRA potentially disqualified | Use IRS-approved depositories only |

| Missing Required Minimum Distributions | 50% of required amount not withdrawn | Track RMD requirements carefully |

Required Minimum Distributions (RMDs)

Gold IRAs converted from traditional SEP or SIMPLE IRAs are subject to Required Minimum Distributions (RMDs) starting at age 73. This means you must begin taking distributions from your account, which can be complicated with physical gold assets. Your custodian can help you navigate this process, which may involve liquidating a portion of your metals or taking an in-kind distribution.

If you’re concerned about future RMDs, consider converting to a Roth Gold IRA. While this would trigger immediate taxation on the converted amount, it would eliminate future RMDs and provide tax-free growth and withdrawals in retirement.

SEP IRA vs. SIMPLE IRA for Gold Investments: Which is Better?

Comparing SEP and SIMPLE IRAs for precious metals investments

Both SEP IRAs and SIMPLE IRAs can be used for gold investments, but they have different features that may make one more suitable than the other depending on your situation.

SEP IRA Advantages

- Higher contribution limits (up to $70,000 in 2024)

- Flexible annual contributions (can vary year to year)

- Ideal for self-employed individuals with no employees

- Simpler administration if you’re the only participant

- No mandatory employer contributions if you have no employees

- Can be established up until the tax filing deadline

SIMPLE IRA Advantages

- Lower employer contribution requirements

- Employee salary deferral options

- Better for businesses with multiple employees

- Catch-up contributions for those over 50

- Employees can contribute their own funds

- Less paperwork than a 401(k) plan

Eligibility and Contribution Limits Comparison

| Feature | SEP IRA | SIMPLE IRA |

| 2024 Contribution Limit | 25% of compensation or $70,000, whichever is less | Employee: $16,000 ($19,500 if over 50) Employer: Up to 3% match or 2% nonelective |

| Who Can Contribute | Employer only | Both employer and employee |

| Ideal Business Size | Self-employed or very small businesses | Small businesses with up to 100 employees |

| Mandatory Contributions | No, but must be equal percentage for all employees | Yes, employer must contribute |

| Establishment Deadline | Tax filing deadline (including extensions) | October 1 of the calendar year |

| Early Withdrawal Penalty | 10% if under age 59½ | 25% within first 2 years, then 10% |

Which is Better for Gold Investments?

For solo entrepreneurs or self-employed individuals with no employees, a SEP IRA often provides the best option for gold investments due to the higher contribution limits and flexibility. For small business owners with employees, a SIMPLE IRA might be more cost-effective due to the lower mandatory employer contribution requirements.

Need Help Deciding Between SEP and SIMPLE IRAs?

Our Gold IRA specialists can help you determine which retirement account is best for your specific situation and guide you through the process of investing in precious metals.

Top Gold IRA Companies That Accept SEP and SIMPLE IRA Rollovers

Leading Gold IRA companies with experience handling retirement account rollovers

When converting your SEP or SIMPLE IRA to a Gold IRA, working with a reputable company is crucial. Here are some top-rated gold IRA companies that specialize in handling retirement account rollovers:

Augusta Precious Metals

Highlights:

- Specialized in SEP and SIMPLE IRA rollovers

- Excellent educational resources

- Transparent fee structure

- Lifetime customer support

Goldco

Highlights:

- Low minimum investment requirement

- Streamlined rollover process

- Excellent buyback program

- Strong customer reviews

Birch Gold Group

Highlights:

- Specialized in small business retirement accounts

- Comprehensive educational resources

- Experienced precious metals specialists

- Multiple depository options

What to Look for in a Gold IRA Company

When selecting a company to help with your SEP or SIMPLE IRA to Gold IRA conversion, consider these important factors:

- Experience with retirement account rollovers: Choose companies with specific experience handling SEP and SIMPLE IRA rollovers.

- Transparent fee structure: Look for clear information about setup fees, annual maintenance fees, storage fees, and transaction costs.

- Educational resources: The best companies provide comprehensive educational materials to help you understand the process.

- Customer service: Responsive, knowledgeable customer service is essential when navigating complex retirement account transactions.

- Storage options: Ensure the company works with reputable, IRS-approved depositories for secure storage of your precious metals.

- Buyback program: A good buyback program makes it easier to liquidate your metals when needed.

Working with a Gold IRA specialist to complete your rollover paperwork

Common Mistakes to Avoid When Converting to a Gold IRA

Common pitfalls to avoid when converting retirement funds to a Gold IRA

Even with the best intentions, investors can make costly mistakes when converting their SEP or SIMPLE IRAs to Gold IRAs. Here are the most common pitfalls to avoid:

1. Attempting Home Storage

Despite what some misleading advertisements might suggest, you cannot legally store Gold IRA assets at home. All precious metals in an IRA must be held in an IRS-approved depository. Attempting to store them yourself will disqualify your IRA and potentially trigger taxes and penalties on the entire account value.

2. Purchasing Non-Qualifying Precious Metals

Not all gold and silver products qualify for IRA investment. Collectible coins, jewelry, and metals that don’t meet minimum purity requirements are prohibited. Always verify that your chosen products meet IRS standards before purchasing.

3. Missing the 60-Day Rollover Window

If you choose the 60-day rollover method instead of a direct transfer, you must complete the process within 60 days of receiving the funds. Missing this deadline means the entire amount becomes taxable, plus a 10% early withdrawal penalty if you’re under 59½.

4. Ignoring the SIMPLE IRA Two-Year Rule

SIMPLE IRA funds cannot be rolled over to a non-SIMPLE retirement account within the first two years of participation. Doing so triggers a 25% early withdrawal penalty instead of the standard 10%.

5. Overlooking Fees and Costs

Gold IRAs typically have higher fees than traditional retirement accounts. These may include setup fees, annual maintenance fees, storage fees, insurance costs, and transaction fees. Failing to account for these expenses can significantly impact your investment returns.

6. Choosing the Wrong Custodian

Not all IRA custodians handle precious metals, and not all precious metals dealers understand the complexities of retirement accounts. Working with inexperienced providers can lead to compliance issues and potential tax problems.

Real-World Example: John, a self-employed consultant with a SEP IRA, decided to diversify into gold. After researching online, he found a dealer offering “home storage Gold IRAs” at lower fees. John purchased gold coins and stored them in his home safe, believing his investment was IRA-compliant. During an IRS audit three years later, the entire transaction was deemed a distribution, resulting in back taxes, penalties, and interest totaling over $30,000. Working with a reputable custodian would have prevented this costly mistake.

Alternatives to Gold IRAs for Precious Metals Exposure

Alternative ways to gain precious metals exposure in retirement accounts

While physical gold in a self-directed IRA offers certain advantages, it’s not the only way to gain exposure to precious metals in your retirement portfolio. Here are some alternatives to consider:

Precious Metals ETFs

Exchange-Traded Funds (ETFs) that track gold and other precious metals prices can be held in traditional SEP and SIMPLE IRAs without the need for a specialized custodian. These offer:

- Lower fees than physical gold IRAs

- Greater liquidity for buying and selling

- No storage concerns or depository fees

- Diversification across multiple metals in a single investment

Popular options include SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR).

Mining Company Stocks

Investing in gold and silver mining companies through your existing retirement account can provide leveraged exposure to precious metals prices. When gold prices rise, mining company profits often increase at a faster rate. Consider:

- Major mining companies with established operations

- Junior miners for higher risk/reward potential

- Mining ETFs for diversified exposure across the sector

Precious Metals Mutual Funds

Mutual funds focused on precious metals offer professionally managed exposure to the sector. These funds typically invest in a combination of mining stocks, ETFs, and sometimes futures contracts. Benefits include:

- Professional management

- Diversification across multiple companies

- Easier to hold in traditional retirement accounts

Comparison of Physical Gold vs. Paper Gold Investments

| Feature | Physical Gold IRA | Gold ETFs/Stocks |

| Direct Ownership | Yes, you own actual gold | No, paper claims on gold |

| Storage Requirements | Must use approved depository | No storage needed |

| Fees | Higher (setup, storage, insurance) | Lower (management fees only) |

| Liquidity | Lower, may take days to sell | Higher, can sell instantly |

| Counterparty Risk | Minimal | Higher |

| Protection in Financial Crisis | Stronger | Potentially weaker |

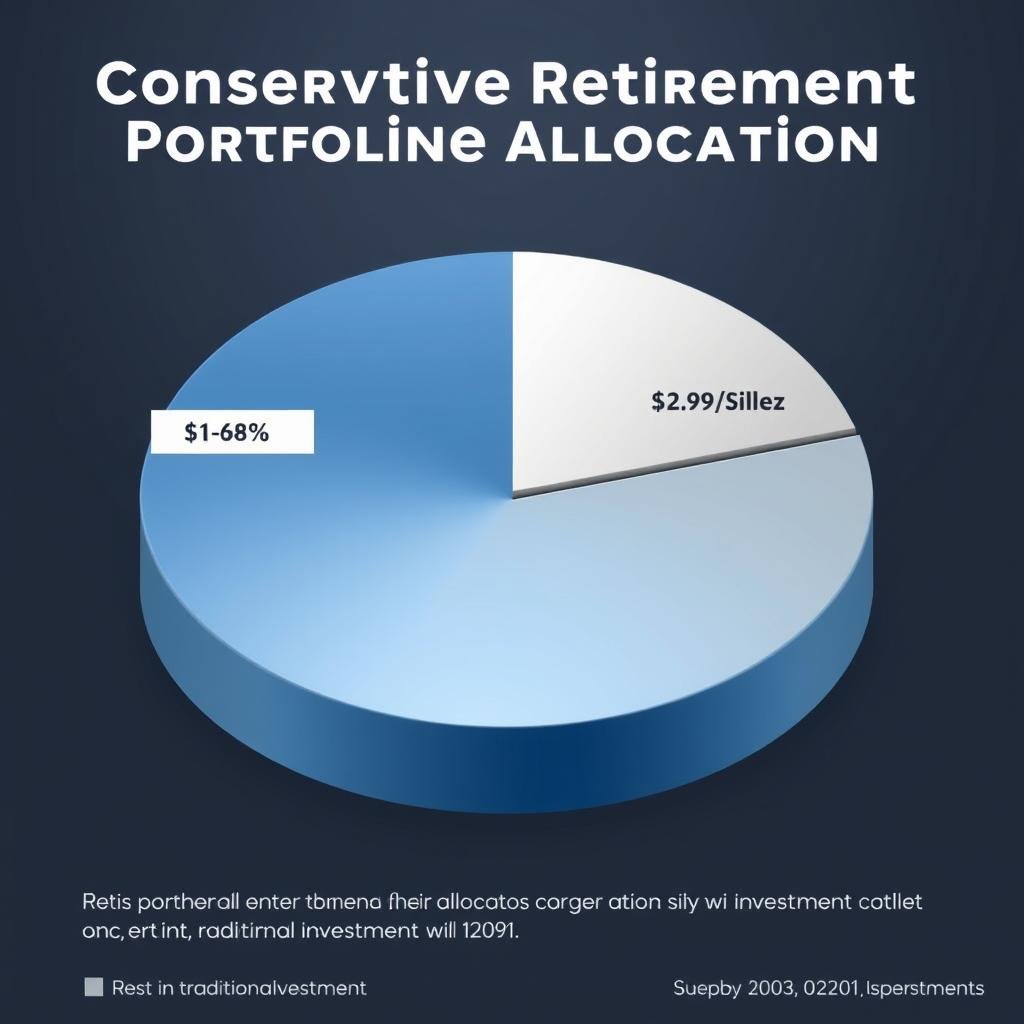

A balanced retirement portfolio with appropriate precious metals allocation

Frequently Asked Questions About Using SEP and SIMPLE IRAs for Gold Investments

Common questions about investing in gold with retirement accounts

Can I use my existing SEP IRA to buy physical gold?

Most standard SEP IRA custodians don’t allow physical gold investments. To invest in physical gold, you’ll need to transfer your SEP IRA funds to a self-directed IRA with a custodian that specializes in precious metals. This process is tax-free when done correctly as a direct transfer between custodians.

How much of my retirement portfolio should I allocate to gold?

Financial advisors typically recommend allocating between 5-15% of your retirement portfolio to precious metals, including gold. The exact percentage depends on your age, risk tolerance, and overall investment strategy. Gold serves primarily as a diversification tool and hedge against inflation rather than the core growth component of your portfolio.

Can I roll over my SIMPLE IRA to a Gold IRA at any time?

No. SIMPLE IRA funds cannot be rolled over to a non-SIMPLE retirement account (including a self-directed Gold IRA) within the first two years of your participation in the SIMPLE IRA plan. Doing so would trigger a 25% early withdrawal penalty instead of the standard 10%. After the two-year period, you can roll over your SIMPLE IRA to a Gold IRA following the normal process.

What happens to my Gold IRA when I reach retirement age?

When you reach retirement age (59½ or older), you have several options for your Gold IRA:

- Take distributions in cash (the custodian sells the gold and sends you the proceeds)

- Take in-kind distributions (receive the physical gold, which becomes a taxable distribution)

- Continue holding the gold in your IRA (until RMDs begin at age 73)

Each option has different tax implications, so consult with a tax professional to determine the best strategy for your situation.

Are there annual contribution limits for Gold IRAs?

Gold IRAs follow the same contribution limits as the underlying IRA type. For 2024:

- SEP IRA: Up to 25% of compensation or ,000, whichever is less

- SIMPLE IRA: ,000 (,500 if over 50)

These limits apply to all contributions to that type of IRA, whether in gold or other investments.

Can I use a SEP IRA or SIMPLE IRA to invest in a Gold IRA if I’m still employed?

Yes, you can use a SEP IRA or SIMPLE IRA to invest in gold while still employed. However, if you’re participating in an employer-sponsored SIMPLE IRA plan, you generally cannot roll those funds over until you leave that employer or the plan terminates. With a SEP IRA that you established as a self-employed individual, you have more flexibility to transfer funds to a self-directed Gold IRA while still working.

Final Thoughts: Is a Gold IRA Right for Your SEP or SIMPLE IRA Funds?

Building a secure retirement with diversified investments including precious metals

Converting your SEP or SIMPLE IRA to a Gold IRA can be a strategic move to diversify your retirement portfolio and protect against inflation and market volatility. However, it’s not the right choice for everyone. Consider your overall investment strategy, time horizon, and risk tolerance before making this decision.

The process of using SEP or SIMPLE IRA funds to invest in gold requires careful attention to IRS rules and regulations. Working with experienced professionals—including a knowledgeable custodian and reputable precious metals dealer—can help ensure a smooth transition and compliance with all requirements.

Remember that precious metals should typically represent only a portion of your overall retirement strategy. Most financial advisors recommend limiting gold and other precious metals to 5-15% of your portfolio to maintain proper diversification while still benefiting from gold’s unique properties as a store of value.

By understanding the rules, avoiding common pitfalls, and working with trusted partners, you can successfully use your SEP or SIMPLE IRA to invest in a Gold IRA and potentially enhance the long-term security of your retirement savings.

Ready to Diversify Your Retirement Portfolio with Gold?

Take the first step toward securing your financial future with precious metals. Our comprehensive Gold IRA guide explains everything you need to know about using your SEP or SIMPLE IRA to invest in gold.