There are nights when the market feels personal — you watch numbers flash and wonder if your savings will fund the life you imagine. That feeling is familiar to many investors who care about retirement but fear a bad year could set them back.

This guide offers a practical way to pair upside potential with downside protection inside your ira account. It treats your portfolio as building blocks: stocks for long-term returns, bonds for steady income, and cash for short-term needs.

There isn’t a one-size-fits-all mix. Your choices should reflect risk tolerance, time until retirement, current money needs, and how much you save each month. Use simple funds and ETFs to get broad exposure without picking single winners.

Review at least once a year and after major life events so market moves do not quietly change your risk. With steady contributions and clear goals, your ira can support retirement income without taking more risk than necessary.

Key Takeaways

- There is no universal portfolio; tailor allocation to your situation.

- Stocks, bonds, and cash each play distinct roles in an ira.

- Use funds and ETFs to diversify efficiently.

- Save consistently and review allocations yearly or after big events.

- Keep fees, taxes, and required income needs front and center.

Start here: What “balance” means for IRA investors in the United States today

Start by framing what success looks like for your retirement and which swings you can tolerate along the way.

Balance matches the need for future income to the volatility you can accept today. That means choosing an allocation that aims for reasonable returns while limiting the risk of big losses near retirement.

In the current market, higher expected returns usually come with bigger drawdowns. A thoughtful mix of stocks, bonds, and cash helps reduce the chance you must sell at the worst time.

Time matters. The more years until withdrawals, the more room most investors have for equity exposure to pursue higher returns. Near retirement, shift toward cash and high-quality bonds to protect savings and provide liquidity.

User intent and outcome

Aim to grow retirement savings while protecting downside. Use broad-market index funds and ETFs for diversified exposure instead of concentrated bets.

The core trade-off

Accept that your balanced point is personal. Income, emergency savings, other accounts, and life goals change how much risk belongs inside each IRA account. Document allocation and rebalancing rules now so you act calmly when the market swings.

| Role | Typical Asset | Why it helps | Action |

|---|---|---|---|

| Growth | Stocks | Aim for higher long-term returns | Use broad-market ETFs |

| Stability | Bonds | Reduce volatility, provide income | Hold high-quality or laddered bonds |

| Liquidity | Cash | Cover withdrawals and rebalance | Keep 3–12 months of needs |

| Governance | Rules & limits | Prevent emotional overreach | Set position caps and rebalancing triggers |

- Be realistic about sequence-of-returns risk near retirement.

- Accept that allocations drift and must be nudged back to target.

- Use guardrails to avoid chasing recent winners in a hot market.

Define your plan: goals, time horizon, and risk tolerance that drive asset allocation

Begin with a clear retirement goal: the life you want and the annual income to support it. Write down the lifestyle you expect, the annual income number it requires, and which accounts will fund each expense.

Key inputs shape sensible choices: your age, steady income, current savings rate, planned retirement date, and personal risk tolerance. Anchor allocations to these facts so choices stay practical.

Essential planning steps

- Map years until retirement and your expected spending needs.

- Convert current balances and savings rate into the amount to invest each year.

- Use your retirement date and time horizon to size equity versus bond exposure.

- Stress-test for bad sequences of returns and hold 1–3 years of expenses in cash or short-term bonds.

Withdrawal guardrails

Many practitioners use an initial 4% withdrawal rate as a prudent cap for a roughly 30-year retirement. Treat it as a guide, not a rule, and adjust for your health, goals, and tax situation.

| Input | Why it matters | Typical action | Notes |

|---|---|---|---|

| Age | Determines years to invest | Set equity exposure | Younger = more stocks |

| Savings rate | Drives progress to goal | Adjust contributions | Prioritize retirement over loans |

| Risk tolerance | Limits acceptable swings | Choose asset mix | Document rebalancing rules |

| Tax context | Affects withdrawal order | Allocate across accounts | Traditional IRA taxed as income; Roth tax-free |

If decisions feel complex or emotional, consult a fiduciary advisor to align allocation, savings, and withdrawal goals across your retirement accounts.

Build your mix: asset allocation with stocks, bonds, and cash for growth and security

A clear mix of stocks, bonds, and cash turns intentions into a working plan for retirement accounts.

Stocks, bonds, and cash: roles, risks, and expected returns

Stocks offer long-term returns and help protect purchasing power, but they swing during market downturns.

Bonds supply income and reduce portfolio volatility; favor high-quality Treasuries and investment-grade corporates for ballast.

Cash preserves liquidity for near-term withdrawals and rebalancing opportunities.

Using the 5% rule and position limits to avoid concentration risk

Cap single-stock exposure near 5% of the portfolio to limit idiosyncratic risk. Also set sector and asset class limits to avoid crowded bets.

Target-date and target-risk funds as set‑and‑adjust options

Target-date funds shift toward bonds as you approach retirement. Target-risk funds hold a steady profile.

Both are one-ticket options that pair core ETFs and mutual funds into a managed allocation.

| Goal | Primary asset | Typical allocation | Action |

|---|---|---|---|

| Long-term growth | Stocks (US & intl) | 50–70% | Core index funds and ETFs |

| Income & stability | Bonds | 20–40% | Short to intermediate duration, high quality |

| Liquidity | Cash equivalents | 3–12% | Short-term funds or money market inside IRA |

| Simple option | Target funds | Single fund | Use target-date or target-risk after reviewing glide path |

For practical planning, treat rules of thumb as starting points and tailor allocation to savings, income needs, and comfort with risk. Learn more about practical withdrawal options and income planning on this guide.

Diversify the right way: spread across asset classes and investment vehicles

True diversification protects a portfolio when markets surprise and keeps one event from undoing years of savings.

Start with core asset classes: U.S. and international stocks, high‑quality bonds, and cash form the foundation. Use broad mutual funds and ETFs to get efficient coverage and low fees.

Consider income options carefully. Dividend-paying stocks and REITs add income but behave like equities. Municipal bonds may provide federally tax‑exempt interest and often belong in taxable accounts rather than an IRA.

Alternatives can be useful, but size them modestly. Know fees, liquidity, and unique risks before adding them as options to your portfolio.

Practical rules

- Avoid concentration: set position and sector limits to reduce single-holding risk.

- Mix Treasuries and investment‑grade corporates for bond stability; limit high‑yield exposure.

- Coordinate funds across accounts to prevent overlap and use tax‑loss harvesting in taxable accounts.

- Review diversification annually to confirm each investment still serves your goals.

| Focus | Examples | When to use |

|---|---|---|

| Core stocks | U.S. total market, international ETFs | Long-term growth sleeve |

| Bonds | Treasure, investment-grade corporates, municipal bonds | Income and volatility control |

| Income & alternatives | Dividend funds, REITs, modest alternatives | Supplement income, diversify risk |

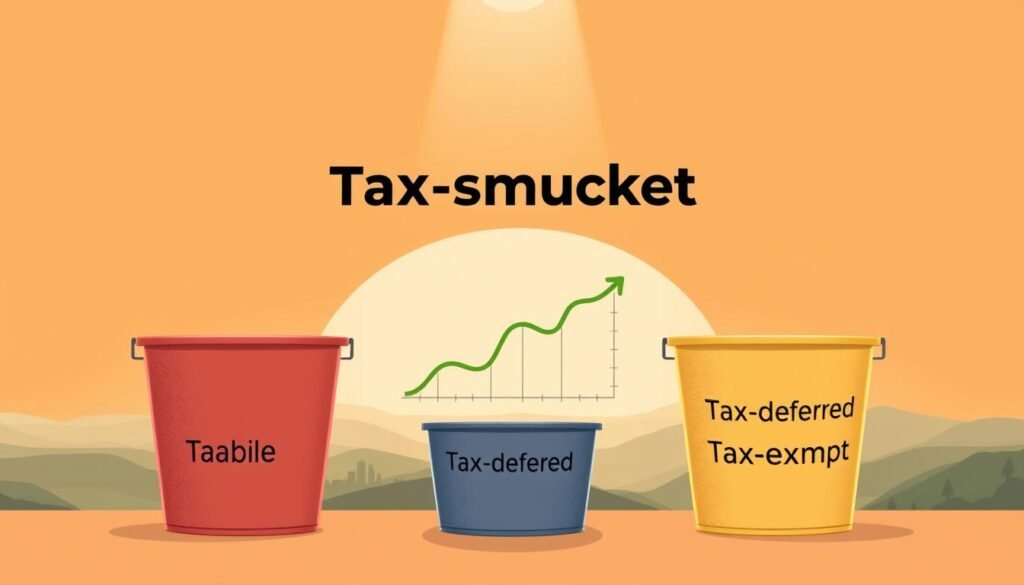

Tax-smart buckets: place assets across accounts to maximize after-tax returns

Treat every retirement account as a different tool: one sheds taxes now, another shelters gains later.

Pre-tax accounts like Traditional IRAs and 401(k)s offer deductible contributions and tax-deferred growth. Withdrawals are taxed as ordinary income and usually face required minimum distributions (RMDs).

Roth accounts use after-tax money. Qualified distributions are tax-free, and Roth IRAs avoid RMDs—helpful for legacy planning and tax control.

Taxable accounts and asset location basics

Taxable brokerage accounts give flexibility. Long-term gains and qualified dividends often have lower rates. You can also harvest losses to offset gains.

Place interest-heavy bond funds and REITs in tax-deferred accounts to avoid annual tax drag. Keep broad equity index funds in taxable accounts when feasible for cheaper turnover and preferential rates.

- Map your buckets: Traditional for deferral, Roth for tax-free withdrawals, taxable for flexibility.

- Consider an HSA if eligible — triple tax benefits for qualified medical costs.

- Watch contribution limits and revisit asset location yearly or after tax law changes.

| Account | Best assets to hold | Why |

|---|---|---|

| Traditional IRA / 401(k) | Bond funds, high-interest assets | Defers annual tax on interest and ordinary income at withdrawal |

| Roth IRA / Roth 401(k) | High-growth equities | Tax-free growth and no RMDs for Roth IRAs |

| Taxable brokerage | Low-turnover index funds, municipal bonds (if appropriate) | Preferential long-term gains, loss harvesting, flexible withdrawals |

Plan withdrawal sequencing and mix distributions to manage your tax rate in retirement. For practical tax-smart withdrawal tactics, see this guide to tax-savvy withdrawals.

Life-stage playbook: adapting your IRA from your 20s to retirement

Different decades of life call for clear but simple shifts in IRA allocations. Follow a stage-based plan to match your age, savings, and tolerance for market swings.

Your 20s

Lean toward stocks through broad index funds and ETFs to capture long-term compounding.

Automate contributions and use dollar‑cost averaging. Keep a starter emergency fund so you won’t raid retirement savings.

Your 30s–40s

Add bonds to reduce volatility and protect progress. Keep saving automatically and raise your savings rate after pay increases.

If you fund a 529, prioritize retirement first—there are loans for college but not for retirement.

Pre-retirement

Shift into higher-quality bonds and cash while keeping some stocks to guard against inflation.

Validate your risk tolerance with stress tests and hold 1–3 years of expenses in short bonds or cash.

In retirement

Focus on capital preservation and steady income: Treasuries, investment‑grade corporates, and conservative dividend payers.

Keep liquidity for healthcare and review beneficiary and estate details regularly.

“Plan each stage so you trade panic for a repeatable rule set when markets move.”

| Stage | Primary focus | Typical allocation |

|---|---|---|

| 20s | Compounding, equity exposure | 70–90% stocks, 10–30% bonds/cash |

| 30s–40s | Growth + volatility control | 60–75% stocks, 25–40% bonds/cash |

| Pre-retirement | Income and protection | 40–60% stocks, 40–60% bonds/cash |

| Retirement | Preserve capital, generate income | 20–50% stocks, 50–80% bonds/cash |

Keep it on track: automate contributions, review annually, and rebalance with discipline

A disciplined routine—regular deposits and scheduled reviews—keeps your plan on track over decades. Automate contributions to your ira so you build wealth without second-guessing each transfer.

Review cadence: check your accounts at least once a year and after major life events or large market moves. Annual reviews let you confirm that your allocation still matches goals and tolerance.

Rebalancing triggers: pick time‑based checks (for example, once per year) or drift‑based rules (rebalance when an asset class shifts by ~5 percentage points).

Practical rules to follow

- When rebalancing, sell overweight positions and add to underweights to restore asset allocation.

- Direct new money to underweighted funds or etfs to reduce trading and cost.

- Keep a small cash buffer to avoid forced sales during downturns.

- Watch transaction costs, bid‑ask spreads, and tax effects in taxable accounts.

- If unsure, seek a fiduciary advisor to set thresholds and review your trade list.

“A rules-based process beats reacting to headlines; consistency protects portfolio outcomes.”

Track results year over year to confirm rebalancing controls risk and preserves diversification. For additional strategies on keeping a retirement portfolio steady, see this practical guide.

How do I balance growth with security in my IRA? Withdrawal order, RMDs, and Roth moves

A clear withdrawal order helps manage taxes, required distributions, and portfolio risk.

Start with maturing cash sources such as CDs or bond ladder principal for planned spending. This preserves invested funds and avoids taxable sales during down markets.

Required minimum distributions matter. The first RMD is due by April 1 of the year after your RMD start date; later RMDs are due by December 31 each year. Calculate RMDs using the prior December 31 account value divided by the IRS life‑expectancy factor. Missing an RMD can trigger a 50% penalty on the shortfall.

Consolidate IRAs to simplify RMDs; you may take the total IRA RMD from any one IRA. Note that each 401(k) requires its own RMD.

Tax-smart order after RMDs: sell from taxable accounts next, favoring long‑term positions and harvesting losses to offset gains. Then use tax‑deferred accounts; leave Roth IRA funds for last to protect tax‑free income and estate flexibility.

Roth conversions can lower future RMDs and create tax‑free income, but they raise taxable income in the conversion year. If you convert, pay the tax from non‑IRA money when possible and consult an advisor before large moves.

“Coordinate withdrawals with rebalancing: trim overweights in good years and rely on cash or bonds during downturns.”

Conclusion

Consistent habits and tax-aware account choices keep portfolios working over decades. Set a sensible asset allocation, automate contributions, and plan rebalances so market noise does not steer your savings. Keep a small cash buffer and clear position limits to control risk.

Use broad funds and ETFs for low-cost diversification across stocks, bonds, and cash. Place interest-heavy holdings where tax rules bite less, and coordinate across accounts to protect returns.

Follow a disciplined withdrawal order in retirement: use maturing cash and short bonds, meet RMDs, draw from taxable then tax-deferred accounts, and preserve Roth for last. Adjust allocation slowly by life stage and review yearly.

When choices feel large, consult a fiduciary advisor and a tax professional. The steady way—diversified, cost-aware, and tax-smart—gives investors the best chance to reach retirement goals.

FAQ

What does balancing growth and security mean for IRA investors today?

It means choosing a mix of assets that seeks long-term gains while limiting losses that can derail retirement plans. That mix depends on age, savings rate, retirement date, and risk tolerance. The goal is growth enough to outpace inflation while keeping volatility manageable so withdrawals remain predictable.

Which inputs matter most when defining an IRA plan?

Key inputs are your age, income, current savings, planned retirement date, and risk tolerance. These determine asset allocation, contribution levels, and withdrawal targets. Use a realistic savings rate and set guardrails like an emergency fund to avoid forced selling in downturns.

How should I set a withdrawal target for retirement?

Many retirees aim near a 4% initial withdrawal rate as a starting rule of thumb. Adjust that target based on portfolio size, expected longevity, spending needs, and market conditions. Build flexibility into spending and plan for phased draws in early retirement.

What roles do stocks, bonds, and cash play in an IRA?

Stocks drive growth and help fight inflation. Bonds provide income and lower portfolio volatility. Cash offers liquidity and capital preservation for short-term needs. The right mix balances expected returns against risk and time horizon.

How can I avoid concentration risk in a retirement account?

Use position limits like a 5% rule for single holdings and diversify across sectors, market caps, and geographies. Consider broad index funds and ETFs to spread exposure and reduce single-stock or sector concentration that can hurt long-term outcomes.

Are target-date or target-risk funds a good option?

Yes, they provide a set‑and‑adjust approach that automatically shifts allocation over time. Target-date funds simplify rebalancing and are convenient for investors who prefer a hands‑off strategy. Check glidepath, fees, and underlying fund quality.

How should I diversify across asset classes and vehicles?

Build a core using U.S. and international equities, high‑quality bonds, and cash. Layer tactical exposure like municipal bonds, dividend payers, or real‑asset funds as needed for income or inflation protection. Use IRAs, 401(k)s, and taxable accounts together for tax efficiency.

When are municipal bonds or dividend stocks appropriate?

Consider municipal bonds for tax‑advantaged income if you’re in a higher tax bracket and hold them in taxable accounts. Dividend payers suit investors seeking yield, but evaluate payout sustainability. Avoid overloading any bucket with a single income source.

How should I allocate assets across tax‑sheltered and taxable accounts?

Place tax‑inefficient, income‑generating assets (like taxable bonds) in tax‑deferred accounts such as Traditional IRAs. Hold growth assets that generate capital gains in taxable accounts. Use Roth IRAs for investments you expect to grow tax‑free and for flexibility in retirement.

What are the tax differences between Traditional and Roth accounts?

Traditional accounts give an upfront tax deferral; withdrawals are taxed as ordinary income. Roth accounts use after‑tax dollars but offer tax‑free qualified withdrawals and no required minimum distributions. Choose based on current tax rate vs. expected rate in retirement.

How should asset location change by life stage?

In your 20s, favor equities and Roth contributions if possible. In your 30s–40s, add bonds and build an emergency fund. Pre‑retirement, shift toward income and lower volatility while keeping some stocks for inflation. In retirement, prioritize preservation, income, and liquidity for healthcare.

What review cadence and rebalancing rules work best?

Review annually and after major life events or market shocks. Use time‑based rebalancing (e.g., yearly) or drift triggers (e.g., 5% drift from target). Rebalance with tax and cash needs in mind, trimming winners to buy laggards and maintain discipline.

What’s the recommended withdrawal sequence across accounts?

A common sequence: use maturing short‑term cash and taxable accounts first, take required minimum distributions when due, then withdraw from tax‑deferred accounts, and use Roth balances last to preserve tax flexibility. Tailor sequencing to your tax picture and spending needs.

What are RMD essentials I should know?

Required minimum distributions have timing rules, penalties for missed RMDs, and are based on life expectancy tables and account balances. Consolidating similar accounts can simplify RMD calculations. Plan withdrawals to avoid large tax spikes in a single year.

Which tax tactics can improve after‑tax returns?

Harvest tax losses in taxable accounts, favor long‑term capital gains, and align trades with rebalancing to limit taxable events. Manage distributions to avoid bumping into higher tax brackets and coordinate Roth conversions when rates or income are favorable.

Should I consider Roth conversions, and when do they make sense?

Roth conversions make sense when you expect higher future tax rates, have room in lower tax brackets, or want to reduce future RMDs. They create an upfront tax bill, so time conversions during low‑income years or market dips to buy tax‑free growth efficiently.