Have you ever wondered how much you can contribute to your 401(k) plan for the year 2025? It’s a question many are asking, especially as retirement planning becomes increasingly essential. Knowing the contribution limits not only helps in strategizing your savings but also ensures you’re making the most of available tax benefits. Let’s embark on a friendly guide through the intricacies of 401(k) contribution limits for 2025.

This image is property of images.unsplash.com.

Understanding the Basics of 401(k) Plans

Before diving into the specific limits set for 2025, it’s crucial to understand what a 401(k) plan is and why it plays a significant role in retirement planning. Essentially, a 401(k) is a retirement savings plan offered by many American employers that offers tax advantages. Employees can contribute a portion of their wages to individual accounts.

Why Contribute to a 401(k)?

The main advantage of a 401(k) plan is its tax deferral benefits. Money contributed is not taxed until it is withdrawn, usually during retirement. This tax deferral effectively lowers your taxable income for the year the contributions are made, potentially reducing the amount of tax you need to pay. For many, this creates an opportunity to grow their retirement savings more significantly than if they were to save using taxed income.

What Determines 401(k) Contribution Limits?

Federal laws set the contribution limits for 401(k) plans, and these limits can vary from year to year. The purpose of these limits is to balance the tax benefits of the 401(k) plan while ensuring a fair playing field across various income levels. Various factors, including inflation and changes in wage levels, can influence these limits.

Inflation and Its Impact

Inflation is one of the most significant factors affecting the adjustments of contribution limits. As the cost of living increases, so do the limits, allowing savers to keep pace with the economic environment. Adjustments are, therefore, an essential mechanism to ensure your savings maintain their value in real terms.

This image is property of images.unsplash.com.

Contribution Limits for 2025

For the year 2025, specific rules and limits apply to your 401(k) contributions. Understanding these can help you maximize your saving potential.

Employee Contribution Limits

For most employees, the limit on annual elective deferrals — meaning the amount you, as a participant, can elect to defer from your paycheck into your 401(k) — will be a pivotal figure. While the specific numbers for 2025 may yet be finalized, understanding how they are calculated based on previous years can give a helpful perspective.

Catch-Up Contributions for Those Over 50

For those aged 50 and over, the catch-up contribution provision allows you to contribute an additional amount above the standard limit. This feature is incredibly beneficial for individuals who might have started saving later in life or want to boost their retirement savings as they approach retirement age.

Total Contribution Limit

Furthermore, there’s a limit on the total contributions to a 401(k) account, which includes both employee and employer contributions. This total, also subject to annual adjustments, helps ensure that the combined contributions do not exceed what’s considered a reasonable level of tax-advantaged saving.

| Year | Standard Contribution Limit | Catch-Up Contribution Limit | Total Contribution Limit |

|---|---|---|---|

| 2025 | TBD | TBD | TBD |

Note: TBD refers to ‘To Be Declared,’ indicating the figures will be announced closer to 2025.

Strategies to Maximize Your Contributions

To make the most of your 401(k) for 2025, adopting a strategic approach can be beneficial. Here are a few friendly tips to consider:

Start Early

Beginning your contributions early in the year can help you spread your savings over time, reducing the financial burden each month. This strategy also allows the savings to accrue interest for a longer period, potentially increasing your total retirement savings.

Adjust for Pay Raises

If you receive a salary increase, consider increasing your contribution rate. Even modest increases can significantly boost your savings over time. Additionally, try to ensure any bonuses or extra income feed into your 401(k) contributions to avoid unnecessary spending.

Make Use of Catch-Up Contributions

If you qualify for catch-up contributions, take full advantage of this to ramp up your savings as you get closer to retirement. This option can significantly affect your total savings and help make up for any earlier years where contributions were lower.

This image is property of images.unsplash.com.

Potential Changes and What To Watch For

Given the ever-evolving financial landscape, it’s wise to stay informed about any changes to 401(k) contribution limits or related legislation that might emerge. Keeping abreast of these changes can ensure you’re always making the best possible decisions regarding your retirement planning.

Legislative Adjustments

Changes in government policies or tax laws could influence 401(k) contribution limits. While it’s impossible to predict the future, staying informed through reliable sources can help you adapt your strategy as necessary.

Employer Offerings

Your employer’s offerings may also change, affecting your maximum contributions. Not all 401(k) plans are the same, and each may have unique rules and benefits. Regularly checking in with your human resources or benefits advisor is a sound practice.

How to Stay Informed About 401(K) Limits

Being proactive about learning current and upcoming 401(k) limits can give you an edge in retirement planning. Here are some friendly ways to remain in the loop:

Regularly Check Official Sources

The IRS website is a definitive source for accurate and updated information regarding 401(k) limits and retirement accounts. Regularly checking their updates can ensure you have the latest information.

Financial News Outlets

Keeping an eye on financial news can also be a great way to stay aware of any significant changes or trends in retirement planning, 401(k) contribution limits, and more. Articles from business sections of reputable newspapers often cover these topics in detail.

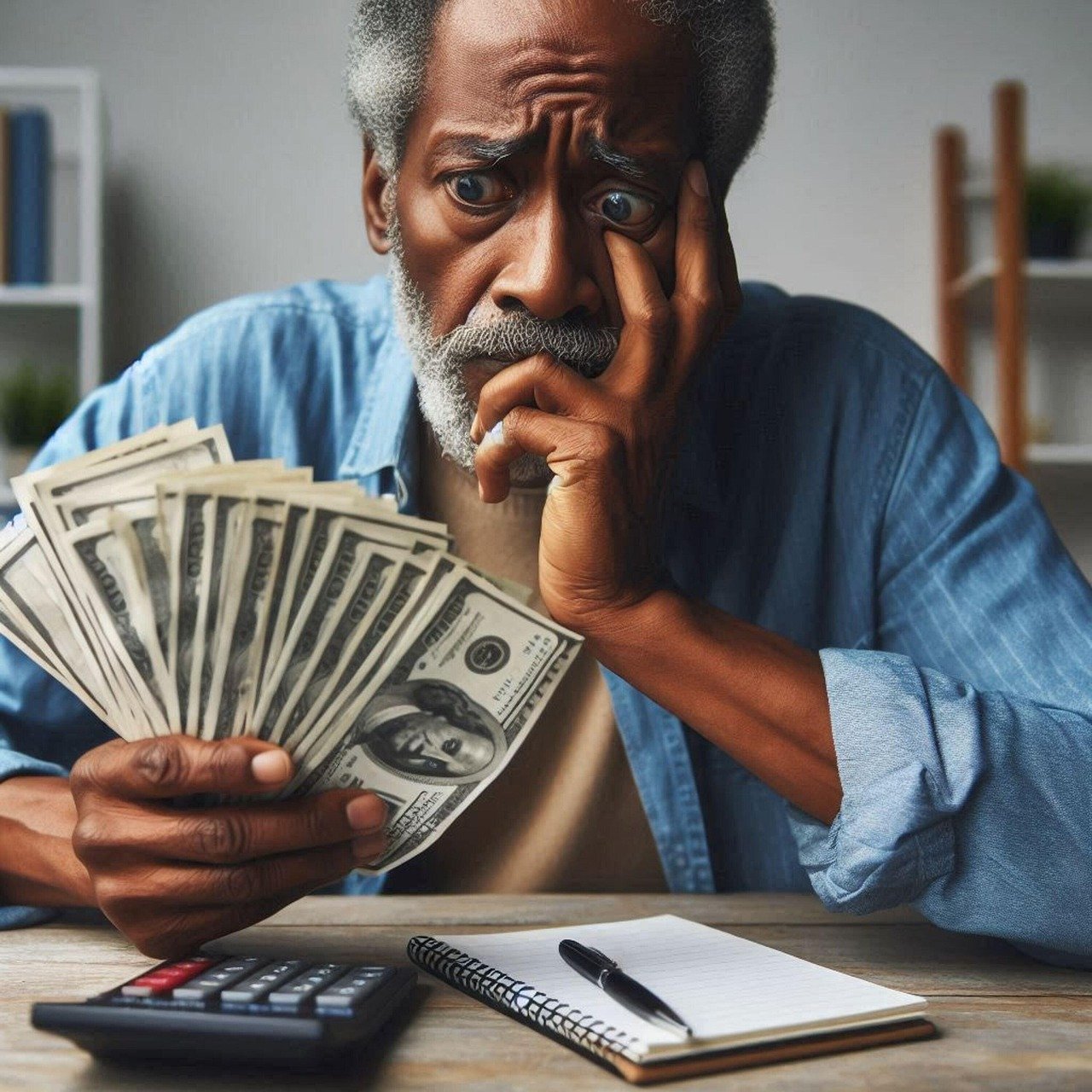

Consult a Financial Advisor

A financial advisor can provide personalized guidance based on your unique circumstances. They can help ensure your retirement strategy aligns with current limits and takes full advantage of any available opportunities.

This image is property of images.unsplash.com.

Conclusion

Navigating 401(k) contribution limits for 2025 involves understanding the basic principles of the plan, recognizing current and potential future limits, and leveraging strategies to maximize your contributions effectively. By staying informed and adopting a proactive saving approach, you can advance toward a financially secure retirement. The right knowledge and strategies can transform the often-daunting task of retirement planning into an achievable and manageable goal.