I remember waking up during a sharp market drop and feeling that knot of fear in my chest. Many readers have been there: late-night scrolling, watching numbers fall, wondering if hard-earned money will ever recover.

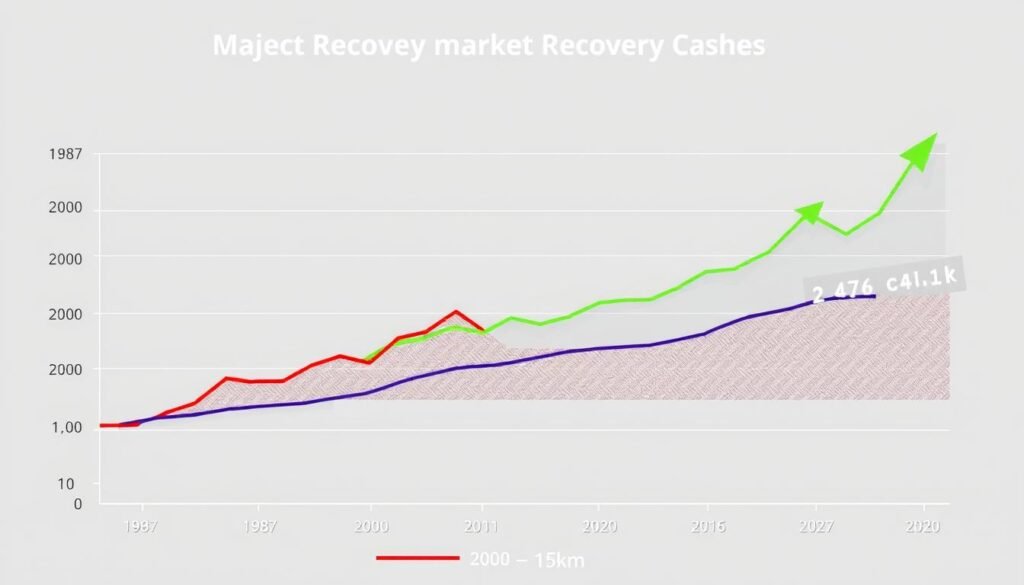

What’s the best way to protect retirement savings from uncertainty? Start by accepting that the stock market and markets move in cycles. History shows pullbacks and corrections are common and recoveries often come sooner than fear suggests.

Build a plan that matches your time horizon and goals. Use diversification across stocks and bonds, keep some cash outside tax-advantaged accounts, and keep steady contributions. These steps help your portfolio ride out volatility and preserve long-term growth.

Preview: This article will explain market cycles, age-appropriate allocation, cash buffers, and rebalancing rules so you can stay calm and act with purpose.

Key Takeaways

- Market drops are normal; recoveries often follow within months.

- Diversify across stocks and bonds to smooth returns.

- Keep liquid cash outside retirement accounts for added safety.

- Stick with steady investments and capture employer match.

- Document a clear plan with goals, contribution rates, and rebalancing rules.

- Read recovery and longevity context at how long $1 million can last.

Understand today’s market volatility and your retirement time horizon

Short-lived declines happen regularly in stock market history and can be understood with a clear timeline.

Since World War II, pullbacks (5–9.99%) have occurred about three times per year on average. Corrections (10–19.99%) appear roughly once a year. Bear markets (20%+) are less common but still expected. Recovery times help put swings in perspective: pullbacks often recover in about 46 days, corrections in under four months, and many bear phases in roughly 13 months.

Why pullbacks, corrections, and bear markets are normal (and often short-lived)

Normalize cycles: Seeing declines as regular events makes it easier to avoid selling at lows. Review quarterly or annually instead of reacting to daily headlines.

Time horizon and risk tolerance: how years to retirement shape your plan

If you have many years until retirement, you can accept more stock exposure because time helps smooth volatility. If retirement is near, shift toward stability and income.

| Time until retirement | Typical equity guidance | Notes |

|---|---|---|

| 20+ years | High (70–90%) | Ride cycles; emphasize growth across stocks and asset classes |

| 10–20 years | Moderate (50–70%) | Blend growth and income; consider target-date funds |

| 0–10 years | Lower (30–50%) | Prioritize liquidity and income; keep cash outside accounts |

- Use rules like “110 minus age” as a starting point for allocation.

- Match emotional tolerance with financial capacity before finalizing any plan.

- Keep some liquidity so accounts can stay invested during downturns.

What’s the best way to protect retirement savings from uncertainty?

When markets wobble, a calm checklist helps investors act instead of react.

Start with a clear audit. List balances for each account—401(k), IRA, savings, and CDs—and note monthly expenses and time until your target date. This snapshot makes decisions factual instead of emotional.

A step-by-step framework: don’t panic, assess, plan, act

Pause before any trade. Confirm your risk tolerance and review how much cash you hold outside tax-advantaged accounts for emergencies.

Set goals, choose an asset mix, automate contributions, review on a schedule

Write a short plan with contribution rates that capture employer match. Pick an asset mix aligned with your time horizon and rebalance on a fixed cadence. Automate contributions and, if available, automatic rebalancing so you buy during dips without timing the market.

When to seek a retirement income specialist for guidance

If withdrawals or income sequencing start within a few years, consider a specialist. They help align tax-aware withdrawals, income products, and bond or guaranteed-style choices for steady income and lower portfolio risk.

- Keep it simple: contribute consistently, maintain diversification, and review annually.

- Act with discipline: rebalance when allocations drift; that naturally buys low and trims gains.

- Build an emergency buffer: avoid tapping tax-advantaged accounts during market dips.

Build a resilient portfolio mix: diversification, age-based risk, and income

A resilient mix of assets helps dampen shocks while keeping growth alive.

Start by matching equity and fixed income exposure to your age and tolerance.

Stocks and bonds: tailoring allocation

Use simple heuristics like “110 minus age” or target-date funds as a baseline. Younger investors can lean heavier on stocks for growth; those nearer retirement should add more bonds for stability.

Broader diversification across markets

Spread equities across U.S. and international markets and across large, mid, and small caps. Blend value and growth so parts of the market can offset each other at different times.

Dividend-paying stocks for income

Dividend stocks can provide steady income during volatility, but check fundamentals—dividends are not guaranteed.

“Diversify within and across asset classes; avoid concentration in one holding.”

| Time until retirement | Equity focus | Fixed income role |

|---|---|---|

| 20+ years | High U.S./int’l, growth + value | Short duration, opportunistic |

| 10–20 years | Balanced large/mid/small caps | Intermediate duration for stability |

| 0–10 years | Lower equity, more income stocks | High-quality bonds, cash buffer |

Revisit allocations periodically and rebalance so your portfolio stays aligned with goals and time horizon.

Create a cash buffer and emergency fund to avoid selling low

Keep a liquid buffer so market swings won’t force you into selling at a loss.

Start with a clear target: aim for three to six months of essential expenses in liquid savings during working years. That preserves retirement accounts and avoids tax hits or the 10% penalty for early withdrawals before age 59½.

How much cash to hold

Workers: three to six months of expenses is a practical default.

Near-retirees: increase the buffer. Holding a year or more of planned withdrawals cuts sequence-of-returns risk and reduces pressure to sell during a downturn.

Where to keep short-term money

High-yield savings accounts give instant access and steady liquidity.

Short-term CDs can lock a better rate for a fixed term, but they limit access and may charge early withdrawal penalties. With potential rate cuts ahead, locking current yields can make sense if the term matches your timeline.

- Segment funds: separate emergency cash from money earmarked for planned costs.

- Match tool to time horizon: use savings accounts for immediate needs and short-term CDs when you can wait the term.

- Protect tax advantages: avoid tapping retirement accounts for routine emergency needs.

| Situation | Recommended cash buffer | Suggested vehicle |

|---|---|---|

| Working household | 3–6 months of essential expenses | High-yield savings account |

| Approaching retirement | 6–12 months (or a year of withdrawals) | Mix of savings and short-term CDs |

| Newly retired | 12+ months of planned withdrawals | Cash-like funds, short-term bonds, laddered CDs |

Integrate cash with your plan: align your buffer with bond ladders and withdrawal sequencing so income needs are met without selling into market weakness. For help building an emergency fund, see building an emergency fund.

Stay the course during market swings: contributions, dollar-cost averaging, and rebalancing

A steady plan keeps investors positioned for recovery, not panic.

Keep contributing. Staying the course during declines uses dollar-cost averaging and adds more shares when prices fall. That habit supports long-run returns and smooths timing risk.

Keep investing through volatility: automatic deposits and employer match

Prioritize contributions enough to capture a full employer match. That match is free money and can offset short-term market drops.

Automate deposits so investments happen every pay period. It removes emotion and helps investors buy on dips without guessing the bottom.

Rebalance with discipline: buy low, sell high without market timing

Use scheduled rebalancing or threshold rules rather than attempts to time markets. Selling what ran up and buying what lagged keeps your portfolio aligned with goals and risk.

| Rule | Action | Why it helps |

|---|---|---|

| Automate contributions | Weekly/biweekly deposits | Harnesses dollar-cost averaging |

| Rebalance schedule | Quarterly or semiannual | Maintains target asset mix |

| Threshold rebalance | Adjust when allocation shifts 5–10% | Buys low, trims gains without guessing market |

- Keep cash for expenses so plan can continue during bear phases.

- Rebalance inside tax-advantaged accounts when possible to limit tax impact.

- Review contributions and matches at least once a year and adjust for goals.

For practical guidance on protecting a 401(k) in down markets, see 401(k) strategies for downturns. For broader context on nest-egg outcomes, read this piece on account milestones: who reaches $1 million in funds.

Conclusion

A clear, repeatable plan helps you weather down markets without panic.

History shows declines often recover within months to a year-plus. A diversified portfolio, steady contributions (including any employer match), disciplined rebalancing, and an adequate cash buffer let investors avoid selling at lows and stay invested through market volatility.

Match strategy to your life stage: younger investors can lean into growth and time, while those near retirement should add income, stability, and larger cash reserves. Keep taxes and costs low by using tax-advantaged accounts and low-cost funds.

Review a written plan annually, adjust for changing goals and expenses, and seek a fiduciary advisor or retirement income specialist if you need tailored withdrawal sequencing or a stocks bonds mix. For practical context on targets and timing, read the magic number for retiring comfortably.

Bottom line: a simple, disciplined strategy — diversification, liquidity, and steady habits — helps your funds navigate markets and reach long-term goals.

FAQ

Why are pullbacks, corrections, and bear markets a normal part of investing?

Market drops happen regularly because prices reflect changing information and sentiment. Corrections and bear markets can be painful, but historically they have been followed by recoveries. Keeping a long-term horizon and a diversified portfolio helps cushion the impact of short-term volatility on retirement accounts.

How does my time horizon affect investment risk?

Years until retirement shape how much risk you can take. Younger investors can tolerate more stock exposure since they have time to recover from downturns. Near-retirees typically shift toward income and capital preservation to limit sequence-of-returns risk during the withdrawal phase.

What steps should I follow during market turbulence?

Don’t panic. First, assess your goals, cash needs, and asset allocation. Next, update your plan and act only if your situation or objectives changed. Maintain discipline—avoid emotional market timing and favor systematic actions like rebalancing and scheduled contributions.

How do I set realistic retirement goals and an appropriate asset mix?

Start with target retirement age, expected expenses, and income sources like Social Security or pensions. Use those figures to estimate required savings and a sustainable withdrawal rate. Then choose an asset mix—stocks for growth, bonds for stability—aligned with your risk tolerance and time horizon.

When should I consult a retirement income specialist?

Talk with a specialist when you face complex choices: planning guaranteed income, managing large balances, dealing with taxes, or creating a withdrawal schedule. An adviser can model scenarios and help convert investments into a reliable retirement paycheck.

How do I build a resilient portfolio through diversification?

Diversify across asset classes (stocks, bonds, cash), regions (U.S. and international), styles (value vs. growth), and sizes (large vs. small/mid caps). Broad exposure reduces reliance on any single market segment and smooths returns over time.

Should dividend-paying stocks be part of my plan?

Dividend stocks can provide steady income and lower volatility relative to non-dividend shares. They’re useful for retirees seeking cash flow but should complement, not replace, a balanced allocation that addresses growth and inflation protection.

How much cash should I keep to avoid selling investments at a loss?

For working savers, three to six months of expenses is common. Near-retirees or those with variable income may hold more—often 12 to 24 months of essential expenses—to cover withdrawals during market downturns without tapping equities at low prices.

Where is it wise to park emergency cash now?

Use liquid, low-risk places: high-yield savings accounts, money market funds, or short-term certificates of deposit (CDs). These offer safety and some yield; the trade-off is limited upside compared with stocks, but they protect principal and maintain access.

How can I benefit from dollar-cost averaging during volatile markets?

Regular contributions buy more shares when prices fall and fewer when prices rise, lowering average cost over time. Keep contributing to employer-sponsored plans to capture matches and compound growth regardless of market swings.

What’s the right rebalancing approach during swings?

Rebalance on a schedule or when allocations drift beyond set thresholds. Selling some of the outperforming assets and buying laggards enforces a buy-low, sell-high discipline without trying to time the market. Rebalancing reduces unintended risk buildup.

How do taxes influence retirement planning decisions?

Taxes affect net returns and withdrawal strategies. Use tax-advantaged accounts (401(k), IRA, Roth) appropriately, plan conversions carefully, and factor tax rates into withdrawal sequencing to preserve after-tax income in retirement.

What role do bonds and fixed income play as I age?

Bonds provide income and lower volatility compared with stocks. As you near retirement, shifting toward higher-quality bonds or laddered short-term fixed income can reduce portfolio swings and fund near-term spending needs.

How often should I review my retirement plan and investments?

Review annually or after major life events—job changes, inheritance, health shifts. Routine checks ensure allocations still match goals and risk tolerance. Avoid constant tinkering; stick to disciplined, documented review rules.