Have you ever wondered if borrowing from your 401k is the right move for you? This question crosses many minds, especially when an unexpected financial need arises, or when you’re looking for a way to fund a significant purchase. Understanding the ins and outs of taking a loan from your 401k can be crucial, not only for your current financial situation but also for your long-term retirement planning.

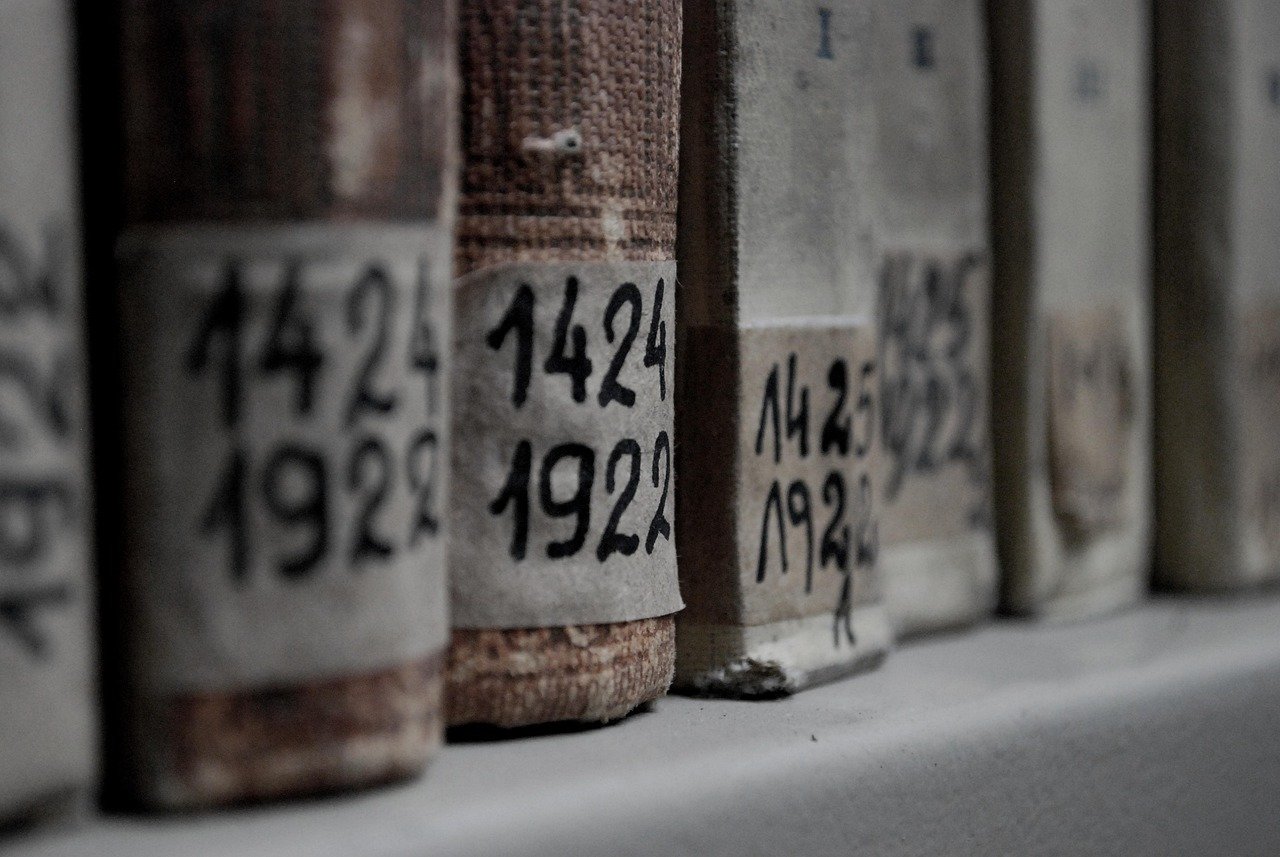

This image is property of pixabay.com.

What is a 401k Loan?

A 401k loan allows you to borrow money from your retirement savings account. This type of loan can be an appealing option because it doesn’t require a credit check, and the interest you pay goes back into your own account. However, it’s not without risks, and understanding the terms and how it impacts your future is essential.

How Does a 401k Loan Work?

In a nutshell, when you take a loan from your 401k, you’re borrowing from yourself. The funds are withdrawn from your account and are typically repaid with interest over a set loan term. However, there are specific rules and limits set by the IRS and your employer’s plan that govern how much you can borrow and the repayment terms.

-

Borrowing Limit: Generally, you can borrow up to $50,000 or 50% of your vested account balance, whichever is less. This rule helps ensure that you do not deplete your retirement savings entirely.

-

Repayment Term: The standard repayment period is usually five years, though some plans may allow longer repayment terms, particularly for buying a home.

-

Interest Rate: The interest rate is determined by the plan but is typically the prime rate plus one or two percentage points. Unlike other loans, the interest you pay goes back into your own 401k account.

-

Repayment Method: Repayments are usually made through automatic payroll deductions, making it easier to stay on track with your payment schedule.

Potential Advantages of Borrowing from Your 401k

While the idea of taking a loan from your future retirement savings might seem daunting, there are some potential benefits associated with a 401k loan.

Easy Accessibility and Quick Approval

One of the most attractive features of a 401k loan is its accessibility. Unlike traditional loans where you might wait weeks for approval, a 401k loan is often processed much quicker. Plus, there’s no need for a credit check since you are borrowing from your own savings, making it an attractive option for those with less-than-perfect credit scores.

Are There Financial Advantages?

Borrowing from your 401k might also make sense financially. Because you pay the interest back to yourself, this option can be cheaper than high-interest loans or credit cards. Furthermore, if you suddenly have a financial crisis or a business opportunity that requires immediate cash, a 401k loan can provide the necessary funds without penalties—as long as you adhere to the repayment terms.

Preserving Other Investments or Assets

Taking a 401k loan can mean that you’re avoiding liquidating other investments or assets, which might incur penalties or fees or result in lost future earnings from those assets. This can be particularly useful if those investments are appreciating or are part of a long-term financial strategy.

This image is property of pixabay.com.

The Risks and Downsides of Borrowing from Your 401k

While there are distinct benefits, borrowing from your 401k can also have significant risks and drawbacks that shouldn’t be overlooked.

Impact on Retirement Savings

Loans from your 401k can have a detrimental impact on your retirement savings. When you withdraw money, that money is no longer working for you in terms of compound growth. This removal can severely affect your nest egg, especially if stock markets are performing well while your money is not invested.

Tax Implications and Penalties

Failing to repay your loan as per the agreed terms can have severe tax implications. If you leave your job or are unable to meet the repayment schedule, the outstanding loan balance may be considered a distribution. Consequently, you could face income taxes and an additional 10% early withdrawal penalty if you’re under 59½.

Financial Instability and Job Loss

A significant risk is what happens if you lose your job. Many retirement plans require you to repay your entire loan balance shortly after leaving your employer. If you cannot do so, it’s considered a distribution, and similar tax penalties will apply.

Comparing a 401k Loan to Other Financial Options

When you’re considering taking a loan from your 401k, it’s essential to understand how it compares with other borrowing options.

| Parameter | 401k Loan | Personal Loan | Credit Card |

|---|---|---|---|

| Credit Check | Not required | Required | Not explicitly required but influences limits and rates |

| Interest Rates | Usually lower, paid to yourself | Based on credit score, often higher | Can be very high, especially for cash advances |

| Repayment Period | Typically up to 5 years | Can range from a few months to several years | Monthly minimum payments, potentially indefinite |

| Tax Implications | Potential taxes if not repaid | No tax implications if repaid | No direct tax implications but interest is not deductible |

Why a 401k Loan May Be Preferable

If you need cash quickly and have a disciplined repayment strategy, a 401k loan can be a cost-effective way to access funds without impacting your credit score. The appeal largely rests on paying interest to oneself and avoiding high-interest rates.

When Other Options Might Be Better

Conversely, if you anticipate future financial instability, maximizing credit opportunities or personal loans might be beneficial. These solutions—while often at higher rates—don’t threaten your retirement savings directly and offer more flexible solutions if repayment becomes challenging.

This image is property of images.unsplash.com.

Steps to Take Before Borrowing from Your 401k

Before making a decision, consider these actionable steps to make an informed choice.

Evaluate Your Financial Situation

Take a detailed look at your current financial situation. Are there other options available that could provide the necessary funds in a less risky manner? Can the expense be delayed?

Speak With a Financial Advisor

Engaging with a financial advisor can provide personalized insight into how a 401k loan might impact your overall retirement goals. Advisors can help weigh the benefits and drawbacks specific to your financial situation.

Review Your 401k Plan Details

Thoroughly reading through your 401k plan documentation is critical to understanding the specific terms, interest rates, and any fees or penalties associated with a loan.

Consider Future Financial Stability

Assess the stability of your employment and other income sources. Ensure you are confident in your ability to repay the loan even if unforeseen circumstances arise.

The Long-Term Implications on Retirement Planning

It’s vital to understand how a 401k loan fits into your long-term financial strategy.

Reducing Future Wealth

By borrowing from your 401k, you’re potentially robbing your future self of growth opportunities. Even if a loan is repaid successfully, the time that money was out of the market means you might have reduced your overall retirement wealth significantly.

Adjusting Retirement Contributions

After taking out a loan, you may need to adjust your retirement savings strategy. This might involve increasing contributions post-loan or adjusting your investment risk.

Reassessing Financial Goals

A loan may necessitate shifts in other financial goals. Planning for larger savings or different investment types may be required to balance the short-term need against your long-term objectives.

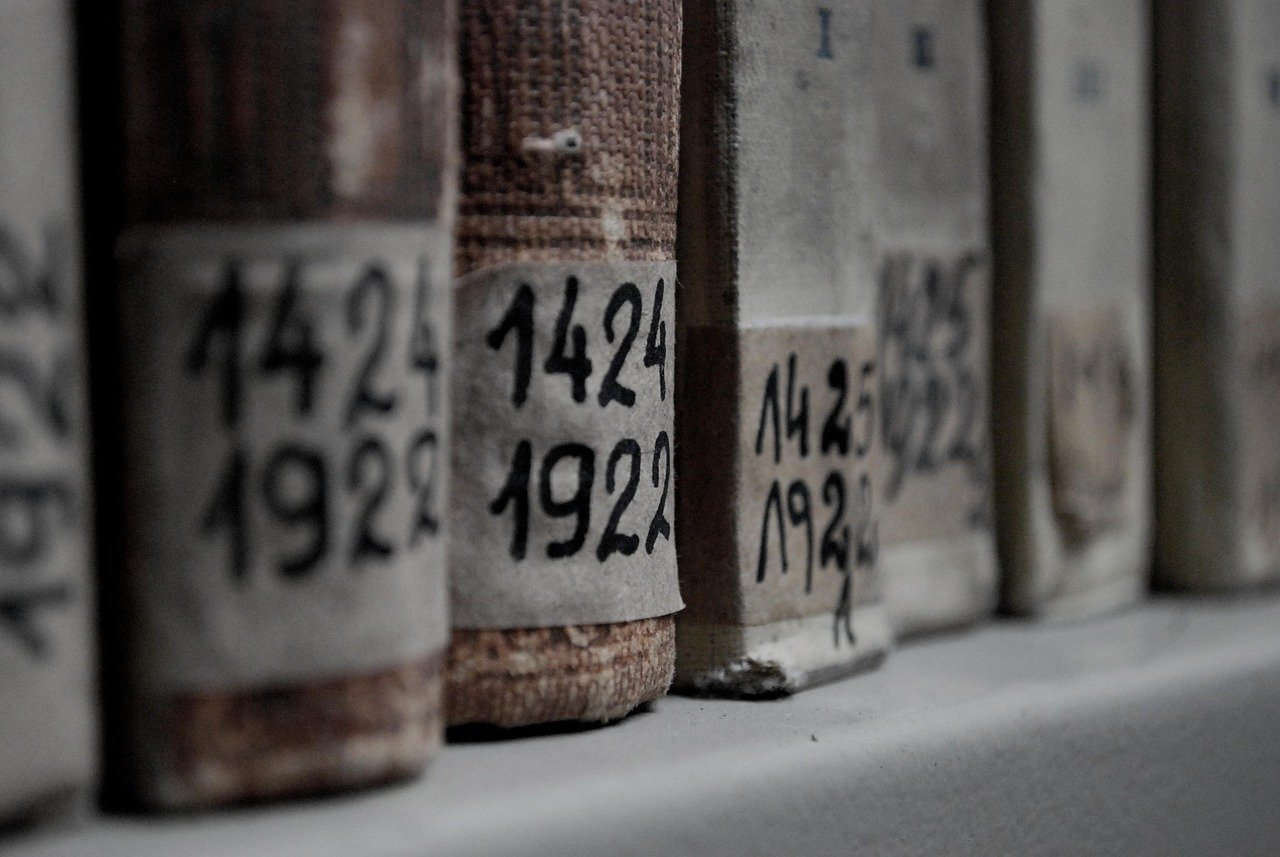

This image is property of images.unsplash.com.

Conclusion: Is a Loan from Your 401k the Right Move for You?

When considering taking out a loan from your 401k, it’s essential to weigh the benefits against the potential risks and long-term implications seriously. While it offers a way to access cash quickly without affecting your credit score, the potential drawbacks like jeopardizing your retirement savings and facing tax penalties require careful consideration.

Knowing your overall financial health, considering possible alternatives, and seeking professional advice can provide clarity in making an informed decision. If borrowing from your 401k turns out to be the most sensible option, ensure you have a solid repayment plan to mitigate risks and safeguard your future financial health.