Inflation silently erodes the purchasing power of your retirement savings, threatening the financial security you’ve worked so hard to build. As the dollar weakens, many investors turn to precious metals as a potential safeguard. Gold IRAs have emerged as a popular vehicle for those seeking to protect their wealth from the devastating effects of rising prices.

But how exactly does inflation impact your Gold IRA, and is this investment truly the inflation hedge many claim it to be? This comprehensive guide explores the complex relationship between inflation and gold investments, providing you with actionable strategies to optimize your retirement portfolio during inflationary periods.

The Relationship Between Inflation and Precious Metals

Inflation and gold have maintained a fascinating relationship throughout economic history. As a physical precious metal with limited supply, gold offers unique properties that make it particularly responsive to inflationary pressures.

Why Gold Responds to Inflation

Gold’s appeal during inflation stems from its status as a real asset with intrinsic value. Unlike fiat currencies that can be printed in unlimited quantities, the gold supply increases by only about 1.5% annually through mining. This scarcity helps gold maintain purchasing power when paper money weakens.

When central banks increase the money supply to stimulate economic growth, each existing dollar becomes less valuable. Investors often respond by seeking assets that can’t be diluted through monetary policy—gold being a prime example.

Gold as a Store of Value

Throughout history, gold has served as a reliable store of value across civilizations and economic systems. An ounce of gold today buys approximately the same amount of goods as it did decades or even centuries ago, demonstrating its ability to preserve purchasing power over time.

This characteristic becomes particularly valuable during inflationary periods when traditional savings accounts and fixed-income investments struggle to maintain real returns. Physical precious metals in a Gold IRA provide tangible assets that exist outside the conventional financial system.

Historical Performance of Gold During Inflationary Periods

The 1970s Inflation Crisis

The most dramatic example of gold’s inflation-fighting potential occurred during the 1970s stagflation era. As inflation soared to double-digit levels, gold prices skyrocketed from $35 per ounce in 1971 to over $850 by January 1980—a staggering 2,300% increase.

During this same period, the purchasing power of the dollar declined significantly, and traditional investments struggled to keep pace with rising prices. Gold not only preserved wealth but substantially increased it, outpacing inflation by a considerable margin.

Recent Inflationary Episodes

More recent history also demonstrates gold’s response to inflation concerns. During the 2008 financial crisis and subsequent quantitative easing programs, gold prices climbed from around $700 to over $1,900 per ounce by 2011 as investors worried about potential inflation from expansionary monetary policies.

Similarly, in 2020-2021, as governments worldwide implemented unprecedented stimulus measures to combat the economic effects of the pandemic, gold reached new all-time highs above $2,000 per ounce, reflecting concerns about future inflation.

| Inflationary Period | Average Inflation Rate | Gold Price Change | S&P 500 Performance |

| 1973-1980 | 9.2% | +1,700% | +5.5% |

| 2007-2011 | 2.3% | +170% | -0.9% |

| 2020-2022 | 5.4% | +25% | +40% |

While gold doesn’t always move in perfect correlation with inflation rates in the short term, the historical data demonstrates its tendency to perform well during extended periods of currency devaluation and economic uncertainty.

How Inflation Impacts Gold IRAs vs. Traditional IRAs

Different Asset Responses to Inflation

Traditional IRAs typically hold paper assets like stocks, bonds, and mutual funds, each responding differently to inflation. Stocks may provide some inflation protection through company growth and price adjustments, but often experience volatility during inflationary periods. Bonds, particularly those with fixed rates, tend to lose value as inflation and interest rates rise.

Gold IRAs, by contrast, hold physical precious metals that have historically maintained or increased in value during inflationary periods. The tangible nature of gold provides a direct hedge against currency devaluation, unlike paper assets that represent claims on future cash flows.

Traditional IRA Inflation Challenges

- Fixed-income investments lose purchasing power

- Bond values decline as interest rates rise to combat inflation

- Cash holdings rapidly erode in value

- Stock market volatility increases during inflation uncertainty

- Dividend yields may not keep pace with rising prices

Gold IRA Inflation Advantages

- Physical gold tends to appreciate during currency devaluation

- Precious metals maintain intrinsic value regardless of monetary policy

- Portfolio diversification reduces overall inflation risk

- Protection from systemic financial risks during high inflation

- Historical track record of preserving purchasing power

Tax Considerations During Inflation

Inflation creates “phantom gains” in traditional investments, where nominal returns may appear positive while real returns (adjusted for inflation) are negative. These phantom gains are still taxable in regular accounts, effectively increasing your tax burden while your purchasing power decreases.

Both traditional and Gold IRAs offer tax-advantaged growth that helps combat this issue. However, Gold IRAs provide the additional benefit of holding assets that historically appreciate during inflation, potentially generating stronger real returns in inflationary environments.

Concerned About Inflation’s Impact on Your Retirement?

Speak with a precious metals specialist to receive a personalized analysis of how your current retirement portfolio might perform during sustained inflation. Our experts can help you determine if a Gold IRA is right for your financial situation.

Strategies for Optimizing Gold IRA Allocation During High Inflation

Determining the Optimal Allocation

Financial experts typically recommend allocating between 5-15% of your retirement portfolio to precious metals, with the specific percentage depending on your age, risk tolerance, and inflation outlook. During periods of high inflation or economic uncertainty, increasing this allocation toward the upper end of the range may provide additional protection.

However, it’s crucial to maintain a balanced approach. While gold offers inflation protection, it doesn’t generate income like dividend stocks or interest-bearing investments. Your overall retirement strategy should include a mix of growth, income, and preservation assets.

Diversifying Within Your Gold IRA

A well-structured Gold IRA doesn’t have to contain only gold. IRS regulations allow for several types of precious metals, including silver, platinum, and palladium, each with unique properties and price movements.

| Precious Metal | Inflation Response | Volatility | Recommended Allocation |

| Gold | Strong positive | Moderate | 60-70% of metals portfolio |

| Silver | Positive | High | 20-30% of metals portfolio |

| Platinum | Moderate positive | High | 5-10% of metals portfolio |

| Palladium | Variable | Very high | 0-5% of metals portfolio |

Timing Strategies During Inflationary Periods

While trying to time any market perfectly is challenging, certain strategies can help optimize your Gold IRA during inflation:

- Dollar-cost averaging: Rather than making a single large purchase, consider regularly adding to your Gold IRA over time to smooth out price volatility.

- Inflation indicator monitoring: Watch key inflation metrics like the Consumer Price Index (CPI), Producer Price Index (PPI), and money supply growth to inform your allocation decisions.

- Rebalancing: As gold prices rise during inflation, your allocation may become overweighted. Periodic rebalancing helps maintain your desired risk profile.

- Product selection: During high inflation, focus on investment-grade bullion like American Eagles or Canadian Maple Leafs rather than numismatic or collector coins, which may not track inflation as effectively.

Risks and Considerations When Using Gold as an Inflation Hedge

Advantages of Gold During Inflation

- Historical track record of preserving purchasing power

- Physical asset not dependent on issuer promises

- Limited supply that can’t be artificially expanded

- Global demand independent of any single economy

- Portfolio diversification benefits

Challenges of Gold During Inflation

- Price volatility in short-term periods

- Storage and insurance costs reduce net returns

- No income generation (dividends or interest)

- Potential liquidity constraints

- Higher fees compared to traditional investments

Short-Term Volatility vs. Long-Term Preservation

While gold has proven effective against inflation over long periods, its price can be volatile in the short term. Factors like interest rate changes, currency fluctuations, and market sentiment can cause significant price swings that don’t necessarily correlate with inflation data.

Investors should view their Gold IRA as a long-term strategic holding rather than a tactical inflation response. The historical data shows that gold’s inflation-hedging properties become more reliable over extended timeframes of 5+ years.

The Impact of Interest Rates

The relationship between gold, inflation, and interest rates is complex. While inflation typically supports gold prices, rising interest rates to combat inflation can create headwinds for gold performance.

Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. When real interest rates (nominal rates minus inflation) turn positive, gold may underperform despite ongoing inflation. This dynamic creates situations where gold might lag during the early stages of inflation as central banks raise rates aggressively.

Custodial and Storage Considerations

Gold IRAs require specialized custodians and secure storage solutions, which introduce additional costs and considerations not present with traditional IRAs. Annual fees typically include:

- Custodian administration fees ($75-300 annually)

- Storage fees ($100-300 annually, depending on holdings)

- Insurance costs (often bundled with storage)

- Transaction fees when buying or selling metals

These ongoing expenses can reduce your effective returns, especially for smaller accounts. When evaluating a Gold IRA as an inflation hedge, factor these costs into your expected performance calculations.

Current Inflation Trends and Their Potential Impact on Gold Prices

Recent Inflation Data and Central Bank Responses

Recent years have seen inflation rates reach multi-decade highs in many developed economies. In the United States, the Consumer Price Index (CPI) exceeded 9% in 2022 before moderating somewhat. Central banks worldwide have responded with aggressive interest rate hikes to bring inflation under control.

This environment creates mixed signals for gold. While high inflation typically supports gold prices, rising interest rates create countervailing pressure. The net effect depends largely on real interest rates—if inflation outpaces rate hikes, creating negative real rates, gold tends to perform well despite nominal rate increases.

Money Supply Growth and Fiscal Policy

The unprecedented expansion of money supply during recent years has created long-term inflationary potential that may support gold prices. The M2 money supply in the United States expanded by over 40% between 2020 and 2022, creating structural pressure on the dollar’s purchasing power.

Continued government deficit spending and debt accumulation further contribute to the long-term inflation outlook. These fiscal realities suggest that even if inflation moderates in the near term, the structural conditions for future inflation remain in place—a potentially supportive environment for gold prices.

Geopolitical Factors and Supply Chain Disruptions

Beyond monetary and fiscal policy, ongoing geopolitical tensions and supply chain restructuring contribute to inflationary pressures. Trade conflicts, resource nationalism, and the reshoring of manufacturing all tend to increase production costs and consumer prices.

These factors often benefit gold in two ways: directly through inflation and indirectly through increased economic uncertainty. Gold’s dual role as both an inflation hedge and a safe-haven asset makes it particularly responsive to geopolitical disruptions that threaten economic stability.

“The current environment of structural inflation pressures, negative real interest rates, and heightened geopolitical uncertainty creates favorable conditions for gold as both an inflation hedge and portfolio diversifier.”

Practical Steps to Protect Your Retirement Savings

Evaluating Your Current Inflation Exposure

Before making changes to your retirement strategy, assess your current portfolio’s inflation vulnerability:

- Review your asset allocation across all retirement accounts

- Identify fixed-income investments with set interest rates

- Calculate your exposure to inflation-sensitive sectors

- Determine your current precious metals allocation, if any

- Estimate your retirement timeframe and income needs

This evaluation provides a baseline for understanding how inflation might affect your specific situation and helps determine the appropriate level of inflation protection needed.

Setting Up or Converting to a Gold IRA

If you decide a Gold IRA makes sense for your inflation protection strategy, you have several options:

- New account setup: Establish a self-directed IRA with a custodian that specializes in precious metals

- Partial rollover: Transfer a portion of an existing IRA or 401(k) to a Gold IRA

- Full rollover: Convert an entire retirement account to a Gold IRA

- Annual contributions: Make new contributions to an existing Gold IRA up to annual limits

The rollover process typically involves selecting a custodian, completing transfer paperwork, choosing your precious metals, and arranging for secure storage. Most reputable Gold IRA companies will guide you through this process step by step.

Selecting the Right Precious Metals Products

Not all gold and silver products qualify for IRA inclusion. The IRS maintains specific requirements for purity and authenticity:

| Metal | Purity Requirement | Common Eligible Products |

| Gold | 99.5% pure (except American Eagles) | American Eagles, Canadian Maple Leafs, Australian Kangaroos, Credit Suisse bars |

| Silver | 99.9% pure | American Silver Eagles, Canadian Maple Leafs, Australian Kookaburras |

| Platinum | 99.95% pure | American Platinum Eagles, Canadian Maple Leafs, Australian Platypus |

| Palladium | 99.95% pure | Canadian Maple Leafs, PAMP Suisse bars |

Focus on widely recognized bullion products from reputable mints and refiners. These offer the best liquidity and most reliable tracking of precious metals prices, maximizing your inflation protection.

Ongoing Management and Rebalancing

Once established, your Gold IRA requires periodic review and management:

- Monitor the percentage allocation of precious metals in your overall portfolio

- Rebalance when allocations drift significantly from targets

- Review storage and custodian fees annually to ensure competitive rates

- Adjust your strategy as you approach retirement

- Stay informed about inflation trends and monetary policy changes

Remember that a Gold IRA works best as part of a comprehensive retirement strategy. Regular consultation with a financial advisor who understands both precious metals and retirement planning can help ensure your inflation protection strategy remains aligned with your overall financial goals.

Conclusion: Balancing Inflation Protection with Overall Retirement Goals

Inflation presents a genuine threat to retirement security, eroding purchasing power and undermining fixed-income investments. Gold IRAs offer a time-tested approach to combating this threat, providing both historical precedent and practical advantages for today’s retirement investors.

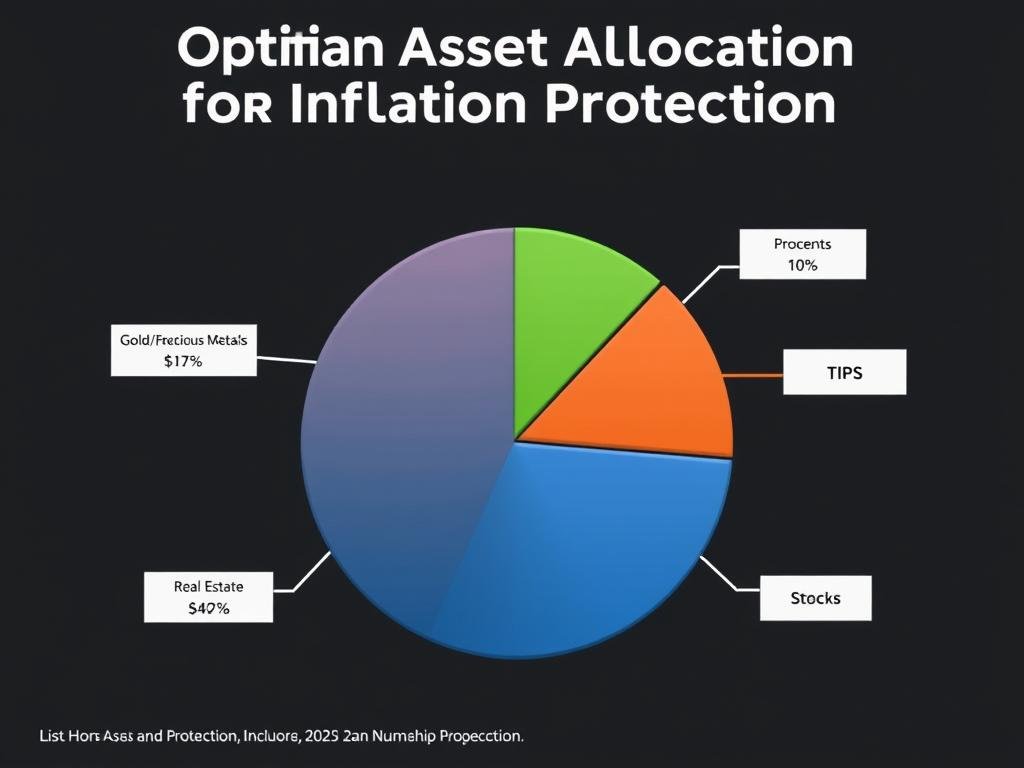

However, effective inflation protection requires balance. While gold has proven its worth during inflationary periods, it performs best as part of a diversified strategy rather than a standalone solution. The optimal approach combines precious metals with other inflation-resistant assets like certain equities, TIPS, and real estate investments.

As you consider how inflation might impact your retirement portfolio, remember that gold’s greatest strength lies in its long-term preservation of purchasing power. Short-term price movements may not always correlate with inflation data, but the historical record demonstrates gold’s ability to maintain real value across decades and economic cycles.

By understanding both the potential and limitations of Gold IRAs as inflation hedges, you can make informed decisions that protect your retirement savings while still pursuing your broader financial goals.

Protect Your Retirement From Inflation

Download our comprehensive “2025 Inflation Protection Guide for Gold IRA Investors” to learn advanced strategies for safeguarding your retirement savings. This free resource includes portfolio allocation models, tax optimization techniques, and expert insights on timing your precious metals investments.

Frequently Asked Questions About Inflation and Gold IRAs

How effective is gold at protecting against inflation?

Gold has demonstrated strong inflation-hedging properties over long time periods, particularly during sustained high inflation. During the 1970s inflation crisis, gold prices increased by over 1,700% while inflation averaged 9.2%. However, gold’s effectiveness can vary in shorter timeframes and is influenced by factors like interest rates, currency movements, and market sentiment.

For retirement planning purposes, gold’s long-term track record of preserving purchasing power makes it a valuable component of an inflation protection strategy, though it works best as part of a diversified approach rather than a sole solution.

What percentage of my retirement portfolio should be in a Gold IRA?

Financial advisors typically recommend allocating between 5-15% of your retirement portfolio to precious metals, including gold. The specific percentage depends on factors like your age, risk tolerance, investment timeline, and inflation outlook.

Investors closer to retirement or those particularly concerned about inflation might consider allocations toward the higher end of this range. However, because gold doesn’t generate income like dividends or interest, maintaining a balanced portfolio remains important for meeting retirement income needs.

Can I hold both a traditional IRA and a Gold IRA simultaneously?

Yes, you can maintain both traditional IRAs and Gold IRAs simultaneously. In fact, this approach often provides better diversification than converting all retirement assets to precious metals. You can also establish a single self-directed IRA that holds both conventional investments and precious metals if your custodian offers this option.

Annual contribution limits apply across all your IRA accounts combined, not to each account individually. For 2023, the total contribution limit is ,500 (,500 if you’re 50 or older).

How does the inflation impact on Gold IRAs compare to other inflation hedges?

Gold IRAs offer several advantages compared to other inflation hedges. Unlike TIPS (Treasury Inflation-Protected Securities), gold isn’t directly tied to government inflation calculations, which some investors believe understate actual inflation. Gold also provides protection against currency devaluation that real estate and certain stocks may not offer during severe economic disruptions.

However, gold lacks the income generation of dividend stocks or rental real estate. A comprehensive inflation protection strategy might include a mix of these assets, with gold serving as the “insurance policy” component that tends to perform best during serious economic dislocations.

What are the tax implications of a Gold IRA during inflationary periods?

Gold IRAs offer the same tax advantages as traditional or Roth IRAs, depending on which type you choose. With a Traditional Gold IRA, contributions may be tax-deductible, and growth is tax-deferred until withdrawal. With a Roth Gold IRA, contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

During inflation, these tax benefits become particularly valuable. Traditional investments in taxable accounts face “phantom gains” taxation, where nominal gains are taxed even if real returns (adjusted for inflation) are negative. The tax-advantaged structure of IRAs helps mitigate this issue, allowing your precious metals to serve as more effective inflation hedges.

Additional Resources

Understanding Gold IRA Rules

Learn about IRS regulations, contribution limits, and required minimum distributions for Gold IRAs.

Gold vs. Silver in Your IRA

Compare the inflation-hedging properties of different precious metals for your retirement portfolio.

Tax Strategies for Precious Metals

Discover tax-efficient approaches to managing your precious metals investments during inflation.