You’ve spent decades building your retirement nest egg, carefully saving and investing for your future. But there’s a silent threat that could significantly diminish the purchasing power of those hard-earned dollars: inflation. When a gallon of milk that cost $3.50 five years ago now costs $5.25, or when your healthcare premiums increase by 8% annually, that’s inflation at work—steadily eroding what your money can buy. For retirees on fixed incomes, this presents a serious challenge that requires strategic planning and proactive measures.

Understanding Inflation’s Impact on Retirement

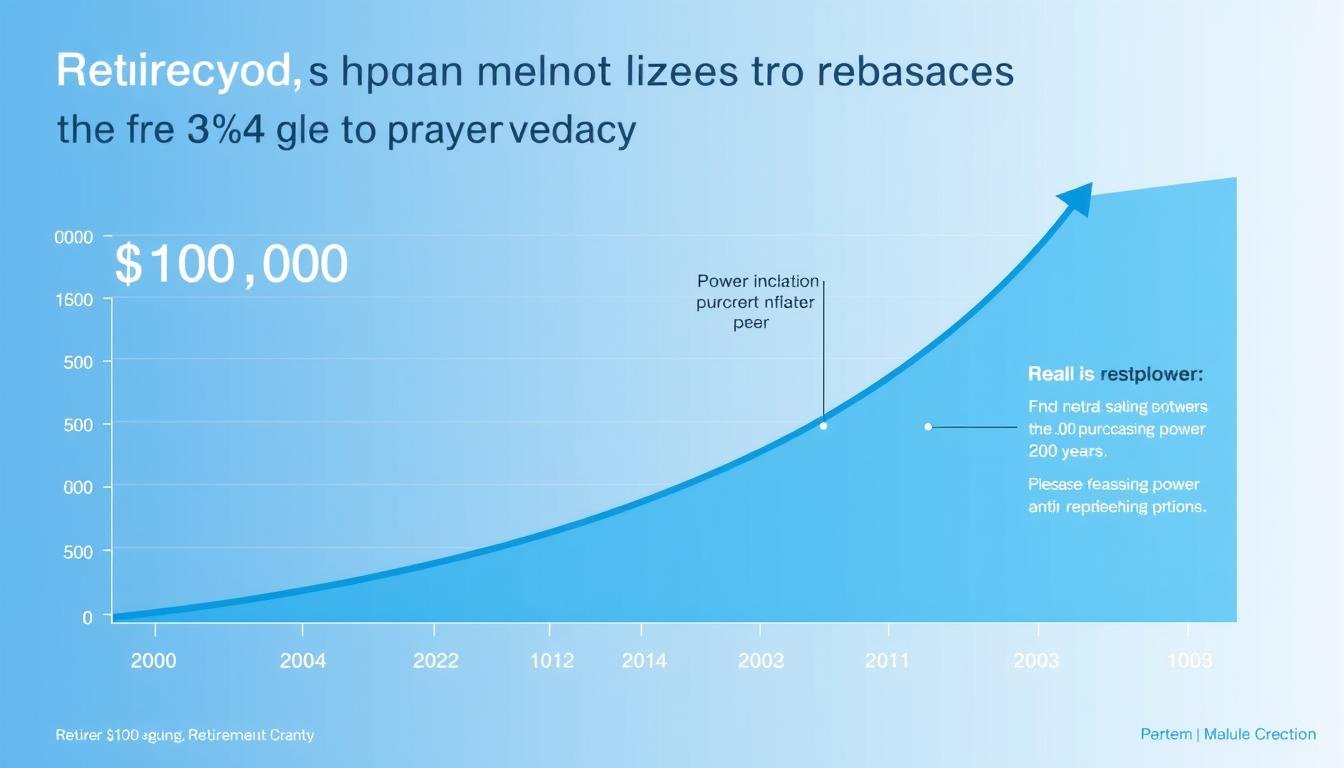

Inflation represents the general increase in prices and the corresponding decrease in purchasing power over time. Historically, U.S. inflation has averaged around 3% annually, though it fluctuates significantly during different economic periods. For retirees, this presents a unique challenge—while your retirement savings might remain numerically the same, what those dollars can actually buy diminishes year after year.

Consider this sobering example: At a modest 3% inflation rate, the purchasing power of your savings will be cut in half in just 24 years. If you retire at 65, by age 89, each dollar will effectively be worth only 50 cents compared to when you retired. For many retirees who are living longer than previous generations, this means potentially facing 25-30 years of steadily declining purchasing power.

Inflation Reality Check: If you need $50,000 annually to maintain your lifestyle today, you’ll need approximately $67,196 in 10 years and $90,305 in 20 years just to maintain the same standard of living (assuming 3% annual inflation).

Healthcare costs present an even greater concern, as they typically rise at rates exceeding general inflation—often 5-7% annually. A 65-year-old couple retiring today can expect to spend approximately $315,000 on healthcare expenses throughout retirement, according to Fidelity’s 2024 analysis. This figure doesn’t account for long-term care, which can add significant additional costs.

Inflation-Proof Investment Strategies

Protecting your retirement from inflation requires a multi-faceted approach to investing. The following strategies can help ensure your savings maintain their purchasing power throughout your retirement years:

Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds specifically designed to protect against inflation. Unlike conventional bonds, both the principal and interest payments of TIPS adjust based on changes in the Consumer Price Index (CPI), ensuring your investment maintains its purchasing power even as prices rise.

“TIPS offer a direct hedge against inflation by design. While their yields may be lower than conventional bonds during periods of low inflation, they provide essential protection when inflation accelerates.”

When purchasing TIPS, you can either buy them directly from the U.S. Treasury through TreasuryDirect.gov or invest in TIPS mutual funds and ETFs, which offer greater liquidity and convenience.

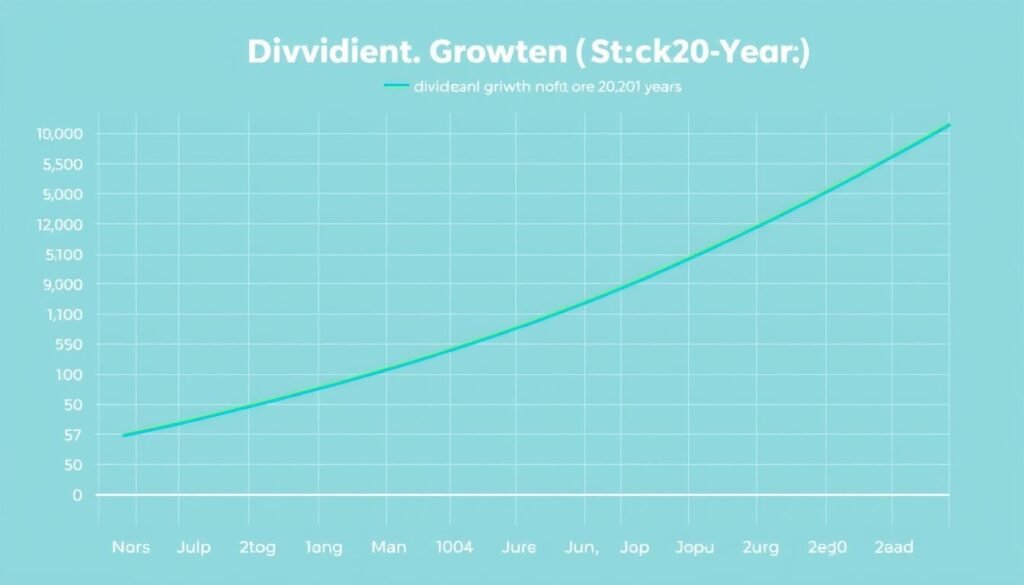

Dividend-Paying Stocks

Companies with a history of consistently increasing their dividends often make excellent inflation hedges. These businesses typically have strong pricing power, allowing them to pass increased costs to consumers while maintaining profitability. Look for companies with:

- A history of dividend increases spanning 10+ years

- Reasonable payout ratios (typically 40-60% of earnings)

- Strong balance sheets with manageable debt levels

- Consistent revenue and earnings growth that outpaces inflation

- Competitive advantages that allow for pricing power

Real Estate Investments

Real estate has historically served as an effective inflation hedge, as property values and rental income tend to increase alongside rising prices. For retirees, real estate investments can provide both appreciation potential and income:

Direct Property Ownership

Owning rental properties can provide inflation-adjusted income, as rents typically increase with inflation. However, this approach requires active management and dealing with tenant issues.

Real Estate Investment Trusts (REITs)

REITs offer exposure to real estate markets without the hassles of direct ownership. Many REITs focus on sectors with strong inflation protection, such as apartments, healthcare facilities, and warehouses.

Commodities and Precious Metals

Commodities like gold, silver, and broad-based commodity funds can serve as inflation hedges in your portfolio. During inflationary periods, hard assets often retain their value better than paper currency. Consider allocating 5-10% of your portfolio to these inflation-resistant assets.

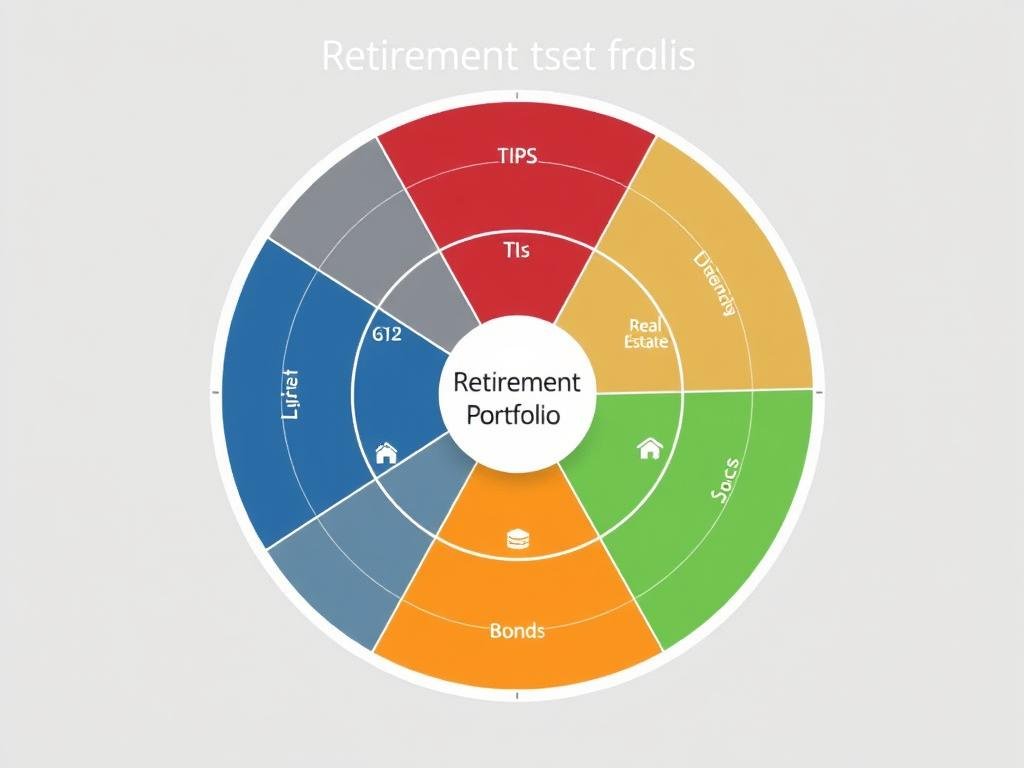

Diversification Strategy

Perhaps the most important strategy is maintaining a well-diversified portfolio across multiple asset classes. Different assets respond differently to inflation, so diversification helps ensure that at least portions of your portfolio will thrive regardless of economic conditions.

| Asset Class | Inflation Protection Level | Income Potential | Recommended Allocation |

| TIPS | High | Moderate | 10-20% |

| Dividend Stocks | Moderate to High | High | 20-30% |

| Real Estate/REITs | High | High | 10-15% |

| Commodities | Very High | Low | 5-10% |

| Short-Term Bonds | Low | Moderate | 15-25% |

| Cash | Very Low | Low | 5-10% |

Remember that these allocations should be adjusted based on your personal risk tolerance, time horizon, and specific financial situation. Working with a financial advisor can help you create a customized allocation strategy.

Beyond Investments: Additional Tactics

While investment strategies form the foundation of inflation protection, several other tactics can further strengthen your retirement security:

Delay Social Security Benefits

One of the most powerful inflation-fighting tools is delaying your Social Security benefits. For each year you postpone claiming beyond your full retirement age (up to age 70), your benefits increase by approximately 8%. This results in a substantially larger lifetime benefit that includes annual cost-of-living adjustments (COLAs).

Social Security Strategy: If your full retirement age is 67 and you delay claiming until 70, your monthly benefit will be 24% higher than if you had claimed at full retirement age, and approximately 77% higher than if you had claimed at 62.

Consider Inflation-Protected Annuities

Annuities with inflation protection features can provide guaranteed income that increases annually to offset rising prices. While these products typically have higher fees or lower initial payouts compared to standard annuities, they offer valuable protection against the long-term effects of inflation.

When evaluating inflation-protected annuities, compare options from multiple providers and pay close attention to:

- The specific inflation adjustment method (fixed percentage vs. CPI-linked)

- Fees and expenses associated with the inflation protection feature

- The financial strength and stability of the insurance company

- Surrender charges and liquidity provisions

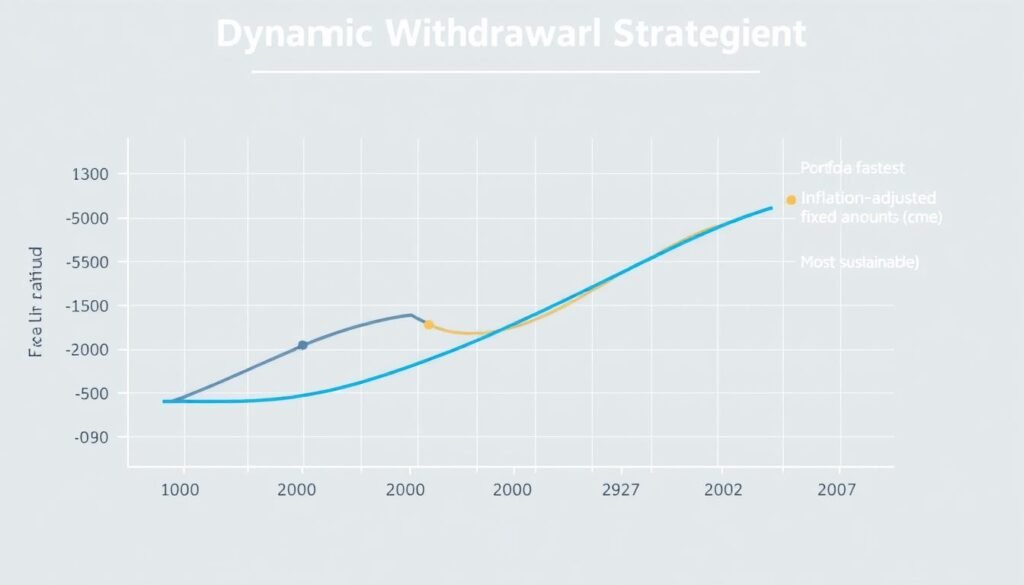

Implement a Dynamic Withdrawal Strategy

Rather than withdrawing a fixed dollar amount from your retirement accounts each year, consider using a percentage-based approach that adjusts based on your portfolio’s performance and inflation rates. This helps ensure your withdrawals remain sustainable throughout retirement.

Popular approaches include:

The 4% Rule with Inflation Adjustments

Withdraw 4% of your portfolio in the first year of retirement, then adjust that amount annually for inflation. This approach provides increasing income to match rising prices while maintaining a high probability of portfolio longevity.

The Guardrails Method

Start with a percentage-based withdrawal but establish upper and lower “guardrails.” If your portfolio performs exceptionally well, you can increase withdrawals (up to a ceiling). If it performs poorly, you reduce withdrawals (to a floor) to preserve capital.

Budget Strategically for Healthcare Costs

Healthcare expenses typically rise faster than general inflation and represent a significant portion of retirement spending. Consider these approaches to manage these costs:

- Maximize Health Savings Account (HSA) contributions during your working years

- Purchase Medicare Supplement (Medigap) insurance to limit out-of-pocket expenses

- Explore long-term care insurance options before retirement

- Budget for healthcare costs separately from other expenses, with higher inflation assumptions

Maintain Flexible Spending Habits

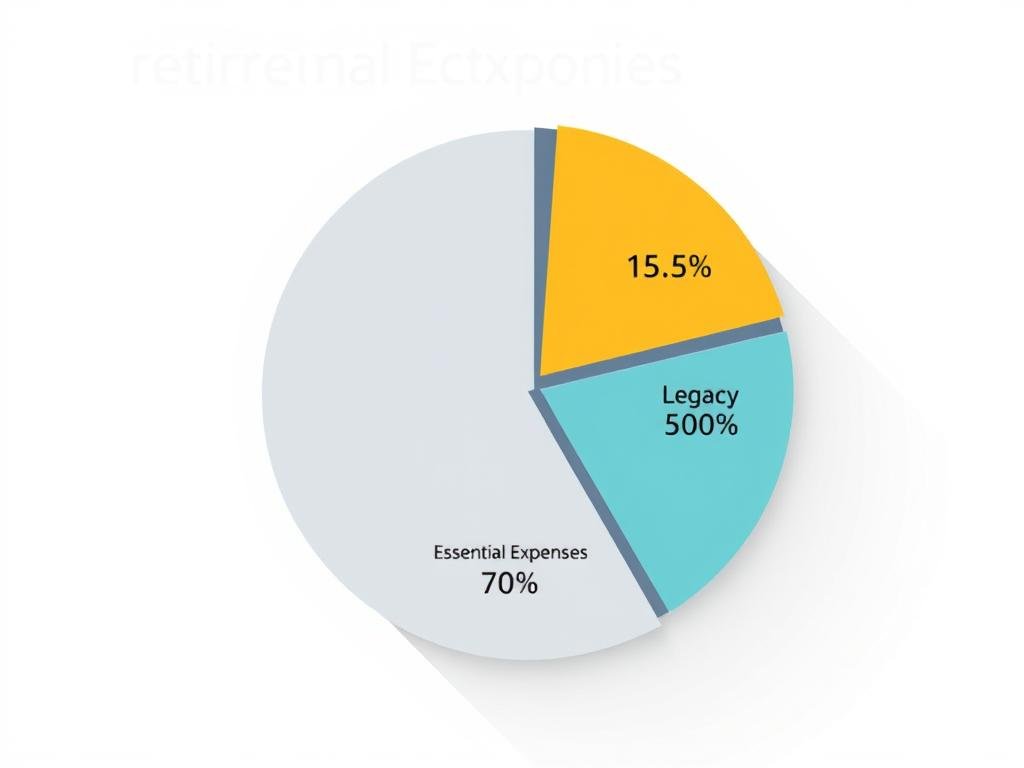

Developing adaptable spending habits can help you navigate inflationary periods more effectively. Consider categorizing your retirement expenses into:

Essential Expenses

Housing, food, healthcare, utilities, and transportation. These should be covered by guaranteed income sources when possible.

Lifestyle Expenses

Travel, entertainment, dining out, and hobbies. These can be adjusted during high inflation periods.

Legacy Expenses

Gifts, charitable donations, and inheritance plans. These are typically the most flexible during challenging economic times.

Regular Portfolio Review and Adjustment

Inflation protection isn’t a set-it-and-forget-it strategy. Regular review and adjustment of your retirement plan is essential as economic conditions change and you progress through retirement.

Consider conducting a comprehensive review of your inflation protection strategy at least annually, focusing on:

- Portfolio performance relative to inflation rates

- Changes in your spending needs and patterns

- Shifts in economic conditions and inflation expectations

- New investment opportunities that may offer better inflation protection

- Adjustments to your withdrawal strategy based on portfolio performance

Many retirees find it valuable to work with a financial advisor who specializes in retirement income planning. These professionals can provide objective analysis and recommendations tailored to your specific situation.

Conclusion: Taking Control of Your Inflation-Protected Retirement

Inflation represents a significant challenge for retirees, but with proper planning and strategic action, you can effectively protect your retirement savings from its erosive effects. By implementing a diversified investment approach that includes inflation-resistant assets, optimizing your Social Security claiming strategy, maintaining flexible spending habits, and regularly reviewing your financial plan, you can help ensure your retirement savings maintain their purchasing power throughout your golden years.

Remember that inflation protection isn’t about making dramatic changes to your portfolio or taking excessive risks. Instead, it’s about thoughtful planning, strategic diversification, and consistent monitoring to ensure your retirement remains secure regardless of economic conditions.

Get Your Personalized Inflation Protection Plan

Concerned about inflation’s impact on your retirement? Our experienced financial advisors can help you develop a customized strategy to protect your savings and ensure financial security throughout retirement.

Frequently Asked Questions

Can I rely solely on Social Security to keep up with inflation?

While Social Security benefits do include annual cost-of-living adjustments (COLAs), these adjustments may not fully keep pace with the inflation you personally experience, especially for healthcare costs. The Social Security COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which may not accurately reflect the spending patterns of retirees. Additionally, Social Security is typically designed to replace only about 40% of pre-retirement income for average earners, making it important to have additional inflation-protected savings.

How much of my retirement portfolio should be allocated to inflation-protected investments?

The ideal allocation varies based on your age, risk tolerance, and overall financial situation. However, many financial advisors suggest that retirees consider allocating 25-40% of their portfolio to investments with strong inflation-protection characteristics. This might include a mix of TIPS, dividend-growing stocks, REITs, and commodities. The specific allocation should be part of a comprehensive financial plan tailored to your individual needs and goals.

Are there any tax considerations when investing for inflation protection?

Yes, tax efficiency is an important consideration. For example, TIPS can be tax-inefficient when held in taxable accounts because you pay taxes on the inflation adjustments to principal each year, even though you don’t receive that money until maturity. Consider holding TIPS in tax-advantaged accounts like IRAs or 401(k)s. Similarly, investments that generate significant income, such as dividend stocks or REITs, may be more tax-efficient in retirement accounts. Work with a tax professional to optimize the tax aspects of your inflation protection strategy.

How often should I adjust my retirement withdrawal rate for inflation?

Most financial planners recommend adjusting your withdrawal amount annually based on the previous year’s inflation rate. However, during periods of unusually high inflation, you might consider making more frequent adjustments (semi-annually) to ensure your income keeps pace with rising costs. Remember that maintaining flexibility in your spending—being willing to reduce discretionary expenses during market downturns or high inflation—can significantly improve your portfolio’s longevity.

Should I pay off my mortgage before retirement to protect against housing inflation?

Paying off a fixed-rate mortgage before retirement can provide protection against housing inflation, as your housing costs become more stable and predictable. However, this decision should be evaluated in the context of your overall financial situation. If your mortgage interest rate is low and you have the opportunity to invest those funds at a higher return, maintaining the mortgage might make financial sense. Consider factors such as your tax situation, investment opportunities, emergency fund adequacy, and personal comfort with debt when making this decision.