When Maria called to say she felt rushed into a rollover, she described a glossy pitch and a promise that sounded like a sure thing. She paused, checked the paperwork, and asked the right questions. That small step saved her retirement from hidden fees and a costly custody mistake.

This guide shows you how to spot the same warning signs that almost trapped her. We explain common tactics: excessive markups, undisclosed fees, pressure to move fast, and illegal home storage claims.

You don’t need to be an expert to protect your nest egg. Learn the three-party setup that legitimate accounts use (dealer, custodian, approved depository) and how fraudsters blur those roles to create trouble with taxes and IRS rules.

Key Takeaways

- Recognize pushy sales tactics and ask for clear, written pricing.

- Verify custodian and storage separately before moving funds.

- Watch for hidden markups and non-compliant products.

- Understand that no investment is risk-free; beware of guarantees.

- Pause the pitch, ask questions, and keep control of your timeline.

Why scammers are targeting Gold IRAs in the United States in 2026

Economic stress pushes curious savers toward physical assets — and that attention brings risk.

Inflation peaked in 2022 and left many people wondering where to put their retirement funds. As demand for a gold ira and other precious metals rose, bad actors followed the interest and the money.

Rollovers are a high-friction moment. Paperwork, unfamiliar rules, and large balances create pressure. That urgency makes it easy to miss unusual fees or vague promises.

What a proper custody chain looks like

Clear roles protect you: a dealer or company helps buy the metal, an IRA custodian manages the account, and an IRS-approved depository stores the holdings. Each step should be named, documented, and verifiable.

“Slow down. Legitimate providers welcome questions and verification — urgency is a red flag.”

| Role | Function | What to verify |

|---|---|---|

| Dealer / company | Buys metals for the account | Licensing, product eligibility, pricing |

| Custodian | Administrates the retirement account | Custody policies, fees, IRS compliance |

| Approved depository | Secure physical storage | IRS approval, insurance, access rules |

- Ask for 24–72 hours to verify details; credible companies won’t rush you.

- The government rules for iras matter—anyone who “reinterprets” them is likely not trustworthy.

Gold IRA scams: the seven warning signs that should stop you in your tracks

Pause and scan for seven clear signals that an offer may not be legitimate. Use this quick stop-sign framework on any call, quote, or contract before you fund an account.

Unusually high markups

Compare any quoted price to the current spot baseline. Normal bullion markups are often 5–10% over spot; excessive quotes—especially hundreds of percent above spot—require a written cost breakdown.

Hidden fees that appear after setup

A low upfront pitch can turn costly once setup, annual maintenance, transaction, storage, and insurance charges are added. Ask for every fee in writing and total cost examples before you sign.

Pressure tactics and oversized allocations

Fear-based scripts, tight deadlines, or advice to move a large portion of savings quickly are classic ways bad actors take advantage of investors. If you feel rushed, step away.

Promises of guaranteed returns

No legitimate provider guarantees future gains or “risk-free” performance. Any promise of certain returns contradicts how markets work and should end the conversation.

Non-compliant products and purity claims

IRS rules require approved metals to meet purity standards (commonly 99.5% for certain metals) and come with documentation. Exclusive or numismatic items often carry extreme premiums and may not qualify.

Home storage pitches that violate rules

Claims you can store retirement metals at home or in a personal safe can trigger taxable distributions and penalties. Treat any home-storage suggestion as a compliance emergency.

Companies that can’t prove credibility

Watch for no verifiable address, thin operating history, evasive answers, or inconsistent reviews. A shaky company is a risky counterparty for your retirement assets.

“Slow down, get written numbers, and verify custody and storage independently.”

Quick next step: If you’re weighing physical holdings, read this primer on how to buy physical metal properly in a retirement account: can I buy physical gold in my.

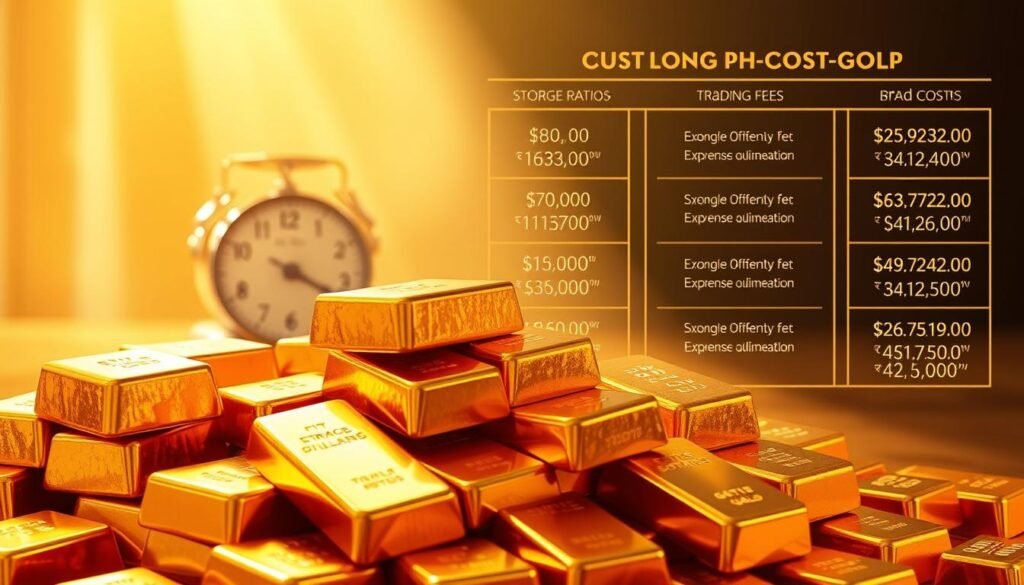

Pricing traps: inflated premiums, collectible coins, and bait-and-switch product offers

A clear price anchor separates fair offers from those that quietly take advantage of buyers.

Start by tying any quote to the live spot price. The Commodity Futures Trading Commission and futures trading commission guidance show typical bullion markup runs about 5%–10% over spot. If a quote is far higher, ask for an itemized explanation.

Real enforcement highlights the risk. In 2023 the SEC took action against red rock secured for promising small markups while some customers paid as much as 130% over spot. That case wiped out reported retirement value for many investors.

Why collectible coins often fail as retirement products

Numismatic pieces carry premiums of 40%–200%. Their value is subjective and resale is harder than for standard bullion.

That gap means you may not recoup the premium even if the market price rises.

Comparing quotes across companies and custodians

Get at least three like-for-like quotes from different gold ira companies and ira companies.

- Confirm the exact product: mint/refiner, weight, and serials.

- Anchor each quote to the same spot time stamp and calculate the percent markup.

- Ask custodians to explain any fee or storage differences in writing.

| Compare | What to confirm | Red flag | Reasonable range |

|---|---|---|---|

| Premium over spot | Show spot time and premium % | Unexplained 50%+ | 5%–10% |

| Product type | Mint, weight, purity | “Rare” without certification | Standard bullion bars/coins |

| Buyback policy | Written repurchase terms | No clear buyback or low bid | Transparent market-based offer |

| All-in cost | Spot, premium, fees, storage | Missing line-item fees | Single-page summary |

“Anchor every quote to spot, demand written fees, and walk away from vague promises.”

Discipline wins: the best option is one you can explain in a single page: spot, premium, all fees, storage, and buyback rules. When numbers are clear, you control the decision and avoid costly surprises.

Fee transparency check: what reputable gold IRA companies disclose upfront

Before you sign, demand a full cost breakdown that shows year one and year two totals. Insist on a single written schedule that lists every charge so nothing is hidden in the fine print.

Typical cost categories to demand in writing

Ask for line items for setup and annual administration, storage and insurance, commissions, and transaction fees. A reputable gold ira company will explain each fee and what it covers.

Storage costs that raise concern

Reasonable storage often runs roughly $100–$300 per year. Pooled storage can be near $100, while segregated or special handling is higher.

Sky-high storage charges or vague storage descriptions are warning signs. They can mask price padding or a misrepresented custody arrangement.

Contract red flags when the fine print contradicts the salesperson

Look for clauses that add commissions, change storage terms, or limit buybacks compared with verbal promises. If the contract and pitch disagree, pause and get a reconciled document.

“Insist on totals, not fragments: what will I pay in year one and year two, all-in?”

| Item | What to request | Reasonable range |

|---|---|---|

| Setup | One-time written setup fee | $0–$150 |

| Annual administration | Custodian/administration fee in writing | $50–$250/yr |

| Storage & insurance | Type (pooled/segregated) and cost per year | $100–$300/yr |

- Fee transparency checklist: request a single-page schedule covering setup, annual admin, storage, insurance, commissions, and transaction charges.

- Compare fee schedules across companies before you fund; small differences compound over time.

Compliance and custody: IRS rules scammers love to “reinterpret”

Clear custody and storage rules protect your account from costly tax reclassifications.

Compliance is protection, not paperwork. Government rules keep an account tax-advantaged. If someone promises a special exception for home storage, treat that as a disqualifying claim.

IRS-approved depository requirements and why home storage is a dangerous myth

The IRS does not allow retirement precious metals to sit at home. Metals must be held by a custodian in an approved depository. Violations can become taxable distributions and may trigger penalties, sometimes severe.

How custodians protect account compliance—and what happens when rules are broken

Custodians administer the account. They execute purchases and sales, report to the government, and ensure storage meets IRS rules. That separation preserves tax benefits and avoids prohibited transactions.

“Name the depository and custodian, and show me where the storage terms are documented.”

Ask for specific names and written storage terms. If a provider can’t answer, walk away—the cost of getting rules wrong often far exceeds any perceived savings.

| Area | What to verify | Why it matters |

|---|---|---|

| Storage location | Named approved depository and insurance | Prevents taxable distribution and penalties |

| Custodian details | Company name, fees, reporting practices | Ensures legal administration and IRS filings |

| Home storage claims | Written policy or denial | Home storage is noncompliant and disqualifying |

Reputation and verification: how to vet a gold IRA company before funding

Before you hand over a single dollar, run a quick reputation check that takes less than 20 minutes. A little research saves time and protects retirement savings.

How to use the Better Business Bureau the smart way

Visit the better business bureau entry for the company. Don’t stop at a grade. Read complaint narratives, look for patterns, and compare the Business Started and BBB File Opened dates for timeline consistency.

Cross-check reviews and public records

Compare Google, Trustpilot, and Consumer Affairs for repeated themes or odd review spikes. Verify details match across sites: address, phone, and product names.

Confirm registration and online footprint

Search Secretary of State databases to confirm incorporation and active status. Map the listed address and call the published phone number. No contact info or a virtual-office address is a strong warning.

“Thorough research is disciplined investing, not paranoia.”

| Step | What to verify | Why it matters |

|---|---|---|

| Identity | Registered name, address | Reveals longevity and legitimacy |

| Reviews | Consistency across sites | Detects fake or manipulated ratings |

| Custody partners | Named custodian and depository | Protects tax status and storage |

Quick workflow: verify identity, check history and pricing transparency, confirm custody partners, then decide. For investors, this habit makes choosing a reputable gold ira or ira company far safer.

Your safer buying path: steps that make scams harder and confidence easier

Take a measured path—small tests, clear papers, and known partners make risky offers fade fast.

Start small, then scale

Begin with the minimum allocation to test order flow and customer service. Use this first purchase to confirm paperwork, delivery to the depository, and after-sale support.

If everything matches the written promises, scale slowly. This protects your money and gives you time to verify each step.

Choose established partners across the chain

Select a reputable company, a credible custodian, and a known depository. Longevity matters—examples with long operating histories include Brink’s (1859), A‑Mark (1965), CNT (1972), IDS (1976), and Delaware Depository (1999).

Verify names, licenses, and insurance before any transfer of funds.

Avoid unsolicited pressure and limited-time offers

When you get an uninvited call or email, pause. Take the company name, end the call, and verify independently on your timeline.

Legitimate retirement decisions rarely need urgent action. Treat any push for a quick move as a signal to step back and re-check fees and product eligibility.

When to bring in a licensed advisor

Consider professional help if you plan a large allocation, a complex rollover, or if you’re unsure about diversification.

A licensed advisor can save money by preventing costly mistakes and overconcentration.

If you suspect fraud: document and report

Record names, dates, emails, contracts, wire instructions, and any claims or promises. This paper trail helps regulators act.

“Document everything and report suspicious activity to the SEC, FTC, and CFTC.”

Filing reports with those agencies creates an official record and increases the chance of recovery or enforcement action.

- Safer path checklist: set your timeline, verify the chain, insist on written promises, start small, and document everything before you move funds.

Conclusion

Small checks—written prices, named custodians, and verified storage—prevent big losses. You can include a gold ira as part of a diversified retirement plan, but treat fraud risk as predictable and manageable with process.

Keep a short checklist in hand: pricing, fees, pressure, guarantees, product compliance, storage compliance, and company credibility. If any item is vague, demand clear paperwork before you move funds.

Compliance is the anchor: precious metals held for an ira require approved custody and proper documentation. Shortcuts can trigger taxes and penalties.

Next step: compare offers, verify reputations, start small, and pick partners who respect your time and protect your long-term goals.

FAQ

What are the biggest warning signs that a precious metals retirement offer might be fraudulent?

Look for unusually high markups above the spot price, vague or hidden fees, hard-sell tactics that create false urgency, promises of guaranteed returns, product purity or documentation that can’t be verified, and proposals for home storage that contradict IRS rules. If a company won’t provide written quotes, custodial details, or a clear depository name, step back and research further.

Why are fraudsters focused on precious metals IRAs during economic uncertainty?

Market volatility and waves of rollover decisions create opportunity. Promoters exploit fear and the desire for diversification, pushing investors to move retirement assets quickly. Scammers count on confusion about custodians, storage rules, and tax consequences to close misleading deals before buyers verify details.

What does a legitimate precious metals retirement setup include?

A legitimate arrangement names a licensed custodian, an IRS-approved depository for physical metals, transparent fees in writing, and verifiable product documentation showing purity and provenance. Reputable firms let you confirm custodian registration, provide third-party assay certificates, and refuse to recommend home storage for IRA-held metals.

How can I tell if a company’s premiums are reasonable or excessive?

Compare written quotes from multiple reputable dealers and ask for a line-item breakdown of spot price, dealer premium, and any commissions or shipping charges. Reference Commodity Futures Trading Commission (CFTC) guidance and recent enforcement actions for context. Excessive markups often exceed typical spreads for bullion and vary widely for collectible coins.

Are rare or numismatic coins suitable for retirement accounts?

Rare and collectible coins often carry steep, subjective premiums and can be hard to resell at fair value. Most retirement investors benefit more from IRA-approved bullion with clear purity standards and wide market liquidity. If a salesperson pushes rare pieces, treat that as a red flag unless you can verify fair-market pricing and liquidity.

What fees should a reputable company disclose up front?

Demand written disclosure of setup fees, annual custodial fees, storage charges, transaction or dealer commissions, insurance costs, and any termination or shipment fees. Transparent companies list typical ranges and the exact fee schedule for your account. If fees appear only after account setup, consider it a major warning sign.

Why is home storage a dangerous proposition for retirement metals?

IRS rules require IRA-owned physical metals to be held by an approved third-party depository or trustee. Home storage can trigger taxes, penalties, and disqualification of the tax-advantaged status. Legitimate custodians and depositories protect compliance and help preserve retirement benefits.

How do custodians and depositories protect compliance and investors?

Custodians maintain the account structure and ensure transactions follow IRS rules. Depositories provide segregated or allocated storage, insurance, and inventory controls with independent audits. Together they create a verifiable chain of custody that prevents the misuse or unauthorized removal of assets.

What steps should I take to verify a company’s reputation before funding an account?

Check Better Business Bureau ratings and complaint histories, cross-check reviews on Google, Trustpilot, and ConsumerAffairs, confirm business filings at your Secretary of State, and verify a real physical address and phone number. Look for consistent operating history, and be wary when contact details or registration can’t be confirmed.

How can I compare quotes across companies and custodians effectively?

Request itemized written quotes that separate spot price, dealer premium, custodial fees, storage, insurance, and any commissions. Use the same product specs (weight, purity, and SKU) for each quote. Compare total cost to buy in and recurring annual costs to hold and eventually sell.

What contract language or clauses are common red flags?

Watch for vague refund policies, automatic rollovers without consent, arbitration clauses that limit legal recourse, surprise termination fees, or fine print that contradicts verbal promises. If a salesperson’s statements aren’t reflected in the contract, don’t sign until terms are corrected in writing.

How should I test a provider before committing a large allocation?

Start small and use a minimal transfer to evaluate service, transparency, and delivery timelines. Confirm that the custodian processes the transfer correctly, the depository provides documentation, and the metal’s purity is independently verifiable. Scale only after you’re satisfied with the process.

When should I consult a licensed financial advisor or attorney?

Bring in a trusted, independent advisor when rollover choices are complex, when promised returns sound too good to be true, or when contract wording is unclear. Professionals can help assess tax implications, diversification strategies, and whether the dealer and custodian meet industry standards.

If I suspect fraud or deceptive sales practices, where should I report it?

Document all communications, preserve contracts and quotes, and report to the Securities and Exchange Commission (SEC), Federal Trade Commission (FTC), and Commodity Futures Trading Commission (CFTC) as appropriate. Also file complaints with your state attorney general, the Better Business Bureau, and the custodian’s regulators.

How do I verify product purity and IRS approval for bullion?

Request assay certificates, manufacturer documentation, and item serial numbers. Ensure products meet the IRS’s acceptable purity thresholds (for example, .995 for many types of bullion) and are listed as allowable retirement metals. If a seller resists providing verifiable documentation, walk away.

What role do insurance and segregation play in safe storage?

Reputable depositories provide insurance that covers loss, theft, and damage, and offer segregated or allocated storage that keeps your metals identifiable and separate from others. Ask for written proof of insurance limits and storage method and verify that independent audits back those claims.

Social Security Benefits: How They Work

Social Security provides a foundation of retirement income for millions of Americans. Benefits are calculated based on your lifetime earnings, with higher earners generally receiving larger monthly payments. The age at which you begin collecting benefits also impacts your payment amount—starting before your full retirement age reduces your benefit, while delaying until age 70 increases it.

Two key aspects of Social Security that interact with retirement accounts like Gold IRAs are:

The Earnings Test

If you claim Social Security benefits before reaching your full retirement age (currently between 66-67 for most people), your benefits may be temporarily reduced if your earned income exceeds certain thresholds. In 2025, beneficiaries can earn up to $23,400 without penalty if they’ll reach full retirement age after 2025.

Taxation of Benefits

Your Social Security benefits may become partially taxable when your “combined income” exceeds certain thresholds. Combined income is calculated as:

Combined Income = Adjusted Gross Income + Nontaxable Interest + ½ of Social Security Benefits

For individuals with combined income between $25,000 and $34,000 (or couples filing jointly with combined income between $32,000 and $44,000), up to 50% of benefits may be taxable. Above these upper thresholds, up to 85% of benefits may be taxable.