Years ago, a colleague called after a rollover and sounded stunned. He thought his move would be simple. Instead, surprise transaction charges and storage add-ons cut his expected return. That call began our mission: to list every cost so investors do not get blindsided.

This introduction defines “hidden” in plain terms: not illegal, but often minimized, bundled, or shown only after you commit. Doug Young and Rick Erhart note common categories—setup, annual maintenance, storage, transaction charges, and the big stealth costs: purchase premiums and sell-back spreads.

Read on to protect retirement outcomes by spotting each cost before you open an account or place a trade. This guide promises a practical checklist to use on sales calls and in follow-ups. The goal is clear: an informed investment strategy so your decision rests on facts, not a pitch.

Key Takeaways

- “Hidden” means bundled or disclosed late, not necessarily illegal.

- Expect setup, ongoing admin, storage, and transaction line items.

- Watch premiums and sell-back spreads—they act like stealth charges.

- Use the checklist during calls and emails to get clear, written answers.

- An investor-first approach makes the best decision repeatable and measurable.

Why “hidden costs” matter when you’re protecting your retirement portfolio with physical gold

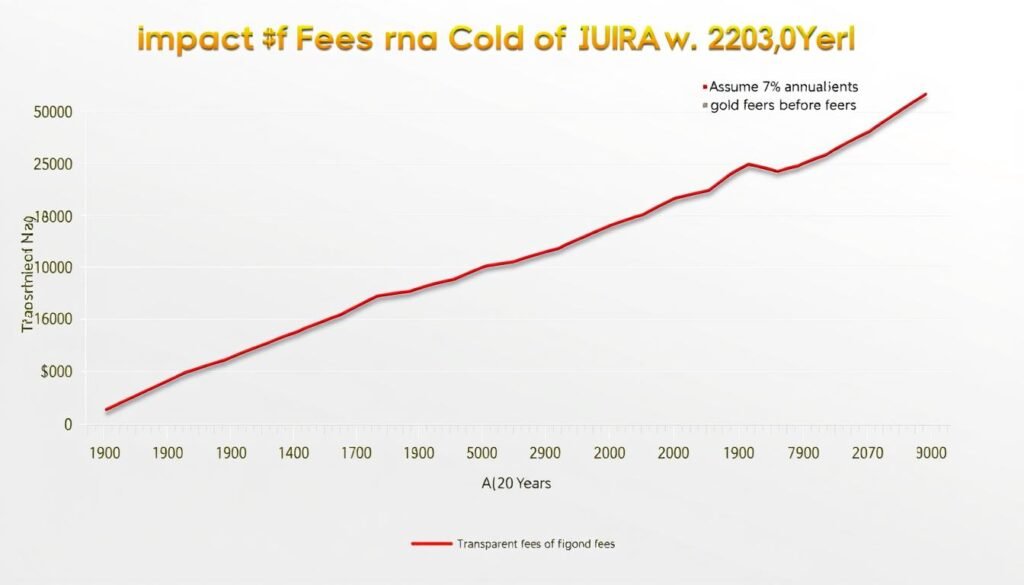

When building a retirement portfolio, recurring charges change the long-term math more than most investors realize.

Consider this simple benchmark: the average annual cost to maintain a precious metals ira sits near $250. That sounds modest until you model compound returns over a decade.

A 1% higher annual cost on a $100,000 holding can reduce value by more than $20,000 over ten years. Every dollar lost to friction is a dollar that does not compound. Over multi-decade horizons, that adds up and changes retirement savings outcomes.

Why are these costs higher than in traditional iras? Physical assets require a custodian, secure storage, insurance, and extra paperwork. Those necessary services create more line items on statements.

People add physical gold to a portfolio to hedge inflation and smooth market volatility. But that promise only holds when pricing is transparent and allocations are intentional. If costs are opaque, resilience weakens.

- Anchor your expectations: use the ~$250 annual benchmark when vetting providers.

- Think opportunity cost: lower friction means more compounding for retirement savings.

- Next step: turn this “why it matters” into an actionable checklist in the following section.

For a deeper look at cost components and how they affect long-term planning, read this detailed guide on understanding the costs of a precious metals.

The complete hidden checklist (what to ask before you open an ira account)

A short script of questions saves money by forcing clear answers before you fund an account.

Use the list below aloud during calls and then ask for written confirmation. Record the answers and attach them to your account paperwork. This protects you from surprise line items after a purchase of precious metals.

One-time setup and account creation

Ask: who charges setup fees and what they cover. Typical setup ranges $50–$100. Confirm whether the custodian or the dealer bills this and if any paperwork or transfer processing is included.

Annual maintenance and storage

Ask: the base maintenance charge and add-ons. Annual maintenance commonly runs $75–$250; budget near $250.

Ask: storage facility costs and insurance. Storage is often $100–$300 per year and is required for IRA-held metals.

Transaction and movement charges

- Transaction processing: 1–2% or $25–$50 per trade.

- Wire, distribution, partial distribution: $25–$100+ depending on action.

- Shipping/handling: $0–$40 per shipment; often billed after purchase.

Fine print penalties

Late payments, statement reissues, and expedited processing add up. Demand a complete, written fee schedule before you transfer funds or place an order.

| Charge | Typical Range |

|---|---|

| Setup | $50–$100 |

| Maintenance | $75–$250 |

| Storage | $100–$300 |

| Trade processing | 1–2% or $25–$50 |

True first-year cost math: what a $100,000 gold IRA can really cost in today’s market

Let’s run the real numbers so a $100,000 position shows its true first-year drag.

Baseline line items: setup ~$100, annual admin ~$100, storage ~$150. Add a trade processing charge (conservative) of $50 and shipping or wire costs of $0–$40. Those operational items total roughly $400–$450 in year one.

Example breakdown using real ranges

On top of admin and storage, the main drag is purchase premium. For a $100,000 purchase, a 5% premium equals about $5,000. Combine that with the $350–$450 admin bundle and the first-year all-in sits near $5,350 or ~5.35% of the account.

The big bite: purchase premiums and why they matter

Spot price is the market quote you see on TV. The premium covers minting, fabrication, and the dealer margin. That gap—commonly 3%–5%—often dwarfs visible account charges.

How a 1% fee difference compounds

A 1% higher annual drag on $100,000 can cost more than $20,000 over ten years when compounding is included. Treat these charges like a silent tax on your long-term value and ask for every line item in writing.

Next: custodians price administration differently. Know each line on the statement so you control costs and protect your investment.

Setup and ongoing account fees: how custodians price your precious metals IRA

Start by understanding exactly what a custodian charges and why those charges exist. A custodian’s job goes beyond holding assets. They handle compliance, reporting, record-keeping, and IRS-required administration so the account stays tax-compliant.

What you’re paying for

Custodial work includes: annual tax reporting, valuation records, transaction logging, and trustee paperwork. These functions justify the maintenance line on your statement.

Common line items on statements

Typical admin components run from $75–$300/yr. Online access often appears as $0–$30/yr. Statement or mailed statement charges are commonly $0–$25.

How waived setup fees can shift costs

Some firms remove setup charges to attract clients, then recoup the margin through higher premiums or recurring charges. Separate custodian charges from dealer pricing to spot this shift.

“Ask for a full, written schedule — know which line items are flat, which are percentage-based, and which change with account size.”

Mini-audit: a quick step-by-step

- Request a complete written fee schedule and two recent sample statements.

- Confirm which charges are billed by the custodian versus the dealer.

- Check which charges vary with account value and which are fixed.

| Charge type | Typical range | Who bills |

|---|---|---|

| Account maintenance | $75–$300 / yr | custodian |

| Online access | $0–$30 / yr | custodian |

| Statements (paper) | $0–$25 / issue | custodian |

| Setup / onboarding | $50–$100 one-time | custodian or dealer |

Benefit: a transparent price model makes long-term planning possible and reduces surprises. Before you fund the account, request sample statements and a written schedule so the process stays predictable.

Storage and insurance: the real cost of keeping gold IRAs compliant and secure

A compliant metals holding requires outside storage, and that reality shapes long-term expense and access.

Why third‑party storage matters: gold iras must use an approved depository to stay compliant. That makes storage an ongoing, required cost — not an add‑on you can skip.

Segregated vs. commingled: segregated storage (separate bins, clear ownership) usually runs about $150–$300 per year. Commingled or non‑segregated options typically cost roughly $100–$250 per year.

Security measures and insurance are commonly bundled into those charges, but confirm what the plan covers in writing. Ask whether insurance limits, deductibles, or special riders apply.

Costs shift with account size, metal type, and the chosen depository. Larger holdings or rare metals can change the schedule, so watch tiered pricing and receiving/shipping surcharges.

- Which depository holds my metals?

- Are there tiered storage schedules or extra shipping costs?

- What exactly does insurance cover and who underwrites it?

Access reality: if it’s not your vault, it’s not your metal. In a crisis, withdrawals can slow, and logistics can add time. Knowing constraints helps align storage options with your retirement goals and your sense of security.

Purchase premiums and sell-back spreads: the fee you pay without seeing it

The single largest hidden cost is often the markup baked into the buy price. That premium is not a line on your statement—it arrives as the gap between spot and what you actually pay.

Spot price vs your price: premiums commonly run 3%–5% above spot. For example, on a $2,000/oz market price, a 4% premium adds $80 per ounce. Multiply that across ounces and you see how purchase markups erode value immediately.

Sell-back spreads: when you exit, expect a 1%–2% haircut versus prevailing quotes. Even if the market rises, that spread lowers realized proceeds and shortens gains at sale.

Numismatic markups and why they matter

Collectible or numismatic pieces can carry 50%–200% markups over spot. Many investors chase rarity and then face thin secondary markets and higher resell friction.

IRA-eligible bullion basics

IRA-eligible bullion must meet strict purity and form rules. Stick to qualifying bars and rounds to avoid steep markups and resale uncertainty.

- Ask: “What is today’s premium over spot?”

- Ask: “What is your written buyback policy and typical spread?”

- Ask: “Which coins or bars you recommend that meet IRA eligibility?”

“Make the invisible visible: pricing transparency protects long-term value and keeps diversification effective.”

Practical step: compare dealer quotes at a single market snapshot and favor plain bullion over collectibles. For a guide to buying compliant physical bullion inside a retirement account, see buying physical bullion in an IRA.

Transaction, transfer, and distribution “gotchas” that erode value

Small operational steps can quietly shave returns when you move retirement holdings between custodians.

Direct trustee-to-trustee transfers are the safest step to transfer funds. They usually arrive with no incoming charge and avoid withholding or extra tax paperwork. An indirect rollover can trigger withholding, missed deadlines, and extra processing that raise costs.

Direct rollover vs indirect rollover

Use a direct transfer whenever possible. Let the sending custodian and the receiving custodian coordinate the move. This step reduces tax risk and common billing surprises.

Transfer funds checklist

- Confirm who initiates the move and which forms you must sign.

- Get a written timeline for each step of the process.

- Ask whether incoming transfers are free or if your old custodian charges a termination amount.

- Verify account numbers and custodian contact names before any funds leave.

Wire, trade processing, and transaction costs

Wires commonly run $25–$50 per movement. Trade processing is often $25–$50 per trade or 1%–2% of the transaction.

Frequent trading multiplies these costs. Each buy or sell may incur processing charges and widen spreads. Active management can turn an investment into a recurring cost center.

Distribution and partial distribution charges

Full distributions typically cost $25–$100. Partial distributions often land near $25–$50. Plan liquidity needs so you avoid surprise charges when you access funds.

“Ask for a written ‘fee for every action’ list: wires, ACH, checks, expedited processing, paper statements, and termination charges.”

| Action | Typical Range | Who Charges | Notes |

|---|---|---|---|

| Direct trustee transfer | Often $0 incoming | Custodians | Prefer this route to avoid tax and processing friction |

| Wire transfer | $25–$50 | Custodian or bank | Billed per movement; confirm routing step |

| Trade processing | $25–$50 or 1%–2% | Custodian or dealer | Applies per buy/sell; frequency increases total costs |

| Partial distribution | $25–$50 | Custodian | Plan withdrawals to reduce repeat charges |

Final step: request written confirmation of every line before you sign. Anticipating these costs keeps your gold ira an investment tool — not a toll road. For more practical checks, see this helpful resource on custodian transfer steps.

Comparing gold IRA fees to traditional IRAs: what you get for the extra costs

Deciding whether to hold physical metals in retirement starts with honest math — not emotion.

Why physical assets add layers: Unlike standard paper accounts, custodial oversight, secure storage, insurance, and specialized handling are required. These services create recurring charges you won’t see in many traditional iras. Custodians must maintain compliance records, depositories charge storage, and insurers add policy costs. Together, these items explain why gold iras typically cost more than traditional iras.

The extra work protects the holding and meets IRS rules, but it also raises the ongoing drag on returns. Market volatility can make tangible allocations feel emotionally safer, yet that benefit vanishes if recurring costs outpace the hedge.

How to judge if the diversification benefits justify higher costs

Use your portfolio goals as the lens. Ask how long you will hold physical metal, what percent of your portfolio you will allocate, and how much you value liquidity versus tangible ownership.

- Expected holding period: longer horizons absorb transaction spreads and setup charges better.

- Allocation size: larger positions lower the effective per-dollar cost.

- Willingness to pay for custody: decide if storage and insurance are worth the peace of mind.

- Liquidity needs: frequent trading multiplies costs and narrows benefits.

Compare total costs as an “effective expense ratio.” Model recurring charges plus purchase and sell spreads against likely returns. When you know why each line exists, you can demand transparency and shop providers with confidence.

How to shop for a gold IRA company without getting surprised later

A clear shopping method removes surprise charges and gives you control over your retirement plan.

Request a written fee schedule: every fee, every time, in plain English

Ask each company for a complete, written schedule covering setup, annual admin, storage, wires, trade processing, distributions, shipping, and closeout.

Insist on plain English. If a line item looks vague, ask who bills it and how often it will recur.

Questions that reveal markups and buyback terms

Get these numbers on the record: current premium over spot (typically 3%–5%) and expected sell-back spread (1%–2%).

Also request written buyback terms and whether quotes are locked for a set period. These queries expose the true cost of any purchase.

Minimum investment realities

Many investors lower their effective expense ratio by starting at $25,000–$50,000.

At those balances, a ~$250 annual maintenance charge becomes roughly 0.5%–1% of the account. Smaller accounts feel disproportionately expensive.

Compare providers consistently: an apples-to-apples checklist

- Same storage type (segregated vs. commingled)

- Same custodian billing model

- Same assumed trade frequency and product types

Red flags in sales pitches

Watch for urgency tactics, “act now” pressure, and “free” promotions without math. Free setup can be recovered in higher premiums or recurring charges.

Avoid strong pushes toward high-markup collectibles unless you understand resale liquidity and spreads.

| What to request | Why it matters | Typical data point |

|---|---|---|

| Written fee schedule | Shows every recurring and one-time charge | Setup, annual, storage, wires |

| Premium over spot | Reveals purchase markup | 3%–5% |

| Sell-back terms | Determines realized proceeds | 1%–2% spread |

Final step: use the same checklist with every company and get answers in writing. You do not need to outsmart the whole market—just ask the right questions before you fund the account and protect your retirement investments.

Conclusion

A quick final check can keep months—or years—of small charges from eroding your retirement plan.

Recap the practical benchmarks: setup $50–$100, annual maintenance commonly near $250, storage $100–$300, transaction processing 1%–2% or $25–$50, premiums 3%–5% and sell-back spreads 1%–2%.

Before you fund, request written confirmation: full fee schedule, current premium and spread, custodian and depository name, storage type, and any distribution charges. Confirm who bills each line and expected timelines for access to your metals.

Own your allocation efficiently: when you ask better questions, you keep more of your savings. Use the checklist, run the math for your funds, and choose transparency over hype so your retirement portfolio works for you, not against you.

FAQ

What is the "Hidden Cost" checklist and why should I use it before opening a precious metals IRA?

The checklist is a practical guide listing every potential charge related to a metals IRA — setup, annual administration, storage, transaction processing, premiums, and transfer or distribution costs. Use it to compare custodians, estimate first-year and ongoing expenses, and avoid surprises that erode retirement savings and portfolio diversification benefits.

How do small annual costs compound and affect my retirement savings when holding physical metals?

Small recurring charges—like a 0 annual admin fee or a 1% transaction spread—reduce your compounding base. Over a decade, those costs can shave thousands from returns, especially when combined with purchase premiums and sell-back spreads. Factoring these in helps you measure true net performance versus the advertised price.

How does a precious metals IRA differ from traditional IRAs when it comes to fees?

Metals IRAs require third-party custody and insured storage of physical assets, so you’ll see additional line items not typical in cash or brokerage IRAs: depository storage, insurance, and shipping. Custodians also charge for specialized reporting and record-keeping required by the IRS for tangible assets.

What is the typical range for one-time setup or account creation charges?

One-time setup fees commonly fall between and 0. Some firms waive this to attract new accounts but then offset costs through higher purchase premiums, transaction charges, or elevated annual admin fees. Always request the written fee schedule.

How much do annual maintenance and administration fees usually cost?

Annual admin fees often range from to 0 or more, with an industry average near 0 for smaller accounts. These cover custodial services, IRS-required reporting, and account access. Larger account balances sometimes qualify for lower effective rates.

What should I expect to pay for IRS-approved depository storage?

Storage facility fees typically run 0 to 0 per year depending on whether holdings are segregated or commingled, plus insurance. Costs vary by depository, metal type, and account size; segregated storage costs more but keeps your bars or coins separate from others.

What are typical transaction fees when buying or selling metals inside an account?

Transaction fees or dealer markups commonly amount to 1%–2% of the trade or fixed fees of – per trade. Premiums above spot price when you buy and spreads when you sell are often the largest unseen cost, so compare buy and sell pricing closely.

Are there wire transfer, distribution, or partial distribution fees I should plan for?

Yes. Wire fees and distribution charges can range from to 0+ depending on the custodian and the action. Partial distributions may trigger additional handling or shipping charges. Clarify these amounts before initiating rollovers or distributions.

Do shipping and handling costs apply even if the metals stay in a retirement account?

They can. If you request physical delivery upon distribution or move metals between depositories, shipping and handling fees — often

FAQ

What is the "Hidden Cost" checklist and why should I use it before opening a precious metals IRA?

The checklist is a practical guide listing every potential charge related to a metals IRA — setup, annual administration, storage, transaction processing, premiums, and transfer or distribution costs. Use it to compare custodians, estimate first-year and ongoing expenses, and avoid surprises that erode retirement savings and portfolio diversification benefits.

How do small annual costs compound and affect my retirement savings when holding physical metals?

Small recurring charges—like a $150 annual admin fee or a 1% transaction spread—reduce your compounding base. Over a decade, those costs can shave thousands from returns, especially when combined with purchase premiums and sell-back spreads. Factoring these in helps you measure true net performance versus the advertised price.

How does a precious metals IRA differ from traditional IRAs when it comes to fees?

Metals IRAs require third-party custody and insured storage of physical assets, so you’ll see additional line items not typical in cash or brokerage IRAs: depository storage, insurance, and shipping. Custodians also charge for specialized reporting and record-keeping required by the IRS for tangible assets.

What is the typical range for one-time setup or account creation charges?

One-time setup fees commonly fall between $50 and $100. Some firms waive this to attract new accounts but then offset costs through higher purchase premiums, transaction charges, or elevated annual admin fees. Always request the written fee schedule.

How much do annual maintenance and administration fees usually cost?

Annual admin fees often range from $75 to $250 or more, with an industry average near $250 for smaller accounts. These cover custodial services, IRS-required reporting, and account access. Larger account balances sometimes qualify for lower effective rates.

What should I expect to pay for IRS-approved depository storage?

Storage facility fees typically run $100 to $300 per year depending on whether holdings are segregated or commingled, plus insurance. Costs vary by depository, metal type, and account size; segregated storage costs more but keeps your bars or coins separate from others.

What are typical transaction fees when buying or selling metals inside an account?

Transaction fees or dealer markups commonly amount to 1%–2% of the trade or fixed fees of $25–$50 per trade. Premiums above spot price when you buy and spreads when you sell are often the largest unseen cost, so compare buy and sell pricing closely.

Are there wire transfer, distribution, or partial distribution fees I should plan for?

Yes. Wire fees and distribution charges can range from $25 to $100+ depending on the custodian and the action. Partial distributions may trigger additional handling or shipping charges. Clarify these amounts before initiating rollovers or distributions.

Do shipping and handling costs apply even if the metals stay in a retirement account?

They can. If you request physical delivery upon distribution or move metals between depositories, shipping and handling fees — often $0–$40 per transaction or more for insured courier service — may apply. Many investors overlook these when planning exits.

What late payment fees or other fine-print penalties should I watch for?

Custodians may charge late fees for missed payments, inactivity fees, or penalties for missed documentation. These charges are usually modest individually but can accumulate. Ask for the full penalty schedule and payment terms.

How do purchase premiums and sell-back spreads affect my cost basis?

Purchase premiums (commonly 3%–5% above spot) increase your cost basis when you buy. Sell-back spreads (often 1%–2%) reduce the net you receive when selling. Together they create a bid-ask cost that can materially lower returns, particularly for frequent traders or those buying small lots.

Why are some coins marked up far above spot price?

Numismatic or collectible coins carry scarcity and grading premiums that can reach 50%–200% above spot. They often fall outside IRA-eligible bullion rules or present higher liquidity risk. For retirement holdings, stick to IRA-eligible bullion to limit excessive markups.

How can a 1% fee difference translate into a large dollar amount over time?

A 1% annual cost difference on a $100,000 account compounds over years. It reduces the capital available to grow, so over a decade that gap can translate into tens of thousands in lost portfolio value. Modeling fee impacts helps you choose providers that keep long-term costs low.

What should I expect curbside when transferring funds via direct rollover versus indirect rollover?

A direct rollover transfers funds straight between custodians with minimal tax friction and lower risk of fees for early distribution. Indirect rollovers require you to receive funds first and redeposit within 60 days; they risk tax withholding and extra charges if mishandled. For metals IRAs, direct rollovers are typically cleaner.

How do frequent trades inside a metals account amplify costs?

Each trade can incur transaction fees, dealer spreads, and processing charges. Frequent trading multiplies these line items and reduces the compounding benefit of your core assets. Metal IRAs are best suited for long-term diversification rather than active trading.

How do fees for a metals IRA compare to a traditional brokerage or traditional IRAs?

Metals IRAs usually cost more due to custody, storage, insurance, and shipping. Traditional IRAs holding paper assets may have lower ongoing fees. The extra cost can be justified if the physical asset provides meaningful inflation hedge or diversification — but only if you secure competitive pricing.

What should I ask a custodian to avoid surprises later?

Request a complete, written fee schedule that lists setup, annual admin, storage, insurance, transaction, wire, distribution, shipping, and penalty charges. Ask for buy and sell pricing examples, minimum investment levels, and details on segregated versus commingled storage.

How do minimum investment requirements affect effective costs?

Minimums—commonly $25,000–$50,000—spread fixed fees across a larger base, lowering your effective expense ratio. Smaller accounts often face higher per-dollar costs. If you can’t meet minimums, compare providers to find one with lower fixed fees or scale advantages.

What sales-pitch red flags should make me walk away?

Watch for pressure to act quickly, “free” offers that hide higher premiums, insistence on specific high-markup products, and refusal to provide a full written fee schedule. A reputable provider will answer questions transparently and give clear, itemized cost examples.

How do segregated and commingled storage differ in price and protection?

Segregated storage holds your bars or coins separately and usually costs more. Commingled storage pools assets and is cheaper but blends ownership records. Segregation reduces counterparty risk and gives clearer ownership in crises; commingled storage saves money but increases some operational risk.

What’s typically included in storage fees versus billed separately?

Storage fees often cover vault space, basic insurance, and standard security. Separate bills may include enhanced insurance riders, handling for distributions, auditing fees, or special retrieval requests. Confirm exactly what the stated storage rate includes.

How can I compare providers consistently to make an apples-to-apples decision?

Use a checklist that lines up setup, annual, storage, transaction, shipping, insurance, and distribution fees for the same hypothetical account size. Compare buy and sell pricing on the same bullion items and factor in any waived fees that reappear as markups.

What documents or disclosures should a trustworthy custodian provide up front?

A clear, itemized fee schedule; account agreement spelling out duties and liability; storage and insurance descriptions; buy/sell price matrix; rollover instructions; and contact information for dispute resolution. If any of these are missing, consider other providers.

How do I estimate first-year costs on a $100,000 metals retirement account?

Add one-time setup fees, first-year admin, storage for segregated or commingled holdings, transaction fees on initial purchases, and purchase premiums. This combined total gives a realistic first-year outlay that reflects true cost of establishing and securing physical assets.

Are there tax or reporting differences I should know about when holding physical metals in a retirement account?

Custodians must follow IRS rules for account reporting and distributions. Holding metals inside the tax-advantaged account avoids immediate capital gains tax until distribution, but distributions themselves follow standard IRA taxation rules. Ensure your custodian provides compliant reporting and timely 1099/RMD support.

How can I reduce the total cost of owning precious metals in a retirement account?

Negotiate lower premiums or reduced transaction fees, consolidate holdings to meet minimums and lower effective rates, choose commingled storage if appropriate for cost savings, and limit trading. Compare custodians and insist on full written disclosure to find the best overall value.

– per transaction or more for insured courier service — may apply. Many investors overlook these when planning exits.

What late payment fees or other fine-print penalties should I watch for?

Custodians may charge late fees for missed payments, inactivity fees, or penalties for missed documentation. These charges are usually modest individually but can accumulate. Ask for the full penalty schedule and payment terms.

How do purchase premiums and sell-back spreads affect my cost basis?

Purchase premiums (commonly 3%–5% above spot) increase your cost basis when you buy. Sell-back spreads (often 1%–2%) reduce the net you receive when selling. Together they create a bid-ask cost that can materially lower returns, particularly for frequent traders or those buying small lots.

Why are some coins marked up far above spot price?

Numismatic or collectible coins carry scarcity and grading premiums that can reach 50%–200% above spot. They often fall outside IRA-eligible bullion rules or present higher liquidity risk. For retirement holdings, stick to IRA-eligible bullion to limit excessive markups.

How can a 1% fee difference translate into a large dollar amount over time?

A 1% annual cost difference on a 0,000 account compounds over years. It reduces the capital available to grow, so over a decade that gap can translate into tens of thousands in lost portfolio value. Modeling fee impacts helps you choose providers that keep long-term costs low.

What should I expect curbside when transferring funds via direct rollover versus indirect rollover?

A direct rollover transfers funds straight between custodians with minimal tax friction and lower risk of fees for early distribution. Indirect rollovers require you to receive funds first and redeposit within 60 days; they risk tax withholding and extra charges if mishandled. For metals IRAs, direct rollovers are typically cleaner.

How do frequent trades inside a metals account amplify costs?

Each trade can incur transaction fees, dealer spreads, and processing charges. Frequent trading multiplies these line items and reduces the compounding benefit of your core assets. Metal IRAs are best suited for long-term diversification rather than active trading.

How do fees for a metals IRA compare to a traditional brokerage or traditional IRAs?

Metals IRAs usually cost more due to custody, storage, insurance, and shipping. Traditional IRAs holding paper assets may have lower ongoing fees. The extra cost can be justified if the physical asset provides meaningful inflation hedge or diversification — but only if you secure competitive pricing.

What should I ask a custodian to avoid surprises later?

Request a complete, written fee schedule that lists setup, annual admin, storage, insurance, transaction, wire, distribution, shipping, and penalty charges. Ask for buy and sell pricing examples, minimum investment levels, and details on segregated versus commingled storage.

How do minimum investment requirements affect effective costs?

Minimums—commonly ,000–,000—spread fixed fees across a larger base, lowering your effective expense ratio. Smaller accounts often face higher per-dollar costs. If you can’t meet minimums, compare providers to find one with lower fixed fees or scale advantages.

What sales-pitch red flags should make me walk away?

Watch for pressure to act quickly, “free” offers that hide higher premiums, insistence on specific high-markup products, and refusal to provide a full written fee schedule. A reputable provider will answer questions transparently and give clear, itemized cost examples.

How do segregated and commingled storage differ in price and protection?

Segregated storage holds your bars or coins separately and usually costs more. Commingled storage pools assets and is cheaper but blends ownership records. Segregation reduces counterparty risk and gives clearer ownership in crises; commingled storage saves money but increases some operational risk.

What’s typically included in storage fees versus billed separately?

Storage fees often cover vault space, basic insurance, and standard security. Separate bills may include enhanced insurance riders, handling for distributions, auditing fees, or special retrieval requests. Confirm exactly what the stated storage rate includes.

How can I compare providers consistently to make an apples-to-apples decision?

Use a checklist that lines up setup, annual, storage, transaction, shipping, insurance, and distribution fees for the same hypothetical account size. Compare buy and sell pricing on the same bullion items and factor in any waived fees that reappear as markups.

What documents or disclosures should a trustworthy custodian provide up front?

A clear, itemized fee schedule; account agreement spelling out duties and liability; storage and insurance descriptions; buy/sell price matrix; rollover instructions; and contact information for dispute resolution. If any of these are missing, consider other providers.

How do I estimate first-year costs on a 0,000 metals retirement account?

Add one-time setup fees, first-year admin, storage for segregated or commingled holdings, transaction fees on initial purchases, and purchase premiums. This combined total gives a realistic first-year outlay that reflects true cost of establishing and securing physical assets.

Are there tax or reporting differences I should know about when holding physical metals in a retirement account?

Custodians must follow IRS rules for account reporting and distributions. Holding metals inside the tax-advantaged account avoids immediate capital gains tax until distribution, but distributions themselves follow standard IRA taxation rules. Ensure your custodian provides compliant reporting and timely 1099/RMD support.

How can I reduce the total cost of owning precious metals in a retirement account?

Negotiate lower premiums or reduced transaction fees, consolidate holdings to meet minimums and lower effective rates, choose commingled storage if appropriate for cost savings, and limit trading. Compare custodians and insist on full written disclosure to find the best overall value.