Nearly $143 billion sits in two physically backed exchange-traded funds, showing how many investors prefer liquid exposure to the metal instead of bars. That scale matters when you weigh simplicity, cost, and evidence-based choices in retirement accounts.

This guide explains why many in the bogleheads community favor liquid ETFs at brokerages like Fidelity and Vanguard. Those funds hold physical metal in vaults and track the spot price closely, avoiding retail redemption headaches for coins or bars.

We’ll compare physically backed ETFs and mining stocks, show key trade-offs, and preview choices: why hold metal at all, what percentage to consider, which tickers to watch, and how to document rules in a written investment policy.

Expect a friendly, frank look at custody, vault locations, expense ratios, and how price swings test people’s resolve, plus hands-on steps for Fidelity and Vanguard. For background on holding physical metal and custody issues, see a deeper discussion here: exploring physical metal in an IRA.

Key Takeaways

- Many investors use liquid, physically backed ETFs to get spot-price exposure without storing coins.

- GLD and IAU offer vault-backed liquidity, but no retail redemption for bars.

- Decide your goal first: hedge, diversification, or speculation.

- Watch cost levers: expense ratios and trading spreads matter inside retirement accounts.

- Document your plan in an investment policy to keep behavior disciplined during swings.

What “holding gold in an IRA” really means for Bogleheads

The phrase ‘hold gold in an IRA’ masks a key choice: tangible bullion or market-traded exposure.

Physical bullion vs. market-traded exposure

In practice, holding physical bullion means a custodian stores bars or coins in a vault. That route adds storage, insurance, and paperwork.

By contrast, market-traded products settle and trade like stocks but are backed by metal in vaults. Funds such as GLD or IAU aim to mirror the spot price of the metal. They offer trading ease without shipping or insurance headaches.

Why intent matters: hedge, diversification, or speculation?

Your reason to buy changes the plan. Use it as a hedge or a small diversifier and size conservatively. Treating metal as speculation means accepting that its value depends on what future buyers will pay, not company cash flows.

“Buying metal can be a bet on beliefs about money and time, not on earnings.”

Mining stocks add company risk and often move differently than the metal itself. Silver behaves more like an industrial metal and has its own volatility.

Document target percentage, rebalance bands, and exit rules. Costs, spreads, and liquidity are practical drivers of which vehicle you choose inside a retirement account.

The Bogleheads philosophy and where gold fits

Before adding metals to a plan, check them against core investing rules. A strong approach favors broad diversification, low cost, and a steady rebalancing routine.

Many people skip metals entirely. They meet diversification through global stocks and high-quality bonds. That keeps portfolios simple and costs low.

Staying the course versus adding a metals sleeve

The trade-off is clear. Simplicity and discipline reduce mistakes over years. An uncorrelated asset can help in some market regimes, but it adds tracking error and another decision to manage.

“If you can’t define why metals belong in your portfolio, stick with the stay-the-course mindset.”

News cycles and crisis headlines often lift interest in metals. That can tempt timing. A written plan and set allocation with rebalancing rules help curb impulse moves.

| Asset |

Primary role |

Typical benefit |

Practical downside |

| Global stocks |

Growth |

Long-term returns, diversification |

Volatility during downturns |

| High-quality bonds |

Risk reduction |

Income and drawdown cushioning |

Interest-rate sensitivity |

| Precious metals |

Uncorrelated sleeve |

Potential hedge in stress |

Low yield, can underperform for years |

| Cash/TIPS |

Liquidity & inflation defense |

Stability in real terms |

Lower long-term returns |

People differ in comfort. Some accept a small metals slice to sleep better. Others choose a clean 3-fund plan and avoid the extra complexity.

Bottom line: define the reason for any metals holding, set a modest allocation if needed, and keep rebalancing rules to preserve your long-term plan.

Bogleheads gold IRA: the preferred vehicles at a glance

Here’s a concise look at the vehicles most investors pick when they want metal exposure inside a retirement account.

Physically backed ETFs like GLD and IAU

GLD and IAU trade like stocks at Fidelity, Vanguard, and other brokerages. They hold physical bullion in vaults and aim to track the metal’s price closely. That structure avoids the shipping, storage, and insurance hassle of handling coins.

Mining funds and precious metals ETFs (example: RING)

Funds such as RING hold companies that mine the metal. They can amplify returns when miners rally, but they also behave like equities and carry company risk. Expect different volatility and dividend profiles than pure bullion exposure.

Why most avoid storing physical coins in an IRA

Physical coins need a specialized custodian and an approved depository. That adds direct cost and paperwork. For many, the extra friction outweighs any perceived benefit.

“Most investors choose liquid, low-cost ETFs to get the price exposure without operational headaches.”

- Quick shortlist: GLD and IAU for direct price exposure; RING for equity-based exposure.

- Cost drivers: ETF expense ratios and trading spreads vs. storage, insurance, and custodian fees for coins.

- Decision hinge: Do you want pure price exposure or leverage via stocks? Your goal should guide the way.

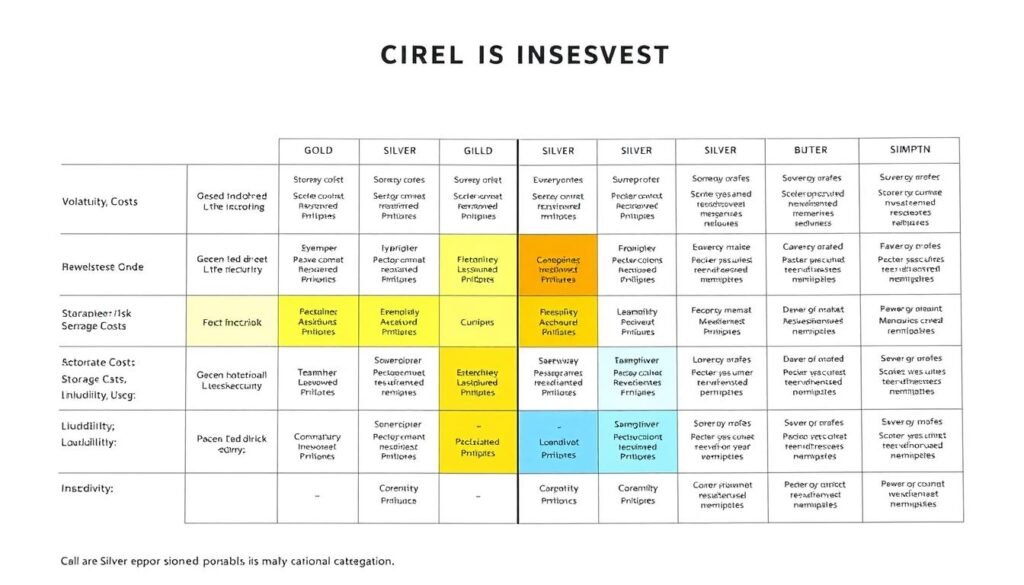

| Vehicle |

Primary exposure |

Typical cost drivers |

Key risk |

| GLD / IAU |

Spot price of the metal |

Expense ratio, trading spread |

Tracking error, market liquidity |

| RING (mining ETF) |

Gold-related companies |

Management fee, sector concentration |

Company risk, equity market moves |

| Physical coins |

Tangible bullion |

Custodian fees, storage, insurance |

Operational complexity, higher cost |

Physically backed ETFs (GLD, IAU): how they work inside an IRA

Inside a brokerage account, physically backed ETFs combine vault custody and exchange trading so investors get bullion exposure without handling bars. These funds hold allocated metal with professional custodians and trade on major exchanges at Fidelity, Vanguard, and others.

Vault custody, price tracking, and liquidity

Custody: GLD’s bullion is stored in London vaults; IAU holds allocated bars with vetted custodians. Shareholders own fund units, not individual bars, so the fund’s controls and audits matter.

Price tracking: Authorized participants create and redeem shares to keep the ETF price close to the spot price. That mechanism supports tight bid-ask spreads and daily liquidity.

Execution quality: Large assets and active trading usually mean tight spreads. That lowers trading cost inside a retirement account versus buying physical coins.

No retail redemption for bars or coins

Important: these ETFs are backed by bullion but do not allow retail redemption for physical coins or bars. Investors must buy and sell shares on the open market.

Some worry about the “paper” angle: you cannot inspect bars yourself. That concern is real, so review each prospectus for custody, insurance, and audit details to match your comfort level.

“ETFs give convenience and recordkeeping, but ownership is indirect — trust in custodian controls is part of the trade-off.”

| Feature |

How it works |

Practical effect for investors |

| Custody location |

Allocated bars in professional vaults (example: London) |

Cross-border custody considerations in disaster scenarios |

| Price linkage |

Creation/redemption by authorized participants |

Tight tracking to spot price and good intraday liquidity |

| Retail redemption |

No delivery of coins or bars to shareholders |

Must trade shares on exchanges; no physical take-home |

| Trading cost |

Bid-ask spreads and expense ratio |

Generally low relative to logistics of physical coins |

Over years, many investors value the simple trading, automated reporting, and ease of rebalancing these funds provide. Still, weigh custody trust, pmlocation, and non -us vault factors when you decide the right way to hold bullion exposure.

Mining stocks and precious metals funds: different risk, different return

Mining ETFs and miner-focused funds invest in companies whose profits hinge on production costs, reserves, and management decisions. That makes them equity plays, not direct proxies for the metal.

When metal rallies, miners can amplify the upside. In bull runs, leverage to production and margins often boosts returns compared with holding bullion.

But in down markets, miners may underperform sharply. Company-level issues, debt, or operational problems can dominate outcomes for years.

- Advantages: Lower fees in some products (example: RING), diversified baskets, and easy trading—fast execution and simple order types.

- Drawbacks: Sector concentration, higher volatility, and equity-specific risk that raises tracking error versus the metal.

Practical tip: Many investors cap miner exposure as a small satellite — often a modest percent of total metals allocation — to limit drawdown risk.

| Exposure type |

Primary driver |

Typical use |

| Bullion ETFs |

Spot metal price |

Low-correlation hedging |

| Mining funds / ETFs |

Company earnings and production |

Equity satellite with upside potential |

| Blended approach |

Both metal and company exposure |

Balance direct price exposure with possible equity return |

“Think through risk budgeting, drawdown tolerance, and how miners fit the role you expect the metal to play.”

Physical gold in an IRA: complexities Bogleheads try to avoid

Holding physical metal inside a retirement account brings paperwork, custody rules, and costs that surprise many investors.

Custodians, storage, and insurance considerations

Operational steps: first find a compliant custodian, then arrange storage at an approved depository, set up insurance, and handle shipping and documentation.

Each step adds measurable cost and oversight. Custodian fees, storage charges, and insured transport create recurring expense and administrative friction.

Rules also limit handling. Coins in a tax account must stay in approved vaults; personal possession is prohibited. That rule surprises people who expect to take coins home.

Why many prefer ETFs: funds like GLD and IAU bundle custody, audits, and insurance into a single expense ratio. This reduces paperwork and makes rebalancing simple.

| Item |

Physical ownership |

ETF alternative |

| Custody |

Specialized custodian, approved depository |

Fund-level custody, no personal handling |

| Recurring cost |

Custodian + storage + insurance + shipping |

Expense ratio + bid/ask spread |

| Flexibility |

Lower (redemption limits, shipping delays) |

High (trade on exchange anytime) |

“Physical ownership can feel reassuring, but inside a tax account it often increases operational risk and long-term friction.”

Consider pmlocation concerns: vault country and access in crisis matter to perceived risk. Over years, small frictions and fees can compound into a real drag on returns.

Some investors still value tangible coins for their intrinsic appeal. If you choose that path, accept strict rules and higher costs. For most people wanting a metals sleeve to complement a diversified plan, the ETF route is the friendlier choice.

Speculation vs. investment: how the community frames gold

Community posts often split on whether bullion is an investment or a pure bet on the next buyer.

One view calls precious metals “speculation” because they do not produce cash flows like stocks or businesses. That poster noted a small position — about 5% across gold and SLV — for liquidity and simplicity.

Another view points to long history and durability as reasons to hold some metal. People who favor this approach see value over time, not short-term price moves.

Why many cap metals at a small percent

Most cap metals at 0–5% to limit tracking error versus a simple index portfolio. A small sleeve can offer diversification without upending long-term returns.

Behavioral risks when prices swing

Timing temptation is common: chasing after a run-up or selling after a drawdown harms long-term outcomes.

“Predefine your allocation and rebalance to avoid headline-driven moves.”

Paper exposure via an etf appeals to people who want quick trades and no storage headaches. A small silver sleeve is possible, but silver’s industrial links can add extra volatility.

Practical tip: write down whether the holding is a hedge, diversification, or speculation. Others may choose no allocation at all — that is a valid, low-cost approach too.

When gold can help—and when it can’t

Investors often ask when a metals sleeve actually stabilizes a portfolio and when it simply adds noise. The short answer: it can help in some drawdowns, but it is not a guaranteed shield.

Diversification during equity drawdowns

Historically, gold has shown low or even negative correlation with stocks during certain equity crashes. That behavior can reduce portfolio drawdown and smooth short-term value swings.

But relationships vary. There are periods when both stocks and gold fall together, so expect no perfect hedge every time.

Inflation narratives vs. real-world outcomes

Gold is often called an inflation hedge in popular narratives. Real results depend on starting price, interest rates, and global demand.

Sometimes gold preserves purchasing power over years. Other times it lags while stocks or bonds deliver stronger returns.

“Treat metal exposure as a potential stabilizer, not a replacement for growth or income assets.”

- Bonds often provide income and a different type of ballast than metal.

- In deflationary shocks bonds may outperform; in some inflationary runs, metal and bonds both underperform.

- Non-us or world stress can shift liquidity, currency moves, and vault access—factors that affect price and availability.

ETFs track the metal price, not company profits, so returns come from market price moves rather than earnings. That distinction matters when you compare metals to stocks.

Physical coins and access are mostly irrelevant for ETF holders in normal times, but they matter in extreme scenarios. That is one reason many keep allocations modest.

Bottom line: think of assets as a team. A small allocation may reduce drawdown pain but won’t replace the compounding engine of global equities or the income profile of high-quality bonds. Match any allocation to your objectives, tolerance, and the specific risks you want to address.

Costs to compare: expense ratios, spreads, and storage

Fees and spreads quietly eat returns; understanding them helps you pick the cleanest metal exposure. Start with the visible line: ETF expense ratios and trading spreads.

ETF expense ratios vs. custodian and storage fees

Large funds like GLD and IAU charge a small annual expense ratio. That fee covers custody, audits, and insurance at the fund level.

By contrast, holding physical coins in an account adds separate fees: custodian account charges, depository storage, insured shipping, and handling. Those items are billed individually and can compound over years.

Trading spreads and the “cost of convenience”

Bid-ask spreads are normally tight for big ETFs, lowering round-trip trading cost. In volatile markets spreads can widen, so using limit orders helps control execution price.

Cost of convenience: ETFs outsource custody and admin; you pay via the expense ratio and occasional spread. Physical holders pay line-item fees but gain direct possession (with regulatory limits).

“Quantify expected fees up front and write them into your investment policy; it keeps comparisons honest.”

| Cost type |

ETFs (example GLD/IAU) |

Physical (coins in custodian) |

| Annual fee |

Expense ratio (fund-level) |

Custodian + storage + insurance |

| Trading cost |

Bid-ask spread, commissions if any |

Redemption/shipping fees, broker spreads if sold |

| Liquidity |

High for large funds; tight spreads |

Lower; logistical delays for transfers |

| Price transparency |

Daily NAV and intraday price |

Market quotes for coins vary; premiums apply |

Also note: returns net of fees can diverge between bullion ETFs and miner-focused funds because of different expense structures and tracking behavior. Deep-liquidity ETFs keep spreads tight, which benefits frequent rebalancers.

Practical point: estimate total ownership cost for a five- or ten-year horizon, include likely spread during rebalances, and record that figure in your policy. That exercise makes the trade-offs clear and avoids surprises when markets move or inflation alters trading volume and spreads.

Implementation steps at major brokerages (Fidelity, Vanguard, others)

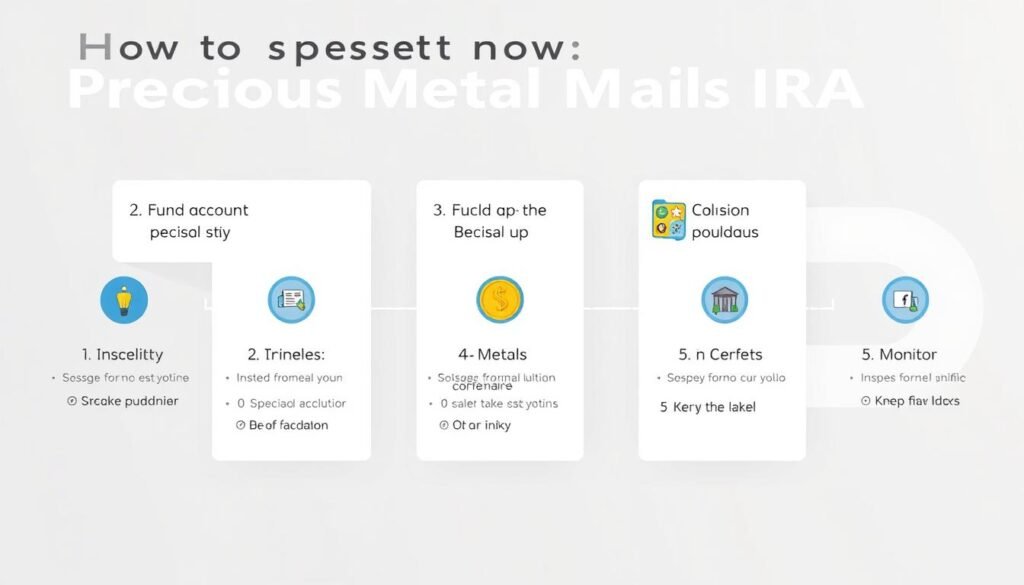

Start implementation by confirming your retirement account is set up and funded at a major brokerage. Use a funded Traditional or Roth account and verify it is designated for retirement use.

Opening or using a Traditional or Roth account

Confirm account type and available cash or transfer capability. If you need to open an account, follow the broker’s guided setup to add beneficiary and tax details.

Finding GLD, IAU, or a precious metals ETF on your platform

Search the platform for tickers such as GLD or IAU. Review the fund page for objective, custody notes, recent price behavior, and pmre or audit details before you proceed.

Placing the trade and setting a rebalancing rule

Place trades like any other ETF. Watch the bid-ask spread and use limit orders during volatile periods to control execution.

Decide a rebalancing method up front — calendar-based (for example, annually) or band-based (for example, +/- 5%).

Documenting your investment policy statement

Write a short IPS that states the purpose of the allocation (hedge or diversification), the target percentage, rebalancing triggers, and conditions to revisit the plan.

“Documenting rules keeps choices mechanical and reduces headline-driven moves.”

- Open or confirm Traditional/Roth and fund the account.

- Locate GLD/IAU or similar ETFs and read custody details.

- Place trades with attention to spreads; use limit orders as needed.

- Record a rebalancing rule and add it to your IPS.

| Step |

Action |

Why it matters |

| Account setup |

Use funded Traditional or Roth |

Keeps tax reporting and amlocation simple |

| Fund selection |

Review GLD/IAU pages |

Confirms custody, liquidity, and price tracking |

| Execution & maintenance |

Limit orders; annual review |

Controls costs and enforces discipline |

Integrate the sleeve with your broader stocks and bonds allocation. Revisit the allocation each year and avoid ad hoc changes driven by short-term moves.

Risk management for a Bogleheads-style gold allocation

A clear risk plan keeps a small metals sleeve from quietly changing your portfolio’s profile.

Sizing: 0% to 5% to avoid portfolio drift

Conservative sizing usually means 0%–5% of total assets. That range limits tracking error versus a simple index portfolio while leaving room for diversification benefits.

Keep combined exposure modest so a large swing in price does not alter your long-term mix or risk budget.

Rebalancing discipline and tracking error

Translate the target into action with clear rules: calendar rebalances (for example, annual) or band triggers (for example, +/- 3–5%).

Use limit orders and low-cost vehicles to reduce execution drag from spreads and expense ratios. Low fees matter because costs compound over time.

- Realistic return expectations: a small metals slice can cushion some drawdowns but may underperform strong equity runs.

- Bonds still matter: bonds provide income and drawdown protection; metals should complement, not replace, core fixed-income exposure.

Monitor attribution: check whether the metals position improves risk-adjusted return or simply adds volatility. Track rolling performance vs. your baseline portfolio.

“Predefine your allocation and rebalancing rules to avoid headline-driven moves.”

- Set target percentage and acceptable drift bands.

- Choose calendar or band-based rebalancing and how often you’ll review.

- Record cost assumptions (expense ratio, typical spread) and expected impact over 5–10 years.

Size with humility: correlations can change in different inflation or stress regimes. Document decisions, review them on a set cadence, and keep the sleeve small, rules-based, and cost-conscious to manage long-term risk and value.

What disaster scenarios mean for gold held via ETFs

When systems strain, the logistical details behind bullion-backed ETFs come into focus. Investors often ask whether fund audits, custody chains, and vault locations would hold up in a real crisis.

Custody trust, vault location, and counterparty risk

Chain of trust: ETF holdings sit with custodians, sub-custodians, and legal structures that segregate assets and limit counterparty exposure. Regular independent audits and fund disclosures document that chain.

Vault location matters. For example, GLD stores bullion in London. Non -us storage raises questions about access, legal regimes, and perceived security in world-disrupting scenarios.

Some investors object that ETFs do not allow retail redemption of bars. That lack of personal access is a real sticking point for people who value physical possession, even though market liquidity usually suffices in normal times.

- Stress effects: spreads may widen, premiums or discounts can appear, and price discovery can be noisy.

- Operational trade-off: bonds and cash provide different crisis protections; no single asset is risk-free.

“Read the prospectus and audit reports; they show how the structure protects owners.”

| Issue |

What to check |

Practical effect |

| Custody |

Audits, custodian names |

Reduces counterparty uncertainty |

| Vault location |

Country and legal regime |

Impacts perceived access in extreme events |

| Liquidity |

Fund size and spread history |

Signals trading resilience under stress |

Takeaway: tail risks are real but hard to predict. For many, that justifies a small, documented allocation rather than a heavy concentration. If you can’t get comfortable with the mechanism, zero allocation is a valid choice.

Alternatives and complements: TIPS, cash, bonds, and global stocks

Many investors reach for tools like TIPS, cash, and high-quality bonds before adding any metal exposure.

TIPS explicitly adjust principal for CPI and can be a more direct inflation hedge than precious metals for some goals. They pay interest and reduce buying-power risk without the storage or custody issues that come with bullion.

Cash and short-term bonds handle liquidity and near-term spending needs. Use them to fund withdrawals or cover emergencies instead of relying on a metals sleeve during a hurry.

Global stocks remain the compounding engine for long-term growth. Diversifying across world markets also provides currency exposure that can act as a partial non -us hedge in stressed episodes.

Assets interact: TIPS, nominal bonds, cash, and equities form a toolkit many prefer to deploy first. Precious metals can be a small satellite for those who want an extra diversifier, but others meet their objectives without metals at all.

“Keep allocations purposeful: assign each asset a clear job and record it in your plan.”

| Tool |

Primary role |

When preferable |

| TIPS |

Inflation protection |

When inflation is a primary concern |

| High-quality bonds |

Volatility dampener |

Near-term funding and income |

| Global stocks |

Growth |

Long-term compounding and diversification |

What forum discussions reveal about real investor behavior

Forum threads show how real investors balance emotion, cost, and convenience when they pick metals or miner funds.

Liquidity and “sleep-at-night” preferences

Many people favor ETFs and liquid funds for their personal investments. Quick trades and clear pricing reduce worry about theft, storage, and logistics.

Sleep-at-night quotes often appear: convenience and platform familiarity beat the perceived safety of hands-on ownership for most posters.

Long holding periods, mixed outcomes

One poster held a mining fund since about 2003. It quadrupled at one point, then slid back near breakeven over the years.

They moved to a lower-fee miner ETF (RING) and keep roughly 5% across gold and SLV to limit drag. That story shows how time can produce mixed results.

“Holding through big runs and reversals reminds you that price moves can swing wildly.”

- Reply print liquidity and simple fund structures make rebalancing and recordkeeping easier.

- Silver and miner exposure are treated as small satellites because volatility and industrial links differ from bullion.

- Posts mix enthusiasm and skepticism; platform ease and costs often decide moves more than theory.

Takeaway: learn from community experience: keep allocations modest, expect volatility, and write rules so regret and hindsight bias don’t drive changes.

Putting it all together: a simple, Bogleheads-aligned plan

Decide first whether a metals sleeve serves a real role in your portfolio. If it does not, keeping a clean mix of broad stocks and bonds is a fine, low-cost choice.

Decide if you need gold at all

Ask the question: am I buying a hedge, diversification, or a speculation? Write the answer down before you buy.

If the goal is diversification or a mild hedge, a small allocation often suffices. Many forum contributors keep exposure near 0–5% to avoid large tracking error.

If yes, prefer low-cost, liquid ETFs and rebalance

Use liquid ETFs such as GLD or IAU to get spot-price exposure without storage hassles. These funds trade like stocks, offer easy rebalancing, and keep operational friction low.

Size modestly, set a target weight, and pick a rebalancing rule (calendar or band-based). Document intent, target, and triggers in a short investment policy so behavior stays mechanical, not emotional.

| Step |

Action |

Why it matters |

| Decide need |

Define hedge/diversification/speculation |

Keeps allocation purposeful and measurable |

| Choose vehicle |

Prefer low-cost, liquid ETFs |

Reduces custody headaches and trading friction |

| Set sizing |

Typically 0–5% of assets |

Limits impact on risk and return |

| Document rules |

IPS with target and rebalance method |

Prevents headline-driven moves and emotional trading |

“Keep it simple: clarity, low cost, and disciplined rebalancing beat precision bets.”

- Integrate the sleeve with core assets so overall risk and expected return stay aligned with your horizon.

- If you add silver or miners, treat them as distinct, smaller bets with different drivers and risks.

- Review the plan annually and adjust only if your objectives change materially.

Conclusion

Ultimately, the best approach balances low cost, liquidity, and a written plan. For most people the preferred way inside retirement accounts is low‑cost, liquid, physically backed ETFs such as GLD or IAU. They track the metal’s price, trade easily, and avoid custody and insurance hassles of coins and bars.

Debates about paper structures and disaster scenarios are real. Many keep allocations small or none. Some prefer miners for equity exposure.

Write a short investment policy, set rebalancing rules, and watch fees. Remember: diversified stocks and bonds remain the portfolio’s engine; a gold or silver sleeve is a complement, not a replacement.

Focus on what you can control today—savings rate, costs, diversification, and disciplined behavior. Review your IPS, check vehicle costs, and decide if a small metals allocation fits your goals. Thanks for reading; keep it simple and documented.

FAQ

What does "holding gold in an IRA" mean for someone following a low-cost, long-term investing approach?

It usually means obtaining market-traded exposure to precious metals through tax-advantaged retirement accounts rather than keeping physical coins at home. Most advocates prefer liquid, low-fee methods that fit a simple, buy-and-hold plan and avoid the extra custody and insurance layers that physical ownership brings.

Should I buy physical bullion or choose a market-traded product inside my retirement account?

For investors focused on cost, simplicity, and diversification, market-traded products that track bullion prices are typically preferred. They offer easier trading, lower ongoing administrative overhead, and no need for special storage arrangements, while physical bars or coins add complexity and extra fees.

How much of my portfolio should be allocated to precious metals if I follow a passive strategy?

Many conservative plans cap the allocation at a small percentage — often 0% to 5% — to limit portfolio drift and maintain focus on broad equity and bond exposure. The key is to set a target, rebalance routinely, and keep the stake modest relative to the rest of the portfolio.

Are physically backed ETFs like GLD and IAU acceptable within a retirement account, and how do they work?

Yes. These funds hold bullion in vaults and issue shares that track the metal’s spot price. They provide custody, liquidity, and straightforward trading on major broker platforms without the need for retail redemption of bars or coins.

Can I store physical coins or bars directly in a tax-advantaged retirement account?

You can, but it requires an approved custodian, secure vaulting, and insurance. Many investors avoid this route because of higher fees, administrative hurdles, and the risk of noncompliance with strict IRS rules on acceptable bullion and storage.

What about mining stocks or funds focused on precious metals — are they the same as holding bullion?

No. Mining shares and specialized funds behave like equities: they carry company-specific risk, leverage to metal prices, and greater volatility. They can boost returns or losses and are better viewed as equity allocations rather than direct commodity hedges.

What costs should I compare when choosing a vehicle for exposure to precious metals?

Compare ETF expense ratios, trading spreads, and any custodian or storage fees for physical arrangements. Also consider the “cost of convenience” — ease of trading and recordkeeping — which often makes low-fee ETFs more economical for small allocations.

How do I implement this at major brokerages like Fidelity or Vanguard?

Open or use a Traditional or Roth retirement account, search for ticker symbols such as GLD or IAU on your platform, place a buy order, and include the position in your rebalancing routine. Keep a simple investment policy statement documenting your target allocation and rules.

What risks should I monitor when holding metals exposure through an ETF?

Watch custody and counterparty risk, tracking error versus spot prices, and liquidity conditions. During extreme market stress, spreads can widen and redemptions may be constrained, so keep allocations small and maintain a rebalancing discipline.

When does exposure to precious metals help a portfolio, and when does it not?

It can provide diversification during prolonged equity drawdowns and specific macro shocks. It tends not to help as a reliable inflation-only hedge over short periods, and it may underperform during steady equity rallies. Use it as a small, strategic complement rather than a primary strategy.

How often should I rebalance a small allocation to metals in my retirement account?

Rebalance on the same schedule you use for the rest of your plan — annually or semiannually is common. The goal is to prevent the allocation from drifting and to maintain the intended risk profile.

Are there disaster scenarios where ETFs pose extra risk compared with physical holdings?

ETFs carry custody and operational risks: vault location, the integrity of trust structures, and potential market access issues. Physical metal also has storage and insurance risks. For most investors, ETFs balance these considerations better due to lower cost and higher liquidity.

What alternatives should I consider alongside precious metals for downside protection?

Treasury Inflation-Protected Securities (TIPS), short-term cash, high-quality bonds, and global equity diversification often provide more predictable outcomes. These instruments align better with low-cost, evidence-based portfolios focused on long-term returns.

How do forum discussions inform real investor behavior around metals exposure?

Community threads often reveal practical concerns: liquidity preferences, emotional comfort during market stress, and mixed long-term outcomes. Real investors frequently choose small, liquid positions to sleep better at night without disrupting a low-cost plan.