Have you ever wondered about the many ways scammers might try to take advantage of your hard-earned retirement savings? It’s a thought that could keep anyone up at night, especially when it comes to your IRA (Individual Retirement Account). Unfortunately, the world of financial planning isn’t free of fraudsters who are on the lookout for such opportunities. Understanding how IRA account scams work can make a tremendous difference in safeguarding your financial future.

This image is property of images.unsplash.com.

Understanding IRA Accounts

Before diving into scams related to IRA accounts, it’s important to have a strong understanding of what an IRA account actually is. Individual Retirement Accounts are savings accounts with tax advantages designed to help you save for retirement. There are several types of IRAs, each with differing features and benefits.

Types of IRA Accounts

Each type of IRA offers different advantages based on your individual circumstances, such as your current income or future tax expectations. Here’s a look at the primary types:

-

Traditional IRA: Contributions to a traditional IRA may be tax-deductible, which can reduce your taxable income in the year in which you contribute. However, you’ll be required to pay taxes upon withdrawal in retirement.

-

Roth IRA: Contributions are made with after-tax dollars, which means you won’t owe taxes on withdrawals in retirement. This can be advantageous if you expect to be in a higher tax bracket when you retire.

-

SEP IRA (Simplified Employee Pension): Aimed at self-employed individuals and small-business owners, these accounts allow higher contributions and treat up to 25% of your income as contributions.

-

SIMPLE IRA (Savings Incentive Match Plan for Employees): This plan is similar to a 401(k) but is simpler and has a lower contribution limit.

Understanding these types of accounts is essential because each offers a distinct level of exposure to potential scams based on how they are managed and who manages them.

Common IRA Account Scams

Having a basic understanding of your IRA can shield you from the traps scam artists set. Here are some of the most prevalent IRA scams you should be aware of:

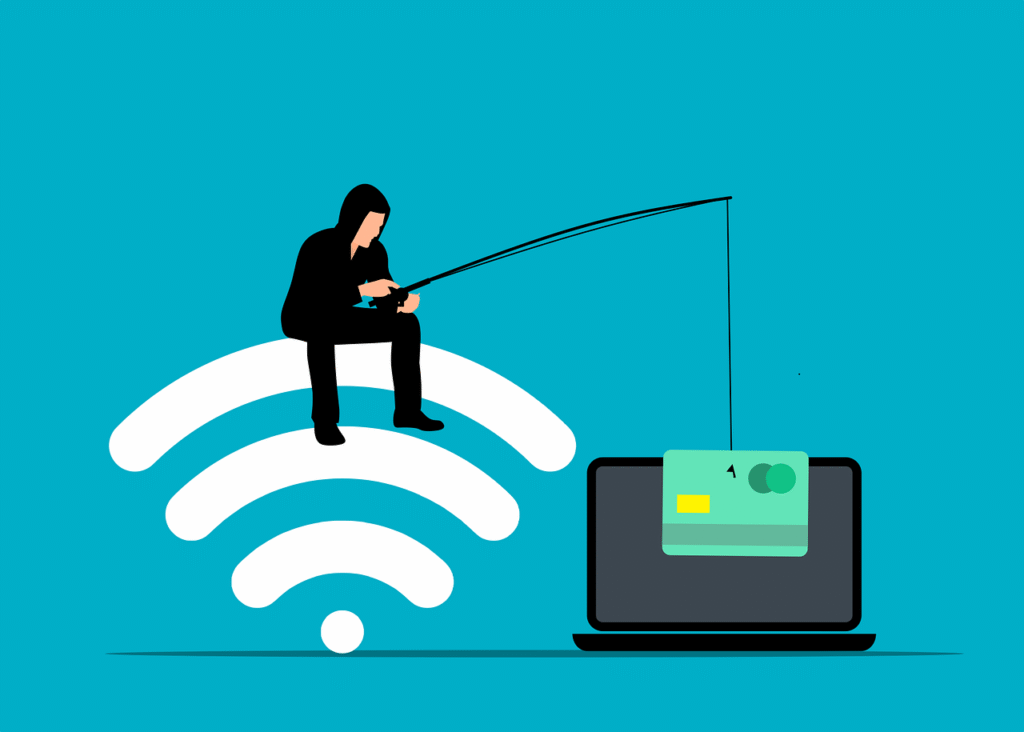

Phishing Scams

Phishing scams often involve fraudulent emails or websites aimed at stealing your personal information. These scams can look very legitimate, masquerading as communication from a trusted financial institution.

Ponzi Schemes

IRA holders can become targets of Ponzi schemes where the scammer promises high returns with little to no risk. These schemes require new investments to pay returns to older investors, falling apart eventually when new investments cease.

Identity Theft

Scammers who gain access to personal information can pose as you, initiate unauthorized changes or transactions, and essentially hijack your IRA account.

Tax Penalty Scams

Fraudulent callers might claim you owe IRS penalties related to your IRA and might threaten legal action unless you pay immediately. The IRS typically contacts taxpayers through mail, not over the phone.

Fake Investment Opportunities

Offerings that guarantee unrealistic returns often require upfront payment. These scams also involve pressuring you to act immediately before you’ve had time to vet the investment opportunity.

This image is property of pixabay.com.

How IRA Scams Work

The strategy behind many IRA scams is gaining your trust and diverting your funds unknowingly. Many scammers are masters in the art of storytelling, creating realistic scenarios where their fraud schemes seem legitimate.

Social Engineering

Social engineering is a tactic involving manipulation to gain access to confidential information. The scammer might pose as a financial advisor offering free advice, later asking you to reveal sensitive details.

Look-Alike Websites and Emails

They might create look-alike websites or send emails that resemble those from a legitimate financial institution. When you respond or input your credentials, these scammers capture your information.

Fake Calls

Posing as IRS representatives or your financial advisor, scammers will often call to gather personal information or scare you into making hasty financial decisions that compromise your IRA funds.

How to Identify IRA Scams

Identifying potential scams isn’t always straightforward, especially since scammers use advanced tactics to cover their tracks. However, staying vigilant can keep them at bay.

Watch for Red Flags

-

Urgency: Scare tactics, like threats of penalties or losing out on a golden opportunity if you don’t act instantly, are common red flags.

-

Promises of High Returns with Low Risk: If it sounds too good to be true, it probably is.

-

Unsolicited Communication: Unsolicited offers, especially those requiring your immediate action, often signal scams.

Verify Source Authenticity

Before interacting, always check whether the source—whether it is an email, website, or phone call—is legitimate. Directly contact your financial institution using known communication channels to verify any claims.

This image is property of pixabay.com.

Protecting Yourself from IRA Scams

Taking preventive steps is far more effective than trying to recoup losses from fraud. Here are ways you can protect yourself:

Increase Security Measures

Use strong, unique passwords for your financial accounts, and enable multi-factor authentication where possible. Regularly update your account details and monitor account activity for any suspicious transactions.

Regularly Check Statements

Examining your account statements will help in identifying unauthorized transactions early. Report any anomalies immediately to your financial institution.

Educate Yourself Continuously

Knowledge truly is power. Stay informed about common scam tactics and latest schemes. Financial institutions often offer educational resources on fraud prevention.

Use Secure Communication Channels

Always use secure and trusted communication channels when discussing your finances. Avoid discussing personal information over email or phone calls that are not initiated by you.

Steps to Take if You Are a Victim

Despite your best efforts, you might fall victim to an IRA scam. In that case, knowing what to do next can mitigate the impact:

Report to Authorities

-

Inform your Financial Institution: Let your bank or financial institution know immediately so they can secure your account.

-

Report to the FTC: The Federal Trade Commission (FTC) handles complaints about scams.

-

Contact Law Enforcement: Notify your local or federal law enforcement agencies for further investigation.

Monitor Financial Activity

After a breach, keeping a close eye on all your financial accounts can help detect any other malicious activities that might follow.

Freeze Your Credit

Consider placing a freeze on your credit reports until you’re sure your identity is secure.

This image is property of images.unsplash.com.

Conclusion

Protecting your IRA account from scams is crucial to maintaining a secure financial future. By understanding the mechanisms of scams, identifying red flags, and following best practices for security, you bolster your defenses against fraudsters. Even with the best protection, if you ever suspect you’ve been targeted, act swiftly to curtail any further damage.

Remember, when in doubt, take a step back. Consult with financial advisors you trust and don’t be rushed into any action that could jeopardize your financial stability. Armed with knowledge and caution, you can enjoy a financially secure retirement without falling prey to scammers.