Market crashes can send shockwaves through traditional investment portfolios, leaving many retirement accounts devastated. During these turbulent economic periods, investors often wonder: what happens to gold IRA when market crashes? Understanding how gold performs during financial crises is crucial for those looking to protect their retirement savings. This comprehensive guide explores gold’s historical relationship with market downturns and explains why many investors turn to Gold IRAs as a safeguard against economic uncertainty.

The Fundamental Relationship Between Gold and Market Crashes

Gold has long been considered a safe-haven asset during times of economic uncertainty. When stock markets tumble, gold often moves in the opposite direction, providing a counterbalance to portfolio losses. This negative correlation between gold and equities is what makes gold particularly valuable during market crashes.

Historically, gold has demonstrated resilience during significant market downturns. While it may experience short-term volatility alongside other assets, gold typically stabilizes and often appreciates as the crisis unfolds. This pattern was evident during the 2008 financial crisis when gold initially dipped due to liquidity needs but subsequently rose by over 25% while stocks continued to decline.

The reason for this inverse relationship is straightforward: as confidence in paper assets and fiat currencies wanes during economic turmoil, investors seek tangible assets with intrinsic value. Gold, with its millennia-long history as a store of value, becomes increasingly attractive when other investments falter.

How Gold IRAs Differ From Traditional IRAs During Market Crashes

Traditional IRAs typically contain stocks, bonds, and mutual funds—assets that can experience significant devaluation during market crashes. In contrast, Gold IRAs hold physical precious metals, providing fundamentally different exposure during economic downturns.

Traditional IRA During Crashes

- Subject to market volatility and potential significant losses

- Value tied directly to company performance and market sentiment

- May face liquidity challenges during severe market stress

- Recovery dependent on broader economic rebound

- Vulnerable to currency devaluation and inflation

Gold IRA During Crashes

- Often moves counter to stock market direction

- Value based on physical precious metal, not paper promises

- Historically maintains purchasing power during currency devaluation

- Not dependent on company performance or earnings

- Provides portfolio diversification when it’s most needed

The fundamental difference lies in what backs these retirement vehicles. Traditional IRAs represent claims on future corporate profits or debt obligations, while Gold IRAs contain physical precious metals with intrinsic value. This distinction becomes crucial during market crashes when paper assets face heightened scrutiny and potential devaluation.

Protective Mechanisms of Gold IRAs During Market Volatility

Gold IRAs offer several specific mechanisms that help protect retirement savings during market crashes and periods of economic uncertainty:

1. Negative Correlation with Stocks

Gold typically shows a negative correlation with stock markets, meaning it often moves in the opposite direction of equities. This inverse relationship helps offset losses in the stock portion of your retirement portfolio during market downturns.

2. Inflation Protection

Market crashes are frequently followed by monetary stimulus and currency devaluation, which can lead to inflation. Gold has historically maintained its purchasing power during inflationary periods, protecting the real value of your retirement savings when paper assets lose value.

3. Currency Hedge

During severe economic crises, central banks often implement policies that can weaken fiat currencies. Gold, priced in dollars but valued globally, serves as a hedge against currency devaluation, preserving wealth when paper money loses value.

4. Physical Asset Security

Unlike stocks or bonds that represent claims on future performance, Gold IRAs contain physical precious metals stored in secure, IRS-approved depositories. This tangible backing provides security during times when financial institutions face stress or uncertainty.

Protect Your Retirement From Market Volatility

Learn how a Gold IRA can help safeguard your retirement savings during economic uncertainty. Get our free guide to precious metals investing.

Gold vs. Other Retirement Assets During Market Crashes

To truly understand the value of Gold IRAs during market turbulence, it’s essential to compare gold’s performance against other common retirement assets during historical crashes:

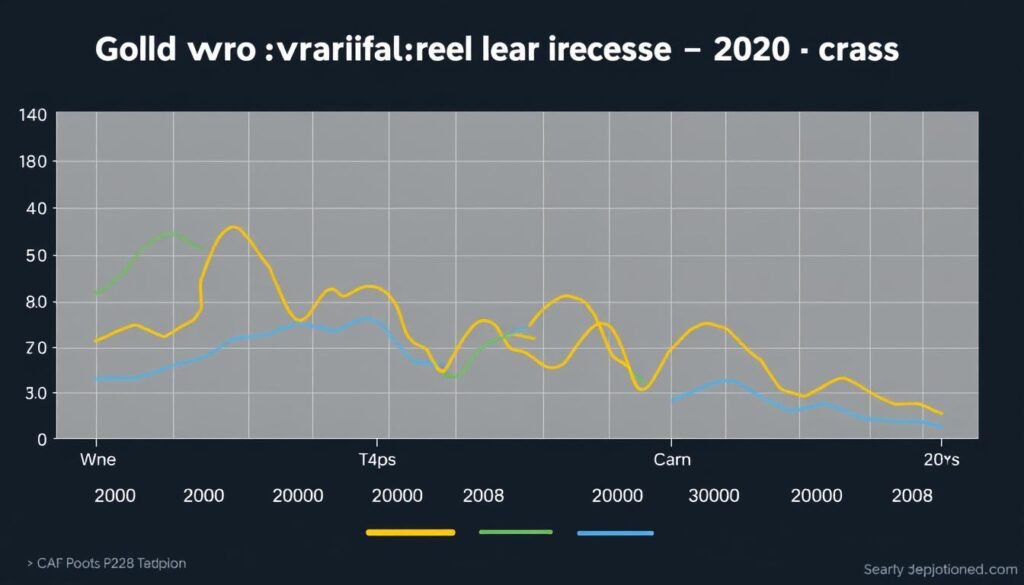

| Market Crash | S&P 500 | Bonds | Real Estate | Gold |

| 2000-2002 Dot-com Crash | -49.1% | +15.7% | +16.2% | +12.4% |

| 2008 Financial Crisis | -56.8% | +5.2% | -30.5% | +25.5% |

| 2020 COVID-19 Crash | -33.9% | +8.7% | -10.3% | +14.3% |

The data reveals a consistent pattern: while stocks typically suffer significant losses during market crashes, gold often maintains its value or appreciates. This performance difference is particularly important for retirement accounts, where preservation of capital becomes increasingly crucial as investors approach retirement age.

Bonds also tend to perform relatively well during stock market crashes, but unlike gold, they face challenges during periods of rising inflation or interest rates—conditions that often follow economic crises as central banks implement stimulus measures.

Real estate, another tangible asset, has shown mixed performance during market crashes. While it provides some diversification benefits, real estate can face liquidity challenges during severe downturns and is often affected by credit market freezes that typically accompany financial crises.

Addressing Common Concerns About Gold IRAs During Crises

Is my Gold IRA liquid during a market crash?

Yes, Gold IRAs maintain liquidity even during market crashes. IRA custodians facilitate the buying and selling of precious metals within your account. While there might be slightly wider bid-ask spreads during extreme market volatility, gold remains one of the most liquid assets globally, with continuous markets operating worldwide. Unlike some real estate or private equity investments that can become illiquid during crises, gold can typically be converted to cash within 1-3 business days.

How is my physical gold stored and is it secure during economic turmoil?

Physical gold in a Gold IRA is stored in IRS-approved depositories with state-of-the-art security systems, including 24/7 monitoring, armed guards, and comprehensive insurance policies. These facilities operate independently from the banking system, providing an additional layer of security during financial crises. Your gold is held in segregated storage, meaning your specific metals are allocated to you and not commingled with others’ holdings, ensuring your ownership remains clear regardless of market conditions.

Can I access my Gold IRA during a severe economic downturn?

Your Gold IRA follows the same distribution rules as traditional IRAs, regardless of market conditions. While early withdrawals before age 59½ typically incur a 10% penalty plus taxes, exceptions exist for certain hardships. During economic downturns, you maintain the ability to take distributions, though it’s generally advisable to avoid liquidating assets during market lows. Some investors actually increase their gold holdings during crashes, viewing them as buying opportunities rather than times to sell.

Important: While Gold IRAs provide significant protection during market crashes, they still follow standard IRA regulations regarding contributions, distributions, and required minimum distributions (RMDs). Consult with a financial advisor about how these rules apply to your specific situation.

Practical Advice for Gold IRA Holders During Market Crashes

What to Do During a Market Crash

- Maintain perspective – Remember that gold typically performs its protective function over the medium to long term, even if there’s short-term volatility.

- Consider rebalancing – Market crashes may present opportunities to rebalance your portfolio, potentially increasing your gold allocation while prices of other assets are depressed.

- Stay informed – Monitor both gold markets and broader economic indicators to make informed decisions about your retirement savings.

- Consult your advisor – Work with financial professionals who understand precious metals and can provide guidance specific to your situation.

- Review your allocation – Ensure your gold holdings represent an appropriate percentage of your overall retirement portfolio based on your age and risk tolerance.

What Not to Do During a Market Crash

- Don’t panic sell – Emotional reactions to market volatility often lead to selling at the worst possible time.

- Avoid excessive concentration – While increasing gold allocation may be prudent, maintain appropriate diversification across asset classes.

- Don’t try to time the market – Even experts struggle to perfectly time market bottoms and tops; focus on long-term strategy instead.

- Don’t ignore tax implications – Remember that transactions within your Gold IRA don’t trigger tax events, but distributions do.

- Don’t forget your investment timeline – Your response to market crashes should align with your retirement horizon.

Prepare Your Retirement for the Next Market Crash

Speak with a Gold IRA specialist to learn how precious metals can help protect your retirement savings during economic uncertainty.

Real-World Examples: Gold IRA Performance During Past Crashes

Case Study: 2008 Financial Crisis

During the 2008 financial crisis, when the S&P 500 plummeted by nearly 57%, a hypothetical Gold IRA would have provided significant protection. While gold initially experienced a brief decline as investors sought liquidity, it quickly rebounded and ultimately gained over 25% from the start of the crisis to its conclusion.

Consider this example: An investor with a $500,000 traditional IRA fully invested in an S&P 500 index fund would have seen their balance shrink to approximately $215,000 at the market bottom. In contrast, an investor with a $500,000 Gold IRA would have seen their balance grow to approximately $625,000 over the same period.

Case Study: COVID-19 Market Crash

The COVID-19 market crash of 2020 provides a more recent example. As global lockdowns triggered a swift 34% decline in the S&P 500, gold initially fell about 12% in the liquidity crunch but quickly recovered and ended the year up 25%. A $500,000 Gold IRA would have grown to approximately $625,000, while a traditional IRA invested in the broader market would have experienced significant volatility before eventually recovering.

“During times of financial stress, gold has consistently demonstrated its value as a portfolio diversifier and wealth preserver. While past performance doesn’t guarantee future results, gold’s historical track record during crises makes a compelling case for its inclusion in retirement portfolios.”

Potential Risks and Limitations of Gold IRAs During Extreme Conditions

While Gold IRAs offer significant protection during market crashes, they aren’t without potential limitations and risks that investors should understand:

Gold IRA Strengths During Crashes

- Historical tendency to preserve wealth during crises

- Protection against currency devaluation

- Portfolio diversification when most needed

- Tangible asset backing

- Global liquidity

Gold IRA Limitations During Crashes

- Potential short-term volatility

- Possible premium increases on physical products

- No dividend or interest income

- Storage and insurance costs continue regardless of market conditions

- Subject to potential government regulations

Short-Term Liquidity Pressures

During severe market dislocations, gold can experience short-term price volatility as institutional investors may need to sell profitable positions (including gold) to cover losses elsewhere or meet margin calls. This can temporarily pressure gold prices before the metal’s safe-haven characteristics reassert themselves.

Premium Fluctuations

Physical gold products like coins and bars carry premiums above the spot price of gold. During extreme market conditions, these premiums can increase due to higher demand and potential supply chain disruptions, affecting the net value of your Gold IRA holdings.

Regulatory Considerations

While extremely rare in modern Western economies, investors should be aware that governments have historically imposed regulations on gold ownership during severe economic crises. However, gold held within IRA structures has additional legal protections compared to direct ownership.

Conclusion: Gold IRAs as a Protective Strategy During Market Crashes

When examining what happens to gold IRA when market crashes, the historical evidence points to a clear conclusion: Gold IRAs typically provide significant protection during economic downturns, often preserving or even increasing in value while traditional paper assets decline.

The unique properties of gold—its negative correlation with stocks, inflation-hedging capabilities, global recognition, and intrinsic value—make it a powerful diversification tool precisely when diversification benefits are most needed. While no investment is without risk, gold’s centuries-long track record as a store of value during turbulent times makes a compelling case for its inclusion in retirement portfolios.

For investors concerned about market volatility and economic uncertainty, a Gold IRA offers a strategic approach to protecting retirement savings. By understanding both the strengths and limitations of gold during market crashes, investors can make informed decisions about incorporating precious metals into their long-term retirement strategy.

Safeguard Your Retirement Against Market Uncertainty

Learn how a Gold IRA can help protect your hard-earned savings from market crashes and economic volatility.

Additional Resources

Gold IRA Rollover Guide

Learn how to transfer existing retirement accounts into a Gold IRA without tax penalties.

Gold Market Analysis

Stay informed with our quarterly analysis of gold market trends and economic indicators.

Retirement Calculator

Calculate how adding gold to your portfolio might affect your retirement readiness.