Have you ever wondered at what age you should begin collecting Social Security benefits? It’s a significant topic that can impact your financial planning for retirement. Understanding the retirement age chart for Social Security is vital because it can help you decide when to start receiving benefits to maximize your income in the later stages of life.

This image is property of pixabay.com.

What is the Social Security Retirement Age?

Social Security retirement age refers to the age at which you can begin receiving your full retirement benefits. However, there are a few options to consider based on your financial situation and lifestyle goals. These choices include collecting benefits early, at full retirement age, or delaying to receive more substantial benefits later.

Early Retirement Age

You can choose to begin receiving Social Security benefits as early as age 62. However, starting early means your monthly benefit amount will be permanently reduced. This reduction is due to the longer period you will be receiving benefits.

Full Retirement Age (FRA)

Full Retirement Age is the age at which you can receive your full Social Security benefit without any reductions. The specific age depends on the year you were born.

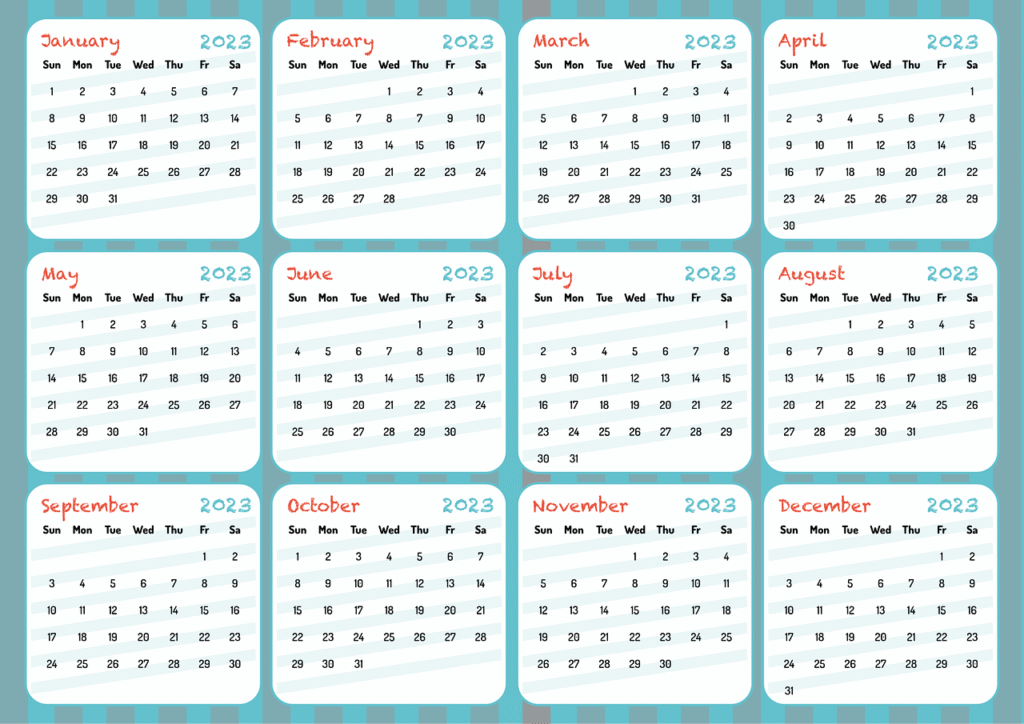

Here’s a quick look at how birth year relates to Full Retirement Age:

| Birth Year | Full Retirement Age |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

This table shows the gradual increase in full retirement age, which reflects changes to ensure the sustainability of the Social Security system.

Delayed Retirement Age

Delaying benefits beyond your full retirement age can increase your monthly benefits. For every year you delay, benefits increase by a certain percentage until you reach age 70. Waiting till 70 provides the maximum benefit, as there are no additional increases past this age.

Why is Knowing Your Full Retirement Age Important?

Knowing your full retirement age is crucial for strategic financial planning, allowing you to optimize your retirement income. Here’s why:

Maximizing Benefits

Deciding when to start collecting Social Security depends largely on your financial needs. The objective is to make the most of the benefits, based on how long you expect to live and what other retirement resources you have.

Bridging the Income Gap

Retirement doesn’t mean an end to expenses. Depending on additional retirement savings, many individuals use Social Security to bridge the income gap or as a primary source of income. Knowing your full retirement age helps in budgeting effectively.

Early or Late Retirement: What’s Best for You?

The choice to start collecting benefits early, wait until your full retirement age, or delay depends on personal circumstances.

Pros and Cons of Early Retirement

Pros:

- Immediate Access: By starting at age 62, you start receiving benefits earlier, which might be necessary in specific financial situations.

- Longer Benefit Period: Collecting early might be advantageous if your life expectancy is below average.

Cons:

- Reduced Benefits: Receiving benefits early reduces your monthly payment permanently.

- Working Penalty: If you continue to work while receiving early benefits, earnings above a certain threshold could reduce benefit amounts until you reach full retirement age.

Pros and Cons of Delayed Retirement

Pros:

- Increased Monthly Payments: Benefits increase annually beyond full retirement age, enhancing long-term monthly income.

- Greater Financial Security: Provides a safeguard against outliving resources if longevity is a concern.

Cons:

- Delayed Gratification: Requires financial stability to wait, as benefits only increase if you can afford to postpone them.

- Shorter Collection Period: If unforeseen circumstances arise and you have a shorter-than-expected lifespan, delaying benefits might mean receiving them for a shorter duration.

Factors Influencing Your Decision

Several factors play into the decision on when to begin collecting Social Security benefits:

Life Expectancy

Considering your health and family history can provide insight into your life expectancy. If you anticipate a longer life, delaying might yield more significant benefits.

Employment Status

Are you still working or planning to work during your retirement years? Your employment status impacts the advantage of collecting early versus delaying.

Financial Needs

Evaluate whether you can meet your needs without immediate Social Security benefits. Having sufficient retirement savings impacts the timing of starting your benefits.

Spousal Benefits

Married couples can strategize by balancing two benefit amounts. One spouse might choose to delay for larger benefits, while the other collects early. Spousal benefits could also increase by waiting.

This image is property of images.unsplash.com.

Calculating Your Benefits

Understanding how benefits are calculated assists in planning. Social Security uses your earnings history, indexed to reflect changes in wage levels over time, to determine benefits.

Average Indexed Monthly Earnings (AIME)

Your benefits depend on your 35 highest-earning years. If you have less than 35 years of work, zeros are included, lowering your AIME.

Primary Insurance Amount (PIA)

This is the benefit you would receive at full retirement age, calculated based on your AIME. It forms the basis for adjustments if you retire early or late.

Cost of Living Adjustments (COLA)

Social Security benefits may increase due to COLA, which allows benefits to keep pace with inflation, ensuring the purchasing power of benefits isn’t eroded over time.

Social Security and Taxes

Understanding the tax implications of Social Security is crucial. Your benefits might be subject to federal income tax if your total income exceeds certain thresholds.

Combined Income

To determine tax liability, calculate your combined income: adjust gross income + nontaxable interest + 50% of your Social Security benefits.

Taxation Thresholds

Depending on your filing status and income, up to 85% of your benefits might be taxable.

- For individuals with a combined income between $25,000 and $34,000, up to 50% of benefits may be taxable.

- For income over $34,000, up to 85% of benefits might be taxable.

State Taxes

Be aware that state taxes vary and some states tax Social Security benefits, adding another layer for consideration in retirement planning.

This image is property of pixabay.com.

The Impact of Healthcare Costs

Healthcare is often a major expense during retirement. Factoring potential medical costs when deciding the timing of benefits is vital. Medicare typically starts at age 65, independent of when you begin receiving Social Security.

Considering Medicare

Aligning your Social Security and Medicare can aid in budgeting health expenses effectively once you reach Medicare eligibility.

Long-term Care

Anticipating potential needs for long-term care is crucial, as these expenses aren’t covered by Medicare. Evaluating if your Social Security will help cover potential long-term costs can shape your retirement decisions.

Retirement Planning Beyond Social Security

While Social Security forms a crucial part of many retirement plans, it’s usually not sufficient alone. Complementing Social Security with other savings can lead to a secure retirement.

Diversified Income Streams

Creating a retirement portfolio that includes pension plans, private savings, and investment income is optimal for long-term financial security.

Budgeting Effectively

Ensure understanding of your living expenses and develop a realistic retirement budget. Align it with income sources, including Social Security, and adjust as necessary for inflation to maintain financial stability.

Financial Advisory Services

Seeking advice from financial advisors can provide tailored planning, ensuring strategic decisions and tax efficiency concerning Social Security and other resources.

This image is property of images.unsplash.com.

Conclusion

Deciding when to start collecting Social Security benefits is crucial yet personal. It requires understanding your unique situation, considering your health, finances, employment, and long-term expectations. The goal is to make the decision that best suits your personal needs and maximizes your benefits over time.

Through understanding and planning, you can navigate your retirement years confidently, ensuring not just financial stability but also peace of mind.