In today’s volatile economic landscape, diversification has become more than just financial advice—it’s a necessity for protecting your wealth. As traditional markets face uncertainty, alternative assets like precious metals and cryptocurrencies have emerged as popular diversification strategies, particularly within retirement accounts.

This comprehensive guide compares gold IRA vs crypto diversification pros cons to help you determine which option aligns with your investment goals. Whether you’re seeking stability or growth potential, understanding these alternative assets is crucial for making informed decisions about your financial future.

The Importance of Portfolio Diversification

Diversification serves as a fundamental risk management strategy in investment portfolios. By spreading investments across various asset classes, you can potentially reduce volatility and protect against significant losses when one sector underperforms.

Traditional diversification typically involves a mix of stocks, bonds, and cash. However, modern portfolio theory increasingly recognizes the value of alternative assets that don’t necessarily move in tandem with traditional markets.

Both gold IRAs and cryptocurrency represent alternative investment vehicles that can provide this decorrelation effect. Their performance often follows different patterns than conventional investments, making them valuable tools for comprehensive diversification strategies.

Understanding your diversification options is the first step toward building a resilient portfolio. As you explore these alternatives, consider how they align with your overall investment strategy.

What is a Gold IRA?

A Gold IRA (Individual Retirement Account) is a self-directed IRA that allows investors to hold physical precious metals as retirement investments. Unlike conventional IRAs that typically contain stocks, bonds, or mutual funds, a gold IRA holds IRS-approved gold, silver, platinum, or palladium in physical form.

How Gold IRAs Work

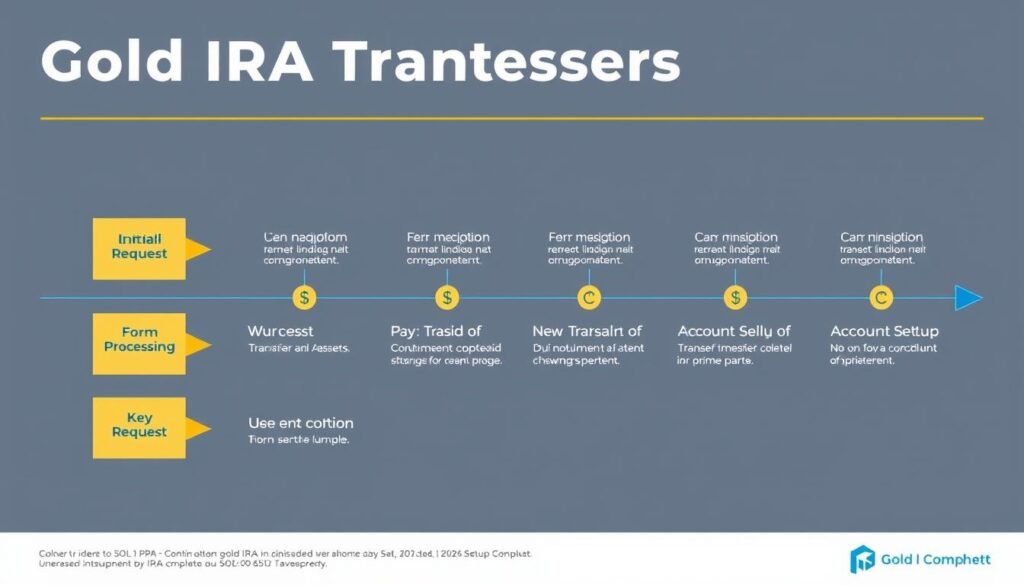

Setting up a gold IRA requires working with specialized custodians who handle the account administration and ensure compliance with IRS regulations. The process typically involves:

- Selecting an IRS-approved custodian specializing in precious metals

- Opening a self-directed IRA account

- Funding the account (through a transfer, rollover, or contribution)

- Selecting IRS-approved precious metals (minimum 99.5% purity for gold)

- Arranging secure storage in an IRS-approved depository

Historical Performance and Stability

Gold has maintained its value throughout thousands of years of economic changes. While not immune to price fluctuations, gold has historically served as a store of value during economic downturns and periods of high inflation.

Over the past two decades, gold has seen significant appreciation, with prices rising from around $300 per ounce in 2002 to over $2,000 per ounce in recent years. This performance demonstrates gold’s potential as both a wealth preservation tool and growth asset.

Tax Advantages of Gold IRAs

Gold IRAs offer the same tax advantages as traditional or Roth IRAs, depending on which type you choose:

Traditional Gold IRA

- Tax-deductible contributions (subject to income limits)

- Tax-deferred growth until withdrawal

- Taxed as ordinary income upon withdrawal

Roth Gold IRA

- Contributions made with after-tax dollars

- Tax-free growth

- Tax-free qualified withdrawals in retirement

Storage Requirements and Fees

IRS regulations require that physical precious metals in a gold IRA be stored in an approved depository. Home storage is not permitted for IRA-held metals. This requirement comes with annual storage and insurance fees, typically ranging from 0.5% to 1% of the asset value.

Additional fees may include setup charges, administration fees, and transaction costs when buying or selling metals. These fees can impact your overall returns and should be carefully considered when evaluating a gold IRA.

Liquidity Considerations

While gold is generally considered a liquid asset, selling physical gold from an IRA isn’t as immediate as trading stocks or mutual funds. The process involves coordinating with your custodian and finding a buyer, which can take several days to complete.

Additionally, like other retirement accounts, withdrawals before age 59½ may incur a 10% early withdrawal penalty in addition to applicable taxes.

Gold IRAs offer a tangible asset for your retirement portfolio. To learn more about setting up a gold IRA with reputable custodians:

Cryptocurrency as a Diversification Strategy

Cryptocurrency represents a digital alternative to traditional assets, offering a fundamentally different approach to diversification. A crypto IRA (also called a bitcoin IRA) is a self-directed IRA that allows investors to include digital currencies like Bitcoin, Ethereum, and other approved cryptocurrencies in their retirement portfolios.

Volatility Patterns and Risk Profile

Cryptocurrencies are known for their significant price volatility. Bitcoin, for example, has experienced multiple cycles of dramatic growth followed by substantial corrections. In 2021 alone, Bitcoin’s price ranged from around $29,000 to nearly $69,000 before settling lower.

This volatility presents both opportunity and risk. While it creates potential for substantial returns, it also introduces considerable uncertainty, especially for retirement planning where stability is often prioritized.

Growth Potential and Historical Performance

Despite its volatility, cryptocurrency has demonstrated remarkable growth potential. Bitcoin, the first and largest cryptocurrency, has appreciated from less than $1 in its early days to tens of thousands of dollars today, representing one of the best-performing assets of the past decade.

Other cryptocurrencies have shown similar growth trajectories, though with varying degrees of success and stability. This growth potential attracts investors looking to maximize returns in their diversification strategy.

Technological Aspects and Innovation

Cryptocurrencies represent more than just financial assets; they embody technological innovation through blockchain technology. This underlying technology offers potential applications beyond currency, including smart contracts, decentralized finance, and digital ownership verification.

Investing in cryptocurrency can therefore represent both financial diversification and exposure to technological innovation that may shape future economic systems.

Regulatory Environment

The regulatory landscape for cryptocurrencies continues to evolve globally. In the United States, cryptocurrencies are treated as property for tax purposes, similar to precious metals. However, regulatory changes could significantly impact cryptocurrency values and availability.

This regulatory uncertainty adds another layer of risk to cryptocurrency investments, particularly for long-term retirement planning where regulatory stability is beneficial.

Security Concerns and Storage Solutions

Securing cryptocurrency investments requires understanding digital security practices. Crypto IRAs typically use specialized custodians who provide secure storage solutions, often through “cold storage” methods that keep digital assets offline and protected from hacking attempts.

While these security measures are robust, they differ fundamentally from the physical security of gold storage, presenting different risk considerations for investors.

Cryptocurrency offers high-growth potential for diversification. To explore reputable crypto IRA providers:

Gold IRA vs Crypto Diversification: Comparative Analysis

When evaluating gold IRA vs crypto diversification pros cons, it’s essential to compare key factors that impact their suitability for your investment strategy. The following table highlights the critical differences between these alternative assets:

| Factor | Gold IRA | Cryptocurrency IRA |

| Risk Level | Moderate – Less volatile with established history | High – Significant price volatility and market uncertainty |

| Potential Returns | Moderate – Historical annual returns of 7-9% over long periods | High – Potential for substantial gains but with significant downside risk |

| Liquidity | Moderate – Requires physical handling and buyer coordination | High – Digital assets can be traded 24/7 on global exchanges |

| Regulatory Protection | High – Well-established regulatory framework | Low to Moderate – Evolving regulations with uncertainty |

| Inflation Hedge | Strong – Historical correlation with inflation protection | Potential – Limited history but designed with scarcity principles |

| Accessibility | Moderate – Requires specialized custodians and depositories | Moderate – Requires specialized custodians with digital security expertise |

| Storage Costs | 0.5-1% annually for secure storage and insurance | Typically 1-2% annually for secure digital custody |

| Historical Track Record | Thousands of years as a store of value | Approximately 14 years since Bitcoin’s creation |

This comparison highlights the fundamental differences in risk profile, potential returns, and stability between gold and cryptocurrency as diversification options. Your personal risk tolerance and investment timeline should guide which option better aligns with your financial goals.

Pros and Cons Analysis

Gold IRA: Advantages and Disadvantages

Advantages of Gold IRAs

- Stability and wealth preservation during economic uncertainty

- Effective hedge against inflation and currency devaluation

- Tangible asset with intrinsic value independent of financial systems

- Low correlation with traditional stock and bond markets

- Well-established regulatory framework with clear guidelines

- Historical track record spanning thousands of years

Disadvantages of Gold IRAs

- Storage and insurance fees can impact overall returns

- Lower growth potential compared to more aggressive investments

- No passive income generation (dividends or interest)

- Less liquidity than traditional securities or digital assets

- Potential dealer markups when purchasing physical metals

- Subject to special collectibles tax rate (28%) for certain distributions

Cryptocurrency: Advantages and Disadvantages

Advantages of Crypto IRAs

- Significant growth potential exceeding traditional investments

- 24/7 market access with high liquidity

- Exposure to blockchain technology and digital innovation

- Potential hedge against monetary inflation due to limited supply (Bitcoin)

- Decentralized nature resistant to government seizure or control

- Increasing institutional adoption and mainstream acceptance

Disadvantages of Crypto IRAs

- Extreme price volatility can threaten retirement security

- Regulatory uncertainty with potential for adverse policy changes

- Cybersecurity risks including hacking and exchange failures

- Relatively short track record compared to traditional assets

- Technical complexity requiring digital literacy

- Potential for total loss if the technology fails or is superseded

Understanding the pros and cons of each investment option is crucial for making informed decisions. For personalized guidance on which option might better suit your situation:

Practical Investment Advice

Minimum Investment Requirements

Both gold IRAs and cryptocurrency IRAs have varying minimum investment requirements depending on the custodian:

Gold IRA Minimums

- Typical minimum: $10,000-$25,000

- Some providers offer lower entry points around $5,000

- Premium services may require $50,000+

Crypto IRA Minimums

- Typical minimum: $3,000-$10,000

- Some platforms allow starting with as little as $1,000

- Premium services with enhanced security may require higher minimums

Recommended Allocation Percentages

Financial experts typically suggest limiting alternative assets to a portion of your overall portfolio:

| Investor Profile | Gold IRA Allocation | Crypto IRA Allocation | Combined Alternative Assets |

| Conservative | 5-10% | 0-2% | 5-10% |

| Moderate | 10-15% | 2-5% | 10-20% |

| Aggressive | 5-10% | 5-10% | 15-25% |

| Young Investor (30+ years to retirement) | 5-10% | 5-15% | 15-25% |

| Near Retirement (5-10 years) | 10-20% | 0-5% | 10-20% |

These allocations are general guidelines and should be adjusted based on your personal financial situation, goals, and risk tolerance. Working with a financial advisor can help determine the optimal allocation for your specific circumstances.

Risk Management Strategies

When incorporating alternative assets like gold and cryptocurrency into your portfolio, consider these risk management approaches:

- Dollar-cost averaging: Invest fixed amounts at regular intervals rather than all at once, particularly for volatile assets like cryptocurrency

- Rebalancing: Periodically adjust your portfolio to maintain your target allocation percentages

- Diversification within alternatives: Consider multiple precious metals or cryptocurrencies rather than concentrating in just one

- Time horizon alignment: Match riskier assets with longer time horizons and more stable assets with shorter ones

- Regular review: Assess performance and adjust strategy as market conditions and personal circumstances change

Important: Both gold IRAs and cryptocurrency IRAs involve special considerations regarding required minimum distributions (RMDs) starting at age 73 (for traditional IRAs). Plan accordingly for potential liquidation needs in retirement.

Which Option is Right for You?

The suitability of gold IRAs versus cryptocurrency IRAs largely depends on your investor profile, risk tolerance, and retirement timeline. Here’s a breakdown of which option might better align with different investor types:

Conservative Investors

Best Option: Gold IRA

- Prioritizes wealth preservation over growth

- Values stability and tangible assets

- Typically closer to retirement age

- Lower risk tolerance

- Seeks protection against economic uncertainty

Balanced Investors

Best Option: Combination Approach

- Seeks both growth and stability

- Moderate risk tolerance

- Mid-career stage with 10-20 years until retirement

- Values diversification across different alternative assets

- Willing to accept some volatility for potential returns

Growth-Oriented Investors

Best Option: Cryptocurrency IRA

- Prioritizes growth potential over stability

- Higher risk tolerance

- Younger investors with 20+ years until retirement

- Comfortable with technology and digital assets

- Willing to accept significant volatility for higher returns

Remember that these profiles represent general guidelines. Many investors may find themselves somewhere in between these categories or may have unique circumstances that influence their optimal strategy.

“The best portfolio is not necessarily the one with the highest potential return, but rather the one that strikes the right balance between risk and return for your specific situation.”

Conclusion: Making an Informed Decision

When evaluating gold IRA vs crypto diversification pros cons, there’s no one-size-fits-all answer. Both options offer unique advantages and challenges as diversification strategies for your retirement portfolio.

Gold IRAs provide stability, inflation protection, and a tangible asset with thousands of years of history as a store of value. They’re particularly well-suited for conservative investors or those approaching retirement who prioritize wealth preservation over aggressive growth.

Cryptocurrency IRAs offer significant growth potential, technological innovation exposure, and high liquidity. They appeal to younger or more risk-tolerant investors who can weather volatility and have a longer time horizon before retirement.

For many investors, a balanced approach that incorporates both assets in appropriate proportions may provide the optimal diversification strategy. This allows you to benefit from gold’s stability while also capturing some of cryptocurrency’s growth potential.

Regardless of which path you choose, remember that alternative assets should typically represent only a portion of your overall retirement strategy, complementing traditional investments rather than replacing them entirely.

Ready to Diversify Your Retirement Portfolio?

Before making any decisions about gold IRAs or cryptocurrency investments, consult with a qualified financial advisor who can provide personalized guidance based on your specific financial situation, goals, and risk tolerance.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Alternative investments involve substantial risk and are not suitable for all investors. Past performance is not indicative of future results.

Frequently Asked Questions

Can I hold both gold and cryptocurrency in the same IRA?

Yes, it’s possible to hold both gold and cryptocurrency in the same self-directed IRA, provided your custodian supports both asset types. Some specialized custodians offer “diversified” alternative asset IRAs that allow you to hold multiple alternative investments within a single account structure.

What are the minimum investment requirements for gold and crypto IRAs?

Minimum investment requirements vary by custodian. Gold IRAs typically require ,000-,000 to start, while crypto IRAs may have lower minimums, often starting around ,000-,000. Some providers offer lower entry points, but may charge higher percentage fees for smaller accounts.

How are gold and cryptocurrency IRAs taxed?

Both gold and cryptocurrency IRAs follow the same tax rules as traditional or Roth IRAs, depending on which type you choose. With traditional IRAs, contributions may be tax-deductible, and growth is tax-deferred until withdrawal. With Roth IRAs, contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

What happens when I need to take required minimum distributions (RMDs) from my gold or crypto IRA?

For traditional IRAs (including gold and crypto), you must begin taking RMDs at age 73. This can be more complex with alternative assets than with cash or securities. You have several options: take in-kind distributions (receiving the physical gold or crypto), liquidate a portion of your holdings to take cash distributions, or maintain sufficient cash in the account to cover RMDs without liquidating assets.

Which option better protects against inflation: gold or cryptocurrency?

Gold has a well-established history as an inflation hedge, typically maintaining or increasing its purchasing power during inflationary periods. Cryptocurrency, particularly Bitcoin with its fixed supply cap, is theoretically designed to resist inflation, but has a much shorter track record. Some investors include both assets as complementary inflation hedges with different risk profiles.