Many investors shy away from Gold IRAs because of persistent misconceptions about how they work. Some believe these accounts are only for the wealthy, while others worry about excessive fees or question their legitimacy. These gold IRA misconceptions can prevent you from exploring a potentially valuable addition to your retirement strategy.

This guide cuts through the confusion to reveal the truth about Gold IRAs. We’ll examine seven common myths and provide factual information to help you make an informed decision about whether precious metals belong in your retirement portfolio.

Understanding Gold IRAs: The Basics

A Gold IRA (Individual Retirement Account) is a self-directed retirement account that allows you to hold physical precious metals instead of traditional paper assets like stocks and bonds. These accounts follow the same basic tax rules as conventional IRAs but with the added benefit of holding tangible assets.

What Exactly Is a Gold IRA?

A Gold IRA is a specialized type of self-directed IRA that holds physical precious metals rather than paper investments. It operates under the same IRS regulations as traditional or Roth IRAs, offering similar tax advantages while allowing you to diversify with physical gold, silver, platinum, and palladium.

These accounts require a qualified custodian to manage the account and ensure compliance with IRS regulations. The precious metals must be stored in an approved depository—not in your home—to maintain their tax-advantaged status.

IRS-Approved Precious Metals

The IRS has strict requirements about which metals qualify for inclusion in a precious metals IRA:

- Gold must be at least 99.5% pure

- Silver must be at least 99.9% pure

- Platinum and palladium must be at least 99.95% pure

Eligible products include certain government-minted coins like American Gold Eagles and Canadian Maple Leafs, as well as approved bars and rounds from accredited refiners. Collectible coins and jewelry do not qualify for inclusion in a Gold IRA.

Myth 1: Gold IRAs Are Only for the Wealthy

One of the most persistent gold IRA misconceptions is that these accounts are exclusively for high-net-worth individuals. This myth likely stems from the perception that investing in precious metals requires substantial capital.

In reality, many reputable Gold IRA companies offer reasonable minimum investment requirements that make these accounts accessible to average investors. While some providers may have higher minimums, others allow you to start with as little as $5,000-$10,000, which is comparable to many traditional retirement account minimums.

Additionally, you can fund a Gold IRA through a rollover from an existing retirement account, making it easier to get started without finding new investment capital. This approach allows investors with modest retirement savings to diversify into precious metals.

Ready to learn if a Gold IRA is right for you?

Download our free guide to discover how Gold IRAs work and whether they fit your retirement strategy.

Myth 2: Gold IRAs Offer No Tax Benefits

Another common misconception is that Gold IRAs don’t provide the same tax advantages as traditional retirement accounts. This is simply not true. Gold IRAs follow the same tax rules as conventional IRAs, with options for both Traditional and Roth structures.

Traditional Gold IRA

- Contributions may be tax-deductible

- Investments grow tax-deferred

- Taxes paid upon withdrawal

Roth Gold IRA

- Contributions made with after-tax dollars

- Investments grow tax-free

- Qualified withdrawals are tax-free

The IRS treats precious metals in these accounts just like any other approved asset. As long as the metals meet purity standards and are held by an approved custodian, you receive the same tax benefits you would with stocks or bonds in a retirement account.

Myth 3: You Can Store IRA Metals at Home

One dangerous gold IRA misconception is that you can keep your IRA-held precious metals at home. This is categorically false and could lead to serious tax consequences if attempted.

IRS regulations explicitly require that precious metals in an IRA must be stored in an approved depository. Taking physical possession of the metals would be considered a distribution, potentially triggering taxes and penalties if you’re under 59½ years old.

Warning: Beware of companies promoting “home storage” Gold IRAs. These schemes often mislead investors about IRS requirements and could result in disqualification of your entire IRA, immediate taxation, and penalties.

Approved depositories offer several important benefits:

- Professional security systems and protocols

- Insurance coverage for your metals

- Regular audits and verification

- Proper documentation for IRS compliance

While you can’t store the metals at home while they’re in your IRA, you can take physical possession when you take a distribution from your account, though this may have tax implications.

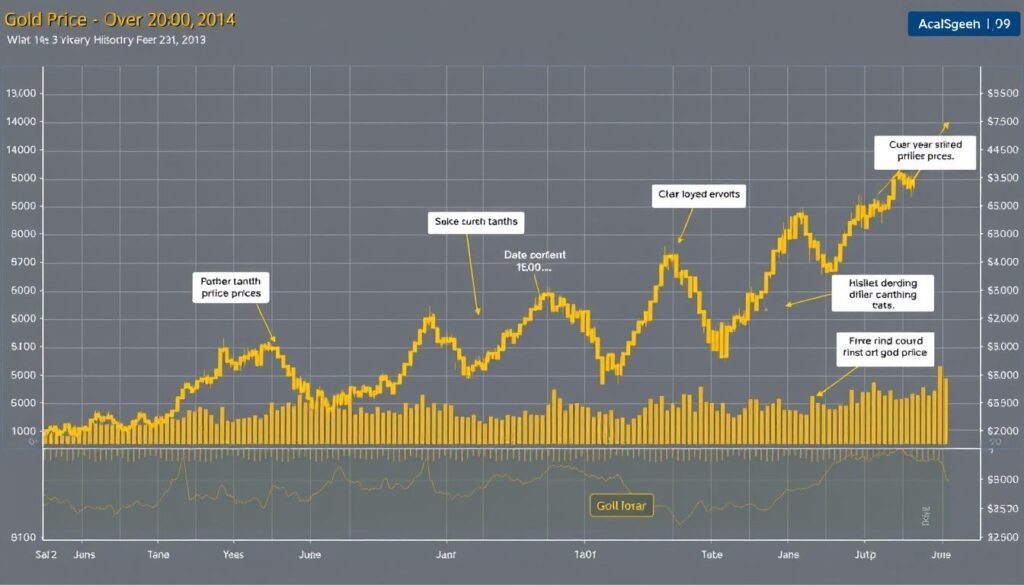

Myth 4: Gold IRAs Are Risk-Free Investments

While gold has historically maintained value over the long term, the notion that Gold IRAs are completely risk-free is a misconception. Like all investments, precious metals come with their own set of risks and considerations.

Understanding Gold’s Price Volatility

Gold prices can fluctuate significantly based on various factors:

- Economic conditions and interest rates

- Currency strength, particularly the U.S. dollar

- Global political events and crises

- Market sentiment and investor behavior

Unlike stocks or bonds, physical gold doesn’t generate income through dividends or interest. Your returns depend entirely on price appreciation, which isn’t guaranteed in any specific timeframe.

“Gold should be viewed as an insurance policy against economic uncertainty, not as a growth investment. Its primary value is in portfolio diversification and wealth preservation.”

Most financial experts recommend allocating only a portion of your retirement portfolio to precious metals—typically 5-15%—as part of a diversified investment strategy.

Stay informed about precious metals markets

Subscribe to our newsletter for regular updates on gold prices, market trends, and retirement strategies.

Myth 5: Setting Up a Gold IRA Is Too Complicated

Many potential investors avoid Gold IRAs because they believe the setup process is overly complex. While a Gold IRA does involve a few more steps than a standard IRA, reputable companies have streamlined the process to make it straightforward.

The Gold IRA Setup Process

- Choose a reputable custodian that specializes in self-directed IRAs and precious metals.

- Complete the account application with your custodian, similar to opening any financial account.

- Fund your account through a contribution, transfer, or rollover from an existing retirement account.

- Select your precious metals from IRS-approved options with guidance from your dealer.

- Finalize storage arrangements with an approved depository through your custodian.

Most Gold IRA companies provide dedicated account representatives who guide you through each step, handle the paperwork, and coordinate between the custodian, metals dealer, and depository. This hands-on assistance makes the process much simpler than many expect.

Rollovers from existing retirement accounts can typically be completed with minimal effort on your part, often requiring just a few signatures on pre-prepared forms.

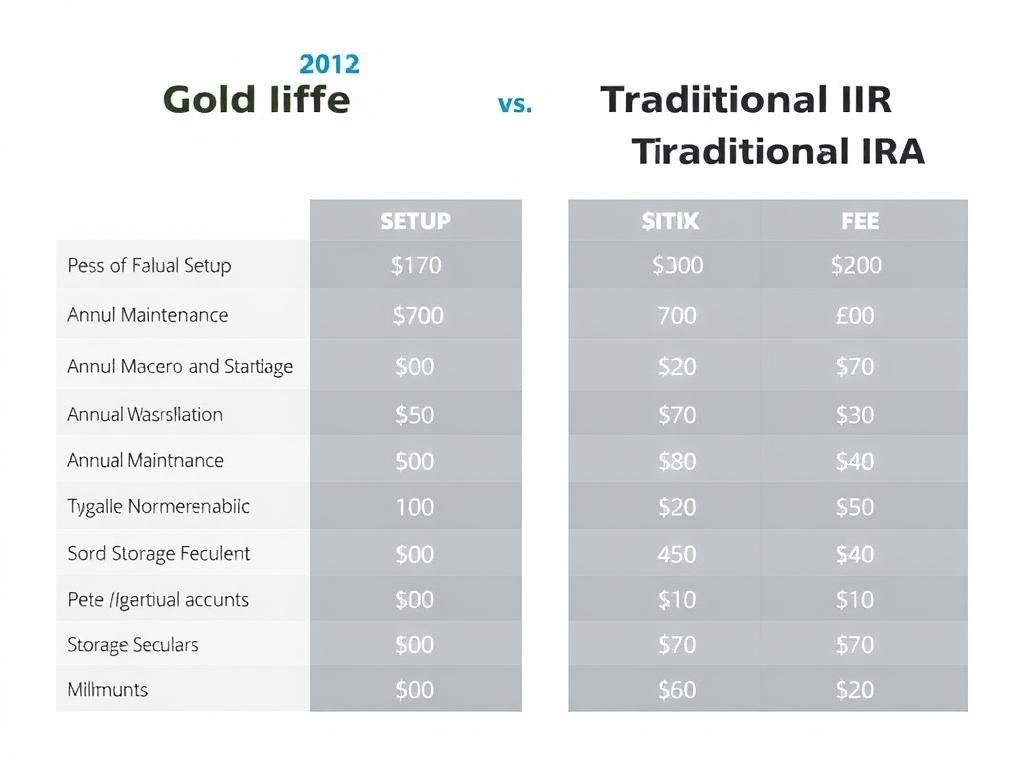

Myth 6: Gold IRA Fees Make Them Prohibitively Expensive

Concerns about high fees are common among those considering Gold IRAs. While it’s true that Gold IRAs typically have additional costs compared to standard IRAs, these fees are often reasonable and transparent when working with reputable providers.

Understanding Gold IRA Fee Structure

| Fee Type | Typical Range | Description |

| Setup Fee | $50-$150 | One-time fee to establish the account |

| Annual Maintenance | $75-$300 | Yearly fee for account administration |

| Storage Fee | $100-$300 | Annual cost for secure depository storage |

| Transaction Fees | Varies | Costs associated with buying/selling metals |

When evaluating Gold IRA providers, look for transparent fee structures with no hidden costs. Some companies offer scaled fees based on account value, while others provide flat-fee options that can be more economical for larger accounts.

While fees are an important consideration, they should be viewed in the context of the potential benefits of portfolio diversification and inflation protection that precious metals can provide.

Myth 7: All Gold IRA Companies Provide the Same Service

Perhaps one of the most dangerous gold IRA misconceptions is that all providers offer equivalent services and reliability. In reality, there are significant differences in expertise, pricing, customer service, and product selection among Gold IRA companies.

Key Differentiators Among Gold IRA Companies

What to Look For

- Transparent fee structure with no hidden costs

- Educational resources and market insights

- Strong industry reputation and reviews

- Reasonable buyback programs

- Dedicated customer support

- Industry credentials and partnerships

Red Flags to Avoid

- High-pressure sales tactics

- Promises of guaranteed returns

- “Home storage” IRA promotions

- Excessive fees or unclear pricing

- Limited or no buyback options

- Poor reviews or regulatory issues

Take time to research potential providers thoroughly. Check customer reviews, Better Business Bureau ratings, and any regulatory actions. Reputable companies will focus on education rather than aggressive sales tactics and will be transparent about all costs involved.

The quality of your Gold IRA experience depends significantly on choosing the right company to work with, making this an essential step in the process.

Benefits of Including Precious Metals in Your Retirement Portfolio

While it’s important to understand the misconceptions surrounding Gold IRAs, it’s equally valuable to recognize the potential benefits they can offer as part of a diversified retirement strategy.

Portfolio Diversification

One of the primary advantages of precious metals is their historically low correlation with traditional assets like stocks and bonds. This means that when stock markets experience volatility, gold often moves independently or even in the opposite direction, potentially helping to stabilize your overall portfolio returns.

Inflation Protection

Precious metals, particularly gold, have historically maintained purchasing power over long periods. Unlike paper currency, which can be devalued through inflation and monetary policy, gold’s inherent scarcity helps it retain value even as the cost of living increases.

Currency Devaluation Hedge

During periods of currency devaluation or monetary instability, precious metals often serve as a store of value. This can be particularly important for retirees who need to preserve their purchasing power through economic uncertainties.

Did You Know? During the 2008-2009 financial crisis, while the S&P 500 fell by over 50% from its peak, gold prices increased by approximately 25%. This illustrates how precious metals can sometimes move counter to traditional markets during periods of economic stress.

Frequently Asked Questions About Gold IRAs

Can I add gold I already own to my Gold IRA?

No, you cannot add gold you already personally own to your Gold IRA. IRS regulations require that precious metals for an IRA must be purchased through the IRA itself and stored directly in an approved depository. This ensures the metals meet purity standards and maintains the tax-advantaged status of the account.

What happens when I want to take distributions from my Gold IRA?

When taking distributions from a Gold IRA, you have two options: you can take physical possession of the metals (which counts as a distribution and may be taxable), or you can have the metals sold and receive cash. Required Minimum Distributions (RMDs) apply to Traditional Gold IRAs just like conventional IRAs once you reach age 72 (or 73 for those born after 1950).

How much of my retirement portfolio should be in precious metals?

Most financial advisors recommend allocating between 5% and 15% of your retirement portfolio to precious metals. The exact percentage depends on your age, risk tolerance, overall financial situation, and retirement goals. Precious metals should be viewed as one component of a diversified portfolio, not the primary investment vehicle.

Are there contribution limits for Gold IRAs?

Yes, Gold IRAs are subject to the same contribution limits as traditional and Roth IRAs. For 2023, the contribution limit is ,500 per year, with an additional

Frequently Asked Questions About Gold IRAs

Can I add gold I already own to my Gold IRA?

No, you cannot add gold you already personally own to your Gold IRA. IRS regulations require that precious metals for an IRA must be purchased through the IRA itself and stored directly in an approved depository. This ensures the metals meet purity standards and maintains the tax-advantaged status of the account.

What happens when I want to take distributions from my Gold IRA?

When taking distributions from a Gold IRA, you have two options: you can take physical possession of the metals (which counts as a distribution and may be taxable), or you can have the metals sold and receive cash. Required Minimum Distributions (RMDs) apply to Traditional Gold IRAs just like conventional IRAs once you reach age 72 (or 73 for those born after 1950).

How much of my retirement portfolio should be in precious metals?

Most financial advisors recommend allocating between 5% and 15% of your retirement portfolio to precious metals. The exact percentage depends on your age, risk tolerance, overall financial situation, and retirement goals. Precious metals should be viewed as one component of a diversified portfolio, not the primary investment vehicle.

Are there contribution limits for Gold IRAs?

Yes, Gold IRAs are subject to the same contribution limits as traditional and Roth IRAs. For 2023, the contribution limit is $6,500 per year, with an additional $1,000 catch-up contribution allowed for those 50 and older. However, there are no limits on how much you can roll over from another qualified retirement account.

,000 catch-up contribution allowed for those 50 and older. However, there are no limits on how much you can roll over from another qualified retirement account.

Making an Informed Decision About Gold IRAs

Understanding the truth behind common gold IRA misconceptions is essential for making an informed decision about whether precious metals belong in your retirement strategy. While Gold IRAs aren’t right for everyone, they can offer valuable portfolio diversification and potential protection against certain economic risks when properly implemented.

Remember that precious metals should typically represent only a portion of your overall retirement portfolio, complementing traditional investments rather than replacing them entirely. The key is to work with reputable providers who offer transparency, education, and fair pricing.

By separating fact from fiction regarding Gold IRAs, you can better evaluate whether this investment option aligns with your long-term financial goals and risk tolerance.

Ready to explore if a Gold IRA is right for you?

Download our comprehensive guide to learn everything you need to know about Gold IRAs, including setup process, costs, and strategies for maximizing your precious metals investment.