When market volatility strikes, your retirement savings shouldn’t be left exposed to the full force of economic uncertainty. That’s where strategic IRA diversification with safe haven assets comes into play. These protective investment vehicles can act as financial shock absorbers during turbulent times, preserving your hard-earned retirement funds when traditional investments falter.

In today’s unpredictable economic landscape, incorporating safe haven assets for IRA retirement diversification isn’t just prudent—it’s essential. This guide will walk you through the strategic implementation of these protective assets, helping you build a more resilient retirement portfolio designed to weather various market conditions.

What Are Safe Haven Assets?

Safe haven assets are investments that typically maintain or increase their value during periods of market turbulence and economic uncertainty. Unlike conventional investments that may experience significant volatility during downturns, these assets provide a measure of stability and protection when markets become chaotic.

These protective investments have historically demonstrated resilience during economic downturns, often moving independently or even inversely to broader market trends. This counter-cyclical behavior makes them valuable components in a diversified retirement strategy.

Key Characteristics of Safe Haven Assets

- Tend to retain value during market downturns

- Often have intrinsic value beyond market pricing

- Generally less correlated with traditional stock markets

- Provide portfolio stability during economic uncertainty

- Act as a hedge against inflation in many cases

Historical Performance

During the 2008 financial crisis, gold prices surged nearly 25% while the S&P 500 plummeted by over 38%. Similarly, during the COVID-19 market crash of March 2020, U.S. Treasury bonds rallied as investors sought safety, demonstrating how these assets can provide crucial protection when traditional markets falter.

This historical pattern of performance during crises underscores why safe haven assets for IRA retirement diversification deserve serious consideration in your long-term planning strategy.

Why Include Safe Haven Assets in an IRA?

Individual Retirement Accounts (IRAs) offer significant tax advantages that make them ideal vehicles for holding safe haven assets. When combined with the stability these assets provide, IRAs create a powerful foundation for long-term retirement security.

Tax Advantages

IRAs provide tax-deferred or tax-free growth, allowing your safe haven assets to compound more efficiently over time. Traditional IRAs offer tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement—both enhancing the protective benefits of safe haven assets.

Inflation Protection

Many safe haven assets, particularly precious metals and TIPS, have historically served as effective hedges against inflation. This protection is crucial for retirement accounts, where preserving purchasing power over decades is essential to maintaining your standard of living.

Geopolitical Risk Buffer

Global tensions, trade disputes, and political instability can wreak havoc on traditional markets. Safe haven assets often strengthen during these periods of uncertainty, providing a buffer against geopolitical risks that might otherwise damage your retirement savings.

Protect Your Retirement from Market Uncertainty

Uncertain about how to properly diversify your IRA with safe haven assets? Our retirement specialists can help you create a personalized protection strategy tailored to your risk tolerance and retirement timeline.

Top Safe Haven Assets for IRA Portfolios

Not all safe haven assets perform equally in different economic scenarios. Understanding the unique characteristics of each can help you build a more resilient IRA portfolio tailored to your specific retirement needs and risk tolerance.

Gold & Precious Metals

Gold has been a traditional store of value for thousands of years, often appreciating during periods of market stress, currency devaluation, and geopolitical tension. Within an IRA, investors can gain exposure to gold through specialized ETFs like IAU (iShares Gold Trust) or through a self-directed IRA that allows physical gold holdings.

Silver and other precious metals also provide similar protective benefits, though typically with more industrial demand influence and potentially higher volatility than gold.

Advantages

- Strong historical performance during market crises

- Effective hedge against currency devaluation

- No counterparty risk with physical holdings

- Limited supply enhances long-term value preservation

Limitations

- No income generation (dividends or interest)

- Storage costs for physical holdings

- Can experience short-term volatility

- May underperform during strong economic growth

Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds specifically designed to protect against inflation—a significant concern for retirement planning. Unlike standard Treasury bonds, TIPS adjust their principal value based on changes in the Consumer Price Index, ensuring that your investment maintains its purchasing power over time.

For IRA investors concerned about inflation eroding their retirement savings, TIPS provide a government-backed solution that combines safety with inflation protection.

Defensive Stocks

Not all stocks are created equal when it comes to market downturns. Defensive stocks—typically found in sectors like consumer staples, utilities, and healthcare—provide essential products and services that remain in demand regardless of economic conditions.

| Defensive Sector | Key Characteristics | Example Stocks/ETFs for IRAs | Historical Stability |

| Consumer Staples | Essential household products with consistent demand | XLP, PG, KO, PEP | High |

| Healthcare | Medical services and products with inelastic demand | XLV, JNJ, PFE, UNH | High |

| Utilities | Essential services with regulated returns | XLU, NEE, DUK, SO | Very High |

Real Estate Investment Trusts (REITs)

Certain types of REITs, particularly those focused on essential properties like healthcare facilities, data centers, and storage units, can provide both stability and income during market turbulence. These specialized REITs often maintain steady cash flows and dividends even when broader markets decline.

Within an IRA, REITs offer the additional advantage of tax-efficient income, as their typically high dividend yields grow tax-deferred or tax-free depending on your IRA type.

Cryptocurrency Hedges

For investors comfortable with higher volatility and emerging asset classes, certain cryptocurrencies like Bitcoin have begun to show some safe haven characteristics, particularly as hedges against currency devaluation and monetary policy concerns.

Self-directed IRAs now allow for cryptocurrency investments, though these should generally represent a smaller allocation within a diversified safe haven strategy due to their still-evolving market behavior and higher volatility profile.

“While cryptocurrencies remain controversial as safe havens due to their volatility, Bitcoin’s limited supply and decentralized nature have increasingly attracted investors seeking protection from currency debasement and traditional financial system risks.”

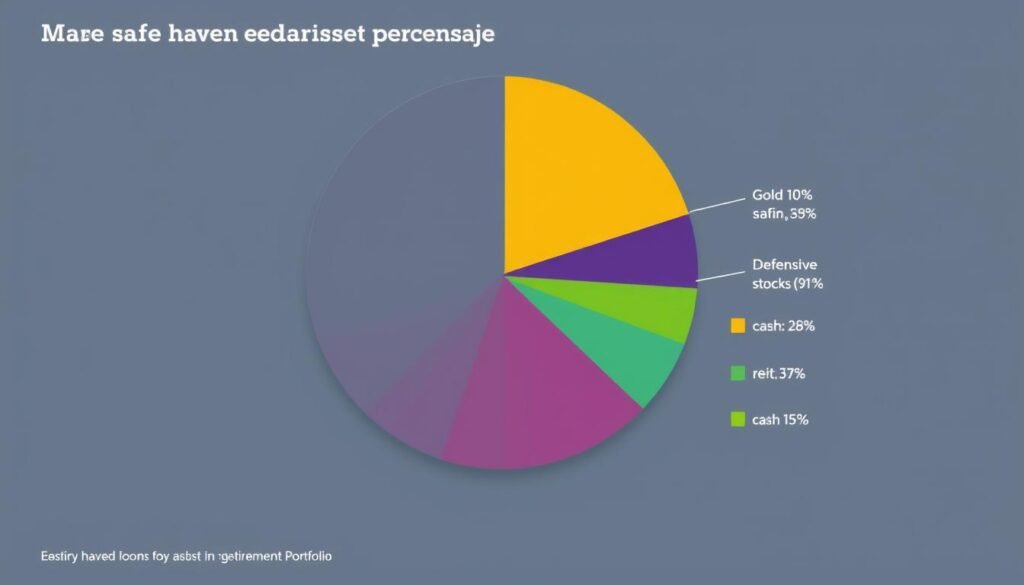

How to Allocate Safe Haven Assets in Your IRA

Determining the right allocation of safe haven assets for IRA retirement diversification depends largely on your age, risk tolerance, and overall retirement strategy. The following frameworks provide starting points that you can adjust based on your personal circumstances.

Sample Allocation Frameworks

| Risk Profile | Gold & Precious Metals | TIPS & Treasury Bonds | Defensive Stocks | REITs | Cash/Money Market | Crypto (Optional) |

| Conservative | 10-15% | 30-40% | 20-25% | 5-10% | 15-20% | 0-2% |

| Moderate | 5-10% | 20-30% | 30-40% | 10-15% | 5-10% | 0-5% |

| Aggressive | 3-8% | 10-20% | 40-50% | 15-20% | 2-5% | 0-10% |

Rebalancing Strategies

Even the best-designed portfolio will drift from its target allocation over time as different assets perform differently. Implementing a disciplined rebalancing strategy helps maintain your desired risk level and ensures your safe haven assets continue to provide the protection you need.

Calendar Rebalancing

Set a regular schedule—typically annually or semi-annually—to review your IRA and adjust holdings back to your target allocation. This approach removes emotion from the process and creates a disciplined framework for maintaining your strategy.

Threshold Rebalancing

Establish percentage thresholds (e.g., ±5% from targets) that trigger rebalancing when exceeded. This approach is more responsive to market movements but requires more frequent monitoring of your portfolio.

Get Your Free Safe Haven Asset Guide

Understanding proper allocation is crucial for effective IRA protection. Download our comprehensive guide to safe haven asset allocation strategies tailored for different retirement timelines and risk profiles.

Risks and Limitations of Safe Haven Assets

While safe haven assets provide valuable protection, they come with their own set of limitations and potential drawbacks that investors should carefully consider before implementation.

Growth Limitations

The very stability that makes safe haven assets attractive during downturns can limit their growth potential during bull markets. Overallocation to these protective assets may result in opportunity cost during strong economic expansions when growth-oriented investments typically outperform.

Liquidity Concerns

Some safe haven assets, particularly physical precious metals or certain real estate investments, may have reduced liquidity compared to traditional securities. This could potentially impact your ability to quickly adjust your portfolio or access funds in an emergency.

Timing Challenges

Attempting to time entry and exit points for safe haven assets based on market predictions often proves unsuccessful. A strategic, consistent allocation approach typically yields better results than reactive moves based on market forecasts.

Important Consideration: Safe Haven Performance Variability

Not all safe haven assets perform identically during every type of market stress. For example, during the initial COVID-19 market shock in March 2020, even gold temporarily declined alongside stocks before recovering and demonstrating its safe haven characteristics. Diversification across multiple safe haven asset types provides more comprehensive protection.

Conclusion: Building a Resilient Retirement Portfolio

Incorporating safe haven assets for IRA retirement diversification represents a prudent approach to protecting your financial future against market uncertainty. By strategically allocating a portion of your retirement portfolio to these protective investments, you create a more resilient foundation that can weather various economic conditions.

Remember that the optimal mix of safe haven assets will vary based on your personal circumstances, including your age, risk tolerance, and overall retirement timeline. As you approach retirement, gradually increasing your allocation to these protective assets can help shield your accumulated wealth from market volatility when you have less time to recover from potential downturns.

While no investment strategy can eliminate all risk, a thoughtfully diversified IRA that includes appropriate safe haven assets provides both growth potential and crucial protection—giving you greater confidence in your retirement security regardless of what the markets may bring.

Ensure Your Retirement Portfolio Is Properly Protected

Our retirement specialists can review your current IRA allocation and help you implement an appropriate safe haven strategy tailored to your specific needs and goals.

Frequently Asked Questions About Safe Haven Assets for IRAs

Can I hold physical gold in my IRA?

Yes, but only through a self-directed IRA with a custodian that specializes in precious metals. The gold must meet specific purity requirements (typically 99.5% pure) and must be stored in an IRS-approved depository, not personally held. Alternative options include gold ETFs and gold mining stocks, which can be held in conventional IRAs.

How much of my IRA should be in safe haven assets?

Financial experts typically recommend between 10-30% of your portfolio be allocated to safe haven assets, depending on your age, risk tolerance, and market conditions. As you approach retirement, this percentage often increases to provide greater protection for your accumulated wealth when you have less time to recover from market downturns.

Are cryptocurrencies truly safe haven assets for retirement?

Cryptocurrencies remain controversial as safe haven assets due to their relatively short history and high volatility. While Bitcoin has shown some safe haven characteristics during specific economic scenarios, particularly related to currency devaluation concerns, it generally exhibits more volatility than traditional safe havens. Most financial advisors recommend limiting cryptocurrency exposure to no more than 5-10% of your overall portfolio, particularly for retirement accounts.