Have you ever wondered how much you need to save monthly to enjoy a comfortable and secure retirement? As you plan for your future, understanding basic principles can make financial preparation much easier. That’s where the “1000 a Month Rule for Retirement” comes in handy. This guideline provides a simplified approach to estimating how much you’d need to save to generate a steady income in your golden years.

This image is property of images.unsplash.com.

Understanding the 1000 a Month Rule

The 1000 a Month Rule is a straightforward strategy designed to estimate how much you need to save in order to generate an additional $1,000 per month during retirement. It’s a simple rule of thumb that can provide clarity on your retirement goals and help you create a roadmap to reach them. By understanding this rule, you can better assess your savings needs and plan for a future where financial worries are minimized.

The Basics of the Rule

Let’s take a closer look at the mechanics behind the rule. The idea is that for each $1,000 you want to receive monthly, you should have about $240,000 saved. This calculation is based on the 4% rule, a guideline used by many financial planners. The 4% rule suggests that you can withdraw 4% of your savings annually without running out of money for 30 years. Therefore, $240,000 in savings could provide you with a $1,000 monthly withdrawal for 30 years, assuming your investments earn at least as much as inflation annually.

Setting Realistic Expectations

While the 1000 a Month Rule is user-friendly and easy to remember, it’s important to recognize its limitations. Your retirement income should reflect various factors such as your lifestyle, health, and other income sources. Consider this rule a starting point; a comprehensive retirement plan should address all your anticipated needs and circumstances.

How to Calculate Your Retirement Needs

Personalizing your retirement plan involves understanding your unique needs and translating them into concrete numbers. By breaking down expenses, estimating sources of income, and considering lifestyle changes, you can determine how much you really need.

Calculating Your Expected Expenses

Begin by listing all potential expenses during retirement. This could include housing, healthcare, food, transportation, and leisure activities. Remember, some costs might increase (like healthcare), while others could decrease (like commuting expenses). Consider a balanced approach to estimate your monthly expenses accurately.

Assessing Your Income Sources

Next, take stock of available income sources, such as pensions, Social Security, and passive income. Subtract this amount from your total estimated monthly expenses to calculate the additional amount you’ll need to fund with your retirement savings. Here’s where the 1000 a Month Rule can be directly applied.

Example Breakdown

| Income Source | Monthly Amount |

|---|---|

| Social Security | $1,800 |

| Pension | $1,000 |

| Rental Income | $500 |

| Total Income | $3,300 |

| Monthly Expenses | |

|---|---|

| Housing | $1,500 |

| Healthcare | $500 |

| Food | $400 |

| Transportation | $300 |

| Leisure and Travel | $300 |

| Total Expenses | $3,000 |

| Monthly Gap for Savings Withdrawal | $700 |

In this scenario, your monthly savings withdrawal requirement is $700, less than $1,000, indicating you’d need a lesser savings pool than if you required the full $1,000 monthly from savings.

This image is property of images.unsplash.com.

Understanding Inflation’s Impact

One crucial factor to consider is inflation. Over time, the cost of goods and services tends to rise, meaning your expenses will likely increase throughout retirement.

How Inflation Affects Savings

The 4% rule assumes your investment return at least matches inflation. This means your purchasing power remains stable even as costs rise. However, an investment return that underperforms inflation could erode your savings much quicker than anticipated. Preparing for inflation is key to ensuring your savings last.

Strategies to Mitigate Inflation

You can adopt several strategies to shield your savings from inflation:

- Diversified Portfolio: Invest in a mix of asset types, including stocks, bonds, and real estate, to balance risk and potential returns.

- Inflation-Protected Securities: Consider allocating some of your investments to Treasury Inflation-Protected Securities (TIPS), which adjust with inflation.

- Regular Reviews: Regularly review and adjust your withdrawal rate and budget to accommodate economic changes.

Adjusting Your Savings Strategy

Every individual’s situation is unique, and understanding how to adjust the rule to fit your personal circumstances is vital. Consider several factors, such as retirement age, longevity, and health.

Considering Your Retirement Age

The age at which you retire will significantly impact your savings needs. Retiring early means drawing from your savings longer, thus needing a larger pool of money. Conversely, retiring later allows more time for savings to grow.

Longevity and Healthcare Considerations

Longer life expectancy entails maintaining your savings over a more extended period. Include healthcare needs and potential long-term care expenses in your calculations. These factors may necessitate saving more than initially planned under the 1000 a Month Rule.

Balancing Risk and Growth

Finding the right balance between risk and conservative investments is crucial to a sustainable retirement strategy. Generally, the closer you get to retirement age, the more conservative your portfolio should be to protect your savings from market volatility.

This image is property of images.unsplash.com.

Key Takeaways on the 1000 a Month Rule

Understanding and applying the 1000 a Month Rule offers a clear perspective on your retirement savings needs. While it serves as an excellent starting point, consider additional modifications for a comprehensive plan.

Tailoring the Rule for Personal Use

Adapt the rule to fit your unique situation by considering comprehensive lifestyle changes, income sources, and unexpected economic conditions. By giving each element due consideration, you create a robust, realistic savings strategy aligned with your goals.

Consulting Financial Professionals

Engaging with a financial advisor can provide invaluable insights and personalized strategies for your savings plan. They can help you evaluate your needs, assess risks, and take advantage of all possible resources.

Conclusion

The 1000 a Month Rule for retirement may appear simple, but it serves as a helpful guide in your planning journey. By understanding its basics and modifying it according to personal circumstances, you can craft a retirement strategy capable of ensuring financial security and peace of mind. Remember, proactive and informed planning can make the dream of a comfortable retirement a reality.

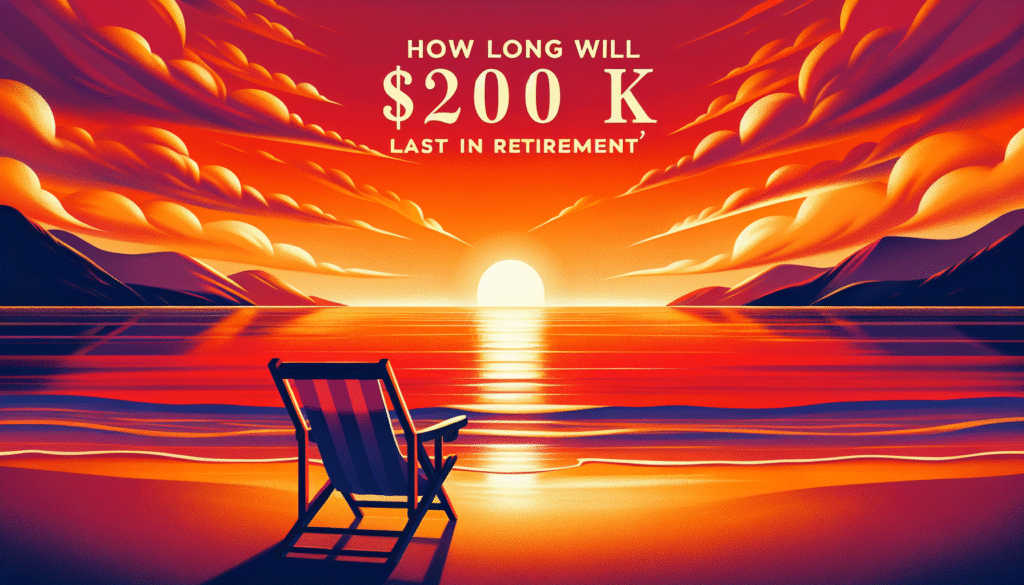

This image is property of images.unsplash.com.