Have you ever wondered what retirement looks like for teachers in Ohio? It’s an important consideration for educators planning their financial futures, and understanding the specifics of the retirement plan can be immensely beneficial. In Ohio, the retirement system for teachers is structured to support educators in their golden years, but it can be complex. By the end of reading this, you’ll have a clearer understanding of the Teachers Retirement System in Ohio and how it works to secure your future.

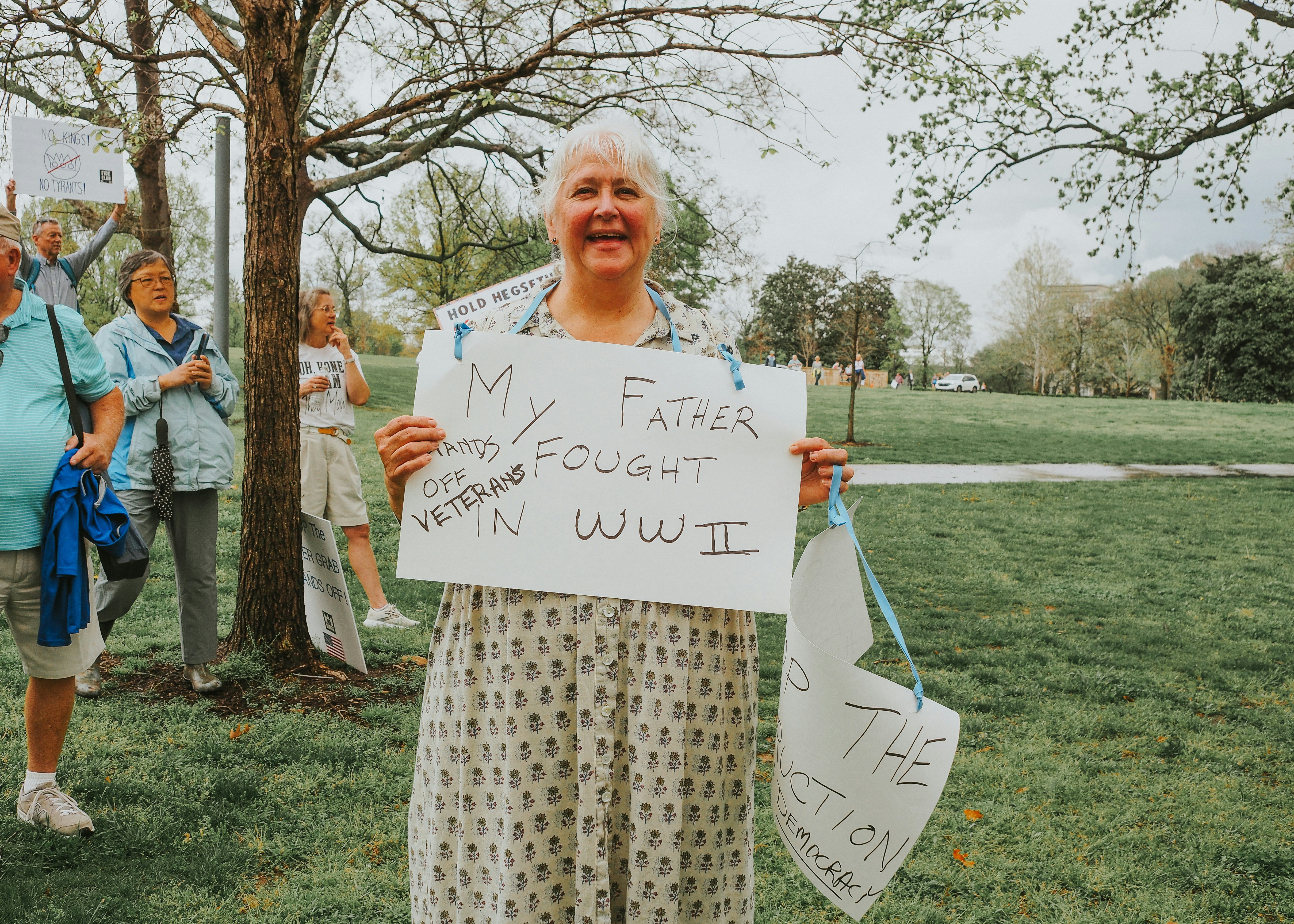

This image is property of images.unsplash.com.

Understanding the Ohio Teachers Retirement System

The Ohio State Teachers Retirement System (STRS) is a pension fund specifically designed to support the retirement needs of teachers and educators across the state. This system provides several benefits, including pension payments, health care coverage, and survivor benefits.

What Is the STRS?

The State Teachers Retirement System of Ohio (STRS Ohio) is one of the oldest and largest public pension funds in the United States. Established to serve Ohio’s public educators, STRS provides retirement benefits, disability benefits, and access to health care programs. As a defined benefit pension plan, it promises a set payout upon retirement, which is a crucial source of financial security for educators.

Why Is a Pension Important for Educators?

A pension plays a critical role in retirement planning, offering financial stability and predictable income. For teachers in Ohio, the STRS provides peace of mind, knowing you’ll have a steady income in retirement. Given the challenges faced by educators, including changes in pay scales and workload demands, a robust pension plan is an essential component of financial wellness.

Key Features of Ohio STRS

Understanding the different elements of STRS can help you make informed decisions about your retirement. Let’s look at some key features that are integral to this retirement system.

Membership and Eligibility

To be eligible for STRS Ohio, you must be a public school employee working in Ohio. This includes teachers, administrators, and other educational professionals. Membership is automatic when you begin qualifying employment, ensuring you’re integrated into the system without needing to take extra steps.

Contribution Rates

Both you and your employer contribute to STRS Ohio. The contribution rates are set by law and can be adjusted by the Ohio legislature. For 2023, the mandatory contribution for members is 14% of their salary.

Contribution Table

| Contributor | Contribution Rate |

|---|---|

| Employee (Teachers) | 14% |

| Employer | 14% |

Service Credit and Retirement Eligibility

Service credit is the amount of time you have worked and contributed to STRS. It directly influences your benefits. Typically, you need a minimum number of service years to qualify for full retirement benefits.

-

Full Retirement Benefits: Generally available for those who have reached age 60 with 35 years of service, or age 65 with 5 years of service.

-

Early Retirement: Possible with reduced benefits, depending on age and years of service.

Benefit Calculation

Your retirement benefits are determined by a formula based on your years of service and final average salary. STRS Ohio uses a specific formula:

[ \text = \text \times \text \times \text ]

The multiplier can vary, but it’s typically around 2.2% to 2.5%.

Health Care Benefits

STRS offers access to several health care plans for retirees, which is an invaluable perk when considering the rising costs of health care. While this is not guaranteed, the system strives to provide comprehensive health care coverage options to its members.

This image is property of pixabay.com.

Planning for Retirement with STRS Ohio

Steps to Prepare for Retirement

As tempting as it is to focus on the here and now, planning for retirement can never start too early. Here are a few steps to consider:

-

Understand Your Benefits: Regularly review your current earned service credits and projected benefits. STRS Ohio provides detailed statements annually.

-

Set a Retirement Goal: Based on your current lifestyle and future plans, determine how much you’ll need annually to live comfortably in retirement.

-

Monitor Contribution Rates: Keep an eye on any legislative changes that might affect your contributions or benefits.

-

Engage with Financial Planning Tools: Take advantage of online calculators and STRS resources to simulate different retirement scenarios.

Retirement Counseling and Resources

STRS Ohio offers various counseling services to help you plan effectively for retirement. These resources include:

- Personal one-on-one counseling sessions

- Group seminars and workshops

- Online educational tools and webinars

These services are tailored to help you make informed decisions about your retirement timeline, understand benefits, and navigate the application process.

Challenges Facing STRS Ohio

Financial Sustainability of STRS

Like many public pension funds, STRS Ohio faces sustainability challenges, largely driven by economic fluctuations and demographic changes. Ensuring the long-term viability of the fund is an ongoing concern for policymakers and system administrators.

Legislative Changes

Laws governing STRS Ohio can change, affecting contribution rates, benefit calculations, and retirement age. It’s essential to stay informed about potential legislative changes that could impact your retirement plans.

This image is property of pixabay.com.

How Legislative Changes Can Affect Teachers

Impact of Policy Revisions

Policy changes can have multiple effects on your retirement benefits. For instance, adjustments in contribution rates directly affect your take-home pay and may alter the structure of your benefits package.

Staying Informed and Engaged

Participation in advocacy and understanding the legislative environment is crucial. Joining associations or unions that provide updates and represent your interests can be beneficial in staying informed about changes.

Comparing STRS Ohio to Other States

Ohio vs. Other States’ Retirement Benefits

Ohio’s STRS is often compared to systems in other states to evaluate competitiveness and effectiveness. Here’s a brief comparison of STRS Ohio with other states’ retirement systems:

| State | Employee Contribution | Employer Contribution | Retirement Age | Years of Service for Full Benefits |

|---|---|---|---|---|

| Ohio | 14% | 14% | 65 or 60 with 35 years | 5 or 35 |

| Florida | 3% | 3.3% (2012) | 65 or 33 years of service | 8 |

| California | 10.25% | 8.25% | 62 or 30 years of service | 5 |

Pros and Cons of STRS Ohio

One strong advantage of STRS Ohio is its comprehensive approach, covering both pension payments and health care. However, it also navigates challenges such as legislative shifts and the need for sustainable funding.

This image is property of images.unsplash.com.

Strategies to Maximize Your Retirement Benefits

Increasing Service Credits

One way to boost your retirement income is to increase your service credits. Consider the following strategies:

-

Buy back service credits: If you’ve taken unpaid leaves or worked in positions not covered by STRS Ohio, you might be eligible to purchase additional service credits.

-

Work longer: Extending your service can often result in higher retirement benefits due to increased years of service and potentially higher final average salary.

Managing Health Care Costs

As health care costs continue to rise, it’s wise to plan for these expenses as part of your retirement strategy. Consider supplemental coverage or health savings accounts to manage future costs better.

Retirement Savings Beyond STRS

Diversifying your retirement portfolio can offer additional financial security. Consider contributing to:

- 403(b) Plans: Often available through your employer

- IRAs: Traditional or Roth, depending on your eligibility

- Other Investments: Stocks, bonds, or real estate, depending on your risk tolerance and financial goals

Common Misconceptions About STRS Ohio

Misconception 1: Full Retirement Age Means You Can’t Retire Early

While STRS sets certain ages for full retirement benefits, you can retire earlier, albeit with reduced benefits. It’s important to explore how early retirement could affect your overall benefit package.

Misconception 2: STRS Benefits Alone Are Sufficient

Although STRS benefits offer a significant part of your retirement income, they may not be sufficient alone. Integrating other retirement savings and investments can help maintain your lifestyle post-retirement.

This image is property of images.unsplash.com.

Conclusion

For educators in Ohio, understanding the intricacies of the State Teachers Retirement System is essential for effective retirement planning. With its defined benefits structure, comprehensive health care options, and numerous planning resources, STRS Ohio stands as a critical pillar of financial stability for teachers. By actively engaging with available information and planning strategically, you can navigate the complexities of STRS and secure a comfortable retirement. So, what steps will you take today to ensure your retirement is everything you’ve envisioned?