Have you ever wondered if you can retire at 62 with a $400,000 401(k)? This is a common question many people ask as they approach retirement age. It’s understandable to be concerned about whether your savings will sustain you through the next chapter of your life. This is a significant question that involves a variety of factors, from your lifestyle goals in retirement to inflation, healthcare costs, and other financial resources you might have.

In this article, we’ll explore how you might approach retiring at 62 with a $400,000 401(k), and what considerations are crucial for your planning.

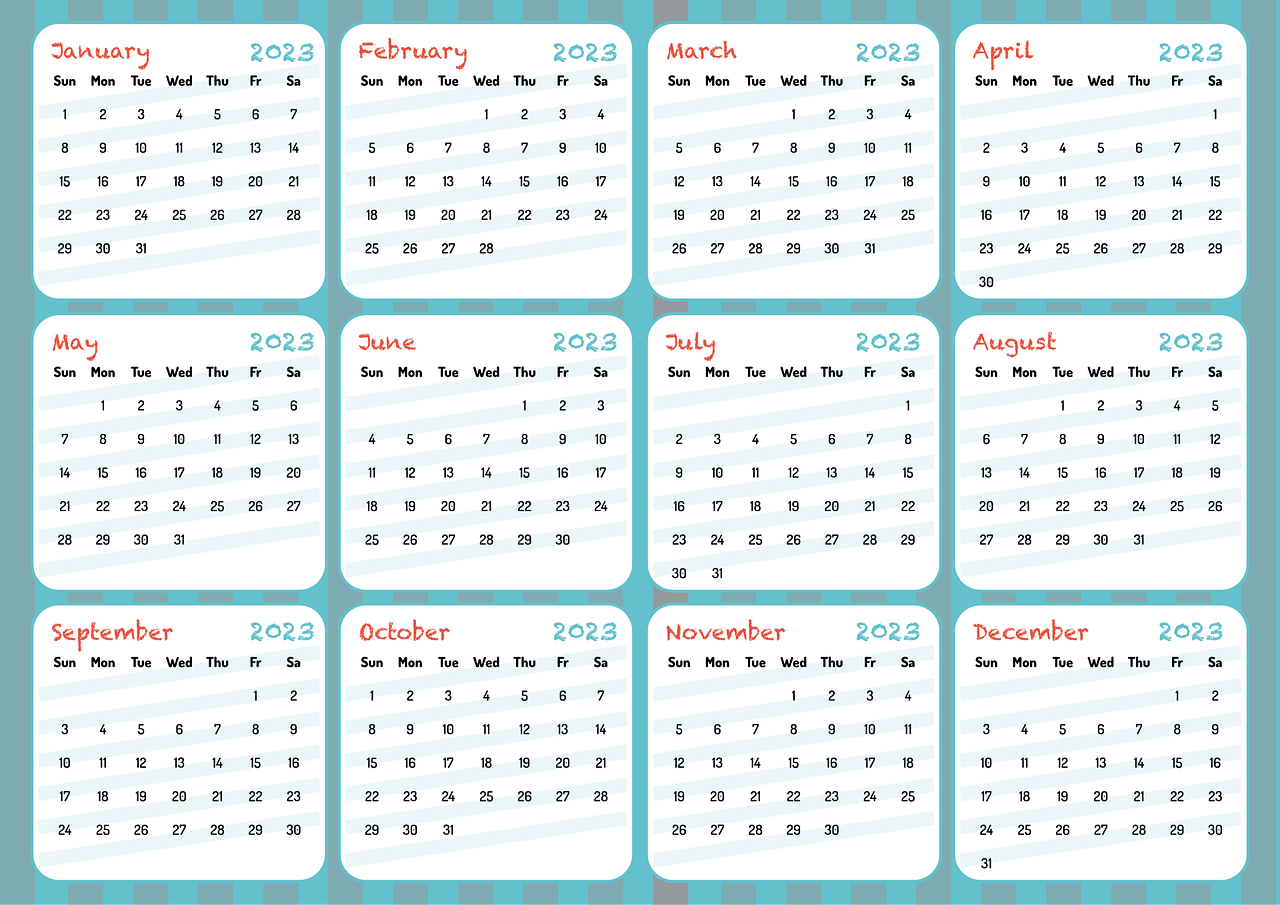

This image is property of pixabay.com.

Understanding Your Retirement Income Needs

Estimating Your Expenses

To determine if your $400,000 401(k) will be sufficient, start by estimating your annual living expenses in retirement. Consider factors such as housing, food, utilities, healthcare, travel, and leisure activities. Don’t forget to factor in potential increases in healthcare costs as you age, as well as inflation.

Write down your current monthly and yearly expenses. Then, think about any changes that might happen once you retire. For example, do you plan to downsize your home, or will you have paid off your mortgage? Will you relocate to a less expensive area? These changes could affect your expenses either positively or negatively.

Cushioning for Inflation

Inflation can erode your purchasing power over time, meaning what you can buy today may cost significantly more in the future. On average, the annual inflation rate is around 2-3%, but it varies yearly. When planning retirement, ensure that your savings grow enough to outpace inflation, preserving your purchasing power.

Assessing Your Current Financial Situation

Your 401(k) Breakdown

Your 401(k) is one of your primary retirement savings, currently standing at $400,000. The goal is to maximize these savings to cover your expenses. The rule of thumb is often to withdraw around 4% per year. This means about $16,000 annually from your 401(k) without drastically depleting your core savings.

Other Income Sources

Explore other potential income sources. Will you receive Social Security benefits? If so, determine how much you can expect. The longer you delay taking Social Security, up to age 70, the higher your monthly benefits might be. You may also have other investments, pensions, or part-time work that further boosts your income.

Potential Investment Returns

Consider how you wish to invest your 401(k) balance. You might choose to keep a portion in stocks for growth or reallocate it into bonds for stability. It’s beneficial to reassess your asset allocation as retirement nears to balance growth and risk management.

This image is property of pixabay.com.

Social Security and Its Impact

Understanding When to Collect

Social Security can begin as early as 62, but your benefits increase if you delay claiming until after your full retirement age — typically 66 or 67 depending on your birth year. Waiting until 70 can provide the maximum benefit. Balance when to start benefits with your immediate income needs and health expectations.

| Age to Start | Benefit Adjustment |

|---|---|

| 62 | Reduced benefit |

| Full Retirement Age (66-67) | Full benefit |

| 70 | Maximum benefit |

Calculating Your Anticipated Benefits

Calculate what your monthly Social Security benefits would be using the Social Security Administration’s (SSA) online tools. Understanding what your monthly cash flow looks like helps frame the rest of your savings strategy.

Healthcare Considerations

Estimating Medical Costs

Healthcare is a major expense in retirement. Medicare eligibility begins at 65, so if you retire at 62, you need to bridge the gap with health insurance. Consider what type of insurance you need and the associated costs. Once on Medicare, you may still have out-of-pocket expenses and premiums.

Importance of Long-term Care Planning

Think long-term about potential healthcare needs beyond regular medical expenses. Planning for long-term care, whether via savings, insurance, or other means, is wise, as the cost can be substantial and easily deplete savings.

This image is property of pixabay.com.

Crafting Your Retirement Plan

Drawdown Strategy

Create a strategic plan for how you will withdraw from your 401(k) and other funds. Drawing down too quickly can reduce your savings too fast, while too slow could result in a lower quality of life. Determine a sustainable withdrawal rate, considering all potential sources of income.

Emergency Fund

Having an emergency fund is crucial. This fund should cover unexpected expenses without you needing to dip into your primary retirement savings. Typically, 3-6 months’ worth of living expenses is recommended, but as a retiree, padding this might provide greater peace of mind.

Fine-tuning Your Retirement Lifestyle

Adjusting Lifestyle Expectations

Flexibility is key in retirement planning. If you find your projections too close for comfort, consider where you might trim. Could you reduce travel plans, or take up part-time work? Sometimes, small tweaks in lifestyle can culminate in significant savings.

Enjoying Quality of Life

Remember, retirement isn’t solely about maintaining your finances. It’s also about ensuring your quality of life remains high. Focus on activities that bring joy and fulfillment, which don’t necessarily require huge expenses. Exploring hobbies, spending time with loved ones, or engaging in community activities can enrich this time greatly.

This image is property of pixabay.com.

Seeking Professional Guidance

Financial Advisors

If managing your finances still feels overwhelming, consulting a financial advisor may be beneficial. They provide personalized strategies based on your individual needs and can help refine your retirement plan to ensure you feel confident and secure.

Online Resources and Tools

Take advantage of tools and resources available online. Retirement calculators, budget planners, and investment trackers can offer you insights and allow you to model different scenarios to see how they affect your retirement.

Reviewing and Adjusting Your Plan

Regularly Monitoring Your Progress

Once retired, it’s important to revisit your plan regularly. Market conditions change, expenses might fluctuate, and life’s unexpected turns occur. Adjust your plan to accommodate these shifts and keep your goals aligned.

Being Open to Change

Stay open to change — maybe working part-time becomes appealing, or you discover your spending patterns differ from your predictions. Flexibility in retirement planning proves beneficial as you navigate this new life stage.

Through careful planning and ongoing adjustments, retiring at 62 with a $400,000 401(k) is a feasible goal. Assessing expenses, understanding income sources, considering healthcare, and being adaptable in lifestyle choices can create a secure and enjoyable retirement journey. Engage with resources, seek guidance if needed, and commonly review your strategy to remain on track, enabling you to live comfortably with confidence in your financial future.

This image is property of pixabay.com.