Planning for retirement is one of the most critical financial decisions you’ll make. With market volatility, inflation concerns, and economic uncertainty becoming increasingly common, many Americans are exploring alternatives to traditional retirement accounts. Two popular options that often come up in this conversation are 401(k) plans and Gold IRAs. But which one is truly better for securing your financial future? This comprehensive guide will help you understand the key differences between Gold IRAs and 401(k)s, their respective benefits and drawbacks, and how to determine which option aligns best with your retirement goals.

Why Retirement Planning Matters Now More Than Ever

Effective retirement planning requires understanding all available options to secure your financial future.

With traditional pension plans becoming increasingly rare, the responsibility of saving for retirement has shifted almost entirely to individuals. Social Security benefits alone are rarely sufficient to maintain your standard of living in retirement, creating a critical need for additional retirement savings vehicles.

Recent economic events have highlighted the vulnerability of traditional market-based retirement accounts. The 2008 financial crisis and the market volatility during the COVID-19 pandemic demonstrated how quickly retirement savings can be impacted by broader economic forces. This has led many investors to seek diversification beyond stocks and bonds.

Additionally, with inflation concerns on the rise, protecting the purchasing power of your retirement savings has become a key consideration. This is where the debate between traditional retirement accounts like 401(k)s and alternative options like Gold IRAs becomes particularly relevant.

Understanding 401(k) Plans: The Traditional Approach

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax salary to a tax-advantaged investment account. These plans have been the cornerstone of retirement planning for millions of Americans since their introduction in the 1980s.

Key Features of 401(k) Plans

Tax Advantages

One of the most significant benefits of a 401(k) plan is its tax treatment. Contributions are made with pre-tax dollars, reducing your taxable income for the year. The funds in your 401(k) grow tax-deferred, meaning you won’t pay taxes on any investment gains until you withdraw the money in retirement, when you may be in a lower tax bracket.

Employer Matching Contributions

Many employers offer matching contributions as part of their 401(k) plans. This is essentially free money – your employer contributes an additional amount to your retirement account based on your own contributions, typically up to a certain percentage of your salary. This can significantly accelerate your retirement savings growth.

Investment Options

401(k) plans typically offer a selection of investment options, primarily mutual funds that invest in stocks, bonds, and sometimes other securities. While these options provide diversification within traditional financial markets, they are generally limited to the choices pre-selected by the plan administrator.

Contribution Limits and Withdrawal Rules

For 2023, the IRS allows employees to contribute up to $22,500 to their 401(k) plans, with an additional $7,500 in catch-up contributions for those aged 50 and older. However, early withdrawals (before age 59½) typically incur a 10% penalty in addition to regular income taxes, though there are some exceptions for hardship withdrawals.

401(k) Advantages

- Employer matching contributions boost savings

- Higher contribution limits than IRAs

- Automatic payroll deductions simplify saving

- Tax-deferred growth potential

- Loan provisions available in many plans

- Protection from creditors under federal law

401(k) Limitations

- Limited investment options

- Vulnerable to stock market volatility

- Required Minimum Distributions (RMDs) at age 73

- Early withdrawal penalties

- No protection against inflation

- Management fees can reduce returns

Gold IRA: An Alternative Retirement Strategy

A Gold IRA is a self-directed individual retirement account that allows you to invest in physical precious metals like gold, silver, platinum, and palladium. Unlike traditional IRAs that typically hold paper assets, a Gold IRA holds physical bullion or coins that meet specific purity standards set by the IRS.

IRS-approved gold coins and bars that meet purity standards for Gold IRA investments.

How Gold IRAs Work

A Gold IRA functions similarly to traditional IRAs in terms of contribution limits, tax advantages, and withdrawal rules. However, it differs in the types of assets held and the requirements for storage and management. To establish a Gold IRA, you’ll need to work with a specialized custodian who handles the account administration and ensures compliance with IRS regulations.

Tax Benefits of Gold IRAs

Gold IRAs offer similar tax advantages to traditional IRAs. Depending on the type of Gold IRA you choose, contributions may be tax-deductible (Traditional Gold IRA) or withdrawals may be tax-free (Roth Gold IRA). In both cases, the growth of your investment is either tax-deferred or tax-free, providing significant long-term tax benefits.

Physical Gold Ownership Requirements

The IRS has strict requirements regarding the types of precious metals that can be held in a Gold IRA. Gold must be at least 99.5% pure, with the exception of American Gold Eagle coins. Additionally, the gold must be stored in an IRS-approved depository – you cannot take personal possession of the metals while they’re in your IRA.

Storage and Fees

Unlike 401(k)s, Gold IRAs involve additional costs for storage and insurance of the physical metals. These fees typically include a one-time setup fee, annual maintenance fees, storage fees, and insurance costs. While these fees are higher than those associated with traditional IRAs, they reflect the added security and specialized handling required for physical precious metals.

Gold IRA Advantages

- Portfolio diversification beyond paper assets

- Potential hedge against inflation

- Protection during economic uncertainty

- Tax-advantaged precious metals ownership

- Tangible assets with intrinsic value

- Historical store of value over centuries

Gold IRA Limitations

- Higher fees than traditional IRAs

- No income generation (dividends/interest)

- Storage requirements and restrictions

- Potential liquidity challenges

- Price volatility in short-term periods

- Complex setup process

Gold IRA vs 401(k): Head-to-Head Comparison

When deciding between a Gold IRA and a 401(k), it’s important to understand how they compare across various factors. The following table provides a comprehensive comparison to help you evaluate which option might better suit your retirement planning needs.

| Feature | Gold IRA | 401(k) |

| Tax Treatment | Traditional (tax-deferred) or Roth (tax-free withdrawals) options available | Traditional (tax-deferred) or Roth (tax-free withdrawals) options available |

| Investment Assets | Physical gold and other precious metals that meet IRS purity standards | Primarily stocks, bonds, and mutual funds selected by plan administrator |

| Contribution Limits (2023) | $6,500 ($7,500 if age 50+) | $22,500 ($30,000 if age 50+) |

| Employer Matching | Not available | Often available, varies by employer |

| Investment Flexibility | High – choice of various precious metals | Limited to plan’s pre-selected options |

| Risk Exposure | Primarily market price of precious metals; historically less correlated with stock market | Stock market volatility, interest rate risk, economic cycles |

| Liquidity | Lower – requires selling physical assets | Higher – easily converted to cash |

| Fees | Higher – includes setup, storage, insurance, and management fees | Lower – typically just management and administrative fees |

| Inflation Protection | Historically strong | Variable, depends on investment selection |

| Required Minimum Distributions | Required at age 73 (Traditional); not required for Roth | Required at age 73 (Traditional); not required for Roth |

Historical performance comparison of gold versus traditional market investments during periods of economic uncertainty.

Key Factors to Consider When Choosing Between Gold IRA and 401(k)

Selecting the right retirement vehicle depends on your personal financial situation, goals, and risk tolerance. Here are the critical factors to consider when deciding between a Gold IRA and a 401(k).

Risk Tolerance and Market Outlook

Your comfort with investment risk plays a significant role in determining which retirement vehicle is more suitable. 401(k) plans typically invest in stocks and bonds, which can offer higher returns but come with greater market volatility. If you have a higher risk tolerance and a longer time horizon, the growth potential of a 401(k) might align with your goals.

Conversely, Gold IRAs tend to perform differently than traditional market investments. Gold has historically served as a hedge against inflation and often moves inversely to stock markets during periods of economic uncertainty. If you’re concerned about market volatility or economic instability, allocating a portion of your retirement savings to a Gold IRA might provide valuable diversification.

Retirement Timeline

Your proximity to retirement should influence your choice between these options. Younger investors with decades until retirement may benefit from the growth potential of market-based investments in a 401(k), as they have time to weather market fluctuations.

Those closer to retirement might consider adding a Gold IRA to their portfolio to provide stability and protection against potential market downturns that could significantly impact their retirement timeline. The historical stability of gold can help preserve wealth when you have less time to recover from market losses.

Diversification Goals

Portfolio diversification is a fundamental principle of sound investing. If your retirement savings are already heavily concentrated in stocks and bonds through a 401(k) or other accounts, adding a Gold IRA can provide meaningful diversification by including an asset class that often behaves differently than traditional financial markets.

The ideal approach for many investors is not choosing exclusively between a Gold IRA and a 401(k), but rather incorporating both into a comprehensive retirement strategy. This balanced approach can help mitigate various types of risk while capitalizing on the unique benefits of each investment vehicle.

Tax Implications

Both Gold IRAs and 401(k)s offer tax advantages, but they may impact your financial situation differently. If you have access to employer matching in a 401(k), this represents an immediate, guaranteed return on your investment that is difficult to match with any other retirement vehicle.

However, if you’re concerned about future tax rates or want to diversify your tax treatment in retirement, having both pre-tax (traditional) and post-tax (Roth) accounts across different asset classes can provide valuable flexibility in managing your tax burden during retirement.

Need Personalized Retirement Planning Guidance?

Our retirement specialists can help you determine the optimal balance between Gold IRAs and traditional retirement accounts based on your unique financial situation and goals.

Rolling Over a 401(k) to a Gold IRA: Is It Right for You?

If you’re considering diversifying your retirement portfolio with precious metals, you may be wondering about the process of rolling over existing retirement funds into a Gold IRA. This section explores the rollover process, eligibility, and important considerations.

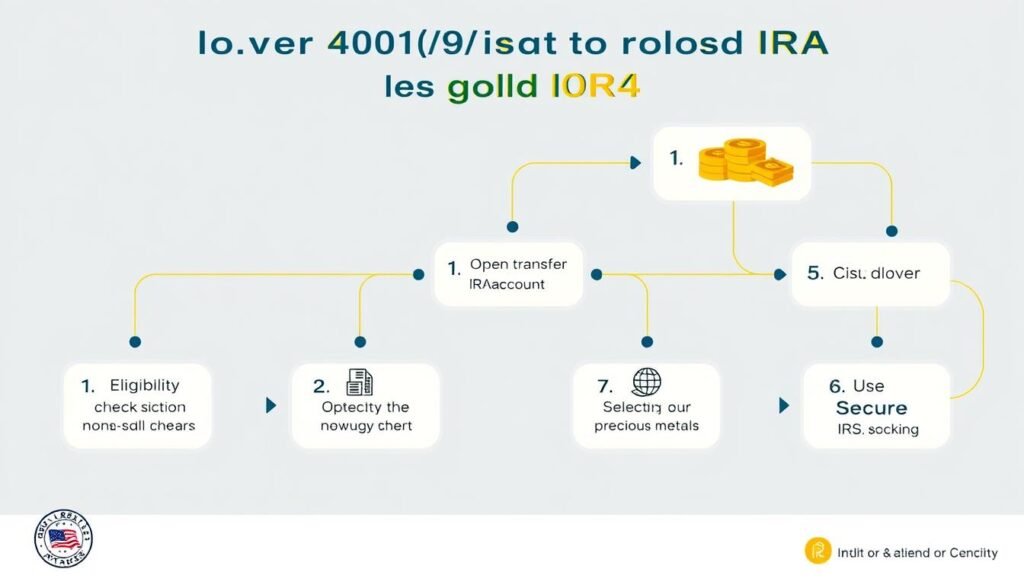

The step-by-step process of rolling over a 401(k) to a Gold IRA while maintaining IRS compliance.

Eligibility for Rollover

You can generally roll over funds from a 401(k) to a Gold IRA if you’ve left your employer, reached age 59½, or if your current employer’s plan allows for in-service distributions. The rollover process must follow IRS guidelines to avoid taxes and penalties. A direct rollover, where funds move directly from one custodian to another, is typically the simplest approach.

Partial Rollover Considerations

You don’t need to choose between your 401(k) and a Gold IRA entirely. Many investors opt for a partial rollover, transferring a portion of their 401(k) funds to a Gold IRA while maintaining some assets in their traditional retirement accounts. This approach allows for diversification while preserving any benefits associated with your existing 401(k).

Steps to Complete a Gold IRA Rollover

- Select a reputable Gold IRA custodian with experience in precious metals IRAs

- Open a self-directed IRA account with the chosen custodian

- Initiate a direct rollover from your 401(k) provider to the new custodian

- Choose IRS-approved precious metals for your Gold IRA

- Complete the purchase through your custodian

- Verify proper storage in an IRS-approved depository

Important: The IRS has strict rules regarding the types of precious metals that can be held in a Gold IRA and how they must be stored. Working with an experienced custodian is essential to ensure compliance and avoid potential tax penalties.

Creating a Balanced Retirement Strategy: Combining 401(k)s and Gold IRAs

Rather than viewing Gold IRAs and 401(k)s as competing options, many financial advisors recommend incorporating both into a comprehensive retirement strategy. This balanced approach can provide the benefits of each while mitigating their respective limitations.

A balanced retirement portfolio might include both traditional investments and precious metals allocation.

Allocation Strategies

Financial experts often suggest allocating 5-15% of your retirement portfolio to precious metals as a diversification strategy. This allocation provides exposure to gold’s potential benefits while maintaining the growth opportunities of traditional investments. Your specific allocation should be based on your age, risk tolerance, and overall financial goals.

Maximizing Employer Benefits

If your employer offers a 401(k) match, consider contributing at least enough to capture the full matching amount before allocating additional retirement funds to a Gold IRA. Employer matching is essentially free money that provides an immediate return on your investment.

Tax Diversification

Having retirement assets across different types of accounts can provide valuable tax flexibility in retirement. Consider how traditional (tax-deferred) and Roth (tax-free withdrawal) options within both 401(k)s and Gold IRAs might fit into your overall tax strategy.

Ready to Diversify Your Retirement Portfolio?

Speak with our retirement specialists to learn how a Gold IRA can complement your existing retirement strategy and help protect your financial future.

Common Mistakes to Avoid When Investing in Gold IRAs and 401(k)s

Making informed decisions about your retirement investments requires understanding potential pitfalls. Here are some common mistakes to avoid with both Gold IRAs and 401(k) plans.

Gold IRA Mistakes

- Overlooking storage requirements: The IRS requires that precious metals in a Gold IRA be stored in an approved depository. Attempting to take personal possession of these assets can result in significant tax penalties.

- Ignoring fees: Gold IRAs typically have higher fees than traditional IRAs due to storage, insurance, and custodial requirements. Failing to account for these costs can significantly impact your long-term returns.

- Choosing the wrong metals: Not all gold and precious metal products meet IRS requirements for inclusion in a Gold IRA. Working with a knowledgeable custodian is essential to ensure compliance.

- Overallocating to precious metals: While gold can provide valuable diversification, allocating too much of your retirement portfolio to precious metals may limit your overall growth potential.

401(k) Mistakes

- Missing out on employer matching: Not contributing enough to receive the full employer match is essentially leaving free money on the table.

- Neglecting diversification: Many 401(k) participants invest too heavily in a single fund or their employer’s stock, creating unnecessary concentration risk.

- Frequent trading: Attempting to time the market by frequently changing your 401(k) investments often leads to poorer performance compared to a consistent, long-term strategy.

- Taking early withdrawals: Withdrawing funds before retirement age can result in significant penalties and tax consequences, as well as derailing your long-term retirement goals.

Pro Tip: Review your retirement strategy annually or whenever you experience significant life changes. This regular assessment helps ensure your investment approach remains aligned with your evolving financial goals and circumstances.

Frequently Asked Questions About Gold IRAs and 401(k)s

Researching your retirement options thoroughly helps ensure you make informed decisions.

Can I roll over my 401(k) to a Gold IRA?

Yes, you can roll over funds from a 401(k) to a Gold IRA through a process called a 401(k) rollover. This is typically possible when you leave your employer, reach age 59½, or if your current employer’s plan allows for in-service distributions. To avoid taxes and penalties, it’s important to execute a direct rollover where the funds move directly from one custodian to another without you taking possession of the money.

Are Gold IRAs FDIC-insured?

No, Gold IRAs are not FDIC-insured. The Federal Deposit Insurance Corporation only insures certain bank deposits, not investment accounts or physical assets like gold. However, reputable Gold IRA custodians typically maintain insurance policies to protect against theft or damage to the precious metals held in their depositories. When selecting a Gold IRA custodian, it’s important to verify their insurance coverage and security measures.

How do fees compare between Gold IRAs and 401(k)s?

Gold IRAs typically have higher fees than 401(k) plans. Gold IRA fees often include setup fees ($50-$300), annual maintenance fees ($75-$300), storage and insurance fees (0.5%-1% of assets annually), and transaction fees when buying or selling metals. In contrast, 401(k) fees usually consist of plan administration fees and investment fund expense ratios, which combined typically range from 0.5% to 2% of assets annually. Employer-sponsored 401(k)s may have lower fees due to institutional pricing and employer subsidization of administrative costs.

What types of gold can I hold in a Gold IRA?

The IRS has specific requirements for precious metals held in a Gold IRA. Gold must be at least 99.5% pure (24 karat), with the exception of American Gold Eagle coins, which are allowed despite being 22 karat. Common IRS-approved gold products include American Gold Eagles, Canadian Gold Maple Leafs, Australian Gold Kangaroos, and gold bars or rounds produced by a NYMEX or COMEX approved refinery or national government mint that meet minimum fineness requirements.

Can I have both a Gold IRA and a 401(k)?

Yes, you can maintain both a Gold IRA and a 401(k) simultaneously. In fact, having both can provide valuable diversification across different asset classes. If you’re currently employed and have an active 401(k), you can still open a Gold IRA as a separate retirement account. However, contribution limits apply separately to each type of account, and you’ll need to ensure you meet eligibility requirements for both.

How does inflation affect Gold IRAs versus 401(k)s?

Gold has historically been considered a hedge against inflation, often maintaining or increasing its value during periods of rising prices. This makes Gold IRAs potentially valuable during inflationary periods. In contrast, traditional 401(k) investments like stocks and bonds can have mixed responses to inflation. Stocks may eventually adjust upward with inflation but can be volatile in the short term, while bonds typically perform poorly during inflationary periods due to rising interest rates. A balanced approach that includes both types of investments can help manage inflation risk.

Conclusion: Making the Right Choice for Your Retirement

Choosing between a Gold IRA and a 401(k) isn’t necessarily an either/or decision. The optimal approach for many investors is to incorporate both into a comprehensive retirement strategy that balances growth potential with risk management.

A balanced retirement strategy can help secure your financial future and provide peace of mind.

A 401(k) plan offers significant advantages for long-term retirement saving, particularly if your employer provides matching contributions. The higher contribution limits, automatic payroll deductions, and diverse investment options make it an excellent foundation for retirement planning. For many investors, maximizing employer matching in a 401(k) should be a priority before exploring alternative retirement vehicles.

A Gold IRA serves as a valuable complement to traditional retirement accounts by providing diversification into an asset class that often behaves differently than stocks and bonds. During periods of economic uncertainty, inflation, or market volatility, gold has historically provided a measure of stability and wealth preservation that can help protect your overall retirement portfolio.

Your optimal strategy will depend on your individual circumstances, including your age, risk tolerance, retirement timeline, and overall financial goals. Younger investors might lean more heavily toward growth-oriented 401(k) investments, while those approaching retirement might allocate a larger portion to wealth preservation vehicles like Gold IRAs.

“The purpose of diversification is not to boost performance—it won’t ensure gains or prevent losses. But it may help set the stage for a potentially smoother ride.”

Whatever approach you choose, the most important step is to start planning and investing for retirement early and consistently. Regular contributions to well-diversified retirement accounts, whether they’re 401(k)s, Gold IRAs, or a combination of both, will help ensure you’re prepared for a financially secure retirement.

Take the Next Step in Securing Your Retirement

Our retirement specialists can help you evaluate your options and create a personalized strategy that may include both traditional retirement accounts and precious metals IRAs.