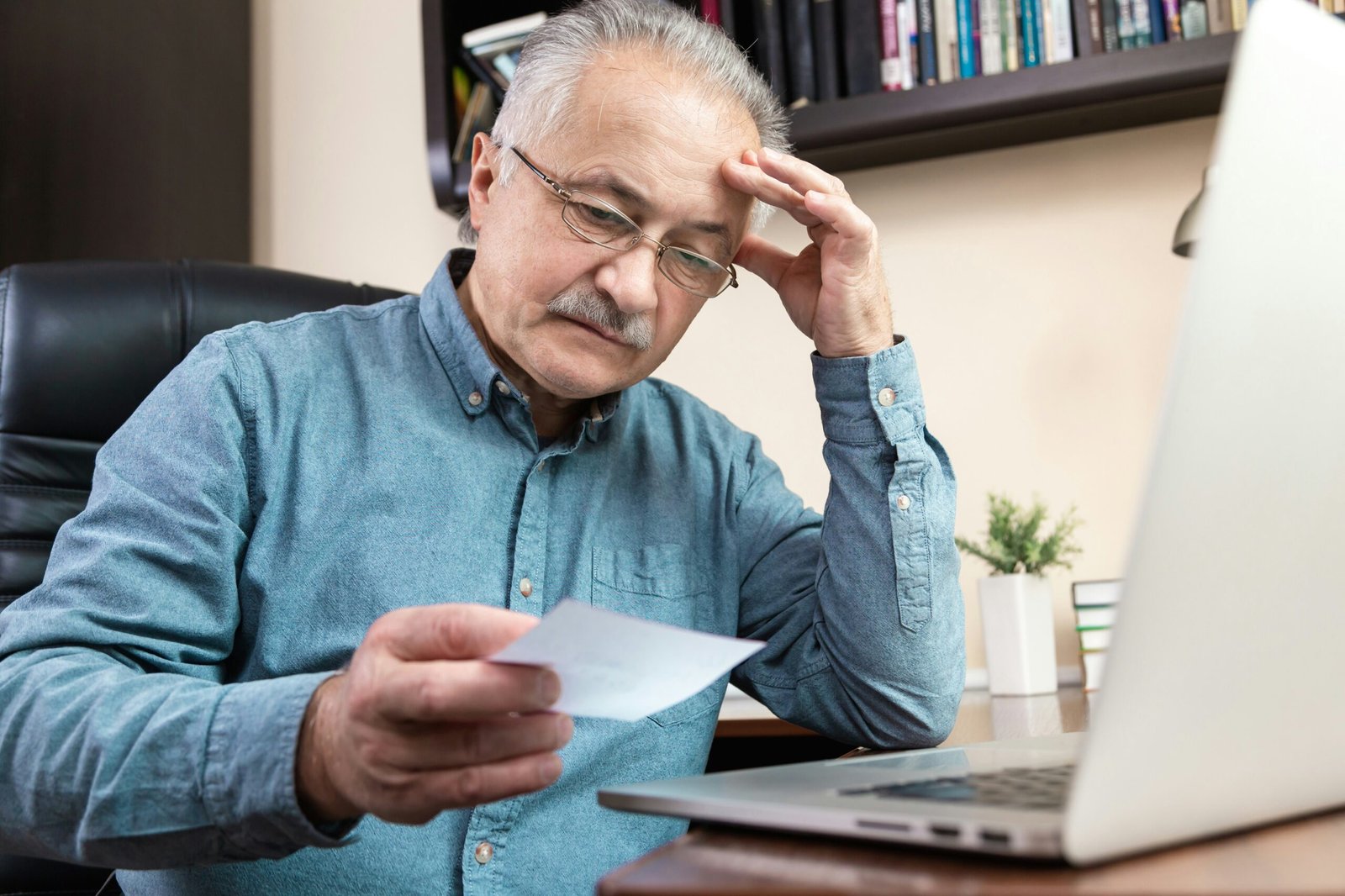

Have you ever thought about what life would be like if you had no retirement savings? It’s a question that many Americans face, as an alarming number of individuals have little to no savings set aside for their golden years. The implications are vast and can affect lifestyle, financial security, and even health in retirement. But why is this issue so prevalent, and how does it impact everyday life? Let’s take a closer look at this pressing matter and explore its potential ramifications.

This image is property of pixabay.com.

The Current State of Retirement Savings in America

Understanding the landscape of retirement savings in the United States offers a critical perspective on just how deep this issue runs. Many Americans find themselves with insufficient retirement funds, leading to financial uncertainty later in life.

How Many Americans Lack Retirement Savings?

According to studies, approximately 25% of non-retired American adults have no retirement savings whatsoever. This statistic alone paints a worrying picture but becomes even more concerning when you consider that about 17% of those in retirement rely entirely on Social Security for their monthly income. This reveals a dependency on fixed income sources that may not fully meet their needs.

Reasons Behind the Lack of Savings

Several factors contribute to why so many people have not saved adequately for retirement. From economic challenges to lifestyle choices, and educational gaps to systemic barriers, the reasons are multifaceted.

Economic Challenges

The cost of living continues to rise, often outpacing wage growth, making it harder for individuals to set aside money for retirement even if they wish to. Unexpected financial burdens such as medical expenses, educational fees, and housing costs can further hinder one’s ability to save.

Lifestyle Choices

Some individuals prioritize current lifestyle choices over long-term savings plans, choosing to focus on immediate gratification rather than future security. While it’s important to enjoy life, this approach can have serious implications later on.

Educational Gaps

Educational systems in the United States often lack comprehensive financial literacy programs. As a result, many people may not fully understand the importance of starting to save early or how to invest wisely for the future.

Systemic Barriers

For some demographics, particularly minorities and women, systemic barriers such as wage discrimination and limited access to quality employment opportunities further restrict the ability to save effectively for retirement.

The Implications of No Retirement Savings

Without adequate retirement savings, individuals face numerous potential challenges that affect their overall quality of life. These implications can be both immediate and long-term, impacting various aspects of an individual’s life.

Financial Insecurity in Retirement

The absence of a financial cushion leads to insecurity during retirement years, often forcing individuals to rely on minimal Social Security benefits alone, which may be insufficient to cover basic living expenses.

Comparison of Average Living Expenses and Social Security Benefits

| Expense Category | Average Monthly Cost | Average Monthly Social Security Benefit (2023) |

|---|---|---|

| Housing | $1,500 | |

| Utilities | $300 | |

| Healthcare | $500 | |

| Groceries | $600 | |

| Transportation | $200 | |

| Total Monthly Cost | $3,100 | $1,543 |

As illustrated in the table above, the average monthly expenses in retirement often exceed the average monthly Social Security benefit. This shortfall forces retirees to find alternative income sources or drastically reduce their quality of living.

Increased Reliance on Government Programs

With insufficient personal savings, many retirees turn to government assistance programs like Medicaid and food stamps to make ends meet. This dependency highlights a broader socioeconomic issue and places additional strain on public resources.

Health Implications

Financial stress can also lead to adverse health outcomes. The anxiety of not having enough money for essential needs or medical expenses can exacerbate health problems, leading to a decrease in overall well-being.

Preparing for a Secure Retirement

Despite the challenges, preparing for retirement isn’t an impossible feat. With strategic planning and informed decisions, anyone can improve their retirement outlook.

Making a Financial Plan

Creating a comprehensive financial plan is crucial. It helps you understand your current financial situation, set realistic retirement goals, and devise a strategy to achieve them.

Steps to Create an Effective Financial Plan

- Assess Your Current Financial Position: Review your income, expenses, debts, and savings.

- Set Retirement Goals: Define what you want your retirement to look like, including lifestyle, location, and activities.

- Calculate Required Savings: Determine how much money you’ll need to achieve your retirement goals.

- Develop a Savings Plan: Establish how much you need to save each month to reach your target.

- Consider Investment Opportunities: Explore various investment vehicles like 401(k)s, IRAs, and other retirement accounts.

- Review and Adjust Periodically: Regularly revisit your financial plan to adjust for changes in your circumstances or goals.

Exploring Retirement Savings Options

Diverse savings options are available, each offering unique benefits that cater to different financial situations.

Employer-Sponsored Retirement Plans

These include 401(k)s and 403(b)s, allowing employees to contribute pre-tax dollars, often with employer matching contributions that enhance savings.

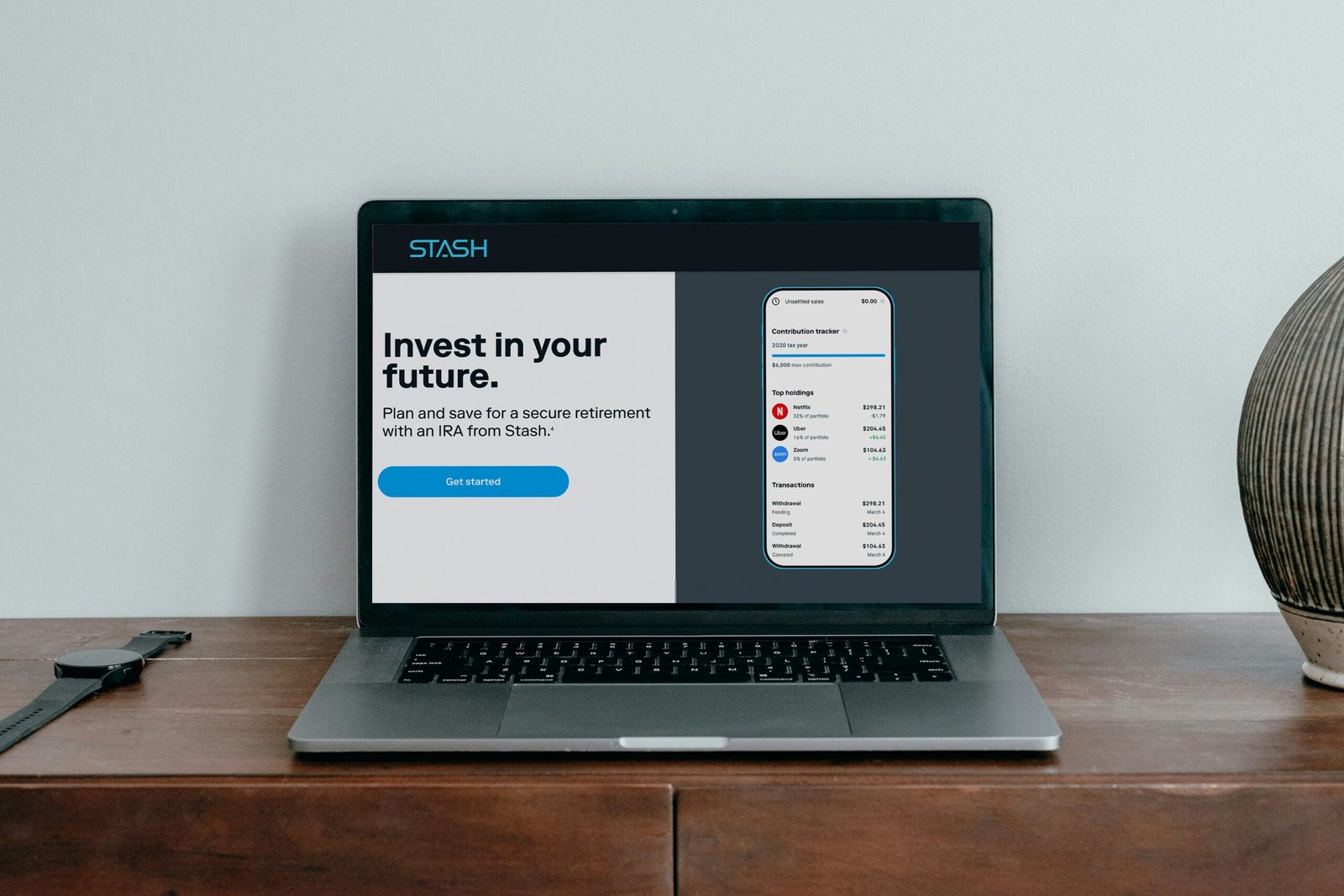

Individual Retirement Accounts (IRAs)

IRAs are available as traditional or Roth accounts, providing tax advantages that benefit retirement savings.

Other Savings Vehicles

Consider other options like taxable brokerage accounts or Health Savings Accounts (HSAs) for ancillary retirement savings and tax benefits.

This image is property of pixabay.com.

Policy Measures and Their Role

Government policies play a significant role in shaping retirement savings patterns and offering safety nets for those without savings.

Social Security Reforms

Ongoing reforms aim to ensure the longevity and sustainability of the Social Security program, a critical source of income for retirees with limited savings.

Introduction of MyRA and Other Saving Initiatives

The government has introduced programs like myRA to facilitate easier access to retirement savings for individuals without employer-sponsored plans.

Educational Efforts in Financial Literacy

Increased efforts in financial education aim to equip individuals with the knowledge needed to manage and grow their finances effectively.

This image is property of pixabay.com.

Conclusion

Navigating retirement without sufficient savings poses numerous challenges with serious implications. However, with strategic planning, leveraging available resources, and advocating for supportive policies, you can steer towards a more secure and fulfilling retirement. It’s never too late to recalibrate your retirement choices to better prepare for the future. Embracing financial literacy, robust savings strategies, and informed decision-making plays a pivotal role in shaping a comfortable and secure retirement.