Have you ever wondered how you envision your life after working hard for many years? Retirement is more than just stepping away from the daily grind; it’s an opportunity to redefine yourself and your life. Imagine a retirement where you are empowered to live your dreams, pursue personal growth, and truly enjoy the life you’ve built. “Empowerment Retirement” is all about making that vision a reality.

What is Empowerment Retirement?

Empowerment Retirement is a concept that places you at the center of your post-career life. It’s about using your newfound freedom to enrich your life in ways that are meaningful to you. Unlike the traditional view of retirement as merely a time to rest, Empowerment Retirement encourages you to take charge and actively design this phase of your life.

A Shift in Perspective

Traditional retirement often focuses on a withdrawal from work, but Empowerment Retirement is more about engagement. It’s about finding purpose, whether through hobbies, self-improvement, community involvement, or even starting a new venture. This concept seeks to change the mindset from seeing retirement as an end to viewing it as a beginning.

The Importance of Personal Fulfillment

Personal fulfillment is at the heart of Empowerment Retirement. By focusing on what makes you happy and fulfilled, you’re more likely to lead a satisfying and joyous retirement. This might involve learning new skills, pursuing passions, or simply spending more time with family and friends. Whatever it is, personal fulfillment ensures that your retirement years are both enjoyable and rewarding.

Planning for an Empowerment Retirement

Planning an Empowerment Retirement involves more than financial preparations, though that is certainly important. It’s a comprehensive approach, considering your interests, goals, finances, and lifestyle. Proper planning empowers you to retire with confidence and embark on this new chapter with enthusiasm.

Financial Independence

A solid financial plan is crucial for a successful retirement. With financial independence, you’re free to make choices that align with your empowerment goals. Work with a financial advisor to develop a savings and investment strategy that supports your desired lifestyle. Remember, it’s not about having a huge amount but having enough to stay comfortable while pursuing your dreams.

Setting Goals and Aspirations

What do you hope to achieve in retirement? Setting clear goals can make this time productive and fulfilling. Your goals might be as simple as traveling more, or as ambitious as starting a second career. Think about what excites you and plan how these aspirations can be practically achieved during your retirement.

Health and Well-being

Maintaining physical and mental health is paramount to enjoying your retirement years. This includes regular exercise, a nutritious diet, and mental stimulation. Consider activities that keep your mind and body active. After all, good health is a form of empowerment, allowing you to enjoy life to its fullest.

This image is property of images.unsplash.com.

Employing Your Time Wisely

Time management is a critical aspect of Empowerment Retirement. With more time on your hands, how you choose to spend it becomes particularly significant. Effective time management ensures a balance between relaxation, activities, and commitments, making your retirement both satisfying and purposeful.

Embracing New Hobbies and Interests

Retirement is a perfect time to explore new hobbies and interests. Whether it’s painting, gardening, writing, or learning a musical instrument, doing something you love can be incredibly fulfilling. Trying new things keeps life exciting and offers a sense of achievement, which is a core aspect of feeling empowered.

Community Engagement and Volunteering

Staying connected with your community is an excellent way to keep active and engaged. Volunteering offers a sense of purpose and can be very rewarding. By giving back, you’re not only helping others but also enriching your own life. It’s a win-win situation, fostering social bonds and personal growth.

The Role of Continuous Learning

Learning doesn’t stop when you retire. In fact, continuous learning can be one of the most empowering aspects of retirement. Whether you choose to take a class, learn a language, or simply read more, staying intellectually active can lead to a more satisfying and enriched retirement.

Lifelong Learning Opportunities

Many educational institutions offer programs designed specifically for retirees. These programs provide opportunities to learn about a variety of subjects without the pressure of grades or exams. You might explore topics related to personal interests, or venture into entirely new areas of knowledge. The joy of learning can significantly enhance your retirement experience.

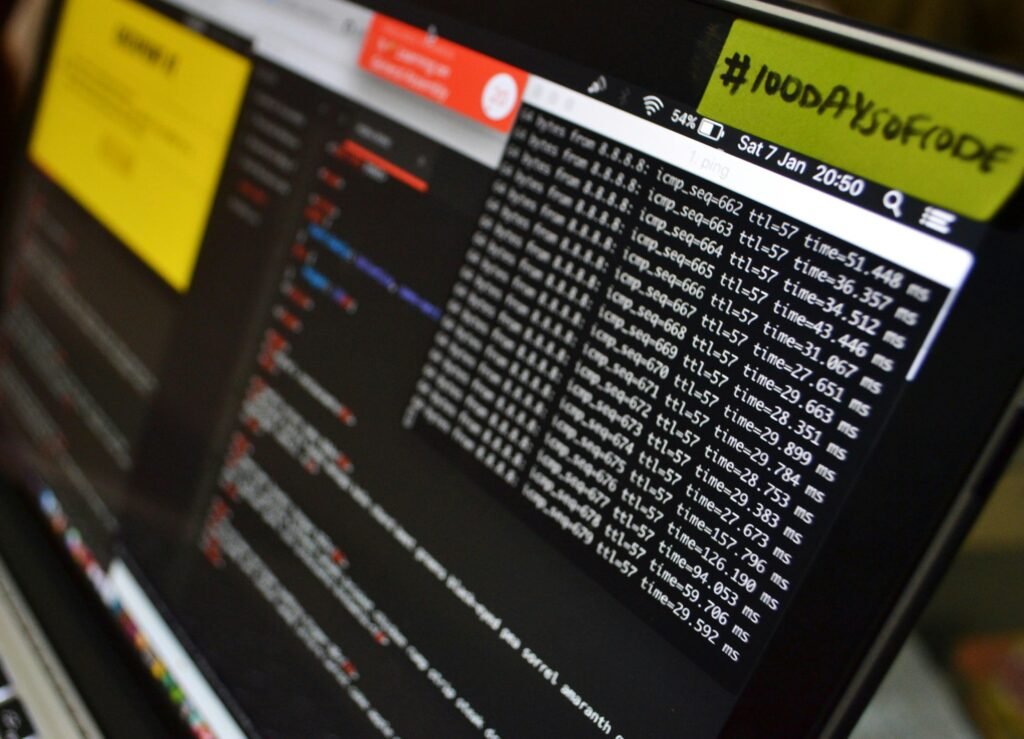

Technology and Digital Skills

Technology is a part of everyday life, and understanding how to use it can greatly empower your retirement. From staying connected with family through social media to managing finances, digital skills open up new possibilities. Consider taking courses or workshops to improve your tech literacy.

This image is property of images.unsplash.com.

Building a Supportive Network

Building and maintaining a supportive network is essential for a successful retirement. Family, friends, and community groups can provide emotional support, companionship, and shared experiences. A strong network can be an effective way to stay motivated and engaged, boosting both your mental and emotional well-being.

Strengthening Family Ties

Retirement gives you the chance to strengthen family bonds. Spending more time with loved ones, planning family gatherings, or simply being present allows for deeper relationships. These connections provide emotional support and create a sense of belonging and contentment.

Making New Friends

Meeting new people can bring fresh perspectives and forge friendships. Get involved in community events, clubs, or online groups. Building new friendships is not only possible after retirement but can be particularly rewarding, as you connect with those who share similar interests and experiences.

Navigating Challenges in Retirement

While Empowerment Retirement is filled with opportunities, it’s also important to acknowledge and navigate potential challenges. Whether it’s adjusting to a new routine or dealing with unexpected financial or health issues, facing these challenges with a proactive mindset can empower you to overcome them.

Emotional Adjustments

Leaving the workforce and transitioning to retirement may lead to emotional adjustments. It’s natural to feel a mix of excitement and anxiety. Embracing these feelings and working through them, potentially with the help of a counselor or support group, can ease the transition and help you embrace your retirement fully.

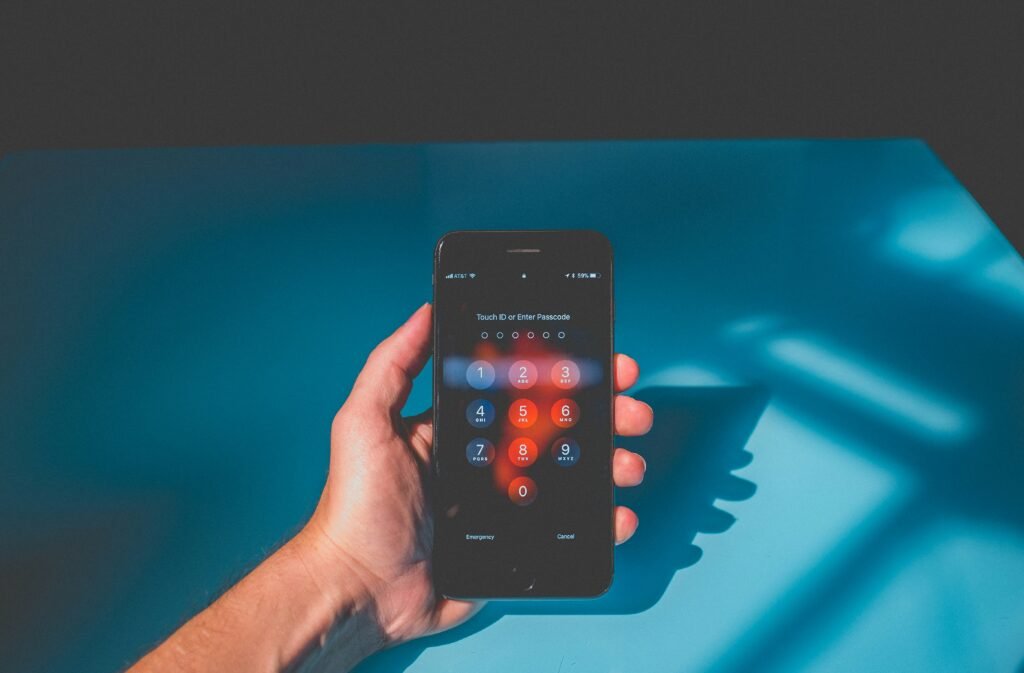

Financial Security Concerns

Ensuring financial security can be a common challenge for retirees. Continually revisiting your financial plan and making necessary adjustments can help alleviate concerns. Consulting with financial advisors can provide peace of mind, knowing you’re making informed decisions about your financial future.

This image is property of images.unsplash.com.

Creating a Legacy

Part of feeling empowered in retirement involves thinking about the legacy you wish to leave. This isn’t just about money or possessions but includes the values and memories you share with others. It’s about making a lasting impact that resonates beyond your lifetime.

Passing on Values and Lessons

Consider what values or lessons you want to impart to future generations. Storytelling is a powerful way to share wisdom, experiences, and values. Whether through writing a memoir, recording video messages, or simply sharing stories over family dinners, passing on your legacy is a rewarding endeavor.

Philanthropic Initiatives

If you’re interested in philanthropy, retirement is a great time to explore how you can contribute. Funding scholarships, supporting a cause close to your heart, or setting up a charitable foundation are all ways to leave a positive impact. Engaging in philanthropy fosters a sense of purpose and contributes to lasting change.

Cultivating a Growth Mindset

Empowerment Retirement is as much about mindset as it is about practical actions. Cultivating a growth mindset allows you to see possibilities rather than limitations. It encourages resilience in the face of challenges and the ability to learn and grow continuously.

Embracing Change

Retirement is a time of change, and embracing this can open up numerous possibilities. By staying open to new experiences and perspectives, you empower yourself to lead a fulfilling retirement filled with growth and opportunity. Adaptability is key, and viewing change as a natural part of life can enhance your retirement experience.

Celebrating Successes

Recognizing and celebrating your achievements and milestones is important in maintaining motivation and a positive outlook. Whether big or small, each success in your retirement journey deserves acknowledgment. Celebrating your accomplishments propels you forward and reinforces your empowerment journey.

As you look forward to or embark on your retirement journey, remember that Empowerment Retirement puts you in the driver’s seat. It’s your opportunity to redefine what the next chapter of your life can be. With careful planning, openness to new experiences, and a focus on personal fulfillment, you can make these years some of the best of your life. Let Empowerment Retirement be your guide to a purposeful and joyful future.

This image is property of pixabay.com.