Have you ever wondered how inflation might affect your retirement plans and what you can do to adjust accordingly? It’s a crucial consideration, especially since inflation can erode your purchasing power over time. Understanding how to prepare and adjust for inflation during your retirement is key to maintaining your lifestyle and financial security.

Understanding Inflation and Its Impact on Retirement

What Is Inflation?

Inflation refers to the rate at which the general level of prices for goods and services rises and subsequently erodes purchasing power. When inflation occurs, the value of currency decreases, meaning you’ll need more money to buy the same items over time. In retirement, when you rely on fixed incomes, adjusting for inflation becomes even more critical.

Why Does Inflation Matter in Retirement?

Inflation poses a substantial risk during retirement because you will likely depend on a fixed stream of income from savings, pensions, or Social Security. If inflation goes unchecked in your planning, you may find it challenging to afford the same lifestyle you had when you first retired. Understanding how inflation affects your income sources is fundamental to making adjustments.

Historical Context of Inflation

To better predict future inflation trends, it’s helpful to look at past patterns. Historically, inflation rates have varied considerably, influenced by various factors such as economic policies, global events, and market conditions. Keeping abreast of economic news and inflation forecasts can provide insight into potential future changes.

Strategies for Adjusting for Inflation During Retirement

Diversify Your Investment Portfolio

One effective way to combat inflation is by diversifying your investment portfolio. By investing in a mix of asset classes, such as stocks, bonds, and real estate, you can increase the likelihood of achieving returns that outpace inflation over time.

Stocks vs. Bonds

While stocks tend to offer higher returns, they come with greater risk. Bonds, particularly those not adjusted for inflation, may not provide sufficient protection against rising prices. Balancing these can offer stability while still providing growth opportunities.

Inflation-Protected Securities

Consider investing in Treasury Inflation-Protected Securities (TIPS) or other inflation-adjusted bonds. These securities provide a fixed rate of return plus an increment based on changes in inflation, offering a safeguard against eroding purchasing power.

Maintain a Flexible Withdrawal Strategy

Adjusting your withdrawal strategy in response to inflation can help your savings last longer. A flexible withdrawal rate allows you to maintain your purchasing power during different economic climates.

Systematic Withdrawal Plans

A systematic withdrawal plan involves setting up regular withdrawals from your Retirement accounts at a rate that considers inflation. Adjusting these rates based on current inflation can help manage your resources effectively.

Bucket Strategy

This strategy involves segmenting your assets into different “buckets” intended for short, mid, and long-term expenses, each with varying levels of risk and liquidity. The short-term bucket should be more conservative, helping to meet current needs without the risk of having to sell more volatile investments at a loss.

Delay Social Security and Pension Benefits

By delaying your Social Security benefits, you can receive an increased monthly amount when you eventually start taking these benefits. This increment can help offset inflationary pressures.

Advantages of Delayed Benefits

Every year you delay taking Social Security beyond your full retirement age, your benefits increase by a certain percentage. Over time, this can create a significant buffer against inflation.

Consider Annuities with Cost-of-Living Adjustments

Annuities can provide a steady income stream. To protect against inflation, choose annuities that offer cost-of-living adjustments (COLAs). These adjustments can help you maintain your purchasing power as prices rise.

This image is property of images.unsplash.com.

Living Adjustments for Inflation

Budgeting for Inflation

Effective budgeting involves planning for increased costs due to inflation. Be proactive in reviewing and adjusting your budget periodically to ensure it aligns with your changing needs and inflation’s impact on your spending.

Reducing Expenses

As prices rise, it may be necessary to curtail unnecessary expenses. Identifying areas to cut back can help stretch your retirement savings further.

Downsizing

Consider downsizing your home or relocating to a more affordable area to reduce living costs. This can free up cash and reduce expenses like property taxes and maintenance.

Energy Efficiency

Implementing energy-efficient practices can help lower utility costs. Investing in energy-saving appliances or home improvements can lead to significant savings over time.

Part-Time Work or Hobbies

Engaging in part-time work or monetizing hobbies can provide additional income, which can help offset inflation. Plus, this can provide a sense of purpose and community engagement.

Utilize Technology

Use technology to find the best deals and manage finances effectively. Online tools and apps can help track spending and manage investments, providing insights into areas where adjustments may be necessary to counteract inflation.

Tax Implications and Inflation

Understanding Tax Brackets

Inflation can push your income into higher tax brackets, affecting your overall tax liabilities. Understanding how tax brackets work and planning accordingly can help mitigate these impacts.

Tax-Efficient Withdrawals

Strategically withdrawing from different types of accounts (e.g., Roth IRAs vs. Traditional IRAs) can help minimize tax burdens. Consulting with a tax advisor to determine the most tax-efficient withdrawal strategy is often beneficial.

This image is property of images.unsplash.com.

Planning for Healthcare Costs

The Rising Cost of Healthcare

Healthcare expenses can rise significantly with inflation. It’s crucial to plan for these costs in your retirement budget to ensure they don’t overwhelm your finances.

Considerations for Medicare and Long-Term Care

Understanding the intricacies of Medicare and potential long-term care needs is essential. Policies that adjust for inflation are preferable, as they provide increased benefits over time to cover rising costs.

Managing Debt in Retirement

Avoiding High-Interest Debt

Carrying high-interest debt into retirement can severely impact your financial freedom. Prioritize paying down debt to minimize the pressure of interest rate increases on your retirement budget.

Refinancing as an Option

Refinancing existing loans for lower interest rates can free up funds and reduce expenses, providing more breathing room in your budget to accommodate inflation-driven costs.

This image is property of images.unsplash.com.

Estate Planning and Inflation

Planning Your Legacy

Inflation can affect the size of the estate you leave behind. Planning for inflation in your estate strategy can ensure your heirs receive the intended value in real terms.

Trusts and Inflation

Consider establishing a trust that can manage inflation effects. Trusts can be structured to provide income that increases with inflation, preserving the value of your estate.

Conclusion

Adjusting for inflation in retirement isn’t a one-time activity but an ongoing process requiring vigilance and flexibility. By maintaining a diversified investment strategy, utilizing strategic withdrawal plans, and being mindful of budgeting, you can navigate the challenges inflation may pose. Regularly reviewing your financial plan and seeking professional advice can also provide reassurance and guidance as you work toward maintaining your desired standard of living. As you plan for your future, consider incorporating the tactics discussed to better safeguard your financial well-being against the relentless creep of inflation.

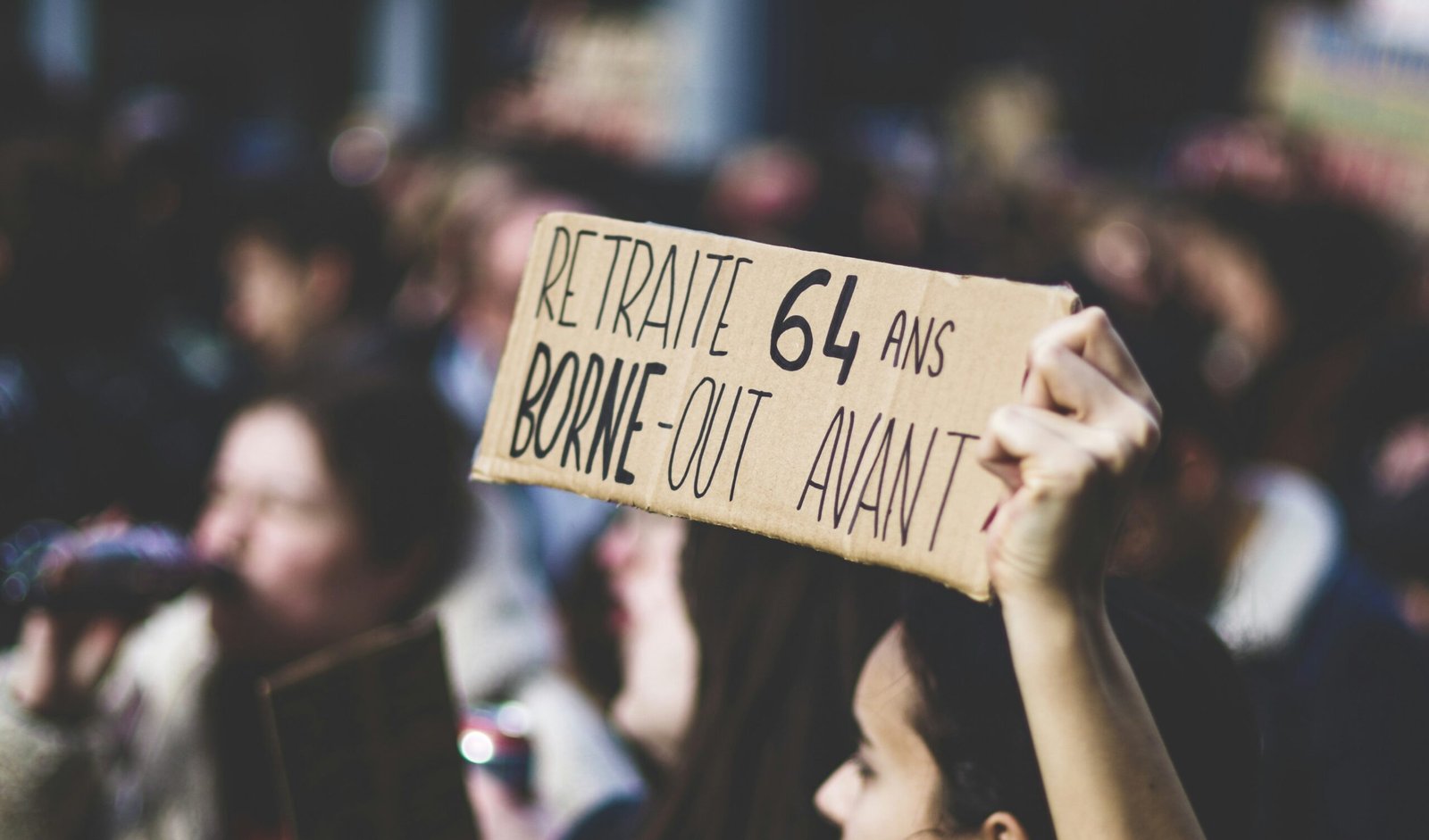

This image is property of images.unsplash.com.